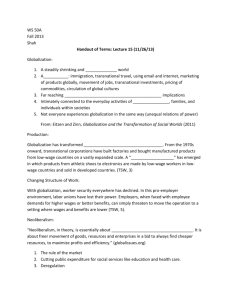

Towards A Global Ruling Class? Globalization and the

advertisement