Alternative Strategies Key to Growth in Mature North

advertisement

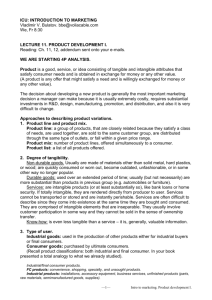

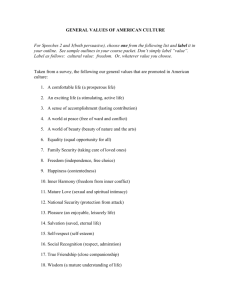

Alternative Strategies Key to Growth in Mature North American Paper Markets To remain viable, companies must establish new sources of growth as traditional markets mature and business fundamentals grow progressively weaker. — BY FRANK PERKOWSKI It is commonly recognized that businesses are either growing or declining and that growing businesses are more profitable, attract capital investment, fuel innova- and consumer behavior, their negative impact on paper consumption will more than likely only increase in the future. Going hand in hand with fundamental demand shifts is tion, and provide more positive work environments for the declining competitiveness of North American produc- employees. Consequently, it is critical for North ers in the global arena (see Table 2). It is well documented American paper producers to find ways to grow their that North American companies have fallen behind other business even as demand for many fiber-based substrates regions of the world in terms of investment, technology, wanes or is more cost effectively met by offshore produc- and overall cost structure. This has made North American ers or alternative products. companies vulnerable to further erosion of their competi- Declining growth rates across most industry grade seg- tive position in domestic and international markets. ments during the past three years indicate that demand for traditional paper products is maturing. While some of the recent volume declines can be explained by external NORTH AMERICAN COMPETIVENESS Declining investment factors, such as the broader economic decline and the Aging assets strengthening dollar, a more complete assessment of Increasing energy and environmental demand drivers also identifies other dynamics that should Government subsidized foreign send up yellow flags to paper producers. Most of these developments (see Table 1) are relatively Table 2. Key Factors Behind Reduced Competitiveness of the N.A. Paper Industry recent phenomena and some of them are still in the early stages of development. But based on observations of market PA P E R D E M A N D R E D U C E R S appear that unless unforeseen changes take place, there is likely to be little if any improvement in the basic funda- Increased access to the internet and its resulting use as a primary communication / advertising medium mentals of the North American paper business in the years Outsourcing of general manufacturing to developing countries financial performance resulting in a continued high level of Growth in electronic commerce and related commercial applications Increased availability of low cost advertising mediums relative to print such as cable TV and wireless communications Flexible packaging innovations that offer consumers increased convenience and package functionality Increased organizational productivity through the elimination of processes and reduced paper usage Relatively higher cost of print due to rising postage costs and lower cost alternative mediums Table 1. Recent Developments Negatively Impacting Paper Consumption 30 In light of these demand and supply dynamics, it would JULY/AUGUST 2004 PaperAge ahead. This will lead to further declines in demand and company consolidations and mill shutdowns. New Approaches Required To avoid continued deterioration in business profitability, North American companies must identify new sources of growth to ensure that their businesses remain viable. But how exactly does a company do this when markets are becoming increasingly mature and business fundamentals are weak and likely to get worse? Following are three specific actions that companies need to take immediately to begin this process of transformation. growth Re-examine Core Competence. Companies in our based on distinctive value propositions. Companies that industry must revisit some of their basic assumptions adopt and become more oriented toward innovation or relating to the core competencies within their organiza- customer centricity will likely create a more differentiated tions. As markets change, competencies must also evolve position in our industry and better meet customer needs. to meet the new requirements. Rather than defining Traditional Growth Options core competencies in terms of what has already been The following approaches can be classified as tradition- demonstrated, the focus should be on leveraging and enhancing these demonstrated competencies so that new al sources of growth that have been broadly employed in areas of expertise can be developed. the paper as well as other established industries. As mar- Redefine the Business. This involves taking a fresh look at what exactly the company does, what customers/groups are served, who the competitors are, and how the company differs from or is better than its competitors. There is still a tendency in our industry to define the business in terms of specific substrate types kets mature, however, these approaches tend to become less effective since they often fail to provide unique value propositions or better customer solutions. For comparison, all of the major growth strategies, including traditional and innovative strategies, are charted in Figure 1 below. High Related Segment Grow Target Market Re-Segmentation Intangible Asset Development Strategic Alliance Mergers/Acquisitions Risk/Reward Continuum that comes off of the end of the paper machine. reflect the customer’s perspective. A better approach is for companies to define their business in terms of what customer problems are being solved. For example, the envelope paper business may be Growth Impact However, this view is extremely limiting and does not New Distribution Geographic Expansion more appropriately defined as direct mail materials and C1S papers can be more appropriately defined as “prod- Low Share Growth uct identification” materials. The key point is that satisfying specific customer needs must be the focal point of the business as opposed to the production of a specific raw material or product. Revisit the Core Business Strategy. Similar to core competence is the concept of core strategy. In his book The Discipline of Market Leaders, Michael Treacy identifies three possible/distinct orientations that define a company’s approach. These alternative orientations (operational excellence, customer centricity, and innovation) all create value in different ways and determine how organizations compete. While a basic competence level in all three areas is necessary to be competitive, successful companies clearly favor one of these strategic approaches. Most CEO’s in our industry probably believe their companies are focused on operational excellence. While Conventional Strategy Effectiveness Innovative Figure 1. Winning Growth Strategies in Mature Markets. Superior Execution. This option is the most common growth strategy employed in our industry (operational excellence) but the least effective in generating long-term growth when markets are mature. Success in this area will most often allow a company to merely maintain its business and share position rather than gain a strategic advantage. To the extent that a company can actually execute significantly better than other major competitors (which is extremely difficult when markets are mature and most companies are focused on operational excellence), share and volume growth may be achieved to some degree. Geographic Expansion. This option produces growth not necessarily bad, this reflects an underlying inside-out because it establishes a company’s brand in new geogra- focus, a commodity orientation, and product centric phi- phies where it does not exist today or possibly in regions losophy. A healthy industry offers a balance across the where markets are less developed. Because most compa- three orientations so that customers have more of a choice nies in our industry place more strategic value on tangi- and can develop stronger loyalties with their suppliers ble versus intangible assets, this option is often only conJULY/AUGUST 2004 PaperAge 31 growth “By having less attractive traditional growth options available, North American paper companies may be more motivated.....to consider bolder alternatives that will ultimately create more viable, profitable businesses in the future.” sidered in the context of asset purchases in new geographic areas. Several growth options are less commonly practiced, Consequently, significant capital investment is nor- particularly in established industries such as pulp and mally required at a time when companies and the market paper where companies have been less focused on devel- as a whole are not returning their cost of capital. Also, if oping the required competencies and internal capabili- a company does not offer a significantly better customer ties. However, these strategies can be more effective solution, this option will not produce superior returns growth options in established markets because they can over the long-term and will therefore fail. In other indus- potentially provide better, more differentiated customer tries where intangible assets are more highly developed solutions (see chart). and superior customer solutions are offered, geographic expansion is more likely to create value and offer a superior return on investment. New Distribution Channels. As supply chains evolve in Strategic Alliances. These are often difficult to execute because they require highly effective management systems and good strategic alignment between two or more companies. However, successful strategic alliances emerging markets, opportunities in new channels often allow companies to effectively access new markets and emerge that provide better solutions to serve specific cus- introduce new products with minimal investment in hard tomer groups. The internet, club stores, catalogs, and office assets. The key to success is finding the right partner with supply outlets are examples of alternative channels that complementary goals and capabilities. have developed in recent years to service higher growth niche segments within the paper and other industries. While channels will continue to evolve in paper mar- Software companies and service providers have been most successful using this growth strategy because the complete commitment of each partner is critical to each kets and provide short-term growth opportunities for other’s success. As the need for more integrated solutions individual companies that are more responsive, distribu- among paper customers increases (e.g., commercial print- tion channels in mature markets such as paper tend to be ers increasingly need total print solutions that incorporate well served and growth in one will tend to be offset by complementary paper, ink, print engine, and accessory declines in others. equipment), the opportunities for effective strategic Mergers and Acquisitions. Still one of the fastest and potentially significant roads to growth, M&A can also effectively destroy value (as many companies in our industry alliances within our industry will increase and become more critical for success. Technology/Intangible Asset Development. The paper have demonstrated) if synergies are not realized or the industry has one of the lowest levels of intangible asset value realized falls short of the acquisition cost. value among all major industries. A tremendous potential The lack of significant intangible assets or proprietary value in acquired companies makes it difficult to generate profitable growth in our industry using this strategy. 32 Innovative Growth Options source of new growth and value creation therefore involves the development and leveraging of these assets. By identifying and leveraging the value inherent in However, to the extent that acquisitions can be imple- proprietary brands, methods, technologies, processes, and mented with the goal of creating a new customer solu- organizational skills, companies can realize new growth tion as opposed to a bigger version of what existed opportunities without significant new capital investment. before; profitable new growth opportunities can be real- In addition, developing these hidden assets usually results ized in mature markets. in the creation of significant new value in the form of JULY/AUGUST 2004 PaperAge growth more highly valued products and services and a stronger, into complementary products or related products sold more loyal customer base into the same market or to the same customer segment. Expanding Target Markets. This approach has been most effectively employed by companies such as GE, Allied Signal, and Coca-Cola, whose leaders challenged their organizations to look beyond historical market boundaries. Examples (albeit poor ones) of this approach applied to our industry might define printing papers as “portable communication devices” or folding cartons as “product protection and merchandising aides.” If these were the product definitions, how many different ways could they be executed in addition to the current approaches employed by our industry? An expansion of target market definitions would necessarily lead to the need to develop new capabilities, customers, and channels which in turn would lead to further growth opportunities. Boise Cascade’s recent purchase of Office Max is one of the few examples of this growth strategy in our industry. Other possible executions of this concept could involve the purchase of businesses that provide equipment, materials, chemicals, information systems, measurement devices, logistics services, and other business services to the existing customer base. Obviously, the possible opportunities for growth in this area are almost limitless for companies with the appropriate vision and commitment. Summary As the preceding list of alternatives suggest, there are many opportunities for North American paper producers to grow, even in cases where the company competes in declining market segments with unattractive dynamics and poor growth prospects. Importantly, the fact that Re-segmenting markets. This approach simply identi- domestic companies may not be cost or technologically fies new niche segments or positioning alternatives by competitive in traditionally defined paper markets does slicing up existing/traditional markets in new and differ- not necessarily preclude growth using some of these ent ways. There are numerous alternative segmentation alternative strategies. approaches beyond the traditional methods that are In fact, the lack of traditional growth opportunities most often based on geography, channel, industry group, may provide just the incentive needed to take advantage or end use application. of alternative growth possibilities. By having less attrac- How many different product/service variations could tive traditional growth options available, North American be created by segmenting markets based on customer paper companies may be more motivated (and therefore income, usage levels, demographics, organization size, com- more likely to be successful long-term) to consider bolder petitive set, business segment, related purchase behavior, alternatives that will ultimately create more viable, prof- etc.? By better understanding your current customer base, itable businesses in the future. ■ new segments can be identified that could potentially create a stronger point of difference for your business in tar- About the Author: get segments. This, in turn, can pave the way for additional Frank Perkowski is the founder and president of Business Development Advisory (BDA), industry-focused consulting firms based in Atlanta, Ga. BDA concentrates on helping companies in mature markets identify and implement growth strategies that add value to their business. Perkowski can be reached at 770-643-9081 or by email at frank@bd-advisory.com. growth opportunities through more effective geographic expansion and intangible asset development. Expansion into Related/Adjacent Segments. This is the boldest, most innovative growth strategy of all, as it builds upon an existing business to establish a potentially much different kind of business. By utilizing existing expertise or capabilities in a different but related context, the company is able to establish a clearly differentiated business in potentially new (but related) categories. Why not subscribe today! There are many different applications of this approach, Go to www.paperage.com. including horizontal and vertical integration or expansion 34 Are you reading your own copy of Paper Age? JULY/AUGUST 2004 PaperAge