Chapter 11 - Stock Market Investing 101

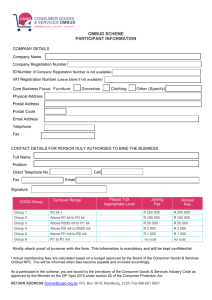

advertisement