Online Search & the Battle for Clicks

advertisement

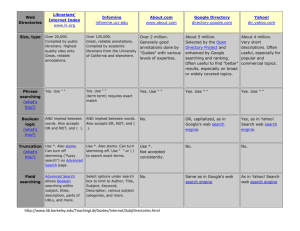

SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP Google: Online Search & the Battle for Clicks May 1, 2005 Prepared by: Priya Iyer Brian Courtney Sloan Fellows ’05 i SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP TABLE OF CONTENTS 1 INTRODUCTION..............................................................................................................................................1 2 SEARCH ENGINE INDUSTRY EVOLUTION .............................................................................................1 2.1 2.2 2.3 3 STRUCTURE OF THE INDUSTRY ...............................................................................................................5 3.1 3.2 4 VALUE CHAIN ...........................................................................................................................................13 CREATING VALUE .....................................................................................................................................14 CAPTURING VALUE ...................................................................................................................................14 DELIVERING VALUE ..................................................................................................................................15 COMPETITIVE RESPONSE ...........................................................................................................................15 CREATION & CONTROL OF PROPRIETARY INDUSTRY STANDARDS ............................................................16 GOOGLE’S FUTURE STRATEGY ..............................................................................................................18 6.1 6.2 6.3 6.4 6.5 6.6 7 VALUE CREATION VS. VALUE CAPTURE .....................................................................................................9 CRITICAL FACTORS OF VALUE CAPTURE ..................................................................................................11 VALUE CAPTURE ACROSS FIRMS - UNIQUENESS VS. COMPLEMENTARY ASSETS .......................................11 GOOGLE’S COMPETITIVE POSITION ....................................................................................................13 5.1 5.2 5.3 5.4 5.5 5.6 6 PORTER’S FIVE FORCES ANALYSIS ..............................................................................................................5 SYSTEM MODEL ..........................................................................................................................................6 VALUE CAPTURE IN THE ONLINE SEARCH INDUSTRY.....................................................................9 4.1 4.2 4.3 5 INDEXING – FINDING CONTENT ...................................................................................................................2 QUALITY OF RESULTS .................................................................................................................................2 MARKET TRENDS ........................................................................................................................................4 GROW CURRENT CONSUMER MARKETS ....................................................................................................18 PROVIDE UBIQUITY ACROSS DEVICES .......................................................................................................19 EXPAND GLOBALLY ..................................................................................................................................19 PENETRATE ENTERPRISE MARKETS ..........................................................................................................19 BUILD NETWORKS & PARTNERSHIPS ........................................................................................................20 CONCLUSION .............................................................................................................................................20 APPENDIX .......................................................................................................................................................21 7.1 7.2 HISTORY OF SEARCH ENGINES AND DIRECTORIES ....................................................................................21 VALUE CAPTURE STRATEGY OF FOLLOWERS ............................................................................................23 ii SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP 1 Introduction Since the inception of the internet the user community has longed for complete and efficient access to the vast array of content on the web. This gave rise to an industry for search engines with players including Lycos, Yahoo!, Infoseek, AltaVista, Inktomi, Ask Jeeves, Google, and Northern Light. Competition revolved around relevance of search results and total indexed content. To find and index more sites, bots and spiders were created to tirelessly search the web. Search engines quickly learned that the vast majority of searches were for retail products. Google leveraged this to become the dominant channel for online advertisements. With billions of dollars at stake, search rank and ad placement became critical and hence highly profitable. Google has evolved from being a best-of-breed search engine to a destination site for a vast array of activities including eCommerce, email, blogging, maps, and much more. When Google went public in 2004 they were generating over a billion dollars a year in adverting revenue. In the battle for platforms, Microsoft is the unequivocal winner having crushed giants like IBM, Apple, Lotus, Netscape, etc. In the post-PC era, control of the platform matters only to the extent that it is one of the means of controlling the on-ramps to the Internet. The emerging battle is about capturing eye­ balls and mouse-clicks; where business models are based on on-line advertising revenue, sale of goods, subscriptions to content, and bundled broadband access1. This paper looks at how the search engine market evolved and how Google is on its way to become the dominant player. We will take a look at how value is created and captured within this market and what the system dynamics are for growth. In looking at the value chain, we will explore how competitive dynamics will evolve in the “battle for clicks”. Will Google win because its search-engine technology makes it the Internet portal of choice? Will Yahoo! manage to gain an advantage by being the most aggressive in acquiring content, e-commerce, and advertising properties on the internet? Or, perhaps it is impossible to beat Microsoft with its monopoly in the operating system platform. With this we will explore the future for the search market and discuss key factors for success. 2 Search Engine Industry Evolution The Internet and the World Wide Web (WWW) were radical innovations that sparked new channels and new forms of businesses. Though the Internet has been around since the 1960’s, Tim Berners Lee created the WWW in 1990. The WWW consist of two main components, a web server for publishing content, and web browsers for accessing content. Both internet browsers and web servers have 1 Battle for Clicks, Fuld & Company, 2005 1 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP been freely available since 1991. The evolution of the WWW was truly astonishing. From 26 known web sites in late 1992 to today where there are millions of web sites and billions of web pages. During this period of rapid growth many new products have been invented to help make the web easier to navigate and use; one of the most meaningful of these is the search engine. 2.1 Indexing – Finding Content In the early days of the Internet, users shared files using FTP servers. To help facilitate the ability to find these files Archie was written by Alan Emtage of McGill University in Montreal in 1990. Archie provided script based data gathering with query capabilities, creating the first true web search. Based on the success of Archie, alternative utilities were created, the most popular of which was Gopher. To search Gopher, Veronica and Jughead were written in 1993. These represent the first S-curve in search evolution. The problem with these tools was that the user had to manually maintain the directory of sites that could be searched. Indexability They were limited in their reach and quickly became outdated. Around this time, Matthew Gray of MIT wrote the World Wide Web Wanderer, the web’s Spiders first robot. Bots were a disruption to the existing state allowing of computers search to Hierarchy technology Bot Based Search WWW Worm automatically Archie index and re-index sites. While they significantly increased the number of sites 1990 2000 2010 Figure 1: Disruptive innovation in index-ability for search that could be accessed through automation of the indexing, result relevancy became the dominant issue. However, over a period of time more generalized ‘bots’ emerged which searched different collections of data. Spiders were another significant incremental innovation to bots - they not only indexed the content, they followed page links and references to find new sites. In 1993, three search engines emerged that leveraged spiders: JumpStation, the World Wide Web Worm, and Repository-Based Software Engineering (RBSE) spider. Bots and Spiders represent the second S-curve in the evolution of search engines. 2.2 Quality of Results JumpStation and WWW Worm simply listed results in the order they were found on the web. This algorithm, a FIFO implementation, was not scaleable and these sites soon disappeared. RBSE 2 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP however implemented a ranking system, and though not successful, was a significant contributor to improving relevancy of search results. Focusing on result quality, many university projects have led to the launch of new search engine companies. The Architect project at Stanford used statistical analysis of word relationships to improve search. A group of six graduate students spun this technology off into a startup called Excite. In early 1994, David Filo and Jerry Yang2 a couple of PhD students at Stanford started creating a directory of their favorite web sites. As the number grew, they added a search capability to their directory and Yahoo! was born. Soon after, Brian Pinkerton of the University of Washington launched WebCrawler3 which utilized the first bot that indexed the entire content of a web page. Also in 1994, Lycos was founded. Michael Mauldin the CTO was credited with the first use of word proximity in search results relevance. Infoseek was also founded in 1994. Though they did not initially further search technology they were adopted by Netscape as their default search engine giving them major traction in the market. Additional incremental innovation followed with natural language queries from AltaVista in Quality of Search Results 1995. Up until this point bots would simply follow links from Clusters Meta-Search one Page Rank document to another making it very Natural Language hard for new websites to gain visibility. AltaVista began to allow Word Proximity customers to submit links rather than just relying on bots. This, coupled Archie with massive bandwidth, pushed 1990 AltaVista to an industry leading 2000 2010 Figure 2: S-Curve for Quality of Search Results position. In 1996 Inktomi was founded by two students from Berkeley. Looksmart was also launched in 1996 which became the default search engine for MSN until 2004. This was followed by Ask Jeeves and 1991 Archie 1994 1993 Lycos RBSE Yahoo! WWW Worm JumpStation WebCrawler Infoseek 1998 1997 1996 1995 1999 Go To MSN Search Go Network Excite Looksmart HotBot Ask Jeeves Google AltaVista About.com Northern Light Inktomi AllTheWeb Megellan FindWhat DejjaNews De Snap InfoSeek Figure 3: Timeline of Search Evolution 3 2001 Teoma 2004 Snap SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP Northern Light in 1997. In 1998, Google was founded by Larry Page and Sergey Brin, graduate students in Computer Science at Stanford University. Goolge, initially called BackRub,4 gave precedence in search results to sites that were the most frequently referenced or that were referenced by important sites. By returning more meaningful search results, Goolge quickly became the number one search engine for the web. It also became the default search engine for Yahoo! and AOL. The Teoma5 search engine, founded by research scientist from Rutgers University in 2001, used a similar technique with clusters to organize web pages into Subject Specific Popularity. Almost immediately after formation, Teoma was acquired by Ask Jeeves to drive its search. In 2004 Snap6 was launched by Bill Gross, the founder of Overture. Snap pushed search technology further, by showing users how many others have searched for similar terms. Snap shows these in search count order, giving the user ideas for different and related search terms. Search results are displayed with statistics like number of user clicks (how many times this result was selected), the average page views, and the cost to advertise for this result and the conversion rate if you do. 2.3 Market Trends Search is moving from a web-based model, accessed by a browser, to the desktop. Tool bars were created for Internet Explorer by all the major search engines. Google has also released a toolbar for the Windows task bar. Both Google and MSN have added Desktop Search that combines web based Company7 search with search on the local machine. In addition Google to searching recently visited sites, Desktop Search also searches past emails, files on the local file system, and IM messages. Today, Google is the leading search engine Searches Percent Of (Millions) All Searches 1,923 47.1% Yahoo 868 21.2% MSN 523 12.8% AOL 269 6.6% Ask 208 5.1% 37 0.9% 258 6.3% 4,086 100.0% EarthLink by more than a 2-to-1 margin over its nearest Others competitor. Eighty percent of all online searches are Total now controlled by the three largest search companies: Google, Yahoo and MSN. With oligopoly power these firms are not content with the status quo. Intense rivalry exists to increase market share forcing each firm to innovate or become marginalized. 2 http://soe.stanford.edu/AR95-96/jerry.html WebCrawler was purchased by Excite in 1997 4 http://www.google.com/corporate/history.html 5 http://sp.teoma.com/docs/teoma/about/developmentteamhistory.html 6 http://www.snap.com/about/about.php 7 http://searchenginewatch.com/reports/article.php/2156451 3 4 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP 3 Structure of the Industry Born in the early 1990’s, the search industry has begun to mature. Market leadership is defined by the site with the best search results and the highest user satisfaction. Behind the scenes the technology has evolved beyond just algorithmic competition. Today it takes hundreds of thousands of computers, working together in a clustered grid to index the billions of pages necessary to return adequate search results. Google leads the way with over 8 billion indexed pages serviced by an infrastructure of over 250,000 computers. 3.1 Porter’s Five Forces Analysis The search industry is a fast growth market with high spillover effects. The high growth, especially in the B2B sector, helps firms continuously innovate and grow rapidly. However, the high spillover allows followers to get into the market and gain market share. In addition, the capital cost for entry is also low and infrastructure can be scaled as the user base grows. This makes operational costs largely variable, increasing rivalry. On the other hand, it can be argued that revenue generation is mostly through online advertising and a large user base is required to attract advertisers. The fixed cost for generating any advertising revenue requires scaling of infrastructure and building a large loyal user base, which can be expensive. This has led to significant market consolidation creating an oligopoly in the industry with a few large players. This trend is expected to Threat of New Entrants is Moderate Suppli Supplier er Power Is Low Intensity of R Intensity Rivalry ivalry is High High continue when Microsoft releases Buyer Power is Moderate Longhorn, the Windows. In next version Longhorn, of desktop search will be available from every window, potentially eliminating the need to go to a web site to search for content. In addition, context and Availability of Substitutes is Low location information are expected to be available for more accurate and Figure 4: Five-forces Analysis of Search Industry localized search. Traditionally search engines have differentiated themselves on comprehensiveness of the search index, the currency of the index, the relevance of the search results, and usability factors such as simplicity, advanced search features, etc. As the industry has matured the ability to differentiate through features and functionality has become increasingly difficult. The switching costs are very low for search engine users. The development of proprietary APIs, by some players, to allow integration with other 5 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP applications is an attempt at increasing switching costs for users. With no exit costs, market consolidation, and high technology spillovers, competition in the industry is fierce. While entry barriers into online search are low, consideration must be given to the entry barriers to compete for online advertising. The advertising industry is a “two-sided” market (you need an existing audience to attract advertisers) while the search industry is a regular market (you attract customers just based on your solution). Barriers to entry for any multi-sided market are higher in general. In fact the numbers are very compelling for online advertising – only the top 10 players generate any meaningful revenue in online advertising. However, switching costs are low which makes the threat of new entrants moderate. The threat of substitutes for search is low in the online world. Possible substitutes exist in the offline space to access print and other forms of offline media. Search is a “pull” technology in which the user makes a conscious effort to locate particular content. Other “push” technologies that bring desired content can reduce the user’s active search but even push techniques will most likely use search technology behind the scenes. Suppliers for search engines are primarily the content providers. Content is plentiful on the web and (mostly) freely available for search engines to index, hence limiting supplier power. Buyers can be divided into two categories: consumers and advertisers. Switching costs for both consumers and advertisers are low which gives them moderate power. Both buyer types are rapidly becoming more educated. Search spend is a small fraction of costs. Little threat of backward integration exits. 3.2 System Model Another way to understand the industry structure is to look at the dynamic model, see Error! Reference source not found.. Here there are a number of reinforcing loops that drive search engine success. These include innovation, word of mouth, economies of scale and scope, attractiveness to advertisers, and standardization. Innovation begins with investment in R&D. Search engines must innovate to drive user satisfaction through new features and functionality and improved quality of results. Factors that lead to better Quality of Results include the comprehensiveness of the search index, the currency of the index, and the relevance of the search results. Additional factors driving User Satisfaction include ease of use, advanced search features, suggestions for other searches, spell checking, and the availability of a tool bar. By increasing User Satisfaction search firms retain customer and grow adoption through increased word of mouth. Word of Mouth is another reinforcing loop that drives customer adoption. An initial core base of users is required to trigger adoption through word of mouth. Once this is established, the more customers 6 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP that use a search engine and have a Innovation positive experience, the more new R users become aware of it and adopt Quality of Results User Satisfaction Innovation it. Additionally, marketing Word of Mouth and advertising of the R search engine can assist Affiliates in improving awareness and further reinforce the Advertisers Applications with Search Web API word of mouth loop. adoption R R are R&D Spend Search Engine Users Attractiveness Standards Ad Relavence attracted to web sites that Advertisers have a large user base. The more users using a Ad Costs R search engine, the more revenue can through higher Revenue generate Economies of Scale & Scope Number of Views/Clicks Marketing Spend click- through rates and banner Figure 5: Reinforcing loops for search engines. ads that pay per thousand views. In addition to these economies of scale, there are also economies of scope. Some search engines include web portals and web applications as a way to draw in more adoption. Features like mail, Instant Messaging, news services, classifieds and the like help make a site ‘sticky’, keeping users on the site longer. This opens the door to more search advertisements and to alternative forms of advertisements like rich media. In addition, with better quality search results, ads can be better targeted at the user. With 70% of all searches focused on consumer goods, it is critical to be able to place the right ad on the right page. Search engines also generate more adoption through affiliate partnerships - by enabling third party sites to use their search engine. APIs can provide programmatic access to the search engine, generating more clicks. Open but proprietary standards for search APIs 7 Figure 6: Advertising and economic growth SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP can further drive adoption and hence the ability to sell more advertising. There is also a direct correlation between advertising spend and GDP, Personal Consumption Expenditures and corporate profits. Research done by the Bureau of Economic Analysis at the University of McCann has tracked this since 1971. This trend suggests larger market risk to publishers like Google that generate all of the revenue from advertising spend compared to more diversified sites, like Yahoo! and AOL that have other sources of revenue. Innovation in the search engine space has led to vast improvements in targeting technology and in measurement technology. This in turn has improved the effectiveness of online advertisers. The more effective online advertising becomes, the more advertisers will spend as a percentage of their overall advertising budget. In addition, the more targeted the ad placement and the better the measurement metrics the more price tolerant advertisers become. Market consolidation in search engines and portals has created a premium market for advertising. Advertisers are willing to pay a premium for the best ad location on the pages with the most visibility. This creates relative scarcity for the premium locations. The top four publishers (Google, AOL, Yahoo! and MSN) represent 50% of all ad spends online. Figure 7: Ad spend skews to oligopolies In addition, broadband penetration into the home market has made rich media a reality. With advertisers able to create TV quality advertisements online, the market for search engines to deliver rich and interactive ads has created more interest by advertisers. These three combined factors: relative scarcity, ad efficiency and rich media, have driven up the pricing for online advertisers. The increase in pricing has led to more revenue for search engines which has increased R&D spend on innovation. The incremental innovations improve the drivers for price increases, creating a reinforcing loop. The main balancing loop in the search engine Technology Competitors Technology market is competition. The technology gap between any two firms results in decreased search performance. Firm R&D Spend Relative Search Results Gap Competitors R&D Spend Decreased performance means less adoption which decreases revenue and hence R&D investment. With less investment a firm is less likely to innovate causing the Competitor Revenue Firm Revenue Adoption results gap to open further. With high spillovers, IP protection is of marginal value. Competitors quickly copy each other, avoiding direct IP confrontation. The key to 8 Figure 8: Balancing loops SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP minimizing this effect is constant technology innovation. 4 Value Capture in the Online Search Industry Online advertising began in 1994 when HotWired (now wired.com) launched its site with ads from AT&T, Sprint, MCI, and Volvo. This sparked the interest of Roy and Jay Schwedelson, who started WebConnect with the idea to sell banner ad placement. Soon after, WebConnect went live with an online advertising media kit. Once they rolled out accurate measurement tools allowing customers to track clickthrough rates and provided banner rotation8 web advertising was born. 4.1 Value Creation vs. Value Capture •Google •Yahoo! High Initially the Search industry was all about Early search engines were created as free utilities. Yahoo! was one of the first companies to monetize on-line search through advertising. •WWW Wanderer Low •Gopher •Veronica •Archie Yahoo! allowed advertisers to place banner ads on the search results page for a fee. Search engines were able to show different ads based on the surfing habits of the individual user. For example, if the •MSN Search Value Captured value creation with little to none in value capture. •Ask Jeeves •Alta Vista •Inktomi •Excite •Infoseek •Lycos Low High Value Created Figure 9: Value Created vs. Value Captured by Search Engine user profile shows that that user frequently visits automobile related web sites, that user may indeed see an automobile ad on the page. As the search industry matured, several new strategies for value appropriation emerged. These include ad dollars in flat-fee formats such as those used in traditional media; e.g. print ads like Yellow Pages or newspapers, and analog media, such as TV or radio. Today's online advertising allows both flat-fee approaches for static ad placement as well as interactive online methods that are based on transactional charges. Most of the attention and success has been focused on the new transactional advertising models, including: 1. Display Advertising: Advertiser pays an online company for space to display a static or hyperlinked banner or logo on one or more of the online company’s pages. 2. Sponsorship: Advertisers sponsor targeted Web sites or email areas (e.g., entire web site, site area, an event, parts or all of an email message). Sponsorship usually contains banner elements. 8 Banner ad rotation allows banner ads to rotate between multiple sites for a single ad purchase. 9 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP 3. E-mail: Banner ads, links or advertiser sponsorships that appear in e-mail newsletters, e-mail marketing campaigns and other commercial e-mail communications. Includes all types of electronic mail (e.g., basic text or HTML-enabled). 4. Search: Fees advertisers pay online companies to list and/or link their company site domain name to a specific search word or phrase (includes paid search revenues). Search categories include: • Paid listings: Text links appear at the top or side of search results for specific keywords. The more a marketer pays, the higher the position it gets. Marketers only pay when a user clicks on the text link. • Contextual search: Text links appear in an article based on the context of the content, instead of a user-submitted keyword. Payment only occurs when the link is clicked. • Paid inclusion: Guarantees that a marketer’s URL is indexed by a search engine. The listing is determined by the engine's search algorithms. • Site optimization: Modifies a site to make it easier for search engines to automatically index the site and hopefully result in better Figure 10: Advertising Revenue by Category placement in results. 5. Referrals: Fees advertisers pay to online companies that refer qualified leads or purchase inquiries (e.g., automobile dealerships which pay a fee in exchange for receiving a qualified purchase inquiry online, fees paid when users register, or apply for credit card, contest or other service). 6. Classifieds and auctions: Fees advertisers pay online companies to list specific products or services (e.g., online job boards and employment listings, real estate listings, automotive listings, auctionbased listings, yellow pages). 7. Rich media: Advertisements that integrate some component of streaming video and/or audio and interactivity, in addition to flash or java script ads, and can allow users to view and interact with products or services (e.g., a multimedia product description, a “virtual test-drive”). “Interstitials” are included within the rich media category and represent full-or partial-page text and image server-push advertisements which appear in the transition between two pages of content. Forms of interstitials can include splash screens, pop-up windows and superstitials. 10 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP 8. Slotting fees: Fees charged to advertisers by online companies to secure premium positioning of an advertisement on their site, category exclusivity or similar preference positioning (similar to slotting allowances charged by retailers). 4.2 Critical Factors of Value Capture Some of the core components of a search engine's monetization approach have comprised a combination of uniqueness and complementary assets including the following: 1. Relevancy before monetization: For some portals, search is their core business. For others, like Yahoo! or AOL, it is part of a much broader business. To achieve maximum benefit out of any monetization strategy, a search engine company must keep the priority on relevancy (and diversity) of results; an updated, user-friendly interface; ever-increasing inventory; and improving the search tool's understanding of the audience's query type. 2. Provide unique search technologies: A search engine has to consider what differentiates its search product from others, and whether or not it clearly provides a perceived value to both search users and advertisers. For example, AskJeeves' differentiates itself by allowing broader type queries. 9 3. Encourage commercial search: Commercial search accounts for 30% of all search queries . These queries are just as complex as their non-commercial counterparts in terms of range of needs and required quantity of relevant results. For a significant portion of queries, users are expressing needs that businesses satisfy best. 4. Present a diversity of vendors, partners, products, and sales channels: All search engine companies have created paid inclusion or paid placement programs to obtain broader reach for more targeted advertising audiences. 5. Keep operational expenses cost effective: Infrastructure to carry for so much search traffic can be very costly if not carefully supervised. Search engine companies must regular monitor peak usage times on their Web servers; improve on their software efficiency with Web servers; and limit the size and complexity of database sizes and search nodes. 4.3 Value Capture across Firms - Uniqueness vs. Complementary Assets The 3 major search vendors, Google, Yahoo and MSN, have different strategies for competing online using different combination of uniqueness and complementary assets. Understanding the differences is important in understating the overall market. Yahoo! was one of the early search engine companies, developed in 1994. Despite all the changes in the search space over the years, Yahoo! has remained one of the most popular search 9 Source: Gary Cromwell, Search Engine Watch, December 16th, 2003. 11 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP destinations on the web. Yahoo! stood out from its early competitors by using humans to catalog the web, thus building uniqueness into its directory system. Crawler-based results from its partners only kicked in if there were no human-powered matches. That actually made search results by Yahoo! more relevant than competitors, making uniqueness its primary strategy for value capture for many years. However, as the industry matured, crawler-based results became both comprehensive and highly relevant. Yahoo! caught up in October 2002, when it Complementary Assets dropped its human-powered results in Available preference to Google's results. The The Inventor’s Dream Tightly Held The Big Win Yahoo! Directory still exists and is leveraged by the company, but today's Yahoo! is a far different from what it was in its early years. Yahoo! had Over time, developed several Easy to Maintain Uniqueness complementary assets including one of the most popular customizable portals with 25 international sites in 13 Hard to Maintain Few returns to Innovation? •Alta Vista •Lycos •Ask Jeeves •Infoseek •Inktomi languages, a widely recognized online brand, personalized Web pages, e-mail, chat rooms, and message boards. While Complementary Assets play •Yahoo! (expanding portal, brand) •Google (index, portal, brand) •AOL (unique content, broadband, AIM,mapquest) •MSN Search (Windows, Office, IE) Figure 11: Uniqueness vs. Complementary Assets most of its sales come from advertising, the company also charges fees for additional mailbox space, personal ads, and other services. Yahoo! also provides Internet access through a deal with SBC Communications. MSN was a late entrant into the search industry and has adopted a pure complementary assets strategy from the very beginning. Until recently, it outsourced its search technology, providing a mixture of results from LookSmart and Inktomi. MSN announced the first version of web search using its own technology in 2005. Strong existing complementary assets, such as the MSN portal and the search feature within its Internet Explorer browser, have made MSN Search one of the most popular search engines on the web. Over time, it hopes to further integrate with other “tightly held” complementary assets such as its Windows operating system and Office suite, creating value through “ease-of-use” and significantly increasing switching-costs – both ultimately facilitating value capture. Google's ability to analyze links from across the web helped it produce a new generation of highly relevant, crawler-based results. Its initial success was due to its unique high speed, highly scalable indexing capability combined with a unique relevancy based ranking of search results and a simple, easyto-use interface. While maintaining uniqueness remains hard, Google has continued to continuously 12 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP invest in its search technology, thus building a reputation (i.e. complementary asset) for being ahead of the curve in technological innovation. Simultaneously, Google has built a portfolio of complementary assets including text translation and image searching services; tools such as a Google dictionary, a Google phone book, and Web log publishing tool Blogger; Google Local to help users find maps, locally relevant Web sites, and listings from businesses in their area; a social networking site called Orkut, and free search-based e-mail service called Gmail. In 2004 Google announced plans to purchase online photo sharing company Picasa, as well as Keyhole, a supplier of online satellite maps that allow users to zoom down to street level to specific locations. Later that year the company unveiled a digital project giving Web searchers access to millions of books from the libraries of leading universities. By combining continuous innovation (uniqueness) with an extensive portfolio of “tightly held” complementary assets, Google is today, the most popular search engine in use and one of the most successful internet based companies when it comes to value capture. Several other search engines that initially gained some momentum through uniqueness have since disappeared due to their inability to build “tightly held” complementary assets during the “take-off” stage of the industry. Some of the notable ones include Infoseek, Lycos, Inktomi, Ask Jeeves and Alta Vista. See section 7.2 for a detailed discussion of uniqueness vs. complementary assets strategy for value capture among these players. As the search engine market took-off and matured, given the lack of opportunities for iron-clad IP protection, the players that focused on building “tightly held” complementary assets have succeeded in capturing value and have continued to survive. 5 Google’s Competitive Position So how does Google stack up? Google’s competitive position and its ability to gain sustainable competitive advantage can best be described using Porter’s Value Chain to see where Google captures value and Porter’s Four-Corners Analysis to allow us to predict Goggle’s future strategy. 5.1 Value Chain An understanding of the value chain of the online search and advertising industry and the positions occupied by the various players helps us better analyze Google’s ability to create, capture, and Content Provider Advertiser Ad Agency Ad Server Web Property ISP/InfraISP/Infrastructure Browser/ OS Figure 12: Value Chain of Online Advertising Industry 13 Consumer SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP deliver value in this industry. At one end of the value chain we have the consumer using a browser and operating system (OS) to access the internet. Microsoft, arguably, has an established monopoly in the browser and OS space with its Internet Explorer and the Windows operating system. Any request or data has to pass through an Internet Service Provider (ISP) or infrastructure provider. Several players including AOL and Microsoft play in this space. The web property includes the search engine or the portal which is the primary mechanism for delivering value. Google, Yahoo!, Microsoft, AOL Time Warner, etc. all have such web properties. Various content providers supply content to this web property. Time Warner is an example of a dominant player in the content creation space. At the other end of the value chain are advertisers interested in targeting products and services to the appropriate consumers. Ad agencies help identify the appropriate consumer profile and create ads with the appropriate message. The important task of matching up the right ads to the right consumers is done by a sophisticated piece of technology - the Ad Server. Companies such as Doubleclick, Yahoo!, and Google are well positioned in this space. 5.2 Creating Value So how does Google create value? Google is known for its sophisticated search algorithms, relevancy based ranking of results, an ever increasing index of web pages (Google’s search index is the largest with over 8 billion pages) and for setting the standard in simplicity, usability, and search features. Through its technology, Google provides complete and efficient access to the vast array of content on the web. Google also creates value for retailers by understanding the consumer and their current search context to create a unique channel for marketing relevant products and services. Finally, their superior technology attracts a large number of users. The larger the number of users the better Google’s relevancy ranking which in turn creates additional value to consumers and attracts more users. A large user base attracts a large partner network which provides a variety of relevant products that creates additional consumer value. This establishes a powerful, reinforcing web-based consumer marketplace. 5.3 Capturing Value Google has succeeded not only in creating phenomenal value but also finding innovative means of appropriating value. Three primary vehicles are used today to capture value: context sensitive ads, ad placement services, and search appliances. Google has the ability to places context sensitive ads, selected according to the words used in the search, on search results. Advertisers bid in highly complex auctions for the right to place ads on results pages for searches that use specific terms like used cars, SUVs, etc. 14 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP Over half of Google’s revenue and profits come from its external advertising network. Google manages advertising for a wide network of external websites for which it provides ad placement services through its AdWord and AdSense products. Google also sells a search appliance, a Linux server running its indexing and search software, to organizations wishing to provide search services for their internal Web servers. This business, however, is currently quite small contributing less than 2% of total revenue to the firm. 5.4 Delivering Value Google has developed a variety of channels for delivering value and continues to expand these. The key delivery methods include: • Localization of Google Search Engine to over 100 languages and cultures. • Focused e-Commerce with Froogle • Google News with continuously updated content from 4,500 sources and real time stock quotes • Desktop search for private content • Vertical searches e.g. mapquest, keyhole, job-search • Collaboration tools E.g. Google Groups, Gmail, Blogger, IM, Catalogs, Directories, etc. • Platform play with APIs for web, mobile, many others devices 5.5 Competitive Response Google maintains some uniqueness through IP patents on its algorithms and has built entry barriers through its massive infrastructure - a farm of 250,000 servers currently indexing 8 billion pages of content. Google has combined its search engine with sophisticated text-matching and auction systems to target, price, sell, and evaluate its ads, both those placed on its own site and those on its affiliates. It is also building platform capabilities with proprietary APIs, leading the evolving search standards, and supporting an open architecture across multiple hardware and operating system platforms. 15 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP Current Strategy Drivers • • • • f • • • • • • Create value by: • Attracting the most eyeballs in the web-based consumer market • Create a unique channel for products and services by understand the current context of the consumer Capture value through: • Context sensitive ads • Ad Placement Services Power of technology Ubiquitous, just- in-time information that is universally accessible. Gatekeeper for public and private content through all devices. Create a great work environment. Hire great talent. Do no evil! f Future Strategy Assumptions • Content is plentiful; finding what is relevant to you at this time is what is crucial Contextual advertising is a powerful source for revenue generation Controlling on-line ad placement universally is one mechanism for value appropriation Emerging and merging markets offer the greatest opportunity and greatest threats for future growth. Standards matter Microsoft is the evil empire! • • • • • Capabilities Superior Brand: #1 online brand! Superior technology for search and indexing Sophisticated ad placement and management capability Largest audience base provides greatest relevance of content and allows for strongest affiliate network; reinforcing loops. $56 billion market cap facilitates acquisition Growing platform capabilities through open/private APIs. Figure 13: Four Corners Analysis of Google Competitive Positioning While Google’s achievement to date is no small feat, its very success has increased competitive rivalry and attracted the attention and focus of powerful players like Microsoft and Yahoo!. Microsoft, specifically, with its extraordinary resources and ability to persist, has a history of coming from behind and tipping the market in its favor; Word over WordPerfect, Excel over Lotus 123, and Internet Explorer over Netscape are just a few examples. With very low switching costs, there is little that prevents consumers from switching to Microsoft search especially if it is seamlessly integrated with other Microsoft products that they are currently using. A technology strategy based on a clear understanding of the market dynamics is critical in order for Google to defy the odds and maintain its dominant position. 5.6 Creation & Control of Proprietary Industry Standards With the explosion of digital content, thanks to the web, its organization, search and retrieval for all types of devices is envisioned to have far reaching impacts over the next decade. As the market extends well beyond the web into enterprise applications and other consumer devices, a plethora of new search products and services will emerge to serve these needs. In order to truly create value, interoperability 16 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP between these new products and services as well as their integration with other applications is essential. Establishing search standards to facilitate this interoperability will be critical to value creation and retention. However, standards create new competitive forces in the industry. All customers want to be on the winning standard to take advantage of interoperability. As the percentage of market share (or perceived market share) for any one particular standard increases beyond a Increasing returns Value of standard to customer “tipping point” the value of that standard to the customer increases exponentially. The underlying logic of the search engine, including the hierarchy of how it lists websites in its results page, is likely to converge into one % market share Figure 14: Future dynamics of the search market standard. People searching on the Web will become used to how results are arranged based on their searches, switching costs will increase, and increasingly customers will be locked in. At the same time, designers will optimize their Web pages around the standardized search logic so that their pages are prioritized in the results based on the keywords entered into the search. Finally, advertisers will pay more to have ads placed with the leading search engine technology, which will further reinforce the move toward standardization. Once a standard is set, it becomes very difficult to displace the incumbent - the customer is locked in to a particular product. This creates a “winner take all” dynamic in the market. Google needs to take advantage of its market Standards are: Closed Open leadership to build and establish search standards and gain market share quickly to tip it in its favor. Private •Yahoo! •Google •Microsoft By increasing the number of ways users can search and the different types of search, Google will increase its presence to support a bid for it Ownership is: becoming the de-facto standard in search. Google Public •Lucy must tread lightly though for Microsoft is the king of winning competitive fights based on standards. After Google’s attack on the desktop, with toolbars, Figure 15: Access vs. Ownership of Search taskbars and desktop search, Microsoft has announced its intent on ‘defining’ the standards in the search space. In an industry where strong network externalities exist, a race to become the standard will quickly take place. Creating and establishing the dominant standard by itself does not guarantee a successful business. Google also needs to be able to appropriate value from its market share. Figure 15 shows the dimensions of access vs. ownership in search standards and the likely positions of the various players. Yahoo! 17 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP currently has proprietary, closed standards. While this has enabled significant value appropriation in the past, it will be difficult to tip that market in its favor given the network effects of the future, as described. Public domain search engines, like Lucy, will adopt an open standard with public ownership. While it could be argued that public standards are perhaps the fastest way to cause the market to tip to a particular standard, it is very difficult to appropriate value from public standards. In order to appropriate value in this market, Google needs to establish open standards that are proprietary Google needs to use its #1 brand position and the current technology gap it has created ahead of its competitors to build proprietary standards while retaining and increasing adoption. 6 Google’s Future Strategy So how can Google accomplish this? We recommend that following broad strategic thrusts for Google going forward. 6.1 Grow Current Consumer Markets Google has become synonymous with search. Being the # 1 brand on the web, people often refer to searching as ‘googling’. With this kind of brand awareness, Google needs to continue to grow its search presence. Today Google has expanded basic and advanced search to include: • Topic specific searches – Searching for information specific to Apple, BSD Unix, Linux and Microsoft. Google also offers search for all US Government sites; hundreds of distinct Universities like MIT, Stanford, and Brown; and Google Scholar which searches through scholarly papers. • Local Search – Searching for consumer goods and services in the context of geography (place). • Desktop Search – Searches the local desktop for content as well as the web. • Catalog Search – Search through mail-order catalogs for goods and services. • Mobile Search – Search from wireless handheld devices. Google must continue expanding search solutions. To that, Google has recently announced new search solutions including: • Search History – Allows a user to review all past search done at Google and gives feedback and suggestions based on your past searches. • Ride Finder – Searches for Taxi cabs, limousines and shuttle buses using real time position of the vehicles. 18 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP • Google Maps – Search for geographic locations along with driving direction and time estimates. In addition, Google offers two unique features over MapQuest and other rivals. First, after the user finds a location, they can see a satellite image of the location. Second, when searching for an address, Google points out what is at the address, by name when it can, and surrounding points of interests. • Google Suggest – As you type Google offers key words to help improve search key accuracy hence improving search results. • Personalized Search – Users enter profile information regarding interests in arts, business, computers, health, home, kids, music, recreation, regions, science, society and sports. Google then uses this information to help improve search results. 6.2 Provide Ubiquity across Devices Today data is stored and retrieved on many different devices. PDA’s and Blackberries are the norm for business users. A proliferation of new computing devices can be envisioned in the future through which digital content is searched and accessed. These present a great opportunity for growth. Google should extend it search capabilities to search not only the desktop, but also the palmtop and every such consumer device of the future. By adding integrated search support across all these devices, through standardized API’s, Google can become the ubiquitous platform for information retrieval any time, any where. 6.3 Expand Globally Currently Google derives 30% of its revenue from international sites. With support for over 100 dialects, Google is well on its way to having a global presence. However, consumer devices other than the traditional desktop are creating significant expansion of global markets, like India and China. In order to remain competitive and ensure that large international markets do not “tip” away from it, Google must continue its expansion in these until all relevant markets are captured. Additionally, Google can partner with Linux players in these markets (e.g. China, where Linux is widely adopted) to become the “Intel Inside” for non-Microsoft operating systems, thus building more complementary assets. 6.4 Penetrate Enterprise Markets Another area for expansion beyond the consumer market for Google is the private applications of enterprises. In order to find its place in the enterprise application value chain Google needs to transform itself into a platform. Figure 16 shows the value chain of the enterprise software application market and the likely position of search engines if Google successfully penetrates this space. 19 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP Operating System Database Search Engine Middleware Business Application Services Figure 16: Value Chain of the Search Enterprise Market Note that the search engine can, both, seamlessly integrate with the operating system or search dynamically generated pages from the database layer above. Such a platform enables significant value creation and value capture for Google. Today advertisers are attracted to Google because of ad efficiency. Presenting an ad for a good that a user is searching for on the results page for that search maximizes the efficiency for each individual ad. The next logical step would be to tie ads with inventory control so that marketers can align promotions with the level of stock. If Google, for example, could integrate search ad placement with backend ERP systems, advertisers could vary prices based on inventory levels. When inventory is high, sale prices could be offered, then as inventory decreases, sale price flatten out and finally as inventory goes to zero, the ads could stop being displayed. There are other strategies for pricing but the point is that tying ad placement together with inventory would allow advertisers to fine tune campaigns an hence create more value appropriation. 6.5 Build Networks & Partnerships Google needs to continue building partnerships, especially in the enterprise markets. Partnerships and integration with database vendors like Oracle, ERP vendors like SAP, and operating systems like Linux will enable it to continue adding value to its client base (seamless integration) while simultaneously increasing switching-costs for its customers. 6.6 Conclusion Winning the search engine game is all about innovation and strategy. If the past is any indication of the future, simply having the best product will not lead to a winning position. In a market dominated with major players and where market disruption is only a new entrant away, Google can never rest. To win, Google must continue to grow its customer base and API adoption and drive the market to standardizing on its technology. In the first quarter of 2005, Google announced record revenues of $1.26 billion, up 93% year-to-year over 2004. This growth stems from stronger site traffic and increases in the size of the Google Network. Google is clearly winning the battles - the question remaining is will they win the war? Will they do what few others have ever done, beat Microsoft? As the future unfolds, we’ll have to google it to find out… 20 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP 7 Appendix 7.1 History of Search Engines and Directories Below is a table showing a summary of the history of search engines and directories. This table is updated as historical events occur within the search engine industry and as new information becomes available about past search engine history. Historical data last modified: 2005-03-2110 2005 R1 2005 R2 2004 R1 2004 R2 2004 R3 2004 R4 2004 R4 2003 R1 2003 R2 2003 R3 2002 R1 2002 10 2005 March . . . IAC/InterActiveCorp acquires AskJeeves . . . 2005 March 2005 March 2005 January 2005 January Yahoo! Celebrates 10th Anniversary Overture Renamed Yahoo! SMS Gigablast Index Size 1,000,000,000+ AOL Search Relaunches 2004 November 2004 November 2004 August 19 2004 September New MSN Search Google Index Size 8,058,044,651 Google IPO GOOG NASDAQ Amazon launches A9.com Search 2004 August 2004 June 2004 June 2004 June Yahoo! launches Local Search Engine New MSN Search Technology Preview AOL acquires Advertising.com Yahoo! launches Yisou.com China 2004 June 2004 June 2004 March 2004 March Ask Jeeves acquires Tukaroo Search Google invests in Baidu Search China AltaVista switches to Yahoo! Search Google Gmail free email service 2004 March 2004 March 2004 March 2004 March Yahoo! Toolbar with WebRank AlltheWeb switches to Yahoo! Search AskJeeves acquires Excite, iWon, My Way Yahoo! Site Match™ powered by Overture 2004 February 2004 February 2004 February 2004 January Yahoo! Web Search powered by Yahoo! Lycos Search discontinued Lycos Communities discontinued New MSN Search BETA 2003 October 2003 October 2003 July 2003 June Google acquires Sprinks Yahoo! acquires Overture Yahoo! to buy Overture Google AdSense 2003 April 2003 April 2003 April 2003 April FindWhat acquires Espotting Google acquires Applied Semantics Overture acquires AltaVista Overture acquires Fast/AlltheWeb 2003 March . . . Yahoo! acquires Inktomi . . . 2002 December 2002 July 2002 March 2002 March Froogle Gigablast Beta LookSmart acquires WiseNut Gigablast Pre-Beta 2002 February . . . Source: http://www.seoconsultants.com/search-engines/history/ 21 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP R2 Google AdWords Select . . . 2001 October 2001 September 2001 September 2001 August GoTo changes name to Overture AskJeeves acquires Teoma WiseNut LookSmart integrates Zeal 2001 May 2001 April 2001 February 2001 February JoeAnt Teoma GoGuides Google acquires Deja Archive 2000 December 2000 October 2000 September 2000 September Google Toolbar Google AdWords LookSmart acquires Zeal Media Espotting 2000 September 2000 June 2000 June 2000 May Business.com Vivísimo Yahoo! Web Search powered by Google Terra acquires Lycos 1999 November 1999 September 1999 August 1999 July NBCi/Snap FindWhat AlltheWeb Disney acquires Infoseek 1999 June 1999 February 1999 January 1999 CMGI acquires AltaVista GO Network At Home acquires Excite About.com 1998 October 1998 September 1998 September 1998 June Lycos acquires Wired/HotBot Google MSN Search ODP/DMOZ 1998 May 1998 April 1998 . Yahoo! Web Search powered by Inktomi Direct Hit GoTo acquires WWW Worm . 1997 August 1997 July 1997 April 1997 February Northern Light FAST Search Ask Jeeves The Mining Company 1997 . . . GoTo . . . 1996 R1 1996 October 1996 June 1996 May 1996 April LookSmart Archive.org HotBot Alexa 1996 R2 1996 January 1996 1996 . BackRub Mamma Dogpile . 1995 R1 1995 December 1995 October 1995 September 1995 August AltaVista Excite Inktomi Magellan 1995 R2 1995 August 1995 June 1995 May 1995 February DejaNews MetaCrawler SavvySearch Infoseek 1994 December 1994 July 1994 April 1994 April First W3C meeting at MIT Lycos Yahoo! WebCrawler 1994 R2 1994 January 1994 . . Galaxy Open Text . . 1993 1993 December 1993 December 1993 December 1993 November 2001 R1 2001 R2 2000 R1 2000 R2 1999 R1 1999 R2 1998 R1 1998 R2 1997 R1 1997 R2 1994 R1 22 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP R1 RBSE JumpStation WWW Worm Aliweb 1993 August 1993 June 1993 March 1993 March Mosaic Web Browser WWW Wanderer Jughead First email message sent by Bill Clinton 1993 February . . . Architext . . . 1992 December 1992 July . . Veronica Lynx Web Browser . . 1991 May 1991 April 1991 April . WWW Server Production Gopher WAIS publisher fed search engine . 1990 December 1990 . . WWW Server Prototype Archie . . 1993 R2 1993 R3 1992 R1 1991 R1 1990 R1 7.2 Value Capture Strategy of Followers In this section, we discuss the uniqueness vs. complementary assets strategy for value capture among some of the followers in the industry. Specifically, we explore Infoseek, Lycos, Inktomi, Ask Jeeves and AltaVista. • Infoseek (1995-2001) originally hoped to capture value through uniqueness – combining a manually maintained directory with a spidered index – and charge for searching. When that failed, the popular search engine shifted to depending like others on banner ads. Disney took a large stake in the company in 1998 and tried building complementary assets by going down the "portal" path that other leading search engines had followed. The site was also renamed "Go." Its failure to maintain uniqueness or build strong complementary assets caused Disney to stop Go's own internal search capabilities abruptly in early 2001. Today, Go remains operating, powered by Yahoo! • Lycos (1994; reborn 1999) operated one of the web's earliest crawler-based search engines. Lycos stopped depending on that spider in 1999 and instead now outsources for its search results from Ask Jeeves. • Inktomi (1996; acquired 2003) grew based on the uniqueness of its powerful search engine - a technology called "Concept Induction™" to automatically analyze and categorize millions of documents incorporating algorithms that model human conceptual understanding of information. Its failure to build complementary assets resulted in it being acquired by Yahoo! in 2003. Its search engine lives on as Yahoo! Search. • Ask Jeeves (1998; reborn 2002; acquired 2005) originally hailed as the "natural language" search engine didn't really have the ability to understand language. Instead, Ask Jeeves had over 100 editors monitoring what people searched for, then hand-selecting sites that seemed to best answer the queries. 23 SLOAN FELLOWS PROGRAM IN INNOVATION & GLOBAL LEADERSHIP Such an approach is good for the most popular queries but doesn't help when people want unusual information. Ask purchased Direct Hit in early 2000, to make it more comprehensive. The company failed to capitalize on that technology, and tried again by purchasing Teoma in 2001. In 2002, it shifted over to relying on Teoma for nearly all of its matches. It was acquired in 2005 by InterActiveCorp (IAC), and still lives as Ask.com. • AltaVista (1995 - 2003) was the Google of its day. AltaVista offered access to a huge index of web sites, when it launched in December 1995. The search engine quickly grew in popularity, driven by uniqueness. It was re-launched as a portal (an attempt at building complementary assets) in October 1999, entering an already crowded field and taking its attention away from uniqueness - the quality of its search results. It paid the price as unsatisfied users flocked to newcomer Google. Throughout everything, AltaVista's crawler has kept going. It was acquired by Overture in 2003 which is now part of Yahoo! 24