Gross Salary

advertisement

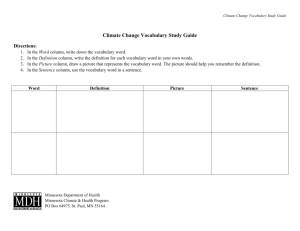

Gross to net salary of a local executive and total cost to employer comparison for selected countries Married, two dependant children All the numbers are in EURO Country Gross Salary Employee Social Security Income Tax Euro 2 (A) (B) Column : 1 Net To Employee 5 Net % To Employee After Social And Income Tax 6 Marginal Income Tax Rate (on next Euro of Income) (C) 7 Employer Social Security Total Gross Cost To Employer (Salary + SS) Total Net Cost To Employer (After Corp. Tax Benefit if Profitable) 9 Top Marginal Corporate Income Tax Bracket Percentage 10 (A) 8 3 4 11 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 9,100 13,000 2,600 12,500 8,000 3,000 6,500 20,400 0 11,500 11,500 10,500 7,100 3,600 11,500 2,600 3,000 10,500 1,600 6,500 7,800 13,500 11,000 7,600 0 1,700 22,100 2,100 2,700 11,400 13,700 3,400 200 4,900 30,200 35,400 22,800 12,500 36,600 20,000 39,000 7,700 25,000 20,700 20,700 29,200 36,800 28,400 33,200 24,300 24,000 16,900 29,500 34,500 30,100 24,200 24,900 14,800 13,000 17,500 29,900 31,600 46,300 19,100 10,300 30,000 13,000 28,700 60,700 51,600 74,600 75,000 55,400 77,000 54,500 71,900 75,000 67,800 67,800 60,300 56,100 68,000 55,300 73,100 73,000 72,600 68,900 59,000 62,100 62,300 64,100 77,600 87,000 80,800 48,000 66,300 51,000 69,500 76,000 66,600 86,800 66,400 61% 52% 75% 75% 55% 77% 55% 72% 75% 68% 68% 60% 56% 68% 55% 73% 73% 73% 69% 59% 62% 62% 64% 78% 87% 81% 48% 66% 51% 70% 76% 67% 87% 66% 50% 54% 30% 13% 59% 20% 53% 38% 25% 41% 41% 40% 38% 41% 45% 25% 24% 39% 35% 52% 40% 40% 37% 16% 13% 19% 41% 43% 61% 38% 25% 35% 15% 40% 20,500 32,700 2,600 35,000 700 33,500 23,600 46,200 0 11,500 11,500 18,400 32,000 10,800 41,900 6,900 31,000 10,200 1,600 3,100 14,100 9,500 23,800 11,000 2,500 5,400 30,900 10,300 32,500 14,700 13,700 21,500 2,600 11,900 120,500 132,700 102,600 135,000 100,700 133,500 123,600 146,200 100,000 111,500 111,500 118,400 132,000 110,800 141,900 106,900 131,000 110,200 101,600 103,100 114,100 109,500 123,800 111,000 102,500 105,400 130,900 110,300 132,500 114,700 113,700 121,500 102,600 111,900 25% 34% 10% 21% 25% 20% 26% 34% 15% 16% 30% 25% 20% 13% 32% 15% 15% 30% 35% 26% 28% 19% 27% 16% 24% 19% 22% 30% 28% 32% 32% 20% 25% 28% 90,400 87,600 92,300 106,700 75,500 106,800 91,500 95,900 96,100 93,900 78,100 88,800 105,600 97,000 95,900 90,900 111,400 77,600 65,200 76,800 82,200 88,700 91,000 93,200 77,900 85,400 102,100 77,200 95,400 78,000 77,000 97,200 77,000 80,600 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 2,300 1,000 1,600 900 5,500 5,500 5,500 5,500 5,500 30,700 25,100 35,000 27,000 16,500 0 19,300 26,662 16,500 67,000 73,900 63,400 72,100 78,000 94,500 75,200 67,838 78,000 67% 74% 63% 72% 78% 95% 75% 68% 78% 35% 28% 46% 28% 19% 25% 22% 30% 19% 11,500 37,300 1,800 5,000 5,500 5,500 5,500 5,500 5,500 111,500 137,300 101,800 105,000 105,500 105,500 105,500 105,500 105,500 35% 34% 34% 28% 35% 25% 42% 46% 36% 72,500 90,600 67,700 75,600 68,200 78,700 60,500 56,400 67,100 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 1,500 1,100 0 0 2,000 7,100 7,900 11,000 5,600 100 38,500 27,700 13,900 33,000 31,200 36,000 14,500 23,900 10,200 34,800 60,000 71,200 86,100 67,000 66,800 56,900 77,600 65,100 84,200 65,100 60% 71% 86% 67% 67% 57% 78% 65% 84% 65% 30% 40% 15% 34% 35% 46% 33% 28% 20% 40% 6,900 2,600 0 0 4,200 4,300 8,300 12,000 3,600 100 106,900 102,600 100,000 100,000 104,200 104,300 108,300 112,000 103,600 100,100 30% 25% 17% 42% 30% 26% 41% 25% 18% 28% 74,800 77,000 83,500 58,000 72,900 77,200 63,900 84,000 85,000 72,100 EUROPE Austria (1) Belgium (2) Cyprus Czech Republic Denmark (3) Estonia Finland (4) France (5) Georgia (6) Germany (7) Germany and Berlin (7) Greece (8) Hungary (9) Ireland (10) Italy (11) Latvia (12) Lithuania Luxembourg Malta before ref & imp. Netherlands (13) Norway Poland (14) Portugal (15) Romania (16) Russia Slovakia (17) Slovenia (18) Spain (19) Sweden (20) Switzerland (Geneva) (21) Switzerland (Zurich) (22) Turkey (23) Ukraine (24) United Kingdom (25) AMERICA Argentina Brazil (26) Canada (Ontario) (27) Mexico (28) USA USA and Reform Graetz USA and Illinois USA and New York USA and Texas ASIA/MIDDLE EAST/AFRICA Australia (29) China (30) Hong Kong India (31) Indonesia (32) Israel (33) Japan (34) Malaysia (35) Singapore (36) South Africa (37) South Korea Taiwan Thailand (38) UAE (39) Qatar 100,000 100,000 100,000 100,000 100,000 3,900 2,200 200 5,000 0 22,800 19,900 27,100 0 0 73,300 77,900 72,700 95,000 100,000 73% 78% 73% 95% 100% 39% 30% 37% 0% 0% 4,800 2,300 200 12,500 0 104,800 102,300 100,200 112,500 100,000 28% 25% 25% 0% 12% 76,000 76,700 75,200 112,500 88,000 (A) Before application to expatriates of Totalization Agreements and EU Directives on social security. (B) Before application of special expatriate tax rulings, e.g. Huyghe Reform, HQ ruling in France, treaty provisions and special statutory rules. (C) This marginal income tax rate is applied to the next amount of additional income received. (1) Austria - In column 8, Employer Social Security includes Social Security, employer part and other payroll taxes to be paid by the employer. The tax calculations are based on the assumption that the annual salary is paid out in 14 installments (as usual in Austria) in order to achieve the most favorable tax rate. (2) Belgium - An average of 7% communal tax has been applied for the calculations. For the employer social security in column 8, an estimate of 35% has been applied. The calculations were based on the assumption of a non working spouse and the children being older than 3. In column 4, the special social security contributions have been included in the calculation. In column 10, the calculation includes an estimates of 3% crisis tax (3) Denmark - Proposal is will reduce the corporate tax rate at 25%. (4) Finland - In column 3, pension insurance payment of 4,6% is applied. A higher rate of 5,8% is applied to employees over years old. In column 4, the National Income Tax and Municipal Tax are included. Church Tax is excluded. Municipal Tax ranges from 16% to 21%. . In this calculation, the percentage of Helsinki (17,5%) is applied (5) France - In column 3 and 7, the flat tax CSG / CRDS of 8% of which 5,1% is deductible is included. Above 100,000 the 11% rate applicable to passive income is used, DLF has opined this is an income tax. 2008 limitation on total personal income tax, flat tax , wealth tax and property tax to 50% of income not considered here In column 3 and 8, 2007 French standard social security contributions rates and brackets and 2007 supplementary social contributions rates. Assuming the employee is not a legal director or member of the board In column 4, 2007 French income tax rates and schedules. Assuming no other personal income is taken into account. Column 10 does not consider local taxes such as professional tax (6) Georgia - 2008 income tax rate is flat 25% and no social security additionally charged; integration. Corporate income tax is payable at the rate 15% of taxable income by enterprises carrying out economic activities in Georgia. Georgian tax legislation does not provide special payroll taxation regime for single persons and married with two children ones. (7) Germany - In column 3 - Social Security calculations including additional employee rate for nursing care is employee is between 23 and 65 of age with no children (where applicable) In column 4 - The individual Income Tax includes solidarity surcharge; excluding church tax. In column 7 - The marginal tax rates are with the solidarity surcharge of 5,5% of the income tax. In column 9 - The solidarity surcharge of 5,5% of the corporate tax included. In column 10 - The Corporate Income Tax excludes the local trade tax which is, for example, an additional 14% in Berlin. (8) Greece - for employees insured prior to January 1, 1993. (9) Hungary - In column 3, if the individual is a Hungarian national and is employed by a Hungarian entity, 8.5% pension contribution (capped at a salary-level of HUF 5,307,000 p.a.) and 4% health contribution are payable on the gross income. (Furthermore the Hungarian entity has to pay 1% contribution the so called Unemployment Solidarity Fund.) In column 7, the Hungarian tax rates are progressive up to 40%. In column 8, if the individual is a Hungarian national and is employed by a Hungarian entity, the employer has to pay 29% social security contribution on the gross income and HUF 3450 per month/person Health Fund contribution. (Furthermore the company is obliged to pay 1.5% Training Fund contribution.) (10) Ireland - In column 3 and 8, Calculations in respect of the married individual assume that his/her spouse will not have any taxable income. In column 4 - The standard rate of corporation tax for a trading company is 12,5%. This rate applies to passive non-trading income. The rate of corporation tax payable by a company depends on whether the income earned by the company is trading or non-trading. (11) Italy - In column 3, It is assumed that the local executive works in an Italian commercial company where the National agreement of "Dirigenti" (executive) of trading company is applied. In column 4, before application of treaty provisions. For local tax purpose, it assumes that the individual lives in Milan. In column 10, is included 33% for ordinary corporate tax and 4.25% for regional corporate tax ("IRAP") (12) Latvia - The maximum annual income subject to social security contributions is LVL 19,900, however, this is likely to be increased to LVL 22,700. (13) Netherlands - The partner's tax credit has been taken into account even though this credit can only be claimed by the partner. These calculations show the minimum social charges and not the maximum charges. (14) Poland - There is no tax benefits due to the number of children. We assumed that the executive has non-earning spouse. In order to benefit from the preferential taxation in joint tax return, the executive has to be married the entire tax year and there should be joint marital property regime between them In column 3, the employee social security contributions include the healthcare contribution, which is not technically the part of social security, but it is levied on the employee's remuneration and constitutes the additional burden. The marginal tax bracket percentage is 40%. (15) Portugal - In column 8, Assuming that they are Board members. Otherwise the social tax applicable would be 10% for the employee and 21.25% for the employer and a cap is also available. In column 10, the corporate income tax includes a 10% municipal surcharge (25%+2.5%) (16) Romania - No personal deductions are deducted for monthly gross incomes over ROL 30,000,000 (equivalent for approx. EUR 824) The figures are rather estimatives, due to specific requirements regarding the computation of certain social security contributions (e.g. number of employees, risk of the activity etc.) (17) Slovakia In column 4, should the spousal deduction and child bonus be applicable. (18) Slovenia - In column 8, Employer Social Security includes the employer's tax on salaries paid. (if the monthly salary is in excess of SIT 750,000 employer's tax on salaries = 14,8%. Employer's social security contribution = 16,1%) (19) Spain - It is assumed that children are between 3 and 25 years old. (20) Sweden - The employee's pension fee is 7% of the salary and benefits, capped at SEK 349,400. 12.5% of the paid pension fee is deductible against income and 87.5% is creditable against income tax The pension fee is included in the preliminary tax withheld. Employer social security contributions are 32.46% of the salary and benefits. No cap apply. Corporate Income tax is a flat rate tax of 28%, however, due to the possibility to make tax allocations reserves the effective tax rate can be lower. In column 7, the income tax rate includes the average Municipal Tax rate for Stockholm, Sweden (31%). The rate varies depending on where the individual is resident and range between 29% and 36%, including church tax, which you pay if your are a member of the Swedish church (0.8-1.0%) (21) Switzerland (Geneva) - In column 4, the Tax rates of the Canton and City of Geneva have been used. Minimum social charges shown. (22) Switzerland (Zurich) - In column 10, Corporate Income Tax rate is progressive, highest rate is used. Taxes are without Church Tax. Minimum social charges shown. (23) Turkey - In column 4, stamp duty has been included. (24) Ukraine - All calculations reflects amounts per year In column 3 and 8, the maximum amount subject to social security contributions is capped at UAH 4,100 per employee per month. In column 8, the amounts are calculated based on the minimum total percentage of the employer social security contributions (37%) as it includes, in particular, contributions to the social security fund against accidents at work that depends on the class of professional hazard established by the fund for each employer. The maximum total percentage is equal to 50%. (25) United Kingdom - The calculations are based on the UK tax rates for the year ending 5 April 2008. Social security rates are based on a "not contracted out" basis for State pension purposes. Contracted out rates result in slight reduction in social security cost up to £31,720. If an employer pension scheme is contracted out the total employee social security will reduced by £432. The total employer social security figure will be reduced by £944 to £270. (26) Brazil - The deductible amount per dependent is R$ 117,00/month per individual. The Social Security Contribution ceiling for the employee is R$ 275,96/month. In column 8, for the purpose of this calculation some labor costs such as vacation, 1/3 additional salary for vacation, prior notice indemnity, etc. were not considered. This calculation included the Employer Social Security (28,8%) plus the FGTS or Government Severance Indemnity Fund for employees (8,5%). In column 10, Corporate Income Tax (25%) plus Social Contribution Tax (9%). (27) Canada (Ontario) - Calculations are based on the 2007 Federal and Provincial rates applicable in the Ontario Province. In columns 3 and 8, Employment Insurance payments are included. Column 4 does not include the Ontario Health Care Premium. (28) Mexico - Some States impose a 1% or 2% payroll tax which should be paid by the employer to the local authorities. In Mexico City, companies pay a 2% payroll tax. (29) Australia - The amount in column 3 is based on the assumption that the taxpayer is not liable to an additional medicare levy surcharge of 1,5% on taxable income on the basis that the single taxpayer (or the married taxpayer and family) is covered by private patient hospital insurance cover. We have claimed spouse rebate of A$1,535 on the assumption the taxpayer maintains his/her spouse, the spouse's separate net income is less than A$6,421, the spouse is a tax resident of Australia and he/she is not entitled to claim family tax benefit Part B (with children under age of 5) For social security calculation, we have assumed the compulsory superannuation contribution obligation is satisfied by the employer in order to ensure the executive is still paid the gross amount of salary. Compulsory superannuation contribution in Australia is 9% of base salary (capped at maximum earning base of A$122,240) (30) China - Local PRC national employee hypothesis (Social Security is only applicable to local PRC national employees). In column 4, income tax is calculated based on taxable income net of employee Social Security. In columns 3 and 8, the current Social Security Contributions rates applicable to the City of Shanghaï was used. (31) India - The Indian tax year runs from April 1 to March 31. The calculations have, therefore been based on income earned during the year April 1, 2006 to March 31, 2007. The tax rates for the year include a surcharge of 10% for incomes over and above Rs.8,50,000 and education Cess of 2% on total tax and surcharge. An employee is eligible for a standard deduction from salary of Rs.30,000 or 40% (whichever is less) if income from salary is less than Rs.500,000 and Rs.20,000 (whichever is less) if income from salary is more than Rs.500,000. India has no system of social taxes. Instead for employees whose base salary is less than Rs. 6500 per month, there is a mandatory participation in Employee ProvidentFund (EPF). Employee & Employer contribute @ 12% of base salary respectively. As in the given case, Salary is higher than Rs. 6500 per month there are no applicable mandatory PF contributions In Column 10, the maximum marginal tax rate for the Indian domestic company has been mentioned, i.e., 35% + 2.5% surcharge + 2% education Cess. However, foreign companies in India are taxed at 41.82% (40%+2.5% surcharge + 2% education Cess).