CERP Recommendation on best Practices for Price Regulation

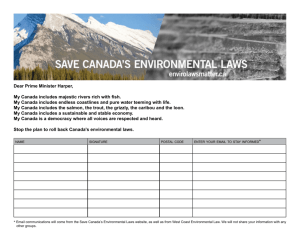

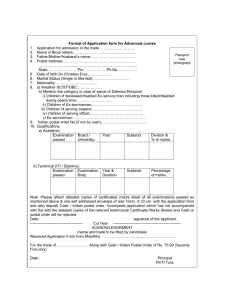

advertisement