Chapter 9 - Jb-hdnp

advertisement

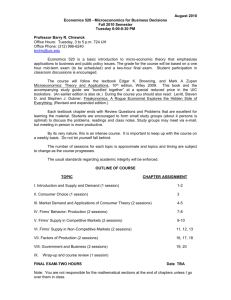

AP Microeconomics – Chapter 9 Outline I. Learning Objectives—In this chapter students should learn: A. How the long run differs from the short run in pure competition. B. Why profits encourage entry into a purely competitive industry and losses result in firms exiting the industry. C. How the entry and exit of firms affects resource flows and long‐run profits and losses. D. The differences between constant‐cost, increasing‐cost, and decreasing‐cost industries. E. How long‐run equilibrium in pure competition produces an efficient allocation of resources. F. About creative destruction and the profit incentives for innovation. II. Pure Competition Characteristics A. Very large numbers of sellers ensure that a single seller has no impact on price by its decisions alone. B. The products in a purely competitive market are homogeneous, or standardized; each seller’s product is identical to its competitor’s product. C. Individual firms must accept the market price; they are “price takers” and can exert no influence on price. D. Freedom of entry and exit means that there are no significant obstacles preventing firms from entering or leaving the industry. III. Profit Maximization in the Long Run A. Several assumptions are made. 1. Entry and exit of firms are the only long‐run adjustments. 2. Firms in the industry have identical cost curves. 3. The industry is a constant‐cost industry, which means that the entry and exit of firms will not affect resource prices or location of average‐total‐cost curves for individual firms. B. The basic conclusion is that after long‐run adjustments are completed, the product price will be exactly equal to, and production will occur at, each firm’s minimum average total cost. 1. Firms seek profits and shun losses. 2. Under competition, firms may enter and leave industries freely. 3. If losses occur, firms will leave the industry; if economic profits occur, firms will enter the industry. C. The model is one of zero economic profits, but note that this allows for a normal profit to be made by each firm in the long run. AP Microeconomics – Chapter 9 Outline 1. If economic profits are being earned, firms enter the industry; this increases the market supply, causing the product price to gravitate downward to the equilibrium price where zero economic profits are earned (Figure 9.1). 2. If losses are incurred in the short run, firms will leave the industry; this decreases the market supply, causing the product price to rise until losses disappear and normal profits are earned (Figure 9.2). IV. Long‐Run Supply A. Long‐Run Supply for a Constant‐Cost Industry 1. Supply will be perfectly elastic; the curve will be horizontal. In other words, the level of output will not affect the price in the long run. AP Microeconomics – Chapter 9 Outline 2. In a constant‐cost industry, expansion or contraction does not affect resource prices or production costs. 3. Entry or exit of firms will affect the quantity of output, but will always bring the price back to the equilibrium price (Figure 9.3). (Constant Cost Industry) B. Long‐Run Supply for an Increasing‐Cost Industry 1. Supply will be upward sloping as the industry expands output and increases the demand for resources. 2. Average‐total‐cost curves shift upward as the industry expands and downward as industry contracts, because resource prices are affected. 3. A two‐way profit squeeze will occur, because the entry of new firms lowers the product price at the same time that the new firms’ increased demand for resources pushes up average total cost (Figure 9.4‐above). C. Long‐Run Supply for a Decreasing‐Cost Industry 1. Supply will be downward sloping as the industry expands output, due to economies of scale. This situation is the reverse of the increasing‐cost industry. AP Microeconomics – Chapter 9 Outline 2. Average‐total‐cost curves fall as the industry expands and firms will enter, until price is driven down to maintain only normal profits (Figure 9.5). V. Pure Competition and Efficiency A. Whether the industry is one of constant, increasing, or decreasing costs, the final long‐run equilibrium will have the same basic characteristics (Figure 9.6 Key Graph). B. Productive efficiency requires that goods be produced in the least costly way. It occurs where P = MC = minimum ATC; at this point firms must use the least‐cost technology or they won’t survive. 1. Although a competitive firm may realize economic profit or loss in the short run, it will earn only a normal profit by producing in accordance with the MR = (P) = MC rule in the long run. 2. In long‐run equilibrium, the profit‐maximizing decision rule that leads each firm to produce the quantity at which P = MR also implies that each firm will produce at the output level that is associated with the minimum point on each firm’s ATC curve. 3. As a result, pure competition leads to the most efficient use of society’s resources. C. Allocative efficiency ensures that society’s scarce resources are directed toward producing the goods and services that people most want to consume. It occurs AP Microeconomics – Chapter 9 Outline where P = MC, because price measures the benefit that society gets from additional units of good X, and marginal cost measures the cost to society of other goods given up to produce more of good X. 1. If price exceeds marginal cost, then society values units of good X more highly than alternative products the resources can otherwise produce. Resources are underallocated to the production of good X. 2. If price is less than marginal cost, then society values the other goods more highly than good X, and resources are overallocated to the production of good X. 3. Allocative efficiency implies maximum consumer and producer surplus. a. Consumer surplus is the benefit buyers receive by having the market price less than the maximum price they are willing to pay (as also seen in Chapter 5). b. Producer surplus is the benefit sellers receive by having the market price greater than the minimum price they are willing to accept for payment. c. Combined consumer and producer surplus is maximized at equilibrium (Figure 9.6b Key Graph). d. Any quantity less than equilibrium would reduce both consumer and producer surplus (reducing the green and blue areas of Figure 9.6b Key Graph) e. Any quantity greater than equilibrium would occur with an efficiency loss that would subtract from combined consumer and producer surplus. D. Dynamic adjustments will occur automatically in pure competition when changes in demand, resource supplies, or technology occur. Disequilibrium will cause expansion or contraction of the industry until the new equilibrium at P = MC occurs. E. “The invisible hand” (introduced in Chapter 2) works in a competitive market system because no explicit orders are given to the industry to achieve the P = MC result (assuming private goods with no externalities). VI. Technological Advance and Competition A. The long‐run equilibrium model assumes that all firms have identical cost structures. But firms have an incentive to innovate and improve technology in a way that AP Microeconomics – Chapter 9 Outline lowers their production costs and gives them an edge over their competitors in earning economic profit. B. Because the actions of individual firms cannot affect the industry, an individual firm that finds a way to lower its costs (and can keep that savings to itself) can, in fact, achieve economic profit that lasts for a while. C. Firms will also attempt to achieve economic profit by developing new products for which they are the only producer, earning economic profit until competitors enter the industry. D. Creative destruction occurs when the creation of new products and production methods destroys the market positions of firms committed to existing products and old ways of doing business. 1. Even the threat of new rivals and technologies pushes existing firms to innovate. 2. The downside of creative destruction is the destruction—the closing of firms and unemployment of workers who may not be able to easily make the transition into new industries with their existing skill sets. E. Consider This … Running a Company is Hard Business 1. About 9.5% of American firms go out of business each year; 65% of new start‐ups will go out of business within ten years. 2. 650,000 new firms open each year, hoping to use the resources of these failed firms in an attempt to provide better, low‐cost products and survive the competition. VII. LAST WORD: Efficiency Gains from Entry: The Case of Generic Drugs A. When a pharmaceutical company introduces a new drug, it typically owns the patent and can price and produce as a monopolist, earning economic profits. B. When patent rights expire, however, firms pursuing economic profits enter the market for that drug (producing generics), and the market changes to more closely resemble pure competition. C. The introduction of competition typically drops prices of these drugs 30‐40 percent. Those lower prices increase efficiency and consumer surplus.