Profit and the aims of a firm

advertisement

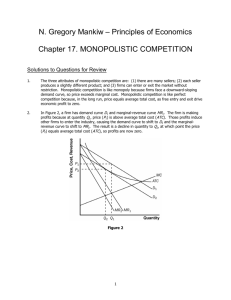

EC 480 SEMINAR 5 Revision: Costs, Revenues & Profit Profit and the aims of a firm Profit is made by firms earning more from the sale of goods than the cost of producing the goods. A firm’s total profit (Tπ) is then the difference between its total sales revenue (TR) and its total costs of production (TC) hence Tπ = TR – TC (Profit = Total revenue – Total cost). In order to discover how a firm can maximise its profit we must first consider what determines costs and revenue. The cost of producing any level of output will depend on the amount of inputs used and the price the firm must pay for them. If a firm wishes to increase output in a hurry, it will only be able to increase the quantity of certain inputs. It can use more raw materials, more fuel, more tools, and maybe more labour, but it will have to make do with its existing buildings and most of its machinery. This is the distinction between short run and the long run and considering ‘fixed factors’ and ‘variable factors’. A Fixed factor is an input that cannot be increased within a given period of time (buildings). A variable factor is one that can. The short run is a time period during which at least one factor of production is FIXED. Output can only be increased by using more variable factors of production. The long run is a time period long enough for all inputs to be varied. (A firm can build a second factory/install new machinery). Note: the short run and long run are not fixed time periods. Definitions Normal Profit is the profit that the owners of a firm could have earned in the next best alternative business. It is the opportunity cost of being in business. It is the amount of profit that is needed to keep the firm in business. (In the lecture 4 Normal profit allowed Kevin to remain a greengrocer). Abnormal profit (also known as pure profit or supernormal profit) is the excess of total profit above normal profit. It arises because of market power. Costs A firm’s costs of production will depend on the factors of production it uses. The more factors it uses, the greater the cost. In the short run, some factors are fixed in supply. Their total costs are fixed, in the sense that they do not vary with output. Rent on land is a fixed cost. It is the same whether the firm produces a lot or a little. The total cost of using variable factors does vary with output. The cost of raw material is a Variable cost. The more that is produced, the more raw materials are used, and therefore the higher is their total cost. The total cost (TC) of production is the sum of the total fixed costs (TFC) and Total variable costs (TVC) of production: TC = TFC + TVC Marginal cost is the extra cost of producing one more unit. That is the rise in total cost per one unit rise in output: MC = TC/ Q. Average cost is cost per unit of production AC = TC/Q Like total cost average cost can be divided into fixed and variable components. AFC = TFC/Q AVC = TVC /Q also AC = AFC = AVC 1 Revenue We can say that Tπ = TR – TC (profit = Total Revenue – Total Cost) We have been looking at costs, now we shall look at the revenue side of the equation. We shall consider Total Revenue; Average Revenue; and Marginal Revenue. 1. Total Revenue: TR = P X Q 2. Average Revenue: is the amount the firm earns per unit sold: AR = TR/Q, so if the firm earns £5,000 (TR) from selling 1,000 units (Q) it will earn £5 per unit. This is simply the price AR = Price. 3. Marginal Revenue: MR = TR / Q, this is the extra total revenue gained by selling one more unit, We now need to see how each of these three revenue concepts (TR, AR, and MR) varies with output. We can show this graphically. The relationship depends on the market conditions under which a firm operates. These market conditions could be where: • A firm is too small to be able to affect market price • A firm which is able to choose the price it charges. If a firm is very small relative to the whole market, it is likely to be a ‘price taker’. It accepts the price given by the intersection of demand and supply in the whole market. Being so small it can sell all it can produce at that price. The left-hand part of the diagram shows market demand and supply. Equilibrium price is £5. P £ D S MC £5 AC AR = MR Q Q The right hand part of the diagram looks at the demand for an individual firm which is tiny relative to the whole market. It cannot influence price. It faces a horizontal demand ‘curve’ at £5. Average revenue is constant at £5. The firm’s AR curve must lie along exactly the same line as the demand curve. (the firm’s demand curve). Marginal Revenue will be the same as average revenue in this case. Selling one more unit at a constant price adds the amount to total revenue. e.g. Price £5 £5 £5 £5 Quantity 1 2 3 4 TR (P X Q) £5 £10 £15 £20 AR (TR/Q) £5 £5 £5 £5 MR … £5 £5 £5 As price is constant, total revenue will rise at a constant rate as more is sold. TR curve is a straight line through the origin. When a firm is a price taker its AR & MR curves are a horizontal line at the given price. 2 When the firm has a relatively large share of the market the firm will face a downward sloping demand curve. This table gives an example of a firm facing a downward sloping demand curve. The demand curve is given by the first two columns. We could plot the demand curve using these figures. Notice also that AR = P. When a firm faces a downward sloping demand curve, marginal revenue is the extra revenue gained by the firm from selling one more unit. Total revenue equals Price X Quantity. We can plot average revenue and marginal revenue on a graph. Price P (£) Quantity Q Total Revenue Marginal Revenue TR (£) MR (£) Average revenue AR (£) 6 5 4 3 2 1 0 0 1 2 3 4 5 6 0 5 8 9 8 5 0 5 4 3 2 1 0 5 3 1 -1 -3 -5 revenue 6 5 4 Average Revenue (Demand) 3 2 marginal revenue 1 1 2 3 4 5 6 7 Output Q The formula for a straight line can be written as y = a + bx, ‘a’ represents the point where the straight line cuts the y-axis and ‘b’ is the slope/gradient of the line. The demand curve can be written so that price is a function of quantity. We can say that P = a – bQ. For the above demand curve (AR) the formula would be P = 6 – Q as the slope/gradient of the demand curve is –1 and the line cuts the y-axis at 6. Now we know TR = P x Q therefore if P = a – bQ then TR = (a – bQ)Q = Qa - bQ² To find marginal revenue we use calculus and differentiate TR implying d(PQ)/dQ = a – 2bQ. In our example this would imply that MR = 6 –2Q implying that the MR line is twice as steep as the AR (demand line) ‘a’ is still 6 and the slope of the line is now –2. Market Structure: Perfect competition & Monopoly It is traditional to divide industries into categories according to the degree of competition that exists between the firms within the industry. We need to consider the • number of firms in the industry. • freedom with which firms can enter the industry… in other words is entry free or restricted? 3 • • nature of the product. Do all firms produce an identical product or do firms produce their own particular brand or model or variety? nature and degree of control that the firm has over the price. Is the firm a price taker or does it have freedom to choose its price? What we are talking about is the nature of the demand curve the firm faces. How elastic is this demand curve? And so on. At one extreme we have perfect competition: many firms are competing, each firm is small relative to the whole industry. The firm has no power over price. The firm is a price taker. At the other extreme there is monopoly where there is just one firm in the industry. Hence no competition from within the industry. Perfect competition The model of perfect competition is built on four assumptions. • • • • Firms are price takers. There are so many firms in the industry that each one produces an insignificantly small proportion of total industry supply and therefore has no power whatsoever to affect the price of the product. It faces a horizontal demand curve at the market price. That is the price is determined by the interaction of demand and supply in the whole market. There is complete freedom of entry of new firms into the industry. Existing firms are unable to stop new firms setting up in business. Freedom of entry applies in the long run. We assume complete factor mobility in the long run. All firms produce an identical product…there is no branding or advertising. Producers and consumers have perfect knowledge of the market. Few if any industries in the real world meet these conditions. Maybe markets for carrots, turnips, cabbages etc. It provides us a gauge to judge things by. In the short run the number of firms is fixed. A firm under perfect competition may be making abnormal profits, normal profits, or a loss. The price is determined in the industry by the intersection of demand and supply in the market. The consumer is sovereign. The perfectly competitive firm faces a horizontal demand (or average revenue) curve at this price. The firm can sell all it can produce at market price Pe but nothing at a price above Pe. In the case of perfect competition profit maximisation takes place where P = MC. If the average cost curve dips below the average revenue curve the firm will earn abnormal profit If the AC curve were above the AR curve at all points the firm will be making a loss. Whether the firm is prepared to continue making a loss in the short run or whether it will close down immediately depends on whether it can cover its variable costs. In the long run if typical firms are making abnormal profit, new firms will be attracted into the industry. Likewise, if existing firms can make abnormal profits by increasing the scale of their operations, they will do so, since all factors of production are variable in the long run. The effect of the entry of new firms and/or the expansion of existing firms is to increase industry supply. This causes the industry supply to expand and thus shift the market supply curve to the right. This in turn leads to a fall in price. Supply will go on increasing and price falling until firms are making only normal profit. Advantages of perfect competition P = MC; Production is at minimum AC; only normal profits will be made in the long run. No supernormal profits, so consumers gain from low prices. If consumer’s tastes change, the resulting price change will lead firms to respond. An increase in consumer demand will call forth-extra supply. Perfect 4 competition is said to lead to consumer sovereignty. Consumers through the market determine what and how much is to be produced. Firms cannot manipulate the market. They cannot control price. The only thing they can do to increase profit is to become more efficient, which also benefits the consumer. If a firm is efficient it will earn supernormal profits (in the short run). Competition between firms acts as a spur to efficiency. There is no point in advertising as all the products are the same. The desire for supernormal profits and the desire to avoid a loss will encourage the development of new technology. Disadvantages of perfect competition Firms may not be able to afford research and development. Investment may be considered a waste of money, as one’s rivals will copy new production techniques. The product is homogeneous. The lack of variety is a disadvantage to the consumer. Under monopolistic competition and oligopoly there is often intense competition over the quality and design of the product. This can lead to pressure on firms to improve their products. This doesn’t exist in perfect competition. There is therefore a lack of competition over product design and specification. Monopoly Monopoly may be difficult to define…whether an industry can be classed as a monopoly is not always clear, but by definition there is only one firm in the industry. In order for a firm to maintain its monopoly position there must be barriers to entry of new firms. These barriers will include: • Economies of scale…the scale needed to produce the good may be so huge that the cost of another firm entering would not be viable. • Brand loyalty…where there is brand loyalty (e.g. coke and Pepsi) it would be difficult for someone new to become established. • Lower costs for the established firm… the already established firm will have developed specialised managerial and production methods. • Ownership of a key factor of production…sole supplier of a vital input. • Ownership of retail/wholesale output. • Legal protection. Since there is by definition, only one firm in the industry, the firm’s demand curve is also the industry demand curve. The demand curve is downward sloping. A monopolist has the power to determine either 1) The price at which it sells its product or 2) The quantity he wishes to sell. Marginal Revenue is below Average Revenue. The monopoly firm is a ‘price maker’. It can choose what price to charge but it is still constrained by its demand curve. A monopolist will maximise profit where MR = MC. It can make abnormal profits in the short and long run. Disadvantages of monopoly There are several reasons why monopolies may be thought to be against the public interest: • It may charge higher price and produce a lower output than under perfect competition; • In the long run there will still be higher price and lower output than under perfect competition as under perfect competition freedom of entry eliminates supernormal profit and therefore keeps longrun prices down; barriers to entry allow supernormal profits in the long run; • The monopolist can still make large profits even if it is not using the most efficient technique of production; • It may have less incentive to be efficient and innovate. Advantages Despite these arguments, monopolies can have some advantages. 5 • • • • It may be able to achieve substantial economies of scale owing to larger plant size, centralised administration and the avoidance of unnecessary duplication; The monopolist can use part of its supernormal profits for R & D and investment; The promise of abnormal profit, protected perhaps by patent may encourage the development of new monopoly industries producing new products; There are those who maintain that a monopolist has gained his status by being the most efficient in the industry. Indeed ‘Natural monopolies’ must also be mentioned here. GLOSSARY Abnormal profit: is the excess of total profit above normal profit. Allocative efficiency: firms products are sold in line with its marginal cost. Consumer surplus: the difference between the amount consumers are willing to pay for a good and the amount they actually pay. Dynamic efficiency: the best use of resources over time. Normal profit: is the profit that the owners of a firm could have earned in the next best alternative business. It is the opportunity cost of being in business. It is the amount of profit that is needed to keep the firm in business. Pareto efficiency: a situation where no one person can be made better off without making someone else worse off. Productive efficiency: production takes place at the least possible cost where the inputs are optimal for the industry. Producer surplus: the sum over all units of production of the difference between the market price of the gook and the marginal cost of production. Sunk cost: an expenditure that when made cannot be recovered (Kevin’s example of a Pizza oven) Bibliography Pindyck, R. S, & Rubinfeld, D. L. (1995) ‘Microeconomics’ Prentice Hall. Sloman, J. (2000) ‘Economics’ Prentice Hall 6