FOOTWEAR NEWS | SEPTEMBER 8, 2014

FOOT

LOCKER @

FORTY

BIG THREATS

What keeps today’s

top execs up at night?

LITTLE LADS

Why the boys’ business

looks so handsome

POWER LOCK

Hot products, cool concepts and smart leadership propelled Foot Locker to the top

of the retail game. Now the athletic force, which marks its fourth decade, is prepping

for even more by focusing on women, Europe and the digital landscape.

micropakltd.com

FN0908P01.indd 1

9/4/14 11:41 AM

DECEMBER 3–5, 2014

WEDNESDAY–FRIDAY

New York Hilton Midtown

& Member Showrooms

SAVE THE DATE:

February 3–5, 2015 (Tuesday–Thursday)

Show information and special hotel rates

FFANY.ORG

Shop FFANY 365 days a year

FFANY365.COM

INSIDER

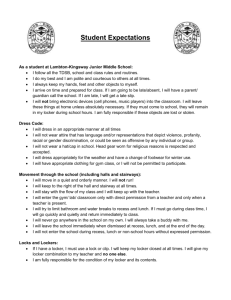

UP FRONT × ON DEADLINE × NEWSMAKERS

High

Alert

What’s worrying some of today’s top

leaders? Find out what’s on their minds as

they ponder major challenges and prime

opportunities. BY ERIKA FLYNN

Danny

Schwartz

A

n uncertain economic climate,

more-demanding consumers and an ever-evolving

e-commerce sector are keeping

footwear industry insiders up at

night. Sourcing and pricing pressures remain

major concerns and are powering

business forward.

Here, industry executives

open up about what is top of

mind and the steps they’re

taking to stay successful.

Michele

Levy

Stacey

Bendet

Josue

Solano

Greg

Tunney

PHOTOS: FAIRCHILD ARCHIVES

Thomas

Florsheim Jr.

David Miller

Tarek Hassan

Liz Rodbell

Joe Ouaknine

Kevin Bailey

SEPTEMBER 8, 2014 |

FN0908P03,04.indd 3

|3

9/4/14 6:49 PM

09042014185240

Approved with warnings

INSIDER

UP FRONT × Executive Report

ers. With Vietnam being the No.

2 supplier to the U.S. market and

growing, the TPP will allow pricing

relief and become one of the most

commercially significant free-trade

agreements ever when it’s finally

enacted.”

Joe Ouaknine, CEO; Titan Industries

“To stay competitive, we need to

make more collections than before

and cannot stay with a particular style too long since it can be

knocked off so rapidly. We’re also

dealing with the ongoing rising

costs in manufacturing in China.

These issues are on our daily

agenda, and we find a way to remain

players in this industry.”

Mandy Cabot, founder, CEO; Dansko

“So far in 2014, the industry has

been experiencing the brunt of

waning consumer confidence and

tightening of the purse strings.

Dansko isn’t taking a wait-and-see

approach. It’s about being a good

business partner to our retailers.

Headed into fall, we are increasing

efforts to drive traffic to our retail

partners, including launching

new product in the fourth quarter

to keep the shelves fresh, giving

consumers even more reasons to

love the brand and frequent our

retailers.”

Daniel Schwartz, CEO; Schwartz &

Benjamin

“Sourcing continues to occupy a

lot of our attention. We’re in the

fashion business, so we have to

create exciting, innovative product.

But that’s not enough today — we

have to provide value and have

great sourcing. We need to be in

the best factories for every type of

footwear product we put into our

collections. We hired a new head of

sourcing, and we’re also in the process of restructuring our product

development organization.”

Greg Tunney, president, CEO, RG Barry

Brands; chairman, FDRA

“The biggest issue we see is the continuing evolution of global sourcing. About 80 percent of production

today comes out of China, but that’s

changing as suppliers chase lower

costs. Duties on footwear is another

critical issue. The pending permanent free-trade agreement through

the Trans-Pacific Partnership

needs to be completed for consum4|

Liz Rodbell, president; Lord & Taylor,

Hudson’s Bay Co.

“The boot business has come on

extremely strong. We believe it is a

great opportunity for us to continue

to grow. [Also] we’re renovating

our flagship and continuing store

renovations at other locations.

Our success online in footwear is

dramatic.”

Thomas Florsheim Jr., chairman,

CEO; Weyco Group

“The cost of our product and overhead expenses continue to rise, but

the middle-market consumer has

less disposable income. It becomes

incumbent on brands like us to

offer more in our product to justify

a higher price point. We’re spending much more time in design and

development, making sure we build

product to hit specific price targets,

and at the same time create shoes

with more features and benefits.

We’re ramping up our digital and

social media efforts, and have new

marketing programs in place.”

Tarek Hassan, co-owner; The Tannery

“My challenge is customer loyalty

and how can we maintain it. The

solution is clearly defining what our

unique selling propositions are and

making sure that our shop floor

is aligned. We also work hard to

have must-have product in-store

and online, and maximize sellthrough before the major players

out there come through and jump

on it. Social media plays a big part

in achieving that. It’s not enough to

sit back and wait for customers to

walk into the store — we need to be

able to reach out to those guys in a

major way.”

Danny Wasserman, president; Tip

Top Shoes

“The lack of traffic in stores is

our biggest threat. With people

shopping on the Internet, a good

segment of our business is being

taken. We’re investing a great deal

of time and money to become part

of that shopping mall. We’re

rebuilding our website from

scratch and are taking it as seriously as opening a new brick-andmortar store.”

David Miller, CEO; Minnetonka

Moccasin

“We were slow to adapt to social

media, but now that we’re there,

we’re moving quickly. But one

of the things that keeps me up

at night is [that being active on

social media] is a double-edged

sword. The Internet gives people

a platform to voice their opinions,

so someone who is not happy can

make a lot of noise. We’ve tried

to be really responsive when that

happens.”

Josue Solano, EVP, COO;

BBC International

“The consumer keeps me up at

night. We spend a lot of time thinking about what they’re looking for

and helping our retail partners

meet their needs. The consumer is

changing in terms of their shopping patterns. What’s driving that

is technology. They’re becoming

much more demanding, and they

have a lot of choices about where

they can go to shop, whether it’s

online or in brick-and-mortar

stores. And as they become more

demanding, it adds up to a complex

set of problems for us as provider.”

Danny Wasserman

Michele Levy, U.S. CEO; Melissa

“The world right now is very unstable. Syria, Ukraine, Russia, Israel,

Europe. Ebola. There are so many

social, political and economic

challenges and crises in the global

arena. That is counterbalanced by

a generally strong U.S. economy

in some sectors and weakness in

others. We see a lot of pressure

on the large-box businesses and a

contraction in the small shops in

the U.S. This uncertainty creates an

opportunity to continue to focus

on captivating ... our customers.”

Stacey Bendet, CEO, creative director; Alice + Olivia by Stacey Bendet

“For the remainder of 2014, we are

focused on our continued retail

expansion, both domestically

and internationally. With six new

stores opening this fall, I want

to make sure each one is treated

specially and in an exciting way,

whether it be in Atlanta, Georgetown [in Washington, D.C.], or

even Shanghai.”

David Ben-Zikry, CEO; Spring

Footwear Corp.

“Staying on top of the evolving

market, especially with new technology, is a high priority for us, as

well as connecting with our end

consumers. Our focus is to create

simplicity and organization in our

presentation and our connection.

We’ve improved our merchandising and organized our product line.

A new showroom in our headquarters has a modern look, and we’re

now trying to incorporate that into

the retail level.”

PHOTO: FAIRCHILD ARCHIVES

Kevin Bailey, president; VF Action

Sports, Vans

“We’re seeing shifts in consumer

traffic trends. Whether brick-andmortar or online, consumer behavior is changing both on a day-to-day

basis and as related to shopping

occasions like back-to-school and

holiday. Understanding these shifts

and, more importantly, the ‘why’ is

critical. Staying current to the speed

of change is even harder. We’re

utilizing deep consumer research

to better understand consumers’

‘whys’ of shopping, their desires

and needs, as well as their opinions

about the ‘how’ of shopping, online

and in-store.”

| SEPTEMBER 8, 2014

FN0908P03,04.indd 4

9/4/14 6:49 PM

09042014185124

INSIDER

Top Stories × ON DEADLINE

Europe Woes Weigh on Micam Attendees

BY EMILY BACKUS

MILAN — The uneven economic recovery in Europe is prompting many

international footwear companies to

alter their strategies, according to key

players interviewed at Micam here

last week.

Micam President Cleto

Sagripanti, who owns Italian Holding

Moda (IHM), said he was building a

portfolio of made-in-Italy brands to

capture different market segments

and exploit group synergies for the

supply chains.

Sagripanti said he was concerned

that European retailers were reluctant to strike multi-season agreements with suppliers to speed up

delivery response times in the way

U.S. retailers do.

Luca Ferrari, owner of Effegi — the

Italian shoemaker behind Canguru

and Freemood brands — closed its

Inside the

Micam show

women’s and children’s lines over

the past several years to concentrate

on more-profitable men’s shoes.

Ferrari said his company is now

“contemplating” moving production

back to Europe from India to reduce

response times for retailers.

Bonis, the Italian shoemaker that

holds the U.S. Polo Assn. license for

Europe, is expanding its product

range and adding distribution in

northern Europe, which has better

credit conditions and faster payments than in southern Europe, said

President Augusto Bonetto.

In fact, the firm severed ties with a

number of southern European clients

last year due to credit issues. While

sales are edging up slightly this year,

the company will more likely not

return to growth until 2015, he added.

For their part, buyers at Micam

said unusual weather has proven

to be a major hazard for retail sales

in the last 12 months, especially for

northern and eastern Europe.

Unseasonably warm weather in

autumn impacted winter shoe sales

in the Netherlands, triggering a local

price war among retailers, reported

Nico Taphoorn, managing director

of Taft-Oscar, a store in Hoofddorp.

The cozy temperatures also drove

down boot sales in Bulgaria, said

Pepina Madjarova, who runs nine

designer shoe stores that sell brands

such as Casadei, Calvin Klein and

Roberto Cavalli.

Rain then hampered summer

business. But when the sun came

out in mid-August, “sales boomed,”

Taphoorn added.

Enzo Auciello, owner of the Brussels store Y-Enzo, said he is overcoming weather woes by relying

more on e-commerce.

Auciello added that, at the show, he

was looking for eye-catching, creative

product, but found too many conservative styles instead.

“Everything is aimed at economy.

[Suppliers] go for the sure thing,”

he lamented.

Roberto Zecchini, a buyer from

the Bologna, Italy-based store

Michel Calzature, said comfort continues to be key for consumers, with

customers gravitating toward lower

heels and flats. A notable exception?

Casadei’s highly recognizable “bladelike” stilettos that have sold well for

four years straight.

Comfort Rules Floor at Atlanta Shoe Market

ATLANTA — Casual, comfortable

and colorful styles dominated retailer

spring ’15 buys at the August edition

of the Atlanta Shoe Market.

While the lack of trends has made

finding key styles difficult in the past

few seasons, buyers did come armed

with specific features to look for, especially footbeds and comfort flats.

Gary Weiner, president of Virginia multi-store independent Saxon

Shoes, said he was still looking for

the newness in the market and was

reserving a number of spring buys

for flats. “We’ve seen flats, espadrilles and skimmers in great colors,”

Weiner said. “[The lack of clear

trends] is one of the biggest problems

in the industry. There isn’t anything

new and exciting right now. We are

looking to reduce our inventory, spice

it up more and certainly aim to turn

things faster.”

Kathy Murphy, owner of Kathy’s

Shoes in Thomasville, Ga., said she

was also looking for comfort that

has the fashion-forward edge for her

shoppers. She stocks brands such as

Toms, Fly London, Chaco and Naot.

“Spring ’15 is really about comfort.

All women are demanding it now —

even the young girls who didn’t even

care expect it, ” Murphy said. “Naot

has been big with the footbed trend

for us because everybody wants the

feeling of the comfort and support.”

Sugar Shoe Lounge in Winter Park,

Fla., mixes a variety of brands, including Gentle Souls, Bernie Mev, Coye

Nokes and United Nude.

“In the South, our ladies want

to be more feminine, so if it has a

comfort or athletic sole, they want a

feminine upper,” said owner Marsette

Mangum. “It’s a lot about colors and

comfort for us in spring, and rain

boots will do well for us, too.”

Tiffany Perry, owner of Perry Footwear and who came to the show from

Bermuda, was shopping for men’s,

women’s and children’s looks for her

stores. Her store carries a higher-tier

price point for styles ranging from

Guess to Marc by Marc Jacobs.

“For women, we look at color and

a lot at flats. Our customer is buying

a lot of the trendier, strappy flats that

aren’t basic and simple,” she said. “We

tried the footbed this past spring and

wasn’t sure how it would go, but it did

well. We’ll do more next year, but will

do it in bright colors and neon soles.”

For men’s, Perry was looking for

comfortable, interesting sandals and

casual sneakers. She said Lacoste was

a strong label for the men’s category,

and also cited Donald J. Pliner and

Guess as key brands.

Rack Room Shoes buyer Steve Mahan was less enthusiastic about the

trends, citing the saturation of Bernie

Mev- and Birkenstock-inspired styles

and the lack of dressed-up looks.

“The biggest disappointment right

now is dress shoes,” he said. “There is

just nothing new.”

Laura Conwell-O’Brien, executive director of the Atlanta Shoe

Market, said she saw an uptick in

attendance at the show and was

pleased with the quality of retailers

and brands attending.

SEPTEMBER 8, 2014 |

FN0908P05.indd 5

PHOTO: COURTESY OF MICAM

BY MARGARET SUTHERLIN

|5

9/4/14 5:55 PM

09042014175622

Lord & Taylor Unveils

Fresh Look for Shoe Space

BY MARGARET SUTHERLIN

SPY

Double Trouble

The Dannijo sisters are off on a Mongolian roadtrip. At least, that was the inspiration for their spring ’15 presentation, where models donned the pair’s newly minted

footwear collection. “We were set on accessorizing our girl from head to toe, and it’s exciting

to have shoes in the show,” said designer Jodie Snyder of the spring debut of more than

20 styles. And to stick with the theme of travel, the designers showcased flat sandals and

gladiator-inspired looks in neutrals and metallics. “My sister, [Danielle Snyder], is wearing

the heel version of them. I’m not a sample size, so I’m still waiting for my pair,” Jodie Snyder

said. The duo also planned to hit the New York Fashion Week circuit for several shows,

including Timo Weiland. “We definitely love to support our friends,” Jodie Snyder said.

Afterward, she will gear up for another new addition. “I’m due in February, so everything I’m

into is kids,” she said, hinting that the line could expand to children’s shoes, too.

Wedding Bells

Tube Talk

Ron White is tying the knot again.

This time, it’s with iconic bridal retailer

Kleinfeld, which recently bowed a

mega-boutique in Hudson’s Bay Co.’s

flagship in downtown Toronto. The

designer, who

Kleinfeld

operates a

Toronto

string of eponymous stores

in Canada in

addition to a

namesake line,

will be offering

his first-ever

bridal collection

exclusively for Kleinfeld in January.

The collaboration came about after

Bonnie Brooks, vice chairman of Hudson’s Bay, suggested the designer create

bridal looks for Kleinfeld, the Manhattan location of which is the setting of

hit reality TV series “Say Yes to the

Dress.” White said comfort was a key

factor in the line, having watched brides

kick off their uncomfortable shoes after

their ceremonies and then run around

barefoot. Included in the collection,

priced from $395 to more than $500,

are pumps, halters and strappy sandals

in luxe materials such as crushed crystals on suede. “It’s fun to envision what

a princess wants to wear,” White said.

Kristin Cavallari is back on the small

screen. The Chinese Laundry collaborator signed on earlier this year as

a cohost on E!’s “The Fabulist,” which

focuses on fashion, beauty and lifestyle topics. And while the guest list is

always rotating, Cavallari is hoping for

one special name to appear on set. “I

would die if Kate Moss came on, she

is my ultimate style icon,” Cavallari

said. On screen, she’s managed to give

her brand partners some play, too. “I

love wearing tons of different heels.

It’s a great time to show off my favorites,” she said.

As for her

spring ’15

Kristin

Cavallari

collection,

the designer

focused on

earth colors

and yellows.

“I’m including

more muted

tones than is typical in spring, which

I love,” she added. While Cavallari,

now a mother of two, is busier than

ever, she still finds time for sketching.

“Luckily my hours are flexible, so I

can work on my shoe designs during nap time or after [my kids] go to

sleep,” she said.

By Kristen Henning, with contributions from Barbara Schneider-Levy

6|

NEW YORK — The battle of the

department store shoe floors

continues, and Lord & Taylor

is the latest player to get in

on the action.

The retailer, which is owned

by Hudson’s Bay Co., renovated

the existing space on the second

floor. The revamp officially debuts this week as part of a larger

transformation.

The floor has a clean, contemporary and feminine aesthetic,

complete with white hydrangeas, mercury glass accents, a

mixture of marble and brass

fixtures, and cozy chairs and

couches. It is adjacent

to the recently opened

Brand Assembly, a curated apparel shop-inshop for new designers,

and also Birdcage, an

accessory-driven, fashion-forward shop set to

open this October.

“Footwear is an

extremely important

part of our business,

and it continues to be

a great focus,” said Liz Rodbell,

president of Hudson’s Bay. “It’s

a multifaceted renovation with

the lovely new space for footwear and new contemporary

additions like Brand Assembly

and Birdcage. It’s taking the

second floor and moving it

forward in a fashion leadership

position, and footwear is an

important part of that.”

Besides a completely updated

design, the footwear space also

boasts an expanded product assortment. Lord & Taylor buyers

are seeking out new brands for

the floor to add to tried-andtrue labels such as Steve Madden and Vince Camuto.

Among the fresh additions

are Matt Bernson, Carolinna

Espinosa, Pollini and Lord &

Taylor private label 424 Fifth,

as well as a greater number of

exclusive styles from existing

brands.

The retailer is also investing in its athletic offering and

bringing in names such as Nike.

The diverse product mix is

aimed at Lord & Taylor’s broad

demographic range, from

millennials to baby boomers,

Rodbell said.

Moving forward, the retailer will replicate the footwear

department in its Albany, N.Y.,

location. It will then remodel

several other stores, though it

hasn’t disclosed those locations.

“We’re looking at how footwear will play an important

The floor boasts an

expanded roster of vendors

role in any renovation that

we’re doing,” Rodbell said.

Vendors are upbeat about

the increased focus on the

shoe category.

“Lord & Taylor continues

to develop their footwear

departments into true focal

areas, not only in the New

York flagship, but in branch

stores as well,” said David

Kahan, CEO of Birkenstock

USA. “This builds consumer

loyalty. Customers know they

can find compelling brands

and be treated to a high level

of customer service.”

The retailer will fete the new

space at an event on Wednesday, with designers including

Sam Edelman, Vince Camuto

and Ivanka Trump expected to

make an appearance.

PHOTOS: DANNIJO: COURTESY OF BILLY FARRELL AGENCY; KLEINFELD: GETTY IMAGES; CAVALLARI: COURTESY OF CHINESE LAUNDRY; LORD & TAYLOR: GEORGE CHINSEE

Dannijo spring ’15

| SEPTEMBER 8, 2014

FN0908P06.indd 6

9/4/14 5:33 PM

SUPPORT THE CAUSE

A portion of advertising proceeds will go to

QVC/FFaNY Shoes on Sale to support the

fight against breast cancer.

S

QVC/FFaNY SHOEE

ON SALEOISctobSUer 6

Issue Date »

ptember 25

os

Cl e Date » Se

BONUS DISTRIBUTION: QVC presents FFaNY SHOES ON SALE EVENT - OCTOBER 8

For more information on advertising, contact Sandi Mines, Vice President, Publisher, at 212.630.4872, or your FN salesperson.

MARKETPLACE

CHILDREN’S × MATERIALS & COMPONENTS

Riding

High

PHOTO: COURTESY OF FLORSHEIM

The boys’ market is on the move.

Major fashion action in the men’s

category is driving interest in

casual dress shoes for kids,

such as these styles

from Florsheim.

SEPTEMBER 8, 2014 |

FN0908P09.indd 9

|9

9/3/14 12:31 PM

09032014123231

MARKETPLACE

CHILDREN’S × Category Revival

Boy Story

Sparked by new energy in the men’s market, retailers and vendors

are paying more attention to the little guys. BY ERIN E. CLACK

T

he boys’ casual shoe market is making

a comeback.

Sparked in part by the metamorphosis of men’s fashion, more vendors are

addressing a category that has long

been overlooked, introducing sophisticated

collections that offer a stylish alternative to

athletic shoes. Veteran men’s label Florsheim

was early to the scene with the 2012 launch of a

boys’ takedown line. A number of other brands

followed, including, most recently, Nina, which

last month debuted Elements by Nina in stores

for back-to-school.

For kids’ retailers, the new

Elements by Nina

merchandise has been a boon

denim chukka

for business. “We’re doing

very well with collections like

Florsheim, and we’re excited

about Nina’s new line,” said Ivan

Castro, kids’ buyer and manager at New York-based Harrys Shoes. “It’s great to

see vendors finally

looking at the

boys’ market.

Until now,

ctic

s

ack

d

ket.

he

ke

k

we

for

ur

d

on

ket

for

ons

ot

10 |

there was nothing fresh or exciting in

boys’ casual footwear. Everything

was focused on the girls’ category.

Customers would come in and say,

‘This is all you have for boys?’ It

was just tired.”

Castro noted that many children’s vendors conceded the

boys’ business over to athletic

players such as Nike and Adidas, but the recent fashion

push in the category is

an opportunity for those

brands to get back in the

game. “Sneakers obviously

dominate the boys’ market,

and we certainly sell a lot

of them, but we need to

have other options. As

some of these kids’

brands are discovering, there is a real

opportunity for them

to bring in more fashion

and fill that void in the casual

area,” he said.

Connie Cohen, footwear buyer for Lester’s, a

clothing and shoe retailer with four locations in

New York, said her boys’ business has picked up

significantly in recent seasons. “Before, there

was hardly ever anything new for boys. Now

there are a lot of cool casual options, so we’ve

definitely increased our buy [on the boys’ side],”

she said. “We’re doing well with men’sinspired styles like bucks, laceups and

slip-ons with bright color pops on the

outsole or the laces. It’s great to finally

see some fun and fashion for boys.”

By tapping into the styling in its men’s

division, Florsheim has found fast

success in the boys’ market, according

to Mark Kohlenberg, who oversees

the children’s business for parent

firm Weyco Group Inc. “We’re seeing

pretty staggering growth. Many of

our retail accounts are doubling their

open-to-buys,” he said. “In all my

years in the kids’ business, I’ve never

seen increases like this. There has

just been a tremendous neglect of the

boys’ market.”

Kohlenberg pointed out, “This is all

gravy business for retailers — business

that, for the most part, didn’t exist before or

that was at a very small level.”

He added that the growing emphasis on

style in the men’s footwear market has helped

pave the way for a transformation of the boys’

category. “It’s now fashionable for men to wear

fashionable footwear, and that

A spring ’15 look by influence has trickled down

Florsheim Kids

to young boys. It’s cool for

boys to dress up and express

PHOTOS: HARRYS: THOMAS IANNACCONE; ALL OTHERS: COURTESY OF BRANDS

Back-to-school shoppers

at Harrys Shoes in New York

| SEPTEMBER 8, 2014

FN0908P10,11.indd 10

9/3/14 6:25 PM

09032014182809

MARKETPLACE

Category Revival × CHILDREN’S

themselves through fashion,” he explained. “That

barrier of resistance has disappeared, opening up

a huge opportunity in the market.”

The success of Florsheim Kids has prompted

Weyco to take a bigger stake in the boys’ business

across its brands. The firm expanded its Stacy

Adams kids’ offering and has added a small boys’

line under the Nunn Bush name for spring ’15.

Its Umi children’s label also has stepped up its

casual offerings for boys.

Nina, meanwhile, is hoping to see similar

success with the new Elements collection.

According to Alan Paulenoff, EVP of the kids’

division, the New York-based brand saw an

opportunity to capitalize on its nearly 25-year

history in the girls’ market with a companion

boys’ line. “The timing felt right,” Paulenoff

said. “We saw what has been happening in

men’s footwear and we heard from our retailers

that they were looking for more options. They

complained of having to buy the same basic

styles over and over because there has been so

much sameness in boys’ footwear.”

For its inaugural season, Paulenoff said the

company secured strong sell-ins with bet-

ter department stores,

independents and etailers. “We’ll have some

great exposure at retail

this fall, but we’ve just

scratched the surface. There

are many retailers who [haven’t

been in] the boys’ market

Textured slip-on

because it’s been so stagnant

from Elements

for so long. We believe there

by Nina

is a lot of opportunity to grow

as more stores address the

category,” he said.

When it comes to product, Paulenoff noted

that the sneaker influence remains important,

even if boys are wearing other styles now. “Boys

live in sneakers, so when they’re wearing other

shoes, they still want them to feel like sneakers. That’s been our approach with Elements:

[We’re offering] versatile, sneaker-inspired

styles,” he said, citing the collection’s vulcanized bottoms, bold color accents and interesting mix of upper materials.

Evan Cagner, president of Synclaire Brands,

reported that the push to inject sneaker influ-

ences into casual footwear has resulted in shoes

that cover more wearing occasions. And that

is a big selling point for parents. “You’re

seeing styles like wingtips and oxfords

on sneaker-type constructions, and

those styles resonate with the boy

because they look and feel like a

sneaker,” he said. “The parent gets

it and likes it because the shoes can be

dressed up — it’s not just a single-occasion item.”

According to Cagner, whose company offers

small boys’ collections under some of its newer

licensed brands, including Tommy Hilfiger and

Elie Tahari, children can take these newly casual

shoes from playtime to a party. “That’s helping

to drive the surge in the business right now. Customers appreciate that versatility,” he said.

And as more vendors beef up their boys’ offerings, Florsheim’s Kohlenberg hopes it will lead

to a better balance in the kids’ category overall.

“[It’s understandable that] much of the market

has only paid attention to girls’ shoes because

that’s where the sizzle and flash is,” he said. “But

half the babies born are boys. It’s a customer base

that can’t remain overlooked.”

The Materials Show

Northeast Sept 11-12 Northwest Sept 17-18

/BUVSBMBOE4ZOUIFUJD-FBUIFSt'BCSJDTt1SJOUTt

"DDFTTPSJFTBOE)BSEXBSFt"QQBSFMBOE'PPUXFBS

$PNQPOFOUTt4FXOQSPEVDUTJOEVTUSZTFSWJDFT

and much more

PHOTOS: HARRYS: THOMAS IANNACCONE; ALL OTHERS: COURTESY OF BRANDS

Americanevents.com

Serving the industry for over 20 years

FN0908P10,11.indd 11

09032014182813

A

E

9/3/14 6:25 PM

MARKETPLACE

CHILDREN’S × Trend

KENSIE GIRL’s T-strap

with rhinestoneembellished vamp

Sandal boot with

textured shaft

by RACHEL

SAM EDELMAN’s

rhinestone-studded

ribbon-lace oxford

Neutral

Ground

Metallic and patent

leather d’Orsay flat

by RUGGED BEAR

Girls’ shoes are lightening up this spring.

Earthy, understated shades of sand and

taupe are a chic contrast to the bold

brights typical of the category.

RALPH LAUREN’s classic

ballerina with decorative bow

Thong sandal

with gold metallic

accents by JOSMO

12 |

PHOTOS: TAHARI: ROBERT MITRA; ALL OTHERS: THOMAS IANNACCONE

ELIE TAHARI’s

zipper-back sandal

with elastic strap

| SEPTEMBER 8, 2014

FN0908P12.indd 12

9/3/14 12:35 PM

09032014123619

A LICENSED DIVISION OF LJP INTERNATIONAL

For additional information or to schedule a meeting, please contact us at LJP-CS@LJPINTL.COM or 732.771.8700

ADVERTISEMENT

THE CHILDREN'S GREAT EVENT SHOE SHOW

The Marriott at Glenpointe | 100 Frank W. Burr Blvd, Teaneck, NJ 07666 | September 8-9, 2014

A feeling of well-being that only the special GEOX breathable,

waterproof membrane can offer. Geox shoes keep feet

comfortable throughout the entire day whether at home,

school or play. Feet stay warm and dry in the winter and cool

and fresh even in the summer.

GRAND BALLROOM #111, 113, 115

Anne Marie Buono

347.849.9113

Buono.annemarie@geox.com

LAURA ASHLEY offers a stylish selection of quality children’s

shoes for dress, school and play. Check out our latest collection!

GRAND BALLROOM #307

Josmo Shoes

201.617.1477

info@josmo.com

www.josmo.com

She’ll love the riding-inspired Sassy Tran boot! NINE WEST KIDS

delivers trend–right footwear geared towards fashion conscious

girls, age 5-11. The collections feature cool and savvy styles that

allow girls to express their individuality and flair for fashion.

Nine West Kids is a reflection of the Nine West brand, offering

what’s new, what’s next and what’s hot!

GRAND BALLROOM #512 AND 514

Ralph Gonzalez

732.771.8700

rgonzalez@ljpintl.com

ADVERTISEMENT

EXHIBITORS

GRAND BALLROOM

#111, 113, 115

GRAND BALLROOM

#307

GRAND BALLROOM

#512 AND 514

Agatha Ruiz De La Prada,

Kid Express

Amiana / A-line

Kids Kapers / Bows

Anasai

Kinderland / Venetini

Angels New York

LAURA ASHLEY

Aster / Mod 8’

Lelli Kelly

BBC / Polo Ralph Lauren

Livie & Luca

Badorf Shoe Company

Luccini

Bearpaw Boots / Muck Boots

McCubbin / Robeez

Beeko

Menina Step

Best Shoe Sales / Michael Berezin

Minimen by Starmax

Bloch / Baby Bloch

Merrell Kids

Bobux

Mini Treasure Kids (MTK)

Bogs Footwear

Naturino / Moschino

Bopy Chassures

Nina Kids

Bumbums & Baubles

NINE WEST KIDS

Camper Kids

Old Soles

Carino Shoes

Pazitos / Picaroz

Chooze Shoes

Plae Inc.

Chupetin Shoes,

Primigi Footwear

Cienta

Rachel Shoes / Scott David

Clarks Kid’s

Rainbow Sandals

Crocs Footwear

GBV Booth #706

Dr Martens Kids

Robertino

Eastland Kids

School Issue

Elephantito

See Kai Run

Eli Shoes

Shoeglits / Laces

Euro Steps

Skechers Kids

Florsheim Kids

Steve Madden Kids / Superga

Froddo / Bambi

Stride Rite Children's Group

Garvalin / Biomechanics

Stuart Weitzman

GEOX

Spraying Gravy / Sanuk

Goedike Shoes / Superfit

Synclaire Brands

Goodwear Shoes

Teva Kids

HOO

The Doll Maker Shoes

IGOR

Trimfoot Company

Josmo Shoes

Tundra / Tingley Boots

Jumbo / Coco Jumbo

Umi Children’s Shoes

Jumping Jacks Shoes

Unitrends USA Inc

Keen Footwear

Vida Shoes International

Kenneth Cole Reaction

Volatile Kids

Kensie Girl

Yoopi Shoes

MARKETPLACE

MATERIALS & COMPONENTS × Trends

DETOX

Texpiel’s oval

paillettes on cotton

Soft pastel colors redefine the

season’s neutral story, from

subtle nearly whites to intense

shades of gray.

Conceria Vignola’s

shaggy sheepskin

American Supply’s

crinkle-effect

polyester

Comertex’s

patent finish on

printed cotton

DECANTER

Vineyard-inspired wine tones

flow from rich Bordeaux to

Beaujolais, accented with

candy pink and rich chocolate.

4

Pan American

Leather’s

caiman crocodile

Pro’Peaux’s embossed

basket-weave calfskin

Gruppo Mastrotto’s

nubuck cowhide

Color Codes

Bizzarro Leather’s

croc-print cowhide

After Lineapelle forecast the essential areas of interest

for fall ’15 leathers and materials, FN scoured the

organization’s Trend Selection New York event last

week for the best examples. BY BARBARA SCHNEIDER-LEVY

Giardini’s syntheticleather multicolor

snakeskin

Klein Karoo

International’s

genuine ostrich

Mégisserie Lauret’s

embossed woven

lambskin

16 |

Meridiana’s alligatorprinted calfskin

The season’s richest color

range warms up with tones

of rust and orange, then

cools down with a shot

of green.

Sciarada Industria

Conciaria’s embossed

calf suede

Montana Leather’s

vegetable-tanned

embossed cowhide

PHOTOS: ROBERT MITRA

HCP’s genuine

alligator

TONING

EX-BLACK

Dark classics, such as

midnight blue and basic

black, gently fade into

lighter hues of earthy

taupes and browns.

Vicenza Pelli’s

embossed aniline

cowhide

| SEPTEMBER 8, 2014

FN0908P16.indd 16

9/4/14 4:40 PM

09042014164201

from one icon to the other,

congratulations on 40 years

of leadership. thank you for your

continued partnership!

FROM YOUR FRIENDS AT

FN MILESTONE

PHOTOS: COURTESY OF FOOT LOCKER AND BRANDS

FOOT LOCKER @ 40

Locker’s Keys

Forty years ago this week, Foot Locker opened its first store in Puente Hills Mall in the

City of Industry, Calif. From the start, the fledgling retailer found success with a simple

formula: to stay laser-focused on the athletic market. Four decades later, the 1,858-door

global powerhouse has not lost sight of that original vision. Read on for an inside look at

the chain’s incredible rise and future ambitions.

SEPTEMBER 8, 2014 |

FN0908P19.indd 19

| 19

9/2/14 4:03 PM

$QQSPWFEXJUIXBSOJOHT

MILESTONE

FOOT LOCKER @ 40 × Q&A

Hicks with a Foot Locker associate

Ken Hicks reflects

on 40 years of

ruling the sneaker

scene and talks

about why he is so

bullish on the future

of the retailer.

BY JENNIFER ERNST BEAUDRY

20 |

oot Locker may be turning 40, but Ken Hicks

is looking way beyond

that number.

“Foot Locker is a

company that has done

well over the past several years,

and because of the great team we

have, we’re even better positioned

for the future with a number of

significant opportunities [for our]

brand both in the U.S. and internationally,” the New York-based

firm’s chairman and CEO told

Footwear News.

Hicks has good reason to be

feeling bullish, thanks in part to

the red-hot sneaker trend fueling

the footwear market.

“Shoes are more than 75 percent

of our business. When you think

of the Foot Locker brand, our

mantra is, ‘It’s Sneaker Central,’”

Hicks said. “[Whether in] Europe,

Canada, Australia or the U.S.,

when people think, ‘I need a pair

of sneakers,’ they think of Foot

Locker first.”

The numbers tell the story of

the retailer’s recent

success: For the period

ended Aug. 2, 2014, the

retailer reported net income

of $92 million, a marked boost

over the $66 million in the same

quarter a year earlier. Sales rose

13 percent to $1.64 billion for the

second quarter of 2014.

“Foot Locker is doing a lot of

positive stuff,” said Matt Powell, an

analyst at SportsOneSource. “The

only place you could say they have

not got it figured out is women’s.

They are on the path there, but

they have not yet nailed it.”

Notably, women’s was a bright

spot for Foot Locker during the

second quarter, said Christopher

Svezia, an analyst at Susquehanna

Financial Group.

The European business, which has been

weak for some companies, is also

showing considerable growth for

Foot Locker. Running and basketball both proved to be highlights

for the firm — and the retailer

continues to stand out from the

pack with exclusive styles from

top vendors.

Q&A

PHOTOS: COURTESY OF FOOT LOCKER

POWER

FORWARD

F

| SEPTEMBER 8, 2014

FN0908P20,21,45.indd 20

9/3/14 4:50 PM

$QQSPWFEXJUIXBSOJOHT

MILESTONE

Q&A × FOOT LOCKER @ 40

But that’s nothing new — the retailer has

always been an athletic trailblazer. When the

company opened its first location in September 1974 in the City of Industry, Calif., the

2,800-sq.-ft. store broke new ground as one of

the first to offer solely athletic footwear.

The business grew rapidly, and today, the

company operates 1,858 Foot Locker stores

globally and more than 3,400 doors across all

of the company’s banners.

Here, Hicks talks about must-have product,

the big opportunity in women’s and his predictions for the next 40 years.

Basketball has been especially strong lately.

Do you see the category taking more share

going forward?

KH: We have strong basketball and running

[programs], and there are new looks and technologies that help both. Some of the basketball

shoes now, they’ve gone more low-cut — in

some cases, unless you look at the sole, you

wouldn’t know whether it was a basketball

or running shoe. And that’s made basketball

a more universal business. Plus, [you’ve got]

great players such as LeBron [James], Kevin

Durant, Kobe [Bryant] and [Derrick] Rose,

[who is] coming back. That helps basketball. In

running, you have great casual looks like Roshe

from Nike, ZX from Adidas and Free from

Nike. There’s also new technology in running:

Boost from Adidas, the new shoes from Asics,

and SpeedForm from Under Armour. There are

more things happening in performance running that will help grow that business.

PHOTOS: COURTESY OF FOOT LOCKER

What progress have you made in developing

the women’s business?

KH: We see some green shoots, [and] we feel

good about women’s both in terms of Lady Foot

Locker and [its two-year-old] Six:02 [concept].

The customer wants a place where she can

shop and buy performance brands in a nice

environment, and what we’re providing is both

shoes and apparel.

What are you doing to better position Lady

Foot Locker?

KH: We have started to step up the remodeled

Lady Foot Lockers — or, I should say, reformatted and re-merchandised Lady Foot Lockers

— to allow for showing more apparel and for

better showing the [merchandising] ideas. We

plan to roll out a number of those through the

rest of this year. The challenge we have is that

we can’t do it in some doors because of size.

Some Lady Foot Locker doors are too small and

don’t allow us to show the products.

So size is critical?

KH: What we’ve learned is that to be a viable

women’s banner, you need to offer a good

selection of both footwear and apparel. Those

[locations] that don’t allow the showing of

apparel probably are not viable long-term. Not

that they can’t sell a lot of shoes, but they won’t

be as effective without the apparel. So we’ll

close the smaller and less-productive stores.

You’ve taken some heat for the slow rollout of

Six:02. What is your stance on that?

KH: We’re less than two years old on Six:02, and

[that] seems like a long time. But Lululemon

didn’t [expand outside] northwestern Canada

for four or five years. We want to get it right

and understand what the customer wants. I

don’t think it’s slow; I think it’s thoughtful, and

when we do roll it out, we will have something

the customer really wants.

Where do your various store redesign projects

stand?

KH: We’ve completed Kids Foot Locker, and by

end of year we’ll be about 20 percent through

with Foot Locker and approaching 30 percent

with Champs. We’re also testing our Footaction

remodel prototype.

The kids’ business has been a bright spot. How

are you capitalizing on the momentum there?

KH: Children’s was our fastest-growing segment [earlier this year], not just in Kids Foot

Locker but also in Foot Locker and in our

Champs and Footaction stores. We’ve

expanded Kids Foot Locker internationally, and it’s now in Europe and

Canada — we’ve been developing that

over the past year or so.

Are there plans to increase the footprint of

these branded shops going into 2015?

KH: We have taken a number of stores down

[in size] each year since I’ve been here, but last

year and next year, our actual square footage

will go up. We’re making the stores bigger to

handle these formats. They’re very productive:

They drive traffic and help the stores be places

customers want to go.

There has been much talk about the decline of

the mall. Does that worry you?

KH: There’s a misconception out there, and I’ve

been saying this for some time: Survey after

survey shows that millennials like stores. They

go to meet friends and see product. But they

also like to shop online, and they like to be connected, so we need to make sure we connect.

Putting our channels together is important.

The winners of the future are those [retailers]

that have stores and online, and that connect

them well.

Is that true across the board?

KH: Some of the lesser malls are more challenged. But we have the ability to trade more

broadly than many of our competitors. We can

trade in an inner city or in a more urban location as well as suburban. We can trade with a

customer who may not have all the advantages,

with young kids and with men my age because

of the breadth of service and assortment we offer. [The new formats also] help us stand out in

the more premier malls, and those continue to

do well. People still like to get out into an

(continued on page 45)

The children’s business is strong

You’ve rolled out a number of branded

partnerships with key vendors — the

most recent being Puma Lab last

year — and recently opened a brickand-mortar element for Eastbay.com.

What’s driving those concepts?

KH: We think of [those types of partnerships as a way of] getting to the customer

and connecting channels, to make the

stores we have more exciting and interesting places to shop. We feel very good

about House of Hoops, Nike Fly Zone, the

Adidas Collective shops and Puma Lab.

They will continue to be an important

part of the draw of our stores.

SEPTEMBER 8, 2014 |

FN0908P20,21,45.indd 21

| 21

9/3/14 4:50 PM

09032014165409

Approved with warnings

MILESTONE

FOOT LOCKER @ 40 × Global Rise

The retailer’s store

on Oxford Street

in London

Blake Krueger

OVERSEAS

AGENDA

Europe leads the way as

Foot Locker rolls out doors

internationally.

BY ERIN E. CLACK

Richard Johnson

22 |

continent.

The New York-based athletic

chain today operates 604 European stores, accounting for a

significant portion of its roughly

$2 billion in international sales. But

Richard Johnson, Foot Locker’s

COO and EVP, said the company

has only scratched the surface.

“We constantly look for and

evaluate new territories to move

into, but right now, given the

opportunities we see, Europe

continues to be where our energy

is focused from a growth perspective,” he said. “We believe there

is still significant door expansion

potential in every one of the 19

European countries in which we

currently operate.”

In particular, Johnson cited

underpenetrated markets such

as France, Poland, Turkey and

Scandinavia as ripe for expansion.

“For example, when we look at

Turkey, where we have three stores

in Istanbul, we see potential for

our door count to be significantly

higher,” he noted. “There is a lot of

room for growth.”

Foot Locker also has 220 stores

in Canada, Australia and New

Zealand, as well as 73 franchised

locations in South Korea and the

Middle East. But Europe remains

the big bull’s-eye.

Last year, the retailer took an

even bigger stake in the region

with its $94 million acquisition

of Runners Point Group, a wellestablished German retailer with

a network of nearly 200 stores

under the Runners Point, Sidestep

and Run2 nameplates.

In addition to significantly

raising Foot Locker’s door count,

the acquisition gives the company

an opportunity to better segment

its customer base across multiple

store banners in Germany, its

largest market outside the U.S.

Boosted by the addition of the

RPG stores, the retailer continues

to see strong sales momentum

throughout Europe.

In fact, in the the second quarter of 2014, Foot Locker Europe

posted a comp-store sales gain in

all 19 countries in which it operates. Footwear comps were up in

the double digits.

“We feel good about our European business,” Johnson said.

“We do face fairly significant

in-country competition, but our

American DNA and great product selection, combined with the

deep-rooted sneaker culture that

exists in Europe, are helping to

fuel our growth there.”

The children’s business, in particular, is seeing robust sales gains

globally. The retailer has been

testing Kids Foot Locker stores

in parts of Western Europe and

Canada for the last two years.

“When we look at crossing the

globe with our other banners,

Kids Foot Locker is the one that’s

leading the way,” Johnson noted.

“It’s a great opportunity to introduce kids to the whole sneaker

lifestyle and then hopefully have

them graduate to Foot Locker as

they get older.”

PHOTOS: JOHNSON: MORITZ & CO.; STORE: COURTESY OF FOOT LOCKER

S

ince planting its first

store in Europe in

1989, Foot Locker has

aggressively grown its

footprint across the

| SEPTEMBER 8, 2014

FN0908P22,24.indd 22

9/2/14 5:58 PM

S

CONGRATULATIONS TO FOOT LOCKER

for revolutionizing the entire culture of footwear for 40 straight

years. Thank you for your incredible partnership and commitment

to athletes everywhere. We’re looking forward to reshaping the

industry with you over the next 40 years!

-Your Partners At Under Armour

MILESTONE

He said Kids Foot Locker, which has 17

locations overseas, is targeting areas where

the business is over-penetrated within its core

stores, indicating the capability to support a

stand-alone children’s shop.

The women’s category is another important

piece of Foot Locker’s international business.

On a square-footage basis, women’s merchandise is allotted more selling space in the

chain’s European stores than in its U.S. doors.

But the customer profile is different, Johnson

pointed out.

“When you look at Europe, it’s more of a

fashion or lifestyle buy as opposed to a performance/workout buy,” he explained. “That’s

where our female-specific Six:02 concept

[launched in 2012] could come into play. But

we need to get the formula right in the U.S.

first before we can think of expanding it

internationally.”

Alongside its brick-and-mortar business,

Foot Locker continues to develop its online

platform overseas. The company’s European

website, which serves nine countries in seven

languages, enables the chain to cover key

pockets of the region not currently served by

its stores.

“Our digital business is growing quite rapidly,” Johnson said. “Our strategy there is no

different than it is here in the U.S. We take a

[holistic] approach: Our goal is to make our total sales grow, so whatever channel those sales

come through, we’re happy with it.”

Regarding Foot Locker’s plans to further accelerate its expansion in Europe, Johnson said

the company’s major advantage is its 25 years

of experience on the continent, which has

allowed it to cultivate a unique local understanding of each of the markets there.

“We’ve been at this a long time, so we know

how to read a market,” he said. “That’s one of

the benefits of having our [European] divisional headquarters in Holland: We have access to

all the usual market and demographic data, but

you need those feet on the street to observe

consumers and what they’re wearing and to get

a good sense of the competition.”

Though the brand mix is generally the

same worldwide, Foot Locker’s assortment is

tailored to individual markets. “The product is

certainly very nuanced country by country and

even by local market,” he said. “Look at Italy:

The north of the country is very different from

the south. Our merchant team does a great job

identifying the right product for each of our

markets.”

Across the board, however, running consistently outpaces all other product categories

outside of North America.

In the first quarter, international sales of

running merchandise were up in the double

digits, led by Nike’s Air Max sneaker franchise

and Adidas’ ZX Flux program. “Running is

the [sneaker] silhouette of choice outside the

U.S. There is a much bigger emphasis on the

category in Western Europe and certainly Australia as well,” Johnson said.

Still, as an influential global retailer, Foot

Locker strives to get customers to embrace

other key trends and lines, such as basketball.

“It’s our job to lead the marketplace. We want

to show the European consumer the lifestyle

aspect of basketball — that there are great

silhouettes and product in that category,”

Johnson said.

Camilo Lyon, an analyst at Canaccord Genuity, said that strategy is already paying off.

“Basketball had mainly been a U.S. category,

but now it’s picking up speed in Europe,” he

said. “Foot Locker is executing well from a

product assortment standpoint, with Nike

a big part of that. Also, fashion trends are

It’s our job to lead the marketplace. We want

to show the European consumer the lifestyle

aspect of basketball. ” — Richard Johnson

24 |

shifting toward basketball. It’s all playing to

Foot Locker’s benefit as it expands in Europe.

[The retailer] is synonymous with basketball

at home, so building that category overseas is

important as it enters newer markets.”

Though the average store footprint is smaller

overseas — 1,500 square feet, compared with

2,400 square feet domestically — Foot Locker

has been able to roll out some of its more

successful shop-in-shop concepts abroad,

among them House of Hoops, a joint venture

with Nike.

“We see good success with House of Hoops

everywhere,” Johnson said. “We opened one in

Perth, Australia, [late last year], and that was

the last geography that had to be covered [with

the concept]. It’s premium retailing with a

great partner in Nike, and it stands for something around the globe.”

While Foot Locker has had to navigate its

international expansion amid a challenging

economic environment, Johnson said it hasn’t

slowed consumers’ demand for its brand.

“The economy has certainly impacted our

business, but our consumers seem to find a way

to feed their love for sneakers,” he said.

Echoing the company’s marketing tagline,

Johnson added, “One of the things driving our

success on a global basis is that consumers believe that if it’s at Foot Locker, it’s approved — it’s

cool enough for them to wear. They know they’re

getting the right shoe when they come to us.”

PHOTO: COURTESY OF FOOT LOCKER

FOOT LOCKER @ 40 × Global Rise

| SEPTEMBER 8, 2014

FN0908P22,24.indd 24

9/2/14 5:58 PM

09022014175947

MILESTONE

FOOT LOCKER @ 40 × Stepping Stones

TIME TRAVELER

How did Foot Locker evolve from single store to global powerhouse? Read on to find out.

1974

• Foot Locker opens its first store in Puente

Hills Mall in the City of Industry, Calif.

Foot Locker Europe opens a 22,204-sq.-ft. location

on London’s Oxford Street

1977 • First Foot Locker commercial airs, touting

nine stores in the Los Angeles area

2001 • The Foot Locker Foundation Inc. debuts

along with the first annual “On Our Feet” fundraising benefit held in response to the Sept. 11, 2001,

terrorist attacks

2004

• Foot Locker Inc. buys Footaction’s 350 stores

2007 • The first stand-alone House of Hoops in

Harlem in New York opens in collaboration with Nike

2010 • The company opens its first Run by Foot

Locker location in New York’s Union Square

1982

• Lady Foot Locker debuts in Joliet, Ill.

• Named Footwear News’ Retailer of the Year,

before winning the title again in 2012

1986

2011 • Sneakerpedia.com, a community-driven

sports and fashion resource, debuts

2013

• Germany-based athletic specialty retailer

Runners Point Group is acquired by Foot Locker Inc.

2012 • Foot Locker Inc. celebrates 100 years on the

New York Stock Exchange

2014 • Puma Lab powered by Foot Locker bows in

select stores

1987 • Kids Foot Locker opens its first store; parent

company (at the time) F. W. Woolworth Co. acquires

Champs Sports

1988 • First international Foot Locker opens in

Australia; chain hits the 1,000-store mark

1993 • Global store count includes 1,400 in the

U.S., 175 in Europe, nine in Mexico, 50 in Australia

and 100 in Canada

• Direct mail and e-commerce e-tailer

Eastbay.com is acquired

1996

PHOTOS: COURTESY OF FOOT LOCKER

1997 • The chain launches an e-commerce platform with the debut of Footlocker.com

• New York flagship opens on iconic shopping

thoroughfare 34th Street; House of Hoops debuts in

Foot Locker stores

1999

• Foot Locker becomes the first athletic specialty retailer to sponsor the New York City Marathon;

2000

26 |

| SEPTEMBER 8, 2014

FN0908P26.indd 26

9/2/14 6:01 PM

09022014180252

MILESTONE

Jake Jacobs with a

Foot Locker striper

COOL

CONCEPTS

With its eye on the core consumer, Foot Locker has

branched out with targeted shops. BY JENNIE BELL

A

lot has changed at Foot Locker over

its 40 years, from one store in a

California mall to a family of retail

banners with locations across the

globe. But Stephen “Jake” Jacobs,

president and CEO of Foot Locker U.S., said the

firm’s basic premise is little altered.

“I don’t think the gut of it has changed that

much. We’re still selling sneakers to kids,”

he said.

But Jacobs noted that over the years, competition in the athletic space has grown drastically.

“Nowadays, you can go anywhere to buy sneakers,” he said. “And you could probably go somewhere and find a basketball shoe for less than

you can find it at Foot Locker or in any of our

28 |

[competitors] in the mall.”

As a result, Foot Locker has risen to meet the

challenge, and Jacobs said the company’s mission now goes well beyond product. “What we’re

selling is intrigue, we’re selling fun, we’re selling

excitement,” he said. “That’s always been the

case with Foot Locker from the day it started to

today; it’s just that we’ve done different things

with the brand.”

And indeed, the firm has done a number of

different things, from launching offshoot chains

Lady Foot Locker and Kids Foot Locker in 1982

and 1987, respectively, to buying Footaction in

2004. All are now overseen by Jacobs as part of

a joint division. (Parent company Foot Locker

Inc. also acquired Champs Sports in 1987 but

operates that chain as a separate unit.)

Jacobs himself has been a witness to much of

the company’s evolution. He joined the organization in 1998 as a buyer for Champs and rose

through the ranks, eventually overseeing that

group’s footwear business and then running

the shoe business for the Foot Locker banners.

He next served as CEO of Champs for two and

a half years before taking on his current role

in 2011.

The executive pointed out that some of the

most rapid change at the company has come

within the last 10 years. “We’ve spent a lot more

time, energy and resources understanding who

our customer is and then creating an experience

for that kid,” he said, adding that for each of the

banners he oversees, the strategy remains the

same. “That’s the simple formula: Know who

your consumer is — your ultimate pinnacle consumer — and understand what your brand means

to them, and then build an incredible experience

for them.”

To craft a compelling shopping experience,

Foot Locker has been busy in both the online

and brick-and-mortar spaces. According to Jacobs, connectivity is key, in whatever realm the

consumer wants. “I hate to even have that conversation about whether it’s a digital experience

or an online experience. It’s just an experience,”

he said.

Foot Locker was an early adopter in the omnichannel push, building up its distribution capabilities to link stores and the Web. The company

now offers what it calls a “Super Stock Locator”

that gives customers various options such as to

buy online and ship to store, or buy on a mobile

device and pick up in store.

“We have designed our systems to make our

entire inventory available for purchase from

anywhere within our network,” said Dowe Tillema, president and CEO of Footlocker.com and

Eastbay.com.

Tillema noted that other important digital

features included enhanced search functionality

on the websites and a responsive design that can

reconfigure to different types of mobile devices.

In its brick-and-mortar doors, Foot Locker has

worked to generate excitement with new retail

projects created with its major vendors. The first,

House of Hoops, debuted in 2007 in partnership

with Nike and is now in 157 doors worldwide. It

has become a model for successful brand/retail

collaborations and inspired Foot Locker to open

the similarly themed Nike Fly Zone shops under

its Kids banner. “It’s an [extension] of that [same

idea] for kids with one of our biggest brands,”

PHOTO: COURTESY OF FOOT LOCKER

FOOT LOCKER @ 40 × Retail Overview

| SEPTEMBER 8, 2014

FN0908P28,30.indd 28

9/3/14 6:28 PM

09032014182949

100 million

replacement insoles sold—and still counting.

We couldn’t have

done it without you

Happy 40th Foot Locker

®REGISTERED AND ™TRADEMARK OF SPENCO MEDICAL CORPORATION. ©2014 SMC. ALL RIGHTS RESERVED

MILESTONE

FOOT LOCKER @ 40 × Retail Overview

in our brick-and-mortar and digital experiences. You’re seeing more investment from this

company in the last couple of years than you’ve

seen in the previous 10.”

One key initiative has been the rollout of Foot

Locker’s new remodel — dubbed the “Willowbrook format” for its first location in the Wayne,

N.J., mall — which emphasizes rich storytelling. “That’s what we do: We sell the stories that

brands are creating,” Jacobs said.

He predicted the investment in stores will

continue apace: “I don’t see any slowdown in it

in the near future. We’ve got a lot of runway in

front of us.”

Foot Locker’s continuously positive financial

results seem to support that strategy, but the firm

credits some of that success to strong product

launches from top athletic brands, particularly in

the basketball space, where Foot Locker controls

a large share of the market. “Our vendor partners have done an incredible job of cultivating

stories around marquee athletes or performance

technologies,” Jacobs said. “You’ll see some very

intriguing stuff coming out soon from the guys on

the basketball side, whether it’s Jordan, Nike or

Adidas — those are the big three, though Under

Armour is starting to step up its game on the

basketball side.”

In the running category, a larger mix of brands

are at play, from Asics and New Balance to

Brooks and Adidas. “There’s a lot of innovation

coming down the pipe from a running perspective,” Jacobs said, citing Adidas’ Boost cushion-

Winning the Female Consumer

Both the athletic and fashion industries have lately

turned their attention to women’s fitness. On the

luxury end, an increasing number of designer labels

are dabbling in sneakers and activewear, while

tough-guy performance brands like Under Armour

are working to soften their image with revamped

product and marketing.

Foot Locker has also been honing its focus on the

female consumer.

“The women’s athletic business is a huge opportunity for us,” said Jake Jacobs, president and CEO

of Foot Locker U.S. “We’re in the initial stages of

understanding and attacking that consumer set.

It’s still a work in progress, but we’re seeing some

very encouraging signs in what we’re doing.”

For the past couple of years, the retailer has been

overhauling its Lady Foot Locker nameplate to positive results, according to the firm. And it is slowly

30 |

growing its Six:02 concept, which debuted with

three locations in November 2012 and now totals

nine doors in Texas, Florida and the New York area.

Natalie Ellis, VP and GM of Lady Foot Locker

and Six:02, noted that Six:02 caters directly to

the female fitness enthusiast. “A key part of this

is creating an environment where women can feel

comfortable and that’s easy to navigate,” she said.

“It’s where she’s going to find that great outfit

You’re seeing more

investment from

this company in the

last couple of years

than you’ve seen in

the previous 10.”

— Jake Jacobs

ing technology as a leading example.

He added, “This is probably one of the most

exciting times in the 16 years I’ve been in the

specialty business, from the sheer amount of

cool, innovative product [coming out for fall

and spring] across a very wide swath of our

vendor base.”

Looking ahead, Jacobs said his team’s goal

remains unchanged: to cater to that core shopper. “We have to — and we want to — make sure

we’re incredibly connected to our pinnacle consumer,” he said. “As long as we do that, as long

as we keep touching more people and bringing

more people into our brand, the end results will

be good.”

to run her 5K, or a place where she can go to get

some inspiration and motivation.”

The stores and Six:02 e-commerce site stock

footwear, apparel and accessories from a range

of brands, including major players Nike, Adidas,

Asics and New Balance, as well as Actra and

Moving Comfort.

The chain’s marketing is part inspirational and

part community-oriented. “A lot of what we are

doing is building a network of women through

social media with [our hashtag] #Six02Moment,”

Ellis said. “It’s a tremendous feeling when you

know you can get people to take time for themselves and think about how they can nurture

themselves.”

She added that the time is right for this type of

retail environment. “Women are demanding and

deserve to have their own space in the athletic

market,” she said. “Because we represent multiple

brands, we can help navigate the selections and

give her all the options that are right for her.” — J.B.

PHOTO: COURTESY OF FOOT LOCKER

Jacobs said of the concept that launched in

November 2013. “We’ve got five open, and we’ll

start expanding those pretty rapidly.”

And last February, the retailer teamed with

another brand to debut Puma Lab. The shopin-shop, which opened in two Atlanta malls, is

expected to roll out in some form to roughly 125

Foot Locker locations. It presents the full range

of Puma product in a periodic table-like framework that highlights design, luxury, creativity

and multiple sport categories.

At the time of the opening, Puma North

America President Jay Piccola told Footwear

News that the merchandise mix could include

anything from “the Puma Suede to the Alexander

McQueen collections,” as well as a number of

exclusive items.

Additional retail concepts have launched in

connection with the Footaction chain, including

the much-buzzed-about Flight 23 (a partnership with the Jordan brand) and the Adidas

Originals Collective.

Beyond engineering new concepts, Jacobs’ team

has been working to hone its real estate roster.

In the first half of fiscal 2014, his division

opened 24 new doors, closed 40 and relocated or remodeled 121, all across the banners

he oversees, which also includes the newly

launched Six:02 women’s format (see sidebar

for more). “We’ve figured out some things

that are working for us, so we’re going [ahead

with it],” Jacobs said. “That’s why you see so

much investment in the end experience, both

| SEPTEMBER 8, 2014

FN0908P28,30.indd 30

9/3/14 6:28 PM

09032014182953

James Harden singing R&B. Approved.

Mike Tyson returning Holyfield’s ear. Approved.

Teasing Hall of Famers who never won a ring. Approved.

Getting demoted to Kris Humphries’ entourage. Approved.

Dennis Rodman leaving and never coming back. Approved.

Scottie Pippen saying he’s the greatest Bull of all time. Approved.

Anything less than great. Not approved.

Thanks for being an amazing partner, and congratulations on 40 years of success.

MILESTONE

FOOT LOCKER @ 40 × Store Design

EVOLUTIONARY

STUDIES

A look at the changing face of Foot

Locker over the past four decades.

BY ERIN E. CLACK

1974

The retailer debuts at

Puente Hills Mall in the

City of Industry, Calif.

1999

A 20,000-sq.-ft. store

opens on 34th Street in

New York

1988

Earlier concepts like

this San Antonio

location used cedar

wood in store design

This Trumbull, Conn.,

spot continues

to highlight the

importance of

mall units

A 10,000-sq.-ft.

space debuts in

Times Square

32 |

PHOTOS: COURTESY OF FOOT LOCKER

2002

2002

| SEPTEMBER 8, 2014

FN0908P32,34.indd 32

9/4/14 1:56 PM

MILESTONE

34 |

2003

The chain targets

downtown New York

shoppers with its

first Soho unit

2010

Inside Garden State

Plaza in Paramus,

N.J., another key

mall location

2011

House of Hoops

on 34th Street

bows with a twostory concept

2013

This Bridgewater,

Conn., space

showcases

a new design

2014

Foot Locker’s Beverly

Center store in Los

Angeles showcases

this year’s “Made by

Kobe” ads

PHOTOS: COURTESY OF FOOT LOCKER

EVOLUTIONARY STUDIES

FOOT LOCKER @ 40 × Store Design

| SEPTEMBER 8, 2014

FN0908P32,34.indd 34

9/4/14 1:56 PM

Epicor Retail

To a company that keeps striding forward…

Congratulations Foot Locker

on your first 40 years of

omni-channel success!

We’re proud to play a part.

800.992.9160 | retailinfo@epicor.com

Epicor.com/retail

Store/Mobile Store | Enterprise Order Management | CRM/Clienteling | Audit | LP | Merchandising | Planning/Assortment Planning | Business Intelligence | Sourcing/PLM

Copyright © 2014 Epicor Software Corporation. Epicor, Business Inspired, and the Epicor logo are trademarks of Epicor Software Corporation, registered in the United States, certain other countries and/or the EU.

MILESTONE

FOOT LOCKER @ 40 × Marketing Muscle

The spring ’14

“No Rings”

commercial

CAMPAIGN TRAIL

H

BY DANA KARLSON

36 |

ow does Foot Locker

make its messaging

stand out?

“Differentiation

is important,” Stacy

Cunningham, EVP

of marketing at Foot Locker,

explained. “But [being] different for the right reason is more

important.”

Cunningham said the brand dug

into its archives to figure out how

to talk to its target consumer —

affectionally referred to as “our

kid” — into the next decade of

athletic wear.

Here is a look at some of Foot

Locker’s most memorable campaigns — from its first productfocused commercial in 1977 to the

star-powered promotions of today.

1977: FIRST COMMERCIAL

In the first few spots, the retailer

focused on broad conversations

about brands and products.

1983: WILT CHAMBERLAIN

This was an early example of Foot

Locker’s strategy of using professional athletes in its ads to portray the expertise of Foot Locker

salesmen.

MID-1980s: “COME TO THE STRIPES”

The store’s positioning in this

long-running theme in the ’80s

was one of authority, no matter

the type of athlete being portrayed

or what sport they played. The

Foot Locker

at the 2013

NYC marathon

PHOTOS: AD: COURTESY OF FOOT LOCKER; RUNNER: GETTY IMAGES

Star athletes. Hot

product. Buzzy

slogans. Foot

Locker has always

courted its sneakerobsessed shoppers

with innovative

marketing plays.

| SEPTEMBER 8, 2014

FN0908P36,38.indd 36

9/3/14 4:45 PM

09032014164723

Approved with warnings

CONGRATULATIONS FOOT LOCKER!

Here’s to

40 YEARS

of keeping feet moving everywhere.

MILESTONE

FOOT LOCKER @ 40 × Marketing Muscle

The 2014 b-t-s

campaign

ubiquitous “Get it right for your body” jingle

was broadcast nationally.

1987: SUPER BOWL AD

As the first athletic retailer to advertise during the

big game, Foot Locker made a serious statement.

1993: WILT CHAMBERLAIN, JOHN HAVLICEK,

MEADOWLARK LEMON TV SPOT

The retired hoops stars relate to a young teen their

tales of hardship from growing up “back in the day.”

2000-PRESENT: NEW YORK CITY MARATHON

Foot Locker has been a principal sponsor and

official athletic retailer of the New York City

Marathon for more than a decade.

2010: “PUPPETS”

This was an installment in Nike’s highly successful “Puppets” campaign starring Kobe

Bryant. Of course, the Kobe puppet enlisted the

iconic “stripers” to talk (or rather, rap) about

one of his upcoming shoe releases.

2013: VICTOR CRUZ

The #Kickstagram #CruzdayTuesday program

started in January 2013 with NFL star Victor

Cruz. The retailer receives hundreds of uploads

each week from fans who are sharing their passion for sneakers. Every Tuesday, Cruz chooses

one follower to get a personal shoutout on Ins-

Victor Cruz fronted

a social media

campaign