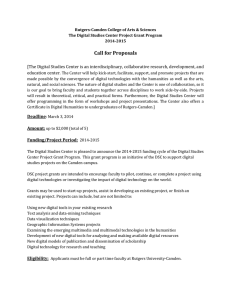

FREE TAX PREP - Camden County Library

advertisement

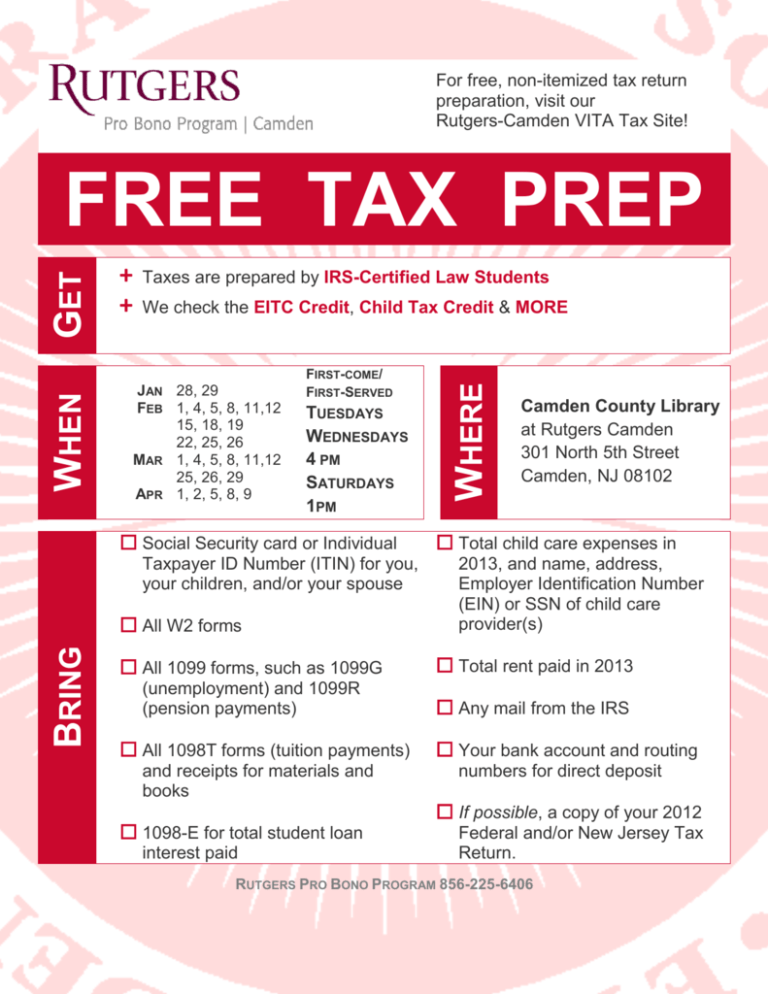

For free, non-itemized tax return preparation, visit our Rutgers-Camden VITA Tax Site! + + Taxes are prepared by IRS-Certified Law Students We check the EITC Credit, Child Tax Credit & MORE JAN 28, 29 FEB 1, 4, 5, 8, 11,12 15, 18, 19 22, 25, 26 MAR 1, 4, 5, 8, 11,12 25, 26, 29 APR 1, 2, 5, 8, 9 FIRST-COME/ FIRST-SERVED TUESDAYS WEDNESDAYS 4 PM SATURDAYS 1PM Social Security card or Individual Taxpayer ID Number (ITIN) for you, your children, and/or your spouse BRING All W2 forms WHERE WHEN GET FREE TAX PREP Camden County Library at Rutgers Camden 301 North 5th Street Camden, NJ 08102 Total child care expenses in 2013, and name, address, Employer Identification Number (EIN) or SSN of child care provider(s) All 1099 forms, such as 1099G Total rent paid in 2013 (unemployment) and 1099R (pension payments) Any mail from the IRS All 1098T forms (tuition payments) and receipts for materials and books 1098-E for total student loan interest paid Your bank account and routing numbers for direct deposit If possible, a copy of your 2012 Federal and/or New Jersey Tax Return. RUTGERS PRO BONO PROGRAM 856-225-6406