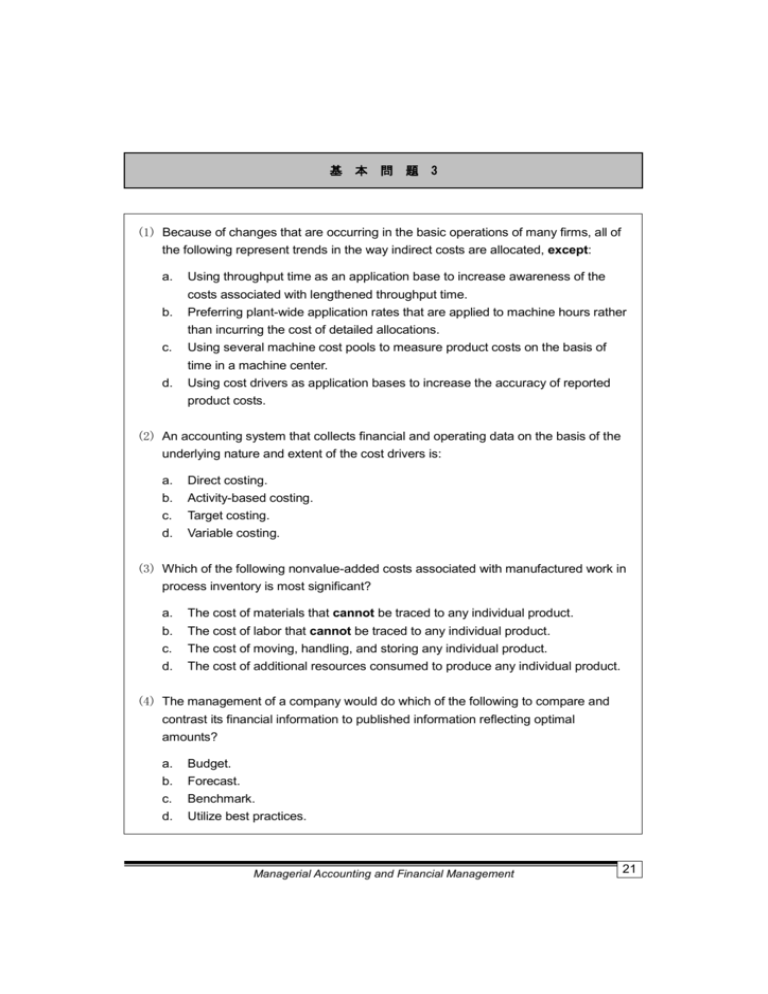

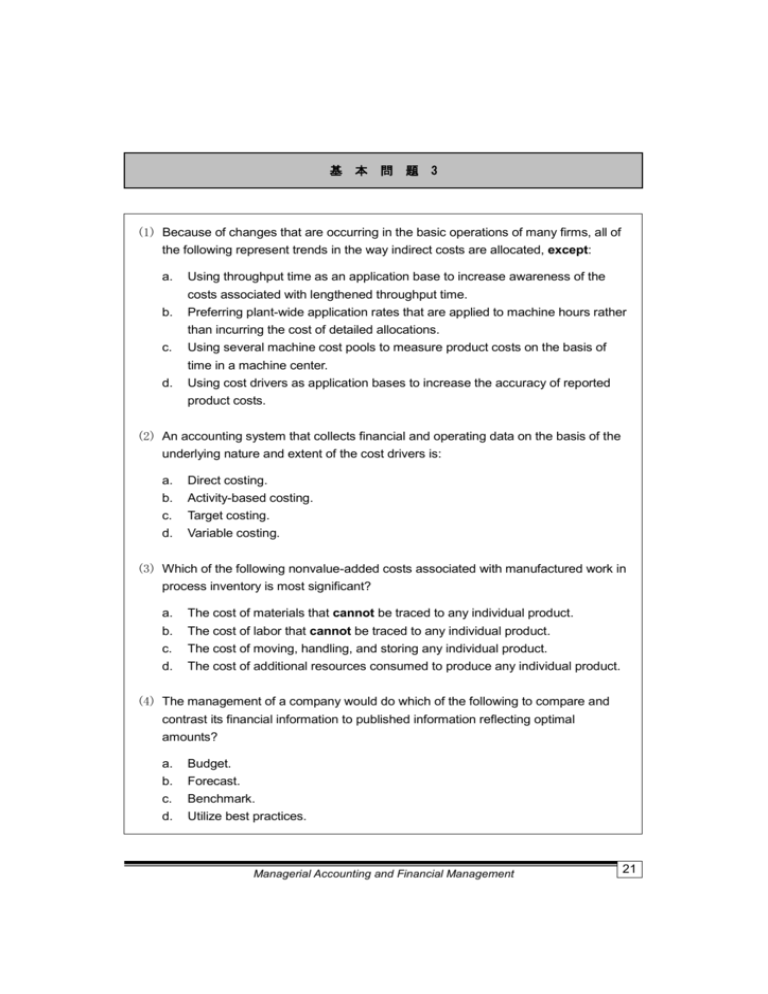

基 本 問 題 3

(1) Because of changes that are occurring in the basic operations of many firms, all of

the following represent trends in the way indirect costs are allocated, except:

a.

Using throughput time as an application base to increase awareness of the

costs associated with lengthened throughput time.

b.

Preferring plant-wide application rates that are applied to machine hours rather

than incurring the cost of detailed allocations.

c.

Using several machine cost pools to measure product costs on the basis of

time in a machine center.

d.

Using cost drivers as application bases to increase the accuracy of reported

product costs.

(2) An accounting system that collects financial and operating data on the basis of the

underlying nature and extent of the cost drivers is:

a.

Direct costing.

b.

Activity-based costing.

c.

Target costing.

d.

Variable costing.

(3) Which of the following nonvalue-added costs associated with manufactured work in

process inventory is most significant?

a.

The cost of materials that cannot be traced to any individual product.

b.

c.

The cost of labor that cannot be traced to any individual product.

The cost of moving, handling, and storing any individual product.

d.

The cost of additional resources consumed to produce any individual product.

(4) The management of a company would do which of the following to compare and

contrast its financial information to published information reflecting optimal

amounts?

a.

Budget.

b.

Forecast.

c.

Benchmark.

d.

Utilize best practices.

Managerial Accounting and Financial Management

21

©TAC all rights reserved

【解答と解説】

(1) (b) Choice "b" is correct. Plant-wide application rates applied to machine hours is a

traditional costing approach. More detailed cost allocations are now preferred.

Choices "a", "c", and "d" are incorrect. These are all trends in the revolution

occurring in cost accounting (in the manufacturing environment).

b.が Traditional costing approach に関する説明であることは明らかでしょう。

(2) (b) 題意の計算方法は、ABC です。

なお、a. Direct costing と d. Variable costing(この2つは同じ計算方法です)は

第4章で、c. Target costing は第11章で紹介します。

(3) (c) Work in process の生産に関連する nonvalue-adding costs(activities)を問う問

題です。

ものを移動する、保管するといった活動は nonvalue-adding activities の代表例で

す。なお、a.と b.は単に indirect materials と indirect labor costs の定義にすぎま

せん。また、d.は direct costs もしくは variable costs を指していると思われます。

(4) (c) Benchmarking would be used by a company in comparing its financial data to

published information to determine if optimal.

題意の方法は benchmark/benchmarking です。なお、この問題では financial

information を挙げていますが、non-financial information も比較の対象となりま

すし、公表された information のみならず非公表の information を訪問先の企業か

ら入手する場合もあります。

[(1)~(4)は Becker 実践トレーニング集にある問題です。

]

22

Managerial Accounting and Financial Management

2. Cost Allocation

基 本 問 題 4

Sonimad Sawmill manufactures two lumber products from a joint milling process.

The two products developed are mine support braces (MSB) and unseasoned

commercial building lumber (CBL). A standard production run incurs joint costs of

$300,000 and results in 60,000 units of MSB and 90,000 units of CBL. Each MSB

sells for $2 per unit, each CBL sells for $4 per unit.

(1) Assuming no further processing work is done after the split-off point, the amount of

joint cost allocated to CBL on a physical quantity allocation basis would be:

a.

$75,000

b.

$180,000

c.

$225,000

d.

$120,000

(2) If there are no further processing costs incurred after the split-off point, the amount

of joint cost allocated to the MSB on a relative sales value basis would be:

a.

$75,000

b.

$180,000

c.

$225,000

d.

$120,000

(3) Continuing with the previous data, assume the CBL is not marketable at split-off but

must be further planed and sized at a cost of $200,000 per production run. During

this process, 10,000 units are unavoidably lost; these spoiled units have no

discernable value. The remaining units of CBL are saleable at $10.00 per unit.

The MSB, although saleable immediately at the split-off point, are coated with a tarlike preservative that costs $100,000 per production run. The MSB are then sold

for $5 each.

Using the net realizable value (NRV) basis, the completed cost assigned to each

unit of CBL would be:

a. $2.92

b. $5.625

c. $5.3125 d. Some amount other than those given above.

(4) Which of the following is not a basic approach to allocating costs for costing

inventory in joint-cost situations?

a.

Sales value at split-off.

b.

Flexible budget amounts.

c.

Physical measures such as weights or volume.

d.

Constant gross margin percentage net realizable value method.

Managerial Accounting and Financial Management

23

©TAC all rights reserved

【解答と解説】

(1) (b) Physical quantity に基づいて joint costs $300,000を配分すると、CBL には

$180,000が配分されます。

CBL 90,000 units

$300,000×

=$180,000

MSB 60,000units+CBL 90,000units

(2) (a) Relative sales value に基づいて joint costs $300,000を配分すると、MSB には

$75,000が配分されます。

MSB ($2×60,000units)

$300,000×

MSB ($2×60,000units)+CBL($4×90,000 units)

=$75,000

(3) (b) 最初に、状況を整理してみます。

MSB60,000units

(価格:$2)

MSB60,000units

(価格:$5)

$100,000

$300,000

CBL90,000units

(価格:-)

Lost:10,000u

$200,000

CBL80,000units

(価格:$10)

..

上図で示したように、CBL は分離点での販売価格がないので NRV を用いて、

..

MSB は分離点での販売価格があるので分離時点での sales value を用いて joint

costs を按分します。

CBL($10×80,000 units-$200,000)

$300,000×

MSB ($2×60,000units)+CBL($10×80,000 units-$200,000)

=$250,000

よって、CBL の完成品1units あたりの costs は$5.625となります。

Joint costs $250,000+Separable costs$200,000

80,000units

=$5.625

(4) (b) Joint costs 按分の基礎とならないものは、flexible budget amount(第7章で紹介

します)です。

[(1)~(4)は Becker 実践トレーニング集にある問題です。

]

24

Managerial Accounting and Financial Management