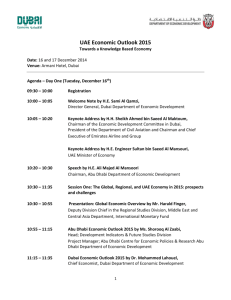

UAE - Alstom

advertisement

ANALYST DAYS IN DUBAI Gulf Overview Sylvain Hijazi 10 March 2008 Geographical context Syria Lebanon Iraq Iran Israel Jordan Kuwait Bahrain Qatar UAE Oman Total Area: 430,000 sq.km Saudi Arabia Population: 12.1 million GDP: 416 B.USD Currencies: Linked to US$ Installed Capacity: 53GW (GT 35 MW + ST 18 MW) Transport Rail: 0 km P2 Yemen History of Gulf Countries (1/2) Were under the British Military control KUWAIT • • The first country gained independence on June 19, 1961 Al-Sabah dynasty has had a close partnership with British Foreign relations and defense since 1899 OMAN • • The second country became independent on Nov.18, 1970 Sultan Qaboos bin Said Al-Said since 1970 (take over from his father) QATAR • P3 Became independent on Sept.3, 1971, Al-Thani family had relations with UK since 1850 History of Gulf Countries (2/2) BAHRAIN • Became independent on Aug. 15, 1971, Al-khalifa family had close relations with UK since 1870 • The federation formed in Dec.2, 1971 with 6 Emirates (excluding Fujairah). Fujairah joined the federation in early 1972 (originally the idea was to create the Federation with 9 Emirates) The Federation members are: Abu Dhabi, Dubai, Sharjah, Ajman, Fujairah, Ras AlKhaimah and Umm Al-Quwain UAE • P4 Gulf Oil & Gas Reserves P5 Oil Gas GCC Interconnection – Gas Link Completed Under construction • Actual Gas price 1.25$/Mbtu to 1.6$/Mbtu (still low versus other countries) • Gas price will be increased to 3$/Mbtu in 2010 • Dolphin pipe line will start to feed by 2 bcf/d on next April 08 P6 (instead of 1.2 bcf/d actual today) Regional policy GCC Interconnection - Electricity Link The interconnections are to be constructed in 3 phases and will provide 600 – 800 MW of power to Bahrain, Kuwait, Oman, Qatar & UAE. P7 Regional policy GCC Interconnection – Rail Link Project realisation may come by 2015 P8 Economic situation Macro Economic Data - Gulf Countries (UAE, Bahrain, Qatar, Oman & Kuwait) COUNTRY UAE Area (km 2) Pop u l a ti o Oi l n (M i l l i on ) Res erve (Bi l l i on Ba rrel s ) Oi l Prod. (M i l l i on Ba rrel s GD P Per GD P Ga s Ga s (Bi l l i o Ca p i ta Res erve Prod. (Tri l l i on (b cf/da y) n US D ) (US D ) M 3) Reven u e (Bi l l i on US D ) Exp en d. Exp ort (Bi l l i on (Bi l l i on US D ) US D ) In p ort Cu rren cy (Bi l l i on US D ) Exc.Ra te Vs US D 90,599 4.5 97.8 2.410 6.06 4.45 189.6 36,222 7.75 7.75 165.2 118.7 AED 3.67 695.3 0.8 0.125 0.188 0.09 0.89 16.9 21,330 3.4 3 16.1 10.9 BHD 0.38 QATAR 11,437 1 15.5 0.790 25.78 3.8 65.8 57,000 20 18 50.5 26.7 QR 3.64 OMAN 309,500 2.6 5.6 0.97 0.95 1.431 40.5 13,609 11.5 12.5 50.5 18.6 RO 0.39 17,818 3.2 101 2.490 1.56 0.84 103.4 30,188 46 37.6 63.9 32.400 KD 0.29 430,049 12.1 220.03 6 .848 34.44 11.411 416 88.6 5 78.85 346 .2 207.30 BAHRAIN KUWAIT Gulf Region P9 Bahrain Bahrain was one of the first States in the Gulf to discover oil The Kingdom of Bahrain is made up of 33 islands and is home to one of the largest aluminum smelters in the world. King: H.H. Sheikh Hamad Bin-Isa Al-Khalifah Capital: Manama Population: 800,000 GNI per capita: US$ 21,330 Area: 695.3 sq km GDP: US$ 16.9 billion Exchange Rate: 0.38 Bahraini Dinar per US$ Oil Reserves: 0.125 billion barrels Gas Reserves: 0.09 trillion m3 Oil Production: 0.188 million barrels per day Gas Production: 0.89 bcf/day Percentage Distribution of Population TCN 26% Exp 1% Arabs 10% P 10 National 63% Kuwait The State of Kuwait is a small, oil-rich country nestling at the top of the Gulf, flanked by large and powerful neighbours - Saudi Arabia to the South, Iraq to the North and Iran to the East. Amir : H.H. Sheikh Sabah Al-Ahmad Al-jaber Al-Sabah Capital: Kuwait City Population: 3.2 million GNI per capita: US$ 30,188 Area: 17,818 sq km GDP: US$ 103.4 billion Exchange Rate: 0.28 Kuwaiti Dinar per US$ Oil Reserves: 101 billion barrels Gas Reserves: trillion 1.56m3 Oil Production: 2.49 million barrels per day Gas Production: 0.84 bcf/day PERCENTAGE DISTRIBUTION OF POPULATION Exp 7% TCN 13% National 45% Arabs 35% P 11 Oman Sultanate of Oman is a well-off country with large oil and gas resources, a substantial trade surplus, and low inflation. Oil is the mainstay of the economy, providing around 40% of GDP. Sultan Qaboos bin Said Al Said Capital: Muscat Population: 2.6 million GNI per capita: US$13,609 Area: 309,500 sq km GDP: US$ 40.5 billion Exchange Rate: 0.39 Riyal per US$ Oil Reserves: 5.6 billion barrels Gas Reserves: 0.95 trillion m3 Oil Production: 0.97 million barrels per day Gas Production: 1.431 bcf/day PERCENTAGE DISTRIBUTION OF POPULATION Exp 1% Arabs 3% P 12 TCN 15% National 81% Qatar The State of Qatar has developed from being one of the poorest Gulf States to become one of the richest. Natural Gas reserves 3rd RASGAS QATARGAS largest in the world. (Contracted LNG exports million tonnes a year) 90 Capital: Doha 80 Population: 1 million 60 70 50 Area: 11,437 sq km 40 30 GNI per capita:US$ 57,000 Emir: H.H. Sheikh Hamad Bin-Khalifah Al Thani 20 10 GDP: US$ 65.8 billion Exchange Rate: 1 Q Riyal 0 = 3.64 per US$ Oil Reserves: 15.5 billion barrels Oil Production : 0.790 million barrels per day PERCENTAGE DISTRIBUTION OF POPULATION TCN 41% Gas Production: 3.8 bcf/day Gas Reserves: 25.78 trillion m3 National 15% Exp 12% Arabs 32% P 13 United Arab Emirates (UAE) A federation of seven emirates formed in 1971: Abu Dhabi, Dubai, Ajman, Fujairah, Ras Al Khaimah, Sharjah and Umm Al Quwain. The UAE is governed by a Supreme Council of Rulers of each of the emirates and presided by Sheikh Khalifa bin Zayed Al Nahyan (Ruler of Abu Dhabi). Capital: Abu Dhabi Population: 4.5 million GNI per capita: US$ 36,222 Area: 90,599 sq km GDP : US$ 189.6 billion Exchange Rate: Dirhams 3.671 per US$ President H.H. Shaikh Khalifa bin Zayed Al Nahyan Oil Reserves: 97.8 billion barrels Gas Reserves: 6.06 trillion m3 Oil Production: 2.4 million barrels per day PERCENTAGE DISTRIBUTION OF POPULATION National 14% TCN 65% Gas Production: 4.4 bcf/d Exp 5% P 14 Arabs 16% UAE UAE: Federation of 7 Emirates EMIRATE P 15 RULER ABU DHABI H.H.Shaikh Khalifa Bin Zayed Al Nahyan DUBAI H.H.Shaikh Mohammad Bin Rashid Al Maktoum SHARJAH H.H.Dr.Shaikh Sultan Bin Mohammed Al Qassimi AJMAN H.H.Shaikh Humaid Bin Rashid Al Nuaimi FUJAIRAH H.H.Shaikh Hamad Bin Mohammed Al Sharqi RAS AL KHAIMAH H.H.Shaikh Saqr Bin Mohammed Al Qassimi UMM AL QUWAIN H.H.Shaikh Rashid Bin Ahmed Al Moalla Economic Context Gulf Continuous high growth on Buildings & Infrastructure High pressure to produce more Oil & Gas Shift of Aluminium production to the Gulf (over 4 MT/Y to be built over the coming 12 years) High Market Potential for Alstom P 16 Dubai - Sheikh Zayed Road Development 1990-2010 Sheikh Zayed Road 1990 2003 Burj Dubai Project 2007: Under Construction P 17 Completion by March 2010 Dubai – Building its Biggest and Prominent Projects The World Dubai Marina P 18 Jumeirah Lakes The Palm-Jumeirah Economic Context – High Growth on Building & Infrastructure P 19 Dubai Emirate Registered Vehicles in Dubai Emirate 1400 1150 # of Veh. (in 1000s) 1200 # of Veh. (in 1000s) 780 1000 568 800 491 600 400 199 213 1995 1996 236 266 294 321 1999 2000 354 389 421 2002 2003 200 0 1997 1998 2001 Year Source: RTA - Dubai P 20 2004 2005 2006 2007 Dubai Rail Projects - Phase Construction Americ an Univ. Red Line Extension Al Sufouh Tram Union Square Red Line Original Green Line Blue Line Extension Burj Dubai Tram Purple Line Green Line Extension Motor city Tram Rashidiya Depot Blue Line Red Line (From Rashidiya to University) 112 km 36 stations Green Line (From Abu Heil to Al Ras) 17 km 19 stations Purple Line : - From Dubai Airport to Jebel Ali International Airport 47 km - Future Extension to Water Front Blue Line (From Dubai Airport to Jebel Ali International Airport) P 21 35 km 90 km 15 stations 4 Stations 13 stations Rail Projects – Abu Dhabi P 22 Abu Dhabi - Prominent Projects SARAYAH IN ABU DHABI P 23 Growth in GCC Countries PEARL QATAR THE BLUE CITY OMAN P 24 BARR AL JISSAH ISLAND Growth in GCC Countries TALA ISLAND BAHRAIN FINANCIAL HARBOUR SILK CITY IN KUWAIT THE RAPID GROWTH & DEVELOPMENT IN THE GULF REGION EQUATES TO A GREATER DEMAND FOR ELECTRICITY IN THE FUTURE. P 25 Economic Context Gulf Continuous high growth on Buildings & Infrastructure High pressure to produce more Oil & Gas Shift of Aluminium production to the Gulf (over 4 MT/Y to be built over the coming 12 years) P 26 High pressure to produce more Oil MB/d 2004 2010 2020 2030 World Demand 82,1 92,5 104,9 115,4 World Offer 82,1 92,5 104,9 115,4 OPEC Middle East 22,8 26,6 35,3 44,0 + > 50% Arab world holds 60% world oil reserves & 35% of Gas reserves Source: World Energy Outlook P 27 Oil Production * Oil demand in 2008 will average 88 Million bpd Source: EIA / CIA) P 28 Gas Production P 29 Economic Context Gulf Continuous high growth on Buildings & Infrastructure High pressure to produce more Oil & Gas Shift of Aluminium production to the Gulf (over 4 MT/Y to be built over the coming 12 years) P 30 Global Aluminium Production Shift 1980 (16 Mt) Others , 19% 2006 (33.9 Mt) Europe, 22% Others , 21% 2020 (57.5 Mt) Europe, 12% USA, 7% China, 2% Middle East, 10% Canada, 7% Canada, 9% Middle East, 1% USA, 30% China, 27% Former USSR, 12% Australi a, 6% Middle East Mainly Gulf Production 1.7 MT/Y China, 25% Australia , 4% Former USSR, 20% Middle East Mainly Gulf Production ≈ 5.7 MT/Y Over of 4 MT/Y Production to be installed in the Gulf P 31 USA, 5% Middle East, 6% Former USSR, 17% Australi a, 2% Canada , 7% Others , 23% Europe, 8% Alstom Presence in the Gulf SHARJAH – IN / GPS / Transport 20 Persons • • • 6 persons International Network/GPS 13 persons Power Systems 1 person Transport ALSTOM Power Service 140 Persons • • Main office & workshop at Jebel Ali Free Zone (Dubai) Branch offices at Abu Dhabi, Bahrain & Iran Total 160 Persons P 32 Major Recent References BAHRAIN • • • MEW – Hidd I & II 1000 MW (5 x GT13E2 + 1 x 300 MW ST + 3 HRSG) – Completed MEW – Riffa Phase II – Upgrade 6 GT13ED to DM/EV Burners – Under realization ALBA – PS4 650 MW (3 x GT13E2 + 2 x 150 MW ST + 4 HRSG) – Completed KUWAIT • MEW – Al-Zour South 800 MW (5 x GT13E2 ) – Under realization OMAN • Sohal – Alum.Smelter 1000 MW (4 x GT13E2 + 2 x 200 MW ST + 4 HRSG) – Completed QATAR • QEWC – Ras Abu Fontas B + B1 1025 MW (8 x GT13E2) – Completed UAE • • • • • • • P 33 DUBAL – Condor & Kestrel Add On ( 3 x 125 MW ST+ 6 HRSG behind 6 GT 9E) – Completed DUBAL – Kestrel II 450 MW (2 x GT13E2 + 1 ST 125 MW + 2 HRSG) Completed DUBAL – GTX 150 MW (1 x GT13E2 + 1 HRSG) – Under realization DUBAL – Modernization of Kiln 1 to 5 (Fume Treatment) – Completed DUBAL – Fume Treatment Plant for Potlines 7B, 9B and 5B & 6B – Under realization EMAL – Fume Treatment & Flue Gas Desulphurization Plant – Under realization ADWEA – Fujairah II – 2000 MW ( 5 x GT26 + 3 ST 220 MW + 5 HRSG) - Under realization Order Intake year 2007/08: Over 1.5 Bn€ Conclusion • • • • • • • • • Surplus cash / Liquidity (High Revenue) Growing Economy & high demographic growth High oil and gas reserves Low cost of Energy No corporate Tax or Individual Tax Low custom Duties (4%) Low cost of manpower (open market) Pre-planned ruling family succession / favorable Political Situation by comparison to region (American military base in Bahrain & Qatar) Safe place to live / moderate social setting Attraction for more Investors in Industrial/ Petrochemical/Oil & Gas/ Aluminum Industries and Regional Hub for International Companies GULF remains WORLD’s fastest growing area in POWER DEMAND Per Capita P 34 GULF becomes an increasing market for Rail Transport www.alstom.com