Smithfield Foods Our Company 2007

advertisement

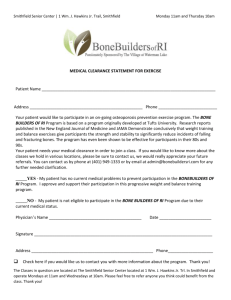

O U R CO M PA N Y 2 0 07 TABLE OF CONTENTS EXECUTIVE MESSAGE 2 PERFORMANCE CHARTS 4 SMITHFIELD UP CLOSE 7 OUR FAMILY OF COMPANIES 23 FINANCIALS 46 MANAGEMENT BOARD, CORPORATE OFFICERS, DIRECTORS 49 CORPORATE INFORMATION 50 FINANCIAL HIGHLIGHTS Fiscal Years Ended (in millions, except per share data) Sales April 29, 2007 April 30, 2006 May 1, 2005 $ 11,911.1 $ 11,403.6 $ 11,248.4 Income from continuing operations 188.4 185.2 300.7 Net income 166.8 172.7 296.2 1.68 1.65 2.68 Income from continuing operations per diluted share Net income per diluted share 1.49 1.54 2.64 Weighted average diluted shares outstanding 111.9 112.0 112.3 $ 477.7 $ 381.6 $ 193.2 219.3 200.1 187.0 1,372.5 1,161.3 1,421.2 Additional Information Capital expenditures Depreciation expense Working capital 1 Total debt 3,092.9 2,558.3 2,274.7 Shareholders’ equity 2,240.8 2,028.2 1,901.4 58.0% 55.8% 54.5% Total debt to total capitalization 2 1 Total debt is equal to notes payable and long-term debt and capital lease obligations including current portion. 2 Computed using total debt divided by total debt and shareholders’ equity. With sales approaching $12 billion in fiscal 2007, Smithfield Foods is the world’s #1 hog producer and #1 pork processor. In the United States, our market shares also make us the… #1 #1 #1 #1 turkey processor cattle feeder bacon producer smoked ham producer #1 #1 #1 #1 spiral hams producer smoked pork chops producer poultry hot dogs producer deli salami producer A LEADER IN BRANDED PACKAGED MEATS Smithfield Foods packaged meats are among the most trusted and sought-after. From national brands and regional powerhouses in the United States to some of the best-known European brands, here are just a few that are prized by retail, foodservice, and deli customers alike. Æ MAP OF OPERATIONS Smithfield Foods now has operations in 13 countries through wholly owned subsidiaries and joint ventures. UNITED STATES MEXICO BELGIUM FRANCE GERMANY ITALY POLAND PORTUGAL ROMANIA SPAIN THE NETHERLANDS UNITED KINGDOM CHINA Wholly owned Smithfield Foods operations as well as the Butterball, LLC, and Five Rivers Ranch Cattle Feeding LLC joint ventures in the United States. Our presence in these countries is through a 50% ownership stake in Groupe Smithfield. Smithfield owns a 23% stake in Campofrio. Our presence in China and Mexico is through a 50% ownership stake in joint ventures. EXECUTIVE MESSAGE To Our Stakeholders: Smithfield Foods reported income from continuing operations for fiscal 2007 of $188.4 million, or $1.68 per diluted share, versus $185.2 million, or $1.65 per diluted share, last year. Sales were $11.9 billion, compared to $11.4 billion in the prior year. Considering the negative impact of increased grain prices on all of our live production operations, I am very pleased with the results, particularly in the international and pork segments. In fiscal 2007, Smithfield broadened and strengthened its base through acquisitions that were immediately accretive to earnings. We are reshaping the company through integrating these acquisitions and executing a strategy to realign and rationalize our manufacturing capacities. o Through a 50/50 joint venture with Oaktree Capital Management, we acquired Sara Lee’s European Meats business. This is a strong, branded $1.5 billion business with large positions in France, Portugal, the Netherlands, and Germany. We have merged our Groupe Jean Caby assets with the acquired French operations, and the new company, Groupe Smithfield, is the largest packaged meats producer in Europe. o In acquiring the branded meats business of ConAgra Foods, Inc., we increased the volume of our core packaged meats operations in the United States by 20 percent. This is a $1 billion business with well-known brands such as Armour and Eckrich, with large shares in key product categories such as precooked bacon, smoked sausage, and dry sausage. o We acquired ConAgra’s Butterball turkey business through a 49-percent-owned joint venture with Maxwell Farms. The combination of Butterball and Carolina Turkeys, owned by the joint venture, was renamed Butterball, LLC, and is now the largest U.S. turkey producer, with sales of more than $1 billion. o A week after the closing of fiscal year 2007, we completed the acquisition of Premium Standard Farms, a vertically integrated provider of pork products. This enabled Smithfield to capitalize on our vertically integrated model and expand our share in hog production to 17 percent from 14 percent. The merger increased our share in pork processing to 31 percent from 26 percent. Europe represents significant potential for Smithfield, and we continue our focus on building a solid pan-European business. The Sara Lee European Meats acquisition has provided the vehicle to pursue broad, branded distribution in Western Europe. Simultaneously, our long-term strategy is to build vertically integrated and low-cost production in Eastern Europe. In Poland, we have become the largest hog producer and pork processor and will use vertical integration to expand the business. After years of investment, we have achieved solid profitability. In total, we plan to invest up to $1 billion in Romania by 2010 through company-owned and contract grower agreements to revitalize the pork industry and develop a fully-integrated business model and infrastructure. 2 This year, we successfully reopened a mothballed pork processing plant that we acquired, and we will continue to ramp up production there. Domestically, Smithfield continues to evaluate manufacturing operations to drive out significant costs and become a low-cost, highly efficient producer. We plan additional changes to realign capacity while we maintain our focus on utilizing our raw materials internally and eliminating low-margin business. Our strategy is to invest in new technology and processes to enable our packaged meats business to become a much stronger component of our profits. This year our commitment to corporate social responsibility remained an integral component of our business strategy. Consequently, Fortune prominently ranked Smithfield on its annual list of America’s Most Admired Companies for the fifth consecutive year and ranked our company first among beef and pork producers. USA Today recently listed the top-performing stocks over the past 25 years, and it was gratifying to see Smithfield listed as number 21, just behind Berkshire Hathaway, with a stock appreciation of 19,414 percent. As always, we thank our employees, customers, and suppliers for making this possible. Paul J. Fribourg, chairman, president, and chief executive officer of ContiGroup Companies, Inc., which owned 39 percent of Premium Standard Farms’ shares, has been elected a member of Smithfield’s board of directors. In addition, Michael J. Zimmerman, executive vice president and chief financial officer of ContiGroup, has been appointed an advisory director. They will be valuable additions to the board. Looking forward, in spite of the anticipated increase in grain costs, I am very optimistic about the future. Grain prices, as well as increases in freight and energy costs, are impacting our operations. However, we are focusing on realigning our product mix and directing our efforts in packaged meats toward our strong regional brands, as well as driving out inefficiencies. All of this bodes well for Smithfield Foods. C. Larry Pope President and Chief Executive Officer June 15, 2007 3 REAPING THE BENEFITS OF VERTICAL INTEGRATION Smithfield Foods embarked on a vertical integration strategy in 1987 but ramped up the effort significantly in 1999. Our participation in both hog production and pork processing has provided a steady supply of high-quality raw materials. It has also resulted in more consistent earnings and cash flow. operating profit in millions price per cwt $700 $60.00 $54.04 $600 $46.15 $500 $41.67 $480.9 $41.68 $330.0 $400 $300 $266.6 $211.4 $125.7 $213.1 $148.0 $50.00 $40.00 $32.94 $200 $100 $47.74 $178.1 $30.00 $166.8 $153.0 $228.0 $20.00 $0 $10.00 $-108.4 $-100 $-200 $0.00 FY2002 FY2003 FY2004 FY2005 FY2006 FY2007 Pork Processing Operating Profit Hog Production Operating Profit 4 Average Live Hog Market Price INCREASING OUR FOCUS ON CONVENIENCE PRODUCTS Although traditional products still account for most of our pork segment’s packaged meats volume, sales of higher- LBS MM 3,000 964.9 margin convenience items have grown significantly. 2,250 760.1 691.3 582.2 1,500 1,888.4 1,626.7 1,433.4 1,590.0 750 0 FY2004 FY2005 FY2006 FY2007 Pork Segment - Packaged Meats Volume Convenience Traditional Volume of traditional products increased by 455 million LBS MM 1000 pounds over the past three years, while volume of convenience 382.7 750 items grew by 383 million pounds over the same period. 500 455.0 177.9 250 109.1 193.3 156.6 0 FY2005 vs FY2004 FY2006 vs FY2004 FY2007 vs FY2004 Pork Segment - Packaged Meats Volume Growth Convenience Traditional This means that the volume of convenience products 30% has grown at a consistently higher rate than that of 24% traditional products. 18% 26.9 18.7 16.1 12% 10.9 10.0 6% 2.3 0 FY2005 vs FY2004 FY2006 vs FY2005 FY2007 vs FY2006 Pork Segment - Annual Volume Growth Rate [% Change] Traditional Convenience 5 PENETRATING U.S. REGIONAL PACKAGED MEATS MARKETS Bacon CENTRAL Lb. Share – 24% Rank #1 Distribution – 100% NORTHEAST Lb. Share – 13% Rank #2 Distribution – 96% SOUTH WEST Lb. Share – 23% Rank #1 Distribution – 99% Lb. Share – 10% Rank #4 Distribution – 83% Smoked Meats CENTRAL Lb. Share – 55% Rank #1 Distribution – 92% NORTHEAST Lb. Share – 54% Rank #1 Distribution – 88% SOUTH WEST Lb. Share – 32% Rank #1 Distribution – 96% Lb. Share – 55% Rank #1 Distribution – 96% Bacon Source: Nielsen Co. Avg acv 52 W/E 4/21/07 Smoked Meats Source: Fresh Look Marketing Avg distribution 52 W/E 4/29/07 6 SMITHFIELD UP CLOSE From the acquisition of several leading U.S. brands to our European expansion, we have continued to build upon the leadership position Smithfield Foods enjoys in many areas of our industry. In this section, we highlight our purchase of the Butterball turkey brand, our growing opportunities in packaged meats, our marketing partnership with celebrity cook Paula Deen, and other key developments of the past year. GROUPE SMITHFIELD JOINT VENTURE EUROPE’S LARGEST IN PACKAGED MEATS No stranger to the European market, Smithfield Foods upped the ante considerably this past year. Building on existing positions in France, Poland, and Romania, Smithfield teamed with Oaktree Capital Management to acquire Sara Lee’s European Meats business in August 2006. The 50/50 joint venture—Groupe Smithfield, S.L.—also includes Smithfield’s established Group Jean Caby subsidiary. With annual sales of $1.9 billion and 6,650 employees, Groupe Smithfield has emerged as Europe’s largest packaged meats company. Like other recent acquisitions made in the United States, the Groupe Smithfield deal has allowed Smithfield Foods to add more higher-margin, branded offerings to the company’s product mix. The acquired brands are among the best known in Western Europe, including France’s Aoste and Justin Bridou, The Netherlands’ Stegeman, and Portugal’s Nobre. A total of 25 plants produce dry sausage, dry ham, cooked ham, cooked sausage, and a long list of other products. From its new headquarters in Paris, the Groupe Smithfield team has been busy this past year integrating the company’s Jean Caby and Groupe Aoste French operations and optimizing their combined manufacturing platform. New products on the way include a broader variety of low-salt and low-fat meats under the Weight Watchers label. Finishing the year significantly ahead of its original sales plan, the company has increased its targets for 2008. ABOUT THIS PHOTO Walk into the Boucherie Duret Dupont in Paris, and it’s a good bet that Monsieur Dupont will have a large assortment of Aoste hams and other Aoste products on hand for customers who appreciate high-quality meats. The Aoste brand originated in France, but it is also Groupe Smithfield’s leading brand in Belgium and Germany. 9 RECENT ACQUISITIONS ADD STRENGTH TO U.S. PACKAGED MEATS OFFERINGS For supermarket shoppers in the Midwest, the Eckrich brand is nearly synonymous with smoked sausages and breakfast links. The market leader in nine states, its heritage dates back to 1894. It’s also one of the latest additions to Smithfield Foods’ rapidly growing packaged meats offerings. In October 2006, Smithfield acquired Eckrich as well as the Armour, Margherita, and LunchMakers brands from ConAgra Foods. Now operating under the banner of Armour-Eckrich Meats LLC, the Naperville, Illinois-based company boasts annual sales exceeding $1 billion. Precooked and other convenience items account for approximately 90 percent of sales. The acquisition supports Smithfield’s strategy of utilizing raw materials internally and migrating to higher-margin, furtherprocessed products. For example, Smithfield acquired the Cook’s ham business from ConAgra earlier in 2006. With annual sales of approximately $330 million, Cook’s produces traditional and spiralsliced smoked bone-in hams, corned beef, and other smoked meat items sold through supermarket chains and independent grocers. Armour-Eckrich Meats has added approximately 600 million pounds of packaged meats to Smithfield’s overall volume, with large market shares in hot dogs, dinner sausages, and luncheon meats. In fact, it contributed to a 20-percent increase in Smithfield’s packaged meats volume during fiscal 2007. Since the acquisition, Armour-Eckrich has focused on increasing distribution in existing markets and introducing a number of premium items. Among them, three new flavors of Eckrich Smoked Sausage—Chipotle, Chorizo, and Baja Blend—hit store shelves in July 2007. ABOUT THIS PHOTO Mothers want the best for their children, so it’s no surprise that they have made the Eckrich and Armour brands a popular supermarket selection for breakfast, a backyard barbecue, or the family dinner table. Armour-Eckrich Meats distributes these and other brands that stand for flavor, high quality, and value through the foodservice channel as well. 11 BUTTERBALL ACQUISITION CATAPULTS SMITHFIELD TO TOP POULTRY RANKS Mention Smithfield Foods, and it’s a good bet that the next words out of the average person’s mouth will be “ham” or “pork.” Smithfield is, indeed, the world’s largest pork processor. However, the company also owns 49 percent of Butterball, LLC, the No. 1 U.S. turkey producer and processor with annual sales exceeding $1 billion. Smithfield’s long-standing Carolina Turkeys joint venture with Maxwell Farms, Inc., acquired the celebrated Butterball brand in October 2006 from ConAgra Foods, and it adopted the Butterball name in the process. The acquisition has catapulted Smithfield to the top ranks of the poultry industry and added a national brand with more than a half century of brand equity to Smithfield’s packaged meats portfolio. It also complements the company’s strengths in pork and beef. Smithfield is the nation’s fifth-largest beef processor and, through another joint venture, the world’s largest cattle feeder. Beyond the whole birds that grace Thanksgiving dinners across the country, Butterball’s seven U.S. plants produce a broad range of retail, foodservice, and deli products for customers in 20 countries. The company sells cooked turkey breasts, turkey sausages, ground turkey, turkey bacon, and lunchmeat, to name just a few. The Butterball brand continued to widen its lead in the marketplace during the past year, helped in part by the 5-percent increase in sales of pre-packaged whole turkeys. The company also launched an All Natural line of cooked deli breasts and introduced several chicken varieties of Butterball lunchmeats. ABOUT THIS PHOTO 12 For more than 50 years, Butterball turkeys have been a staple of Thanksgiving dinners such as the one being enjoyed by this Florida family. Moreover, Butterball is the only national poultry brand to offer a complete line of premium turkey and chicken products for a variety of year-round meal occasions. A bit of trivia: The Butterball name was originally chosen to characterize a new breed of broad-breasted white-feather turkeys. NEW KINSTON PLANT PAVES THE WAY FOR PACKAGED MEATS EXPANSION Among Smithfield Foods’ current strategic goals, utilizing more raw materials internally and migrating to higher-margin, furtherprocessed products top the list. The company has been busy acquiring several leading packaged meats brands in the United States and Europe over the past year for just this purpose. At the same time, Smithfield has also been addressing capacity issues among core brands to pave the way for their continued growth. Nowhere is this more evident than in the new deli ham and sliced lunchmeat plant that The Smithfield Packing Company opened in Kinston, North Carolina, in 2006. The $100 million facility, dubbed “K2” to distinguish it from the company’s other processing operation across town, already produces 90 million pounds of packaged meats annually for the retail, foodservice, and deli channels. Products bearing the Smithfield and Gwaltney brands fill departing tractor-trailers, as do popular regional brands such as Lykes, Valleydale, and Esskay. With 238,000 square feet, K2 has the capacity to produce up to 130 million pounds each year to serve Smithfield Packing’s markets along the East Coast. Among its other benefits, K2 has allowed Smithfield Packing to close two other plants and manufacture their products far more efficiently. The most automated ham processing plant in the world, K2 has been built from the ground up to consume less water than traditional plants. It also employs the latest in food safety technology. For example, the Armor Inox Thermix™ system that cooks and chills the hams virtually eliminates the need for workers who monitor the process to touch products after raw meat is first stuffed into casings. ABOUT THIS PHOTO 14 Smithfield Packing Company’s K2 plant took 13 months to construct, and it employs approximately 300 people. Among them, Gritzel Morales is busy inspecting Smithfield Virginia Brand half hams before they undergo the pasteurization process. Built with a focus on enhanced food safety, K2 houses its seven slicing lines in separate halls with dedicated drainage and air handling systems. PAULA DEEN AND SMITHFIELD DEVELOP WAYS OF PROMOTING THE FAMILY MEAL Getting families to sit down to meals together on a regular basis can be challenging these days, but Smithfield Foods has enlisted a secret weapon on this front. Since September 2006, the company has teamed with celebrity cook Paula Deen in a partnership that includes community outreach efforts, personal appearances, Web-based recipe and meal-preparation tips, and new products. With her two shows on the Food Network, six cookbooks, and Cooking with Paula Deen magazine, food lovers across the country are familiar with the ubiquitous Deen and the Southern spell she casts on her dishes. A longtime user of Smithfield products, she hopes to make people feel more confident in selecting cuts of meat that take less time to prepare, are easy to make, and are wellbalanced for family members. Not surprisingly, studies by Iowa State University and other schools have found that the family meal offers clear benefits. Along with providing children with better nutrition, this time together allows parents to teach table manners, social skills, family values, a sense of community, and basic cooking skills. In July, Smithfield launched a national Cable TV ad campaign featuring Deen. The 30-second spots feature Deen telling consumers about all the wonderful, easy-to-fix recipes using Smithfield products that she has waiting for them at Smithfield.com. In the first four TV spots running this summer, Paula entices viewers with her delicious recipes for Smithfield Smoked Sausage, Marinated Pork Tenderloin, Deli Thin Sliced Tub Lunchmeat, and Naturally Hickory Smoked Bacon. ABOUT THIS PHOTO In her home kitchen in Savannah, Georgia, Paula Deen puts the finishing touches on a Smithfield spiralsliced half-ham. Her homemade glaze contains premium peanuts from The Peanut Shop of Williamsburg, part of The Smithfield Specialty Foods Group. In January 2007, this Smithfield subsidiary launched a line of sauces and seasonings under the Paula Deen brand. 17 SMITHFIELD’S CULINARY THINK TANK PUTS INNOVATION ON THE MENU How does a restaurant shave enough minutes off a dish’s preparation time to add it to the menu? Ask Certified Master Chef Michael Formichella. He was in his office at the Smithfield Innovation Group (SIG) when a call came in from a representative of Smithfield Foods’ national account team. One of its customers, a large chain of casual dining restaurants, had a problem: It wanted to serve a double-cut boneless pork loin chop wrapped in AppleWood Smoke bacon, but the kitchen staff couldn’t find a way to cook the dish quickly enough. Formichella dispatched a member of his team, who analyzed the restaurant’s preparation techniques and demonstrated a different way to sear the meat and hold it in the oven. That shaved six minutes off its prep time—a lifetime in the restaurant business—and the dish was added to the menu. For SIG, challenges like this add up to business as usual. Since its founding in 2003, this five-member culinary think tank has provided virtually all of Smithfield’s independent operating companies with solutions to specific customer needs as well as offering new product ideas. Formichella, whose lengthy resumé includes a stint as executive chef at a five-star restaurant, has been with SIG since its inception. He took over the reins in 2006. Among the past year’s successes, SIG helped the Smithfield Specialty Foods Group leverage its relationship with celebrity cook Paula Deen by developing a line of sauces and seasonings. Introduced in January 2007, Paula Deen Collection Sauces & Seasonings have been a big hit on the QVC home shopping network and among catalog shoppers. A line of Simply Southern heat-and-eat side dishes are on the way as well. ABOUT THIS PHOTO 18 Chef Michael Formichella puts the entrepreneurial talents of the Smithfield Innovation Group to work on a year-round basis for the Smithfield Foods family of companies. He frequently hits the road to present new dishes to retailers and restaurant chains and often hosts customers at the company’s test kitchen in Buffalo Grove, Illinois. CORPORATE SOCIAL RESPONSIBILITY TAKES MANY FORMS AT SMITHFIELD Thanks to Smithfield Foods’ John Morrell & Co. subsidiary, 25 needy high school seniors from Sioux Falls, South Dakota, have dually enrolled at a two-year school where they are pursuing their dreams of a post-secondary education. These students are the first to benefit from Learners to Leaders, a national educational alliance funded by the Smithfield-Luter Foundation. Made up of Smithfield’s independent operating companies and local education partners, Learners to Leaders wants to close the economic gap that keeps many high school students from obtaining further education. Participating students are typically the first generation in their families to continue beyond high school. Subsidiaries in Green Bay, Wisconsin, and Denison, Iowa, have since launched their own Learners to Leaders programs, with several more in the works. The Smithfield-Luter Foundation supports a number of other education programs as well, including the work of An Achievable Dream. This organization provides underprivileged children in the Newport News, Virginia, area (the student in the far right photo among them) with a solid education that prepares them for college. As sponsor of its 2006 high school graduating class, Smithfield has given more than 30 students each a merit scholarship worth $2,000 annually for four years of college. Smithfield has also made protecting the environment, ensuring worker safety, improving animal welfare, and other areas of corporate social responsibility a priority. For example, the company is helping fund the Ducks Unlimited Sound CARE initiative in North Carolina as part of the $2 million contributed annually for the state’s environmental enhancement grants. Begun in 2003, Sound CARE has conserved or restored some 10,000 acres of wetlands to date such as the Mattamuskeet National Wildlife Refuge (right). By joining the Chicago Climate Exchange (CCX) in February 2007, Smithfield has committed to cutting the company’s greenhouse gas emissions in the United States by a minimum of 6 percent by 2010. 20 OUR ORGANIZATIONAL STRUCTURE SMITHFIELD FOODS, INC. Pork Smithfield Packing Company, Inc. The Smithfield Specialty Foods Group John Morrell & Co. Armour-Eckrich Meats LLC Curly’s Foods, Inc. Cumberland Gap Provision Farmland Foods, Inc. Cook’s Hams, Inc. Patrick Cudahy, Inc. North Side Foods Stefano Foods, Inc. Smithfield RMH Foods, LLC Smithfield Innovation Group Beef Smithfield Beef Group Five Rivers Ranch Cattle Feeding LLC1 International Europe Animex (Poland) Groupe Smithfield, S.L. (Europe)1 Smithfield PROD (Romania) Smithfield Foods, Ltd. (U.K.) Campofrio (Spain)2 Other Maverick Food Co. Ltd. (China)1 Norson (Mexico)1 Hog Production Murphy-Brown, LLC Other Butterball, LLC1 1 Joint venture 2 Smithfield Foods owns a 23% stake. OUR FAMILY OF COMPANIES A series of successful acquisitions completed largely over the past decade have transformed Smithfield Foods into a global food company with annual revenue approaching $12 billion. Here is a breakdown of our fiscal 2007 sales by operating segment: Pork (59%), Beef (19%), Hog Production (14%), International (7%), and Other (1%). Our operating companies and joint ventures maintain their individual identities, but together they make Smithfield Foods a leader in several key categories. The following pages provide snapshots of these companies, including selected brands and markets as well as highlights from the latest fiscal year. Founded in 1936 by Joseph W. Luter and his son, Joseph W. Luter, Jr., The Smithfield Packing Company today enjoys annual sales of more than $2.5 billion. Smithfield Packing’s primary lines of business include fresh pork, smoked meats, bacon, cooked hams, and hot dogs for HEADQUARTERS: Smithfield, VA PRESIDENT: Joseph W. Luter, IV retail, foodservice, and deli channels. The company exports products to more than 30 countries. In addition to the Smithfield brand, its Gwaltney, Esskay, and Valleydale products EMPLOYEES: 12,000 are among the leaders in their respective markets. The Smithfield Specialty Foods Group is home of the Genuine Smithfield Ham, The Peanut Shop of Williamsburg, and other gourmet offerings. SUBSIDIARIES i Smithfield Specialty Foods Group (see profile on pg. 35) MAJOR BRANDS i Smithfield i Smithfield Tender N Easy i Smithfield Self Basting i Gwaltney i Great i Esskay i United States i South Korea i Russia i Japan i Mexico i European Union i China i Canada MAJOR MARKETS 24 www.smithfield.com PROCESSING FACILITIES i Smithfield, VA Fresh pork, bacon, sausage i Kinston, NC Smoked hams, water-cooked hams i Landover, MD Smoked hams i Elon, NC i Wilson, NC Dry-cured hams Bacon i Portsmouth, VA i Tar Heel, NC Franks, lunchmeat Fresh pork i Plant City, FL Smoked hams, franks FISCAL 2007 HIGHLIGHTS F i Forged a marketing partnership with Paula Deen that has i Opened the most modern, efficient cooked-ham plant in generated increased consumer awareness of the Smithfield the United States in Kinston, North Carolina, positioning brand and substantial interest among trade partners Smithfield as a leading provider of sliced and whole deli ham and turkey products for retail and foodservice i Expanded retail distribution level of Smithfield bacon in channels core Eastern U.S. markets from 69 percent to 80 percent, according to ACNielsen i Increased sales of Gwaltney-branded hot dogs by 3 percent over the previous year, securing Gwaltney’s position as the i Experienced double-digit increases in deli and foodservice No. 1 brand of retail hot dogs in its core marketing area sales; precooked bacon volume jumped by more than 200 percent with launch of new capacity i Developed solid export business in European Union with other Smithfield subsidiaries as well as external customers and the No. 4 brand of hot dogs in the United States i Introduced the One Step Closer™ line of marinated stuffed pork in response to consumer demand for great-tasting, easy-to-prepare meals i Installed CO2 stunning at its plants in Smithfield, Virginia, and Tar Heel, North Carolina 25 OUR FAMILY OF COMPANIES John Morrell & Co. was founded in England in 1827 and is the oldest continuously operating meat manufacturer in the United States. It enjoys annual sales of approximately $2 billion. Serving the retail, foodservice, and deli channels, John Morrell & Co.’s primary product lines include smoked sausages, hot dogs, natural smoked hams, bacon, deli meats, corned beef, and fresh pork products. The company sells products under the flagship John Morrell brand and HEADQUARTERS: Cincinnati, OH PRESIDENT: Joseph B. Sebring EMPLOYEES: 6,700 more than a half-dozen others. Its celebrated Kretschmar brand offers a full line of Germanstyle favorites for the service deli, including hams, turkey, cooked beef, sticks, and loaves. John Morrell & Co. is also one of the nation’s largest producers of private-label packaged meats. SUBSIDIARIES i Armour-Eckrich Meats LLC (see profile on pg. 28) i Mohawk Packing i Cumberland Gap Provision i Henry’s Hickory House (see profile on pg. 29) i Curly’s Foods Inc. (see profile on pg. 29) MAJOR BRANDS i John Morrell i Mosey’s Corned Beef i EZ Cut Hams i Kretschmar Deli i Rath Blackhawk i Hunter i Midwest U.S. i Northwest U.S. i Eastern Asia i Northeast U.S. i Southwest U.S. MAJOR MARKETS 26 www.johnmorrell.com PROCESSING FACILITIES i Sioux Falls, SD Fresh pork, sausages, smoked meats i Sioux City, IA Fresh pork i Great Bend, KS i Cincinnati, OH Fresh pork, smoked meats Hot dogs, sausages, lunchmeats i San Jose, CA Corned beef, smoked meats FISCAL 2007 HIGHLIGHTS S i Restaged John Morrell brand with new logo and package i Gained more than 800 distribution points as a result of graphics, a new advertising and promotional campaign, and new retail offerings NFL quarterback Carson Palmer as brand spokesperson i Rolled out 13 cheeses for the service deli channel under i Introduced several new retail products, including ham the Kretschmar brand and poultry cuts in resealable packages, cocktail smokies, resealable tub bacon, Bavarian branded boneless hams, quarter spiral bone-in hams, deli party trays, and cocktail party trays i Launched Applewood naturally smoked bacon for foodservice customers i Grew to the No. 1 brand of ham cuts in the United States and the No. 2 brand of cocktail links 27 OUR FAMILY OF COMPANIES www.armour-eckrich.com Armour-Eckrich Meats LLC enjoys annual sales exceeding $1 billion, 90 percent from precooked and other convenience items for the retail, deli, and foodservice channels. Anchored by the venerable Eckrich and Armour brands, the company’s primary product lines include dry and smoked sausage, lunchmeat, precooked bacon, hot dogs, portable lunches, and deli products. Eckrich brand sausage is ranked No. 1 in sales in nine U.S. markets, with Armour a HEADQUARTERS: Naperville, IL PRESIDENT: Michael E. Brown EMPLOYEES: 3,600 leading value brand in hot dogs. LunchMakers is the No. 2 portable lunch brand nationally. MAJOR BRANDS i Eckrich i Armour i Margherita i Texas i Northeast U.S. i St. Charles, IL i Peru, IN i Mason City, IA i Hastings, NE i Omaha, NE i Junction City, KS i St. James, MN i Lufkin, TX MAJOR MARKETS i Central U.S. PROCESSING FACILITIES FISCAL 2007 HIGHLIGHTS i Developed Armour Sizzle & Serve frozen breakfast links and patties i Prepared three new Eckrich smoked sausage flavors for summer 2007 launch: Chipotle, Chorizo, and Baja Blend i Restaged Eckrich Ready Crisp precooked bacon with upgraded product quality and improved packaging 28 i Launched Eckrich Fried Favorites, among the industry’s first line of fried meat items for the deli case i Upgraded the package graphics for Armour meatballs and began work on a similar initiative for Armour hot dogs i Created dedicated sales, marketing, operations, logistics, and finance teams following 2006 acquisition by Smithfield HEADQUARTERS: Edina, MN www.curlys.com www.cumberlandgapprovision.com HEADQUARTERS: Middlesboro, KY PRESIDENT: John Pauley PRESIDENT: R.D. McGregor EMPLOYEES: 700 EMPLOYEES: 325 Established in 1988, Curly’s Foods, Inc. supplies leading Cumberland Gap, the first great gateway to the West, is also restaurant chains with raw and fully cooked ribs as well home to great-tasting hams, sausages, and other specialty as smoked pork, beef, and chicken entrees. The company’s packaged meats smoked using 100-percent genuine hickory retail offerings can be found at many club stores and wood. Founded in 1979, the company makes the best-selling supermarkets. At its plant in Sioux City, Iowa, an authentic semi-boneless ham in the United States. It serves some of the pit smoker gives Curly’s meats genuine, wood-smoked nation’s largest supermarket chains with branded products barbecue flavor. and a substantial private-label business. MAJOR BRANDS MAJOR BRANDS i Curly’s Foods i Cumberland Gap MAJOR MARKETS MAJOR MARKETS i United States i Taiwan i Mexico i Colombia i Olde Kentucky i United States FISCAL 2007 HIGHLIGHTS FISCAL 2007 HIGHLIGHTS i Revenue increased 17 percent due mainly to growth in i Sales rose by 6 percent due to success of semi-boneless retail sales and in the cooked beef foodservice category i Introduced cooked carnitas and prime rib for foodservice customers and cold-smoked ribs for retailers ham and increased private-label business i Successfully completed transition to new order-entry and billing system 29 Farmland Foods, Inc., derives the majority of its more than $2.2 billion in annual sales from a broad selection of pork products for retail and foodservice customers. Its primary lines of business include fresh pork, case-ready pork, hams, bacon, fresh sausage, cooked sausage, lunchmeat, dry sausage, and specialty sausage. Since its founding in 1959, Farmland Foods has PRESIDENT: George Richter maintained a proud heritage of working side by side with American farm families. Smithfield EMPLOYEES: 6,500 Foods acquired the company in 2003. Farmland Foods has a large and growing international business, exporting products to more than 60 countries across six continents. Its Carando Foods subsidiary is one of the largest suppliers of Italian deli and specialty meats in the United States. SUBSIDIARIES i Carando Foods i Cook’s Hams, Inc. (see profile on pg. 32) MAJOR BRANDS i Farmland i Carando i Cook’s MAJOR MARKETS S S i United States i China i Canada i Japan i Europe i Taiwan i Mexico i South Korea i Australia i Russia 30 HEADQUARTERS: Kansas City, MO www.farmlandfoods.com www.carando.com PROCESSING FACILITIES i Crete, NE Fresh pork, hams, bacon, sausage i Denison, IA Fresh pork, hams, bacon i Monmouth, IL Fresh pork, hams, bacon i Wichita, KS i New Riegel, OH Smoked sausage, hot dogs, lunchmeat i Carroll, IA Bone-in hams, spiral hams i Salt Lake City, UT Cook-in-bag products Case-ready fresh pork i Springfield, MA Dry sausage and specialty sausage FISCAL 2007 HIGHLIGHTS i Worked with Murphy-Brown to develop a new herd of vegetarian-fed, antibiotic-free animals for Farmland Simply Natural brand i Moved corporate office to a new location with state-of-theart R&D and test kitchen facilities GI i Brought new CO2 stunning facility online in Denison, Iowa, i Launched 15 Farmland Simply Natural and 13 Farmland improving animal welfare and enhancing pork quality All Natural products in January 2007 i Received European Union certification to begin exporting i Secured a contract as the exclusive supplier of pork to products from Crete, Nebraska, plant Sodexho, with annual volume estimated at 36 million pounds i Exceeded third-year objectives as part of a six-year plan to utilize all hams and bellies internally i Opened new distribution center in Crete, Nebraska, in July 2007 i Continued work on modernizing manufacturing facilities across the company 31 OUR FAMILY OF COMPANIES www.CooksHam.com HEADQUARTERS: Lincoln, NE HEADQUARTERS: Arnold, PA GENERAL MANAGER: Mark Meiners PRESIDENT: Robert G. Hofmann, II EMPLOYEES: 1,300 EMPLOYEES: 325 The acquisition of Cook’s Hams, Inc., in 2006 brought North Side Foods has been making great-tasting meats for another producer of high-quality packaged meats under the nearly a century. Today, the company’s plants in Arnold, Smithfield umbrella. Cook’s offers traditional and spiral Pennsylvania, and Cumming, Georgia, specialize in sliced bone-in hams, other smoked meats, and corned beef precooked pork and turkey sausage patties, links, and primarily for supermarket chains and independent grocers. crumbles for the foodservice industry. The first provider of The company operates plants in Lincoln, Nebraska; Martin fully cooked sausage to McDonald’s Corporation, North Side City, Missouri; and Grayson, Kentucky. Foods remains one of its major suppliers. MAJOR BRANDS MAJOR BRANDS i Cook’s i Ember Farms MAJOR MARKETS MAR MAJOR MARKETS i United States i Canada i Mexico i Eastern U.S. i Midwest/Western U.S. i Canada FISCAL 2007 HIGHLIGHTS FISCAL 2007 HIGHLIGHTS i Launched exact-weight boneless ham items and i Completed plant expansion in Georgia, increasing the quartered spiral-sliced ham i Increased market share of value-added ham products by broadening retail customer base 32 www.emberfarms.com company’s production capacity by 33 percent i Broadened market reach into Canada with the addition of a major quick-serve account www.stefanofoods.com HEADQUARTERS: Charlotte, NC www.rmhfoods.com HEADQUARTERS: Morton, IL PRESIDENT: Enrico Piraino PRESIDENT: Jonathan Rocke EMPLOYEES: 95 EMPLOYEES: 120 From its roots as an Italian delicatessen and pizzeria, Smithfield/RMH Foods Group produces more than 150 Stefano Foods today produces ready-to-eat and ready-to-cook varieties of fully cooked beef, pork, and chicken entrees at entrees, appetizers, and snacks at its two plants in its two plants in Morton, Illinois. The company provides Charlotte, North Carolina. The company’s pizzas, calzones, branded and private-label offerings for retail customers and panini, and other convenience items are a popular choice also serves the deli and foodservice channels. With roots in the deli section of grocery stores. Its products are also dating back to 1937, RMH has long specialized in high- sold through foodservice and fundraising channels. quality, value-added meat products. MAJOR BRANDS MAJOR BRANDS i Stefano’s i Rip-n-Dip i Party Dipper MAJOR MARKETS MAR i United States i Smithfield i Quick-N-Easy i Flavoré MAJOR MARKETS i Canada i Mexico i United States FISCAL 2007 HIGHLIGHTS FISCAL 2007 HIGHLIGHTS i Increased sales by more than 45 percent, with i Enjoyed 17-percent sales growth driven in part by the retail and fundraising providing the greatest gains i Tripled grilled panini sales, mostly through the retail channel Quick-N-Easy brand’s expansion into club stores i Launched a three-item heat-and-serve appetizer tray under the Smithfield and Quick-N-Easy brands 33 OUR FAMILY OF COMPANIES www.patrickcudahy.com www.814americas.com Founded in 1888 in Milwaukee, Wisconsin, Patrick Cudahy specializes in high-quality, branded packaged meats for the foodservice, deli, and retail channels. Primary lines of business include precooked and traditional bacon, dry sausage, ham, and sliced meats. Patrick Cudahy is among the top three U.S. producers of precooked bacon. The company has long been identified with Sweet Apple-Wood Smoke Flavor®, one of its most popular bacon varieties. In 2005, Patrick HEADQUARTERS: Cudahy, WI PRESIDENT: William G. Otis EMPLOYEES: 2,300 Cudahy purchased 814 Americas as part of its expansion into the fast-growing Hispanic market. MAJOR BRANDS i Patrick Cudahy i Realean i Higüeral i El Miño i La Abuelita i Riojano i Pavone i Canada i Caribbean i Japan MAJOR MARKETS i United States i Mexico P PROCESSING FACILITIES i Cudahy, WI i Sioux Center, IA i Elizabeth, NJ FISCAL 2007 HIGHLIGHTS i Enjoyed 10-percent volume growth for premium dry sausage and specialty Italian deli products i Increased volume and revenue by 15 percent in the i Expanded capacity for precooked bacon in Sioux Center, Iowa, to support rapid category growth i Focused on improving productivity across all operations to Hispanic foods segment; expanded distribution and product keep core Patrick Cudahy business competitive; improved introductions drove strong performance across all brands at line efficiencies by 20 percent 814 Americas 34 S HEADQUARTERS: Buffalo Grove, IL www.smithfieldinnovationgroup.com SENIOR VP & COO: Michael Formichella CMC www.thepeanutshop.com www.smithfieldhams.com www.smithfieldcollection.com EMPLOYEES: 5 HEADQUARTERS: Toano, VA VP & GENERAL MANAGER: Wm. W. “Pete” Booker, III EMPLOYEES: 30 Founded in 2003, the Smithfield Innovation Group is a The Smithfield Specialty Foods Group is the gourmet products culinary think tank that develops new food product ideas division of Smithfield Foods. Home of The Peanut Shop of for the Smithfield Foods family of companies. Chef Michael Williamsburg and Genuine Smithfield Ham, it sells dozens Formichella and his team capitalize on emerging trends of high-quality nuts, meats, desserts, and dressings. These in foodservice, retail, and deli. As a result, they create products are popular choices for gifts and incentives, and they solutions that set Smithfield companies apart from the are available through the company’s catalogs, Web sites, and competition and address unique customer needs. four retail locations in Virginia, Georgia, and South Carolina. KEY CAPABILITIES MAJOR BRANDS i Developing original, cost-effective menu solutions i The Peanut Shop of Williamsburg i Paula Deen Collection i Providing culinary expertise specific to each customer’s needs i Genuine Smithfield Ham i Basse’s Choice i Assessing the operational needs of foodservice operators as they MAJOR MARKETS relate to time, space, and labor i United States FISCAL 2007 HIGHLIGHTS FISCAL 2007 HIGHLIGHTS i Created marinated meats and 40-ounce dinner kits for i Posted double-digit sales growth, in part through club stores as well as rubbed loins for grocery stores i Developed 10 Paula Deen sauces for QVC and specialty stores and stuffed beef filets for a large retailer broader catalog distribution and strategic partnerships i Introduced Paula Deen Collection Sauces & Seasonings through The Peanut Shop of Williamsburg 35 OUR FAMILY OF COMPANIES The fifth-largest beef processor in the United States, the Smithfield Beef Group specializes in highquality USDA Prime and Choice beef. It processes more than 2 million head of cattle each year for annual sales exceeding $2.5 billion. Smithfield Beef Group provides fresh beef in sub-primal and case-ready packaging for both the retail and foodservice industries. Specialty brands include Cedar River Farms Natural, which comes from cattle raised without the use of growth-promoting HEADQUARTERS: Green Bay, WI PRESIDENT: Richard V. Vesta EMPLOYEES: 5,600 hormones. In addition to a strong domestic base of customers, Smithfield Beef Group exports to more than 20 countries. The Smithfield Beef Group was created following Smithfield Foods’ 2001 acquisitions of Packerland Holdings and Moyer Packing Company. SUBSIDIARIES i Packerland Packing Company, Inc. i Sun Land Beef Company i Packerland Transport, Inc. i Packerland–Plainwell, Inc. i Moyer Packing Company i Cattle Production Systems, Inc. i Smithfield i Aberdeen Farms Black Angus i Packerland i Cedar River Farms Natural i Showcase Foods MAJOR BRANDS MAJOR MARKETS i United States i Japan 36 i Mexico i Canada www.sfbeef.com PROCESSING FACILITIES i Green Bay, WI Sub-primal cuts, ground beef chubs i Plainwell, MI i Souderton, PA Sub-primal cuts, ground beef chubs, Sub-primal cuts, ground beef chubs, case-ready ground beef case-ready ground beef, patties i Tolleson, AZ Sub-primal cuts FISCAL 2007 HIGHLIGHTS S i Increased volumes by 11 percent on a year-over-year basis i Returned beef processing to profitability in spite of due to growth in foodservice and retail customer base i Re-entered Japanese and Korean markets successfully following end of ban on U.S. beef i Launched the Aberdeen Farms Black Angus brand successfully i Expanded high energy fed Holstein capabilities through additional strategic alliances with calf feeders challenging industry conditions i Repositioned all processing facilities under the Smithfield Beef Group banner i Increased efficiencies at the Tolleson, Arizona, facility through major reconfiguration of the harvest area i Established a strategic alliance to be the exclusive producer of Premium Gold Angus Beef 37 OUR FAMILY OF COMPANIES www.fiveriverscattle.com HEADQUARTERS: Loveland, CO Formed in 2005, Five Rivers Ranch Cattle Feeding LLC is an independently operated joint venture between the cattle feeding businesses of ContiGroup Companies, Inc., and Smithfield Foods, Inc. Five Rivers, the world’s largest cattle feeder, has a combined feeding capacity of PRESIDENT & CEO: Mike Thoren more than 800,000 head of cattle. It has 10 locations in Colorado, Idaho, Kansas, Oklahoma, and Texas. From one-load and hobby cattle feeders to large-scale beef processors, Five Rivers EMPLOYEES: 575 provides exceptional service to a variety of cattle-feeding customers. COLORADO i Colorado Beef i Gilcrest Feedlot i Kuner Feedlot i Hartley Feeders i XIT Feeders i Yuma Feedlot IDAHO i Interstate Feedlot KANSAS i Grant County Feeders OKLAHOMA i Cimarron Feeders TEXAS DS i Coronado Feeders FISCAL 2007 HIGHLIGHTS i Instituted an aggressive management recruitment and development program i Dedicated substantial capital to ensuring sustainable environmental compliance at multiple locations 38 i Completed several significant capital improvements focused on improving energy and milling efficiencies i Provided existing and new customers with cattle for valueadded and branded beef programs www.murphybrownllc.com Murphy-Brown, LLC, is the world’s largest hog producer and a key part of Smithfield Foods’ vertical integration strategy. The company was established in 2001 following the acquisitions of Brown’s of Carolina, Carroll’s Foods, Murphy Family Farms, and Circle Four Farms. MurphyBrown owns approximately 1 million sows, with 85 percent based in the United States. Its U.S. operations bring nearly 13 million hogs to market annually. Murphy-Brown International HEADQUARTERS: Warsaw, NC PRESIDENT: Jerry Godwin EMPLOYEES: 5,700 produces more than 2 million additional hogs each year. The company’s Smithfield Premium Genetics subsidiary is charged with improving swine genetics throughout the organization. MURPHY-BROWN EAST 250 company-owned farms and approximately 1,200 contract producer farms i North Carolina i Pennsylvania MURPHY-BROWN WEST 50 company-owned farms and approximately 500 contract producer farms iCiColoradoIllinois i i Iowa Missouri i Oklahoma South Dakota i Texas Utah i Missouri Oklahoma i South Texas Dakota i Utah Illinois i Illinois Iowa i South Carolina i Virginia MURPHY-BROWN MAJOR BRANDS INTERNATIONAL i Mexico: Norson i Poland: Agri Plus i Mexico: Granjas Carroll de Mexico (GCM) i Romania: Smithfield Ferme FISCAL 2007 HIGHLIGHTS i Expanded farming operations in Mexico and began increasing Circle Four Farms sow herd in Utah i Continued dramatic growth in Europe, expanding farms i Established team to manage transition of sows from individual gestation crates to group housing i Partnered with North Carolina energy provider to promote in Poland and Romania by 16,000 and 24,000 sows, legislation that would offer incentives to hog farms that respectively produce electricity from renewable sources i Completed construction of a feed mill in Romania and began construction of a second i Completed implementation of Animal Welfare Management System at Murphy-Brown West 39 Butterball, LLC, is the largest U.S. turkey producer, with annual sales exceeding $1.2 billion. Smithfield Foods owns 49 percent of the company, a joint venture with Maxwell Farms, Inc., of Goldsboro, North Carolina. Formerly Carolina Turkeys, the company adopted the Butterball name in acquiring the brand in October 2006. The celebrated Butterball name is the most widely recognized brand in the turkey industry and carries more than a half-century of brand equity. HEADQUARTERS: Mount Olive, NC CEO: Keith Shoemaker EMPLOYEES: 5,700 Primary lines of business include whole turkeys and parts, cooked turkey breasts, turkey sausages, ground turkey, lunchmeat and fresh tray pack, bone-in and boneless turkey. Available through retail, deli, and foodservice channels, Butterball products are sold in 20 countries. MAJOR BRANDS i Butterball i Carolina Turkey MAJOR MARKETS 40 i United States i Costa Rica i The Bahamas i Mexico i Panama i Dominican Republic i China i Guatemala i Russia i Bermuda i Puerto Rico www.butterball.com PROCESSING FACILITIES i Mount Olive, NC Cooked deli breasts, pre-packaged fresh tray i Carthage, MO i Longmont, CO Pre-packaged fresh tray pack turkey, raw bulk turkey Pre-packaged sliced turkey, cooked deli pack turkey, ready-to-eat frozen breasts, turkey medallions, pre-packaged frozen turkey breasts, raw turkey breasts breasts, raw meats, hot dogs i Jonesboro, AR i Huntsville, AR Cooked deli breasts Pre-packaged fresh, frozen, and cooked i Kinston, NC Sliced turkey products (bulk and pre-packaged) i Ozark, AR whole turkeys, pre-packaged bone-in tray Pre-packaged fresh and frozen whole turkeys pack turkey products FISCAL 2007 HIGHLIGHTS S i Increased sales of Butterball pre-packaged whole turkeys i Broadened foodservice national account distribution with by 5 percent i Widened market-leading Butterball brand share while category sales declined 3 percent i Introduced All Natural line of cooked deli breasts addition of several national restaurant chains i Began selling turkey medallions to a major food manufacturer for a new line of consumer branded products i Realized double-digit international value-added sales by introducing branded items into five new markets i Expanded distribution of Butterball lunchmeats with introduction of chicken varieties i Enhanced U.S. deli distribution with addition of several major grocery retailers 41 OUR FAMILY OF COMPANIES HEADQUARTERS: Paris, France Groupe Smithfield is the home of Aoste, Jean Caby, Stegeman, Nobre, and many of Western Europe’s other most popular branded packaged meats. Its annual sales total $1.9 billion. Smithfield Foods owns 50 percent of this joint venture with Oaktree Capital Management, LLC. The company was formed in 2006 through the combination of Smithfield’s Groupe Jean Caby subsidiary and the former Sara Lee European Meats business. Primary PRESIDENT: Robert A. Sharpe II EMPLOYEES: 6,650 product lines include dry sausage, dry ham, cooked ham, cooked sausage, poultry, pâté, hot dogs, and ready-to-eat meals. Groupe Smithfield serves Europe’s modern and traditional retail trade as well as a large and growing number of foodservice customers. SUBSIDIARIES i Nobre i Groupe Aoste i Imperial i Stegeman i Aoste SB Germany MAJOR BRANDS i Aoste i Stegeman i Cochonou i Marcassou i Justin Bridou i Nobre i Jean Caby MAJOR MARKETS 42 i France i Luxembourg i Belgium i Portugal i The Netherlands i Germany i U.K. www.aoste.de www.imperial.be www.nobre.pt PROCESSING FACILITIES i Portugal Cooked ham, dry ham, sausage, salami, i Belgium Cooked ham, dry ham ready meals i France i The Netherlands Cooked ham, dry ham Dry ham, dry sausage, cooked ham, cocktail sausage FISCAL 2007 HIGHLIGHTS S i Finished the year significantly ahead of plan, leading to i Launched initiative to reposition Jean Caby and Aoste increased sales targets for fiscal 2008 i Reaped operational efficiencies through the merger of Jean Caby and Aoste in France i Struck an agreement with McDonald’s for the production of a salad i Agreed with Weight Watchers to increase product range products for the high end of the private-label market i Developed plan to improve margins by optimizing the manufacturing platform for the French companies i Increased budget for marketing and advertising by 35 percent to revamp brands and develop new products i Began producing sandwiches for a top-quality bakery chain of new low-fat and low-salt varieties from 12 to 20 43 OUR FAMILY OF COMPANIES www.animex.pl Animex is Poland’s largest producer of fresh and packaged meats and home of the prized Krakus ham. With annual sales of approximately $775 million, its primary lines of business include fresh pork, beef, and poultry as well as smoked and cooked hams, sausages, hot dogs, bacon, canned meats, and pâtés. Animex products are available in more than 50 countries at retail and through foodservice channels. Smithfield Foods acquired a controlling stake in the HEADQUARTERS: Warsaw, Poland PRESIDENT: Darek Nowakowski EMPLOYEES: 8,750 company in 1999. MAJOR BRANDS i Krakus i Morliny i Mazury i Poland i European Union i Japan i United States i South Korea i Yano MAJOR MARKETS PROCESSING FACILITIES i Szczecin i Morliny i Opole i Ilawa i Zamosc i Elk i Starachowice i Debica i Suwalki i Grodkow i Krakow FISCAL 2007 HIGHLIGHTS i Introduced the Yano brand in Poland with cooked hams, i Began selling fresh pork to the Japanese market sausages, hot dogs, and other value-priced products i Enjoyed 45-percent U.K. volume growth, mainly through i Increased export volumes by 30 percent, largely due to increased sales in the European Union and Far East 44 new line of convenience poultry products and introduction of packaged meats in Tesco stores www.smithfieldfoods.ro Smithfield Foods entered the Romanian meat products market in 2004 by acquiring Agrotorvis. Smithfield PROD’s annual sales have since grown to more than $60 million. Romania’s European Union accession in 2007 positions the company to play a key role in Smithfield’s expansion strategy on the continent. Its primary product line is fresh pork, principally for retail customers. Smithfield PROD also owns a 50-percent stake in food distributor Agroalim and cold storage HEADQUARTERS: Timisoara, Romania PRESIDENT & CEO: Morten Jensen EMPLOYEES: 430 warehouse company Frigorifer. MAJOR BRANDS i Comtim MAJOR MARKETS i Romania PROCESSING FACILITIES i Timisoara i Tulcea FISCAL 2007 HIGHLIGHTS S i Opened refurbished pork processing plant in Timisoara i Built state-of-the-art rendering and wastewater treatment facilities for Timisoara plant i Doubled sales of fresh pork due largely to expansion of Smithfield Ferme hog production operations i Invested in Frigorifer vegetable packing plant, funded in part by the European Union i Began distribution of fresh pork cuts to retail trade i Invested in Frigorifer warehouse expansion F 45 FINANCIAL SUMMARY Fiscal Years (dollars and shares in millions, except per share data) 2007 2006 2005 $ 11,911.1 $ 11,403.6 $ 11,248.4 OPERATIONS Sales 1,134.8 1,092.3 1,212.3 Selling, general, and administrative expenses 745.6 673.8 643.6 Interest expense 175.4 148.6 132.2 188.4 185.2 300.7 166.8 172.7 296.2 $ 1.68 $ 1.65 $ 2.68 Gross profit Income from continuing operations Net income (1) (1) PER DILUTED SHARE Income from continuing operations (1) (1) 1.49 1.54 2.64 Book value 20.03 18.11 16.93 Weighted average shares outstanding 111.9 112.0 112.3 $ 1,372.5 $ 1,161.3 $ 1,421.2 6,968.6 6,177.3 5,773.6 3,092.9 2,558.3 2,274.7 2,240.8 2,028.2 1,901.4 2.01 1.88 2.30 58.0% 55.8% 54.5% $ 477.7 $ 381.6 $ 193.2 Depreciation expense 219.3 200.1 187.0 Common shareholders of record 1,128 1,196 1,269 53,100 52,500 51,290 Net income FINANCIAL POSITION Working capital Total assets Total debt (2) Shareholders’ equity FINANCIAL RATIOS Current ratio Total debt to total capitalization (3) OTHER INFORMATION Capital expenditures, net of proceeds Number of employees (1) Fiscal 2001 income from continuing operations and net income include a gain of $45.2 million, or $.41 per diluted share, from the sale of IBP, inc. common stock, net of related expenses. (2) Total debt is equal to notes payable and long-term debt and capital lease obligations including current portion. (3) Computed using total debt divided by total debt and shareholders’ equity. 46 2004 2003 2002 2001 2000 1999 1998 $ 9,178.2 $ 7,075.3 $ 6,554.4 $ 5,123.7 $ 4,511.0 $ 3,550.0 $ 3,867.4 933.6 603.9 873.4 762.3 529.3 448.6 347.9 559.4 487.9 491.5 416.2 353.7 280.4 222.4 118.5 85.5 87.1 81.5 67.5 38.4 31.9 167.9 14.8 193.0 214.3 68.0 89.6 53.4 227.1 26.3 196.9 223.5 75.1 94.9 53.4 $ 1.50 $ .14 $ 1.75 $ 1.95 $ .69 $ 1.09 $ .67 2.03 .24 1.78 2.03 .76 1.16 .67 14.31 11.83 12.41 10.05 8.21 6.47 4.83 111.7 109.8 110.4 110.1 98.8 81.9 79.5 $ 1,059.9 $ 939.9 $ 917.1 $ 635.4 $ 609.9 $ 215.9 $ 259.2 4,828.1 4,244.4 3,907.1 3,250.9 3,129.6 1,771.6 1,083.6 1,787.0 1,642.3 1,391.7 1,188.7 1,219.8 610.3 415.8 1,598.9 1,299.2 1,362.8 1,053.1 902.9 542.2 361.0 2.05 1.90 2.06 2.01 1.98 1.46 2.03 52.8% 55.8% 50.5% 53.0% 57.5% 53.0% 53.5% $ 133.5 $ 166.0 $ 136.5 $ 108.0 $ 87.1 $ 91.2 $ 91.7 165.2 148.3 124.9 114.5 101.0 59.3 42.3 1,332 1,195 1,390 1,345 1,514 1,230 1,143 46,400 44,100 41,000 34,000 36,500 33,000 19,700 47 CONSOLIDATED CONDENSED STATEMENTS OF INCOME Fiscal Years (in millions, except per share data) Sales Cost of sales Gross profit Selling, general and administrative expenses Interest expense Equity in income of affiliates Income from continuing operations before income taxes Income taxes Income from continuing operations Loss from discontinued operations Net income Income from continuing operations per diluted common share Net income per diluted common share 2007 2006 2005 $ 11,911.1 10,776.3 $ 11,403.6 10,311.3 $ 11,248.4 10,036.1 1,134.8 1,092.3 1,212.3 745.6 175.4 (38.9) 673.8 148.6 (9.2) 643.6 132.2 (17.5) 252.7 279.1 454.0 64.3 93.9 153.3 188.4 185.2 300.7 (21.6) (12.5) (4.5) $ 166.8 $ 172.7 $ 296.2 $ 1.68 $ 1.49 $ 1.65 $ 1.54 $ 2.68 $ 2.64 CONSOLIDATED CONDENSED BALANCE SHEETS Fiscal Years Ended (in millions) April 29, 2007 April 30, 2006 $ 57.8 689.1 1,805.8 181.0 $ 89.4 650.0 1,584.2 151.7 2,733.7 2,475.3 2,345.1 997.8 892.0 2,040.9 936.9 724.2 $ 6,968.6 $ 6,177.3 $ 15.2 239.1 524.0 582.9 $ 43.1 215.7 516.2 539.0 1,361.2 1,314.0 2,838.6 514.1 2,299.5 517.3 4,713.9 4,130.8 13.9 18.3 ASSETS Cash and cash equivalents Accounts receivable Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Goodwill and other intangible assets Investments and other assets Total assets LIABILITIES AND SHAREHOLDERS’ EQUITY Notes payable Current portions of long-term debt and capital lease obligations Accounts payable Accrued expenses and other current liabilities Total current liabilities Long-term debt and capital lease obligations Deferred income taxes and other long-term liabilities Total liabilities Minority interests Total shareholders’ equity Total liabilities and shareholders’ equity 48 2,240.8 2,028.2 $ 6,968.6 $ 6,177.3 MANAGEMENT MANAGEMENT BOARD C. LARRY POPE President and Chief Executive Officer, Smithfield Foods, Inc. CAREY J. DUBOIS Vice President and Chief Financial Officer, Smithfield Foods, Inc. JOSEPH W. LUTER, IV President, The Smithfield Packing Company, Incorporated RICHARD J.M. POULSON Executive Vice President, Smithfield Foods, Inc. JERRY H. GODWIN President, Murphy-Brown, LLC DAREK NOWAKOWSKI President, Animex Sp. z o.o. ROBERT W. MANLY, IV Executive Vice President, Smithfield Foods, Inc. ROBERT G. HOFMANN, II President, North Side Foods Corp. WILLIAM G. OTIS President, Patrick Cudahy Incorporated MORTEN JENSEN Chief Executive Officer, Central and Eastern Europe ENRICO PIRAINO President, Stefano Foods, Inc. C. LARRY POPE President and Chief Executive Officer MICHAEL H. COLE Vice President, Chief Legal Officer, and Secretary JERRY HOSTETTER Vice President, Investor Relations and Corporate Communications RICHARD J.M. POULSON Executive Vice President JEFFREY A. DEEL Vice President and Corporate Controller GEORGE H. RICHTER President, Farmland Foods, Inc. JOSEPH B. SEBRING President, John Morrell & Co. RICHARD V. VESTA President, Smithfield Beef Group CORPORATE OFFICERS ROBERT W. MANLY, IV Executive Vice President DOUGLAS P. ANDERSON Vice President, Rendering CAREY J. DUBOIS Vice President and Chief Financial Officer BART ELLIS Vice President, Operations Analysis JEFFREY M. LUCKMAN Vice President, Livestock Procurement HENRY L. MORRIS Vice President, Operations JAMES D. SCHLOSS Vice President, Sales and Marketing MICHAEL D. FLEMMING Vice President and Senior Counsel KENNETH M. SULLIVAN Vice President and Chief Accounting Officer DHAMU THAMODARAN Vice President, Price-Risk Management DENNIS H. TREACY Vice President, Environmental and Corporate Affairs VERNON T. TURNER Corporate Tax Director MANSOUR ZADEH Chief Information Officer DIRECTORS JOSEPH W. LUTER, III Chairman of the Board C. LARRY POPE President and Chief Executive Officer, Smithfield Foods, Inc. ROBERT L. BURRUS, JR. Former Chairman and Partner in the law firm of McGuireWoods LLP CAROL T. CRAWFORD, ESQ. Former Commissioner, U.S. International Trade Commission PAUL J. FRIBOURG Chairman, President, and Chief Executive Officer, ContiGroup Companies, Inc. RAY A. GOLDBERG Moffett Professor of Agriculture and Business Emeritus at Harvard Business School WENDELL H. MURPHY Private Investor, former Chairman of the Board and Chief Executive Officer of Murphy Farms, Inc. FRANK S. ROYAL, M.D. Physician MELVIN O. WRIGHT Formerly a senior executive of Dean Witter Reynolds, now Morgan Stanley MICHAEL J. ZIMMERMAN* Executive Vice President and Chief Financial Officer, ContiGroup Companies, Inc. JOHN T. SCHWIETERS Vice Chairman, Perseus LLC, a merchant bank and private equity fund management company *Advisory Director 49 CORPORATE INFORMATION COMMON STOCK DATA The common stock of the company has traded on the New York Stock Exchange under the symbol SFD since September 28, 1999. Prior to that, the common stock traded on the Nasdaq National Market under the symbol SFDS. The following table shows the high and low sales prices of the common stock of the company for each quarter of fiscal 2007 and 2006. First Second Third Fourth 2007 HIGH LOW 2006 HIGH LOW $ 29.63 30.51 27.26 31.50 $ 25.90 25.67 24.40 25.27 $ 31.12 31.34 31.47 29.63 $ 25.69 25.90 26.95 25.00 HOLDERS As of May 31, 2007, there were 1,114 record holders of the common stock. DIVIDENDS The company has never paid a cash dividend on its common stock and has no current plan to pay cash dividends. In addition, the terms of certain of the company’s debt agreements prohibit the payment of any cash dividends on the common stock. The payment of cash dividends, if any, would be made only from assets legally available for that purpose and would depend on the company’s financial condition, results of operations, current and anticipated capital requirements, restrictions under thenexisting debt instruments, and other factors then deemed relevant by the board of directors. CORPORATE HEADQUARTERS Smithfield Foods, Inc. 200 Commerce Street Smithfield, VA 23430 757-365-3000 www.smithfieldfoods.com TRANSFER AGENT AND REGISTER Computershare Investor Services LLC 2 North LaSalle Street Chicago, IL 60602 312-360-5302 INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Ernst & Young LLP One James Center, Suite 1000 901 East Cary Street Richmond, VA 23219 FORM 10-K REPORT Copies of the company’s 10-K Annual Report are available without charge upon written request to: Corporate Secretary Smithfield Foods, Inc. 200 Commerce Street Smithfield, VA 23430 757-365-3000 ir@smithfieldfoods.com 50 ANNUAL MEETING The annual meeting of shareholders will be held on August 29, 2007, at 2 p.m., at Williamsburg Lodge, 310 South England Street, Williamsburg, VA 23185. INVESTOR RELATIONS Smithfield Foods, Inc. 499 Park Avenue, Suite 600 New York, NY 10022 212-758-2100 ir@smithfieldfoods.com CEO AND CFO CERTIFICATIONS The company’s chief executive officer and chief financial officer have filed with the SEC the certifications required by Section 302 of the Sarbanes-Oxley Act of 2002 regarding the quality of the company’s public disclosure. These certifications are included as exhibits to the company’s Form 10-K Annual Report for fiscal 2007. In addition, the company’s chief executive officer annually certifies to the NYSE that he is not aware of any violation by the company of the NYSE’s corporate governance listing standards. This certification was submitted, without qualification, as required after the 2006 annual meeting of shareholders. The company makes available free of charge through its Web site (www.smithfieldfoods.com) its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on form 8-K, and any amendments to those reports as soon as reasonably practicable after filing or furnishing the material to the SEC. Design and Writing: RKC! (Robinson Kurtin Communications! Inc) Executive & Feature Photography: Burk Uzzle • Printing: The Hennegan Company This report is printed on recycled paper. SMITHFIELD FOODS, INC. 200 Commerce Street, Smithfield, VA 23430 757.365.3000 www.smithfieldfoods.com