AMP Flexible Super – Application for employer form

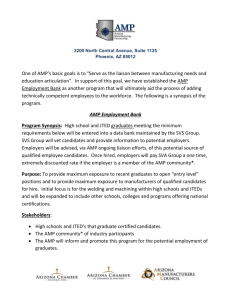

advertisement