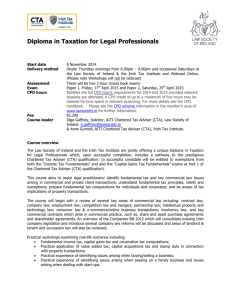

AITI Chartered Tax Adviser (CTA) Syllabus 2012

advertisement