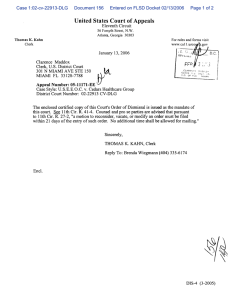

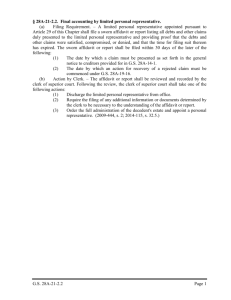

GENERAL MANUAL CLERKS OF COURTS

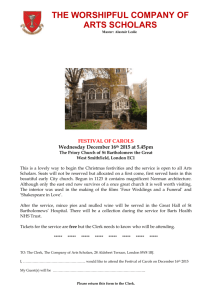

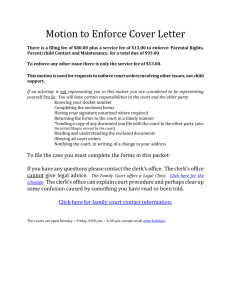

advertisement