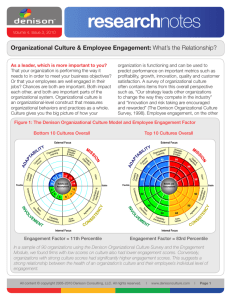

Denison Organizational Culture Survey

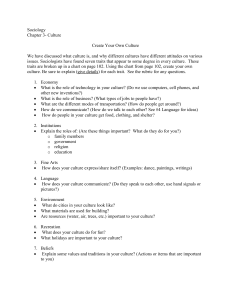

advertisement