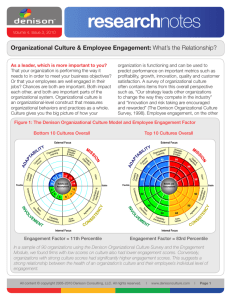

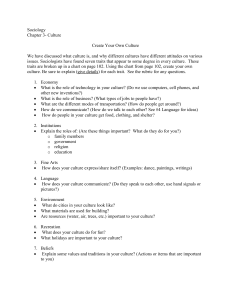

Denison Organizational Culture Survey

advertisement