the boston matrix

advertisement

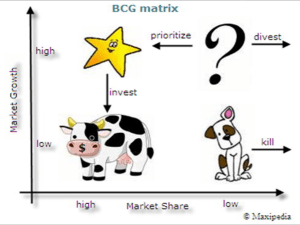

THE BOSTON MATRIX CONTENTS The Boston Matrix Product portfolio management Activity 20 : Smith and Sons Ltd the boston matrix The Boston Matrix If a business provides a portfolio (range) of products, a helpful technique for analysis is the Boston Matrix. Created by the Boston Consulting Group, this model looks at the value of products by looking at two criteria: market growth and market share. Why is there a concern to identify market growth? If total sales of this product type by all firms is growing quickly there is more opportunity for sales growth. It is harder to achieve sales growth when the market is declining or stagnant. Why look at market share? Market share is used as a criterion because of the advantages that being a market leader brings. Categorising different products within a portfolio by using the Boston Matrix means that each product is put into one of four broad categories. In matrix form this is shown below. High Low High Stars Problem children Low Market Growth Relative Market Share Cash cows Dogs The Boston Matrix Problem children (low market share in a high growth market) Problem children can also be described as ‘question marks’. Problem children are products that have so far not sold enough in what should be a rapidly growing and therefore profitable market. The business should either be prepared to invest time and money into turning around the market position of these products or consider whether to admit defeat and stop production. Rising stars (high market share in a high growth market) Rising stars are profitable, or at least on their way to becoming so. But because the market has high growth, the business may need to invest in increasing production capacity. Marketing expenditure © LearnLoads 2011 | www.learnloads.com 2 the boston matrix will also be quite high because of the need to maintain market position in the face of competition. Other businesses will have seen the opportunities in this market. Although rising stars require a lot of resources, any business will seek to hold them in their range of products as they are potentially lucrative. Dogs (low market share in a low growth market) These products may produce some income, but they will probably need to be deleted from the product portfolio in the near future. Even if the relative market share of dogs can be improved, there is limited opportunity for sales growth in a market where consumer demand is stagnating. Cash cows (high market share in a low growth market) Although the size of the market in which these products sell is not expected to increase significantly in the future, the products are profitable. There is no need to invest in extra production facilities. Due to high levels of customer awareness, there is less need for promotional spending. Cash cows generate income that can be used to fund the development of rising stars. If this is managed well, when cash cows enter the decline phase revenue from sales of the product portfolio as a whole can remain at a steady level, assuming rising stars have achieved their sales potential. Product portfolio management The Boston Matrix can be used to evaluate whether a business has a balanced portfolio of products. A business should not have too many products in any one category within the matrix. To illustrate this, suppose that a business has mostly cash cows in its portfolio. These products are sold into are low growth markets. Cash cows obviously account for most of the company’s revenue. When the cash cows enter the decline stage, total revenue will fall quite sharply. Now answer Activity 20 below. © LearnLoads 2011 | www.learnloads.com 3 the boston matrix Activity 20 : Smith and Sons Ltd Smith and Sons Ltd has a portfolio of 5 products (A, B, C, D and E). Sales figures are available for the past 7 years. Throughout this period, the product range has been unaltered. The market share for each product has changed very little over time. The tables and bar chart below show: • Market growth for the markets in which Smith and Sons sells its products. • Percentage market share held by Smith and Sons in each of those markets. • The value of company sales in millions of pounds over the 7 year period. Look at the figures carefully before answering the tasks. smith and sons ltd: market growth years 1 to 7 (%) product market growth A 13 B 0 C -3.2 D -25 E 130 smith and sons ltd: approximate market share (%) © LearnLoads 2011 | www.learnloads.com product market share A 50 B 19 C 60 D 63 E 16 4 the boston matrix smith and sons ltd company sales by product (£m) year a b c d e 1 1.1 1.0 3.7 7.3 0.2 3 1.2 1.0 3.8 6.2 0.3 5 1.2 1.0 3.7 5.7 0.3 7 1.0 1.0 3.5 5.9 0.4 MARKET SHARE FOR YEAR 5 (%) 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 A B C D E PRODUCTS TASKS 1. How would you classify each of these products within the Boston Matrix? (10) 2. The market demand for D has fallen. Briefly give three possible reasons for a fall in demand. (6) 3. Calculate the percentage change in total revenue for Smith and Sons Ltd between year 1 and year 7. (2) 4. Based on the available evidence, how well has the product portfolio been managed? What approach should the company take with respect to managing its product portfolio in the future? Justify your recommendations. (10) © LearnLoads 2011 | www.learnloads.com 5