exhibit 24 - E

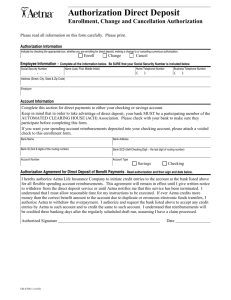

advertisement

EXHIBIT 24

EXHIBIT 25

EXHIBIT 26

EXHIBIT 27

EXHIBIT 28

EXHIBIT 29

EXHIBIT 30

EXHIBIT 31

ENDORSED

FILED

Heather Gibson (SBN 240938)

Kevin K. Panahi (SBN 280630)

Law Offices of Heather E. Gibson L.L.P

20398 Blauer Drive

Saratoga, CA 95070

(408) 359-1035

(408) 3 59-1 102 (fax)

legal@basurgical.com

Attorneys for Plaintiff,

FOREST AMBULATORY SURGICAL ASSOCIATES, L.P.

zotz HAR 23 Pil 5: 06

Davidfi,

dk4C4ull

DePutiael

Agmbas

IN THE SUPERIOR COURT OF THE'STATE OF CALIFORNIA

COUNTY OF SANTA CLARA

DOWNTOWN SUPERIOR COURT

LIMITED JURISDICTION

”%

FOREST AMBULATORY SURGICAL) Case No. 12CV21

ASSOCIATES, L.P. DBA FOREST)

SURGERY CENTER L.P. (A Limited)) PLAINTIFF FOREST AMBULATORY

SURGICAL ASSOCIATES L.P.'S

Partnership),

COMPLAINT FOR DAMAGES AGAINST

DEFENDANT AETNA LIFE INSURANCE

Plaintiff

COMPANY

V.

AETNA LIFE INSURANCE COMPANY,

and DOES 1 through 25, inclusive,

Defendants

1) Breach of Contract

2) California Business & Professions

Code § 17200 et seq.

3) Negligent Misrepresentation

4) Promissory Estoppel

5) Equitable Estoppel.

DEMAND FOR JURY TRIAL

DEMAND OVER $10,000

PLAINTIFF'S COMPLAINT FOR DAMAGES

INTRODUCTION

1. This is an action for Breach of Contract, for violations of California Business an

Professions Code § 17200 et seq., for Negligent Misrepresentation, Promisso

Estoppel, and Equitable Estoppel against Defendant AETNA LIFE INSURANC

COMPANY. ("AETNA").

2. By the allegations set forth herein, Plaintiff FOREST AMBULATORY SURGICA

ASSOCIATES L.P. DBA FOREST SURGERY CENTER L.P., ("FOREST"), seek

damages for the difference between the amount that AETNA paid FOREST for surgica

procedures performed, and the amount billed by FOREST for those surgical procedure

in addition to other damages, according to proof at trial.

3. Pursuant to AETNA'S agreement with FOREST, AETNA was required to pay 60% o

the cost of approved surgical procedures for out-of-contract providers, such

FOREST.

4. Plaintiff FOREST is now pursuing payment on its own behalf only, for the underpai

surgery by pursuing each Cause of Action against AETNA stated below.

5. Defendant AETNA failed to make full payment to FOREST, and instead paid onl

$14,992.50 of the billed $73,860.00, or approximately 20% rather than the 60')/

promised by AETNA.

6. Plaintiff FOREST is ignorant of the true names and capacities of defendants sue

herein as DOES 1-25, inclusive, and therefore sues defendants by such fictitious names.

Plaintiff FOREST will amend this complaint to allege their true names and capacitie

when ascertained.

7. Plaintiff FOREST is informed and believes and thereon alleges that, at all times herei

mentioned, each of the defendants sued herein was the agent and employee of each o

the remaining defendants and was at all times acting within the purpose and scope o

such agency and employment.

///

///

PLAINTIFF'S COMPLAINT FOR DAMAGES

-2

JURISDICTION AND VENUE

8. This action arises under California law and the amount in controversy exceed

$10,000.00, but is less than $25,000.00 and therefore venue in an limited jurisdiction

appropriate.

9. Jurisdiction is proper pursuant to Cal. Civ. Proc. Code §§ 410.10, 410.50 and 1060.

10.Venue is proper in this judicial district pursuant to Cal. Civ. Proc. Code § 395.

11.This case is not pre-empted by Federal ERISA law, because Plaintiff has alleged direc

causes of action under Califomia state law against its patient's insurer, AETNA, fo

breach of contract, negligent misrepresentation, promissory estoppel, breach of contrac

and equitable estoppel. Kurtz, Richard, Wilson & Co. Inc. v. Insurance Communicator

Marketing Corp. (1993) 12 Cal.App.4th 1249.)

THE PARTIES

12.Plaintiff, FOREST, is, and at all times herein mentioned was, a limited partnership

organized and existing under the laws of the State of California with its principle place

of business located at 2110 Forest Ave Suite 2, in the City of San Jose, County of Santa

Clara.

13.Plaintiff is informed and believes that Defendant AETNA both advertises for, and

conducts business on a continuous basis within the State of California, County of Santa

Clara.

14.The individual upon whom the surgery at issue was performed, identified by AETNA

Member ID W172789787 (in compliance with the Federal Health Insurance Portability

and Accountability Act (HIPAA)) resides within the County of Santa Clara in the State

of California.

15.The surgery upon which this lawsuit is predicated was performed at the Forest Surgery

Center located in San Jose, California, which is managed by the Bay Area Surgical

Management, LLC., located in Santa Clara County California.

///

///

PLAINTIFF'S COMPLAINT FOR DAMAGES

-3

FACTUAL ALLEGATIONS

16.Forest Surgery Center is an ambulatory surgery facility located in San Jose, California.

17. One of FOREST's patients, (identified by AETNA Member ID No. W172789787 and

AETNA Claim ID.: EQAASFQ0K00 in order to preserve the patient's privacy in

compliance with HIPPA laws) hereafter referred to as "PATIENT" was scheduled for

surgery on July 8, 2011 at Forest Surgery Center. Dr. Nicholas Abidi and Dr. Robert

Bruce were scheduled to perform the surgery.

18.The surgery performed by Dr. Abidi and Dr. Bruce consisted of: secondary ankle

ligament repair; the implantation of a prosthetic device; secondary repair of a lower leg

tendon; and shoulder arthroscopy with rotator cuff repair; identified by HIPPS and

Current Procedural Terminology (CPT) Codes: 27698, 27691, 29827, L8699.

19. The PATIENT was insured by AETNA.

20. Prior to the PATIENT's scheduled surgery, on July 7, 2011, Gladys Martin a FOREST

employee verified with an employee of AETNA via phone that pre-authorization was

not necessary for the surgery the PATIENT was scheduled to undergo. The same

AETNA employee then confirmed that the PATIENT was covered under AETNA

health insurance, verified the terms of the PATIENT's insurance coverage, and

provided Gladys Martin with reference number 778203951. (Verification of this

preauthorization is attached hereto as Exhibit A.)

21. In addition, FOREST confirmed that the PATIENT was insured by AETNA online, in

the provider self-service-eligibility and benefits details portion of AETNA's web page.

This online verification further verified that AETNA would cover the PATIENT for at

least 60% of the billed price of procedures on the PATIENT by FOREST, an out of

network provider.

22. On July 8, 2011, Dr. Abidi and Dr. Bruce performed the PATIENT's surgery, as

scheduled, and exactly as described to the AETNA agent who stated that no preauthorization was necessary for the above-stated planned procedures.

PLAINTIFF'S COMPLAINT FOR DAMAGES

-4

23. Shortly following the PATIENT's surgery, FOREST billed AETNA for the

PATIENT's procedure, however, AETNA failed to tender the amount due.

24. Thereafter, FOREST contacted AETNA via written correspondence, sent on August 23,

2011, informing AETNA of the underpaid claim, and requesting that the claim be paid

as promised.

25. Thereafter, FOREST contacted AETNA again via written correspondence, sent on

October 14, 2011 informing AETNA of the underpaid claim, requesting that the claim

be paid according to the PATIENT's insurance benefits as promised, and informing it

of AETNA's intent to file suit in the event that no further payment was made within

fourteen (14) days of AETNA's receipt of FOREST's correspondence.

26. FOREST continued to attempt to contact AETNA via phone during the month of

October and November, and made contact with AETNA's agents who were unable to

state whether any further payment would be made.

27. To date, AETNA has refused to pay the contracted price for the PATIENT's surgical

procedures, therefore FOREST has brought this instant action to recover the amount it

is owed.

FIRST CAUSE OF ACTION

(Breach of Contract Against Defendant AETNA)

28. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

29. On information and belief, on or about January 1, 2011, the PATIENT and Defendant

AETNA, entered into a written contract whereby AETNA agreed to tender payment in

the amount of 60% of the billed price for qualified surgical procedures.

30. Because FOREST was an out-of-network provider at the time that the PATIENT's

surgery was performed, this agreement extended to those procedures performed at

Forest Surgery Center.

31. Prior to performing surgery on PATLENT, FOREST contacted AETNA via phone in

order to verify that the scheduled surgical procedures would be considered "qualified"

PLA1NTIFF'S COMPLA1NT FOR DAMAGES

-5

and therefore covered by AETNA. AETNA verified the PATIENT was covered, and

that no pre-authorization was necessary for the scheduled procedures.

32. Accordingly, Plaintiff performed medically necessary surgery on the PATIENT, an

individual insured by AETNA.

33. Nevertheless, Defendant AETNA breached its contract as described in Irg 20, 21, 22,

and 23 of the instant complaint by failing and refusing to perform in good faith its

promise to honor the contracted agreement and to tender 60% of the billed amount or

$73,860.00 for services rendered.

34. As a result of the breach of Defendant AETNA, in the obligations pursuant to the

contract as described herein for the entire sum of $49,316.00 less the allowed amount

of $21,202.50, or $23,113.50 is now due, owing and unpaid; Plaintiff has made

numerous demands upon Defendant for payment, but no further payment has been

made.

35. To date, Defendant AETNA has failed and refused, and continues to fail and refuse to

tender full payment pursuant to the terms of its contract as described herein for the

$73,860.00 billed for the procedures at issue by Plaintiff FOREST.

36. Defendant has therefore breached its contract with Plaintiff, who has been damaged

thereby in the sum of the difference between the amount allowed by AETNA, and the

amount outstanding, or $23,113.50 plus interest at the legal rate from and after the date

due according to the proof, plus additional damages including the costs of this lawsuit

as stated below according to proof.

SECOND CAUSE OF ACTION

(California Business & Professions Code 17200 et. seq. Against Defendant AETNA)

37. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

38. The Unfair Competition Act (UCA) California Business and Professions Code 17200 et

seq., prohibits any "unlawful, unfair or fraudulent business act or practices..."

39. In the instant case, AETNA unlawfully refused to honor the terms of its contract

described herein in violation of section §235(2) of the Restatement Second of

PLAINTIFF'S COMPLAINT FOR DAMAGES

-6

Contracts, and thus, giving rise to FOREST's claim to damages pursuant to California

Civil Code section §3300 et seq.

40. Defendant AETNA, further illegally attempted to persuade Plaintiff into agreeing to

take less than the contracted amount for services rendered, on numerous occasions, in a

bad faith attempt at settlement, in violation of California Insurance code § 790.03 and

also in contravention of California Business and Professions code §17200. et seq.

41. Defendant AETNA did nothing to correct the apparent illegalities in attempting to

persuade Plaintiff FOREST to settle for a lower amount than what it owed, and instead,

verified those illegalities by doing nothing in response to FOREST's repeated requests

for appropriate payment.

42. Further, there has been no response from DEFENDANT to Plaintiff's written demand

sent on October 14, 2011, and therefore, AETNA has further violated California Ins.

Code §790.03 by failing to respond within the applicable (30) day time period.

43. By engaging in unlawful conduct pursuant to California Civil Code §3300 that violates

the parameters set forth in the Restatement Second of Contracts §235(2), by making

misrepresentations with respect to authorization given for the PATIENT's surgical

procedures and the percentage of the authorized amount that would be paid, and for

violations of insurance code §790.03, AETNA is engaging in unlawful business

practices and is in violation of Business and Professions code §17200 et seq.

THIRD CAUSE OF ACTION FOR NEGLIGENT MISREPRESENTATION

(Against Defendant AETNA)

44. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

45. Defendant AETNA owed a duty to Plaintiff FOREST to give it accurate statements of

fact with respect to the pre-authorization of surgery scheduled to be performed on the

FOREST PATIENT insured by AETNA.

PLAINTIFF'S COMPLAINT FOR DAMAGES

-

7

46. Defendant AETNA made an incorrect statement to FOREST through its agent, that "no

pre-authorization was necessary" for the surgery that the PATIENT was scheduled to

undergo on July 8, 2011.

47. The AETNA employee and agent who made this statement either knew, or should have

known, that making this statement to the FOREST employee who had called for preauthorization would cause that FOREST employee to rely on that statement and go

forward with the surgery with the understanding that AETNA did not need to expressly

authorize it.

48. FOREST justifiably relied on AETNA's misrepresentations as set forth above, and

went forward with the procedure, reasonably expecting to be reimbursed at the very

least in the amount of 60% of the billed price of the surgery pursuant to the express

statements from AETNA, that out-of-network providers, such as FOREST would be

paid at least 60% of the billed amount.

49. In the event that the AETNA representative had told FOREST that it would not

authorize its insured's scheduled procedure for any reason, or refused to give preauthorization for any reason, then FOREST would not have gone forward with the

PATIENT's surgery as scheduled.

50. As a direct and proximate cause of the misrepresentation made to FOREST, FOREST

went forward with the PATIENT's surgery, and payment was not made at the

contracted for amount, and therefore FOREST suffered damages as a result of its

reliance upon AETNA's misleading and incorrect statements.

51. As a direct and proximate cause of FOREST's justifiable reliance upon AETNA's

misrepresentations, FOREST suffered loss according to proof at trial.

FOURTH CAUSE OF ACTION FOR PROMISSORY ESTOPPEL

(Against Defendant AETNA)

52. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

PLAINTIFF'S COMPLAINT FOR DAMAGES

-

8

53. Defendant AETNA made a clear and definite promise to FOREST when FOREST

contacted AETNA, gave AETNA specific information regarding procedures to be

performed, prior to the PATIENT's surgery, and requested verification that either preauthorization would be given to FOREST, or that no-preauthorization was necessary

for the procedures stated.

54. AETNA responded to FOREST's request by expressly stating that "no preauthorization was necessary" for the procedure codes given. Therefore, FOREST, as an

out-of-network provider would be paid for at least 60% of the billed amount for the

PATIENT's procedure. (Detailed in Exhibit A attached hereto). Therefore, FOREST

went forward with the PATIENT's scheduled surgery in reliance on AETNA's

statement.

55. AETNA made the above-mentioned promise that no pre-authorization was necessary

for the PATIENT's scheduled surgery with the expectation that FOREST would rely on

that promise, and would go forward with the PATIENT's surgery as scheduled.

56. It was foreseeable that FOREST would proceed with the PATIENT's surgery, as

scheduled, based on AETNA's assurance that "no pre-authorization was necessary"

prior to the time that the surgery was performed.

57. FOREST reasonably relied upon AETNA's promise that no pre-authorization was

required, and given for the PATIENT's surgery, and therefore went forward with the

PATIENT's surgery as scheduled.

58. FOREST suffered a detriment of a definite and substantial nature as a -result of its

reasonable reliance upon AETNA's above stated promise in that it was not reimbursed

at the contracted rate for the services rendered to the PATIENT, and in fact, was paid

less than 21% of the cost of the billed surgical procedures performed.

FIFTH CAUSE OF ACTION FOR EOUITABLE ESTOPPEL

(Against Defendant AETNA)

59. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

PLAINT1FF'S COMPLA1NT FOR DAMAGES

-9

60. AETNA had been advised, prior to the date of the PATIENT's surgery, that FOREST

had scheduled surgery for that PATIENT, and had expressly explained to AETNA wha

that surgery would consist of, therefore AETNA had been advised of all relevant facts

prior to the PATIENT's surgery.

61. AETNA was aware that, and intended for, FOREST to proceed with the PATLENT's

surgery, as scheduled, and AETNA's intentions were supported by its refusal to explain

to FOREST that it would not cover any portion of the PATIENT's procedure at the

agreed upon contracted rate of 60% or more of the billed procedure's price. As such,

AETNA's actions and omissions were reckless and malicious.

62. FOREST was ignorant of the true facts, specifically that AETNA had decided not to

cover the PATIENT's scheduled surgical procedure at the rate of 60% or more.

63. FOREST relied, to its detriment upon AETNA's statement that, "no pre-authorization

was necessary" in moving forward with the PATIENT's surgical procedure as

scheduled, instead of cancelling it. FOREST therefore lost a significant amount of

money, in having to complete the PATIENT's surgery, pay for all of the cost and labor

associated with that surgery, and then to be paid less than 21% of the billed price of tha

surgery. Consequently, FOREST has changed its position for the worse in its good

faith reliance upon AETNA's negligent misrepresentations with respect to payment for

the PATIENT's procedure.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff prays for declaratory relief and judgment as follows:

1)

That defendant AETNA must pay to plaintiff the amount of $23,113.5

plus interest at the legal rate accruing from the date of breach;

2)

Pre-judgment and post-judgment interest as allowed by law;

3)

Costs According to proof; and

4)

Such other and further legal and equitable relief as the Court deems jus

and proper.

///

PLAINTIFF'S COMPLAINT FOR DAMAGES

- 10

DEMAND FOR JURY TRIAL

Plaintiff hereby demands a trial by jury.

///

///

RESPECTFULLY SUBMITTED,

DATED: March 23, 2011

LAW OFFICES OF HEATHER E. GIBSON, LLP.

GIBSON

KEVIN K. PANAHI

Attomeys for Plaintiff Forest Ambulatory

Surgical Associates L.P. DBA Forest

Surgery Center L.P.

PLAINTIFF'S COMPLAINT FOR DAMAGES

- II

i

2

3

4

5

6

7

8

9

10

11

12

13

14

15

EXHIBIT A

16

17

18

19

20

21

22

23

24

25

26

27

28

PLAMITIFF'S COMPLAINT FOR DAMAGES

-

12

No. 1915

2011 10:19AM

Sel ). . 27.

P.

3

FOltEST SURG140(

.

Patient

Procedare/ Comments:

Insurance Veriikation Form

'

DOSJfl3

I

1iysicia.n Name:

(1,01K1-e. (1._t—A-V1t0C0 k.")>/ , 1'DV (.).

1t:

•

N

•

Plume:

Insurance Company N

Clanus Address:

City:

Su.1).seviber (if <lifferclit frorn patient):

Su bscriber D011:

Subscribers

Pation.vs D(W):

4:

C

_

Work Phone:

Em1.loyer Name:

krnpl oyer Address

Workers r p: Y N Date of Injmy:

Adjuster's Name: Auth

I

.:1)_(:_)(1bn

State:

.KY

..

to Palien t::

Patients S.S

Gro

1 aCli 61

:•

Phone:

usocance Conipa ny Name:

ClailrIs /1(1(shetss:

Stat e:

..

S )suril)or (it'd iffereiit fI-oni p a t.i en t.) :

•

1-4 elaIionship to Patient:

Subscrilwr 1)013:

Patients S.S 1

Subscribers

Pakients DO13:

R •

V

Called By:

11:ffective Date:

1n Nawork:

Ont-of-Network:

_

N_Ct

Verified Wi

Date Callecl: —7 1* 1\ v ) 11-.—of network)

(If

not

contracted

obtairt

both

In

and

011contracted: Y (.1'NF's

•• _ • ____ _•--

•

_

04)

$

Co-Pay: $__

,1

AmOUnt inet: 3 -C) • c;

0

Dednctibje: $

_______ %

Co-Pay: $_1

Amottilt 1nel:: SC)

• -

•Pre-Aut.h 1U;quired; Y

N

ouT

ELO

sl: 3So o . 0-: Cb Q /

l' -I 000 i> q 't 0

— '' -- "-- ------ — ----

cr!d u re/__Cfl:

__21•6 cij. .-S _.

--1--c-.-e-qo f). - --

r_ Q Z--. . 7)-----

1

30 1 •i

1

-

oop

his. Covers

lichelit/ coverrige commenrs:

1 i 8 - q .7

Autli

..1 d A - W-

- li'stiplatect Charges: ..,- 1 '

• $ 3cto s...---ricl.rp_=-N.yl,c0 . .,.- -ifq r) i-- —. A.e..lk

s

I

DUE FROM PATT13.N'f'

.:,

.

••••■••■■•■■■••011.1

.. ..

Dally M ax:

1

1

1)017. I70 R AN ESTIA ESIA

1 .

$

i

!

ATTACHMENT CV•501 2

CIVIL LAWSUIT NOTICE

CASE NUMBER:

Superlor Court df California, County of Santa Clara

191 N. First St., San Jose, CA 95113

112CV22) 3 28

PLEASE READ THIS ENTIRE FORM

PLAINTIFF (the person suing): Within 60 days after filing the lawsuit, you must serve each Defendant with the Complaint,

Summons, an Altemative Dispute Resolution (ADR) Information Sheet, and a copy of this Civil Lawsuit Notice, and you must file

written proof of such service.

DEFENDANT (The person sued): You must do each of the following to protect your rights:

1.

2.

3.

You must file a written response to the Comp/aint, using the proper legal form or format, in the Clerk's Office of the

Court, within 30 days of the date you were served with the Summons and Complaint

You must serve by mail a copy of your written response on the Plaintiffs attorney or on the Plaintiff if Plaintiff has no

attorney (to "serve by mail" means to have an adult other than yourself mail a copy); and

You must attend the first Case Management Conference.

Warning: lf you, as the Defendant, do not follow these instructions,

you may automatically lose this case.

RULES AND FORMS: You must follow the California Rules of Court and the Superior Court of California, County of Santa Clara

Local Civil Rules and use proper forms. You can obtain legal information, view the rules and receive forms, free of charge, from

the Self-Help Center at 99 Notre Dame Avenue, San Jose (408-882-2900 x-2926), www.scselfservice.orq (Select "Civin or from:

•

•

State Rules and Judicial Council Forms: www.courtinfo.ca.00v/forms and www.courtinfo.ca.qov/rules

Local Rules and Forms: htto://www.sccsuperiorcourt.orq/civiltrule1toc.htm

CASE MANAGEMENT CONFERENCE (CMC): You must meet with the other parties and discuss the case, in person or by

telephone, at least 30 calendar days before the CMC. You must also fill out, file and serve a Case Management Statement

(Judicial Council form CM-110) at least 15 calendar days before the CMC.

You or your attomey must appear at the CMC. You may ask to appear by telephone — see Local Civil Rule 8.

9

Your Case Management Judge is: Honorable Mark Pierce Department: The

CMC is scheduled for: (Completed by Clerk of Court)

1 2012 Time:

Date: 1:30 pro in Department:

9

The next CMC is scheduled for: (Completed by party if the l st CMC was continued or has passed)

Date:

Time: in Department:

ALTERNATIVE DISPUTE RESOLUTION (ADR): If all parties have appeared and filed a completed ADR Stipulation Form (local

.form CV-5008) at least 15 days before the CMC, the Court will cancel the CMC and mail notice of an ADR Status Conference.

Visit the Court's website at www.sccsuperiorcourt.oroicivil/ADR/ or call the ADR Administrator (408-882-2100 x-2530) for a list of

ADR providers and their qualifications, services, and fees.

WARNING: Sanctions may be imposed if you do not follow the California Rules of Court or the Local Rules of Court.

Forrn CV-5012 REV 7101108

CIVIL LAWSUIT NOTICE

Page 1 of 1

•

p

SUPERIOR COURT OF CALIFORNIA, COUNTY OF SANTA CLARA

ALTERNATIVE DISPUTE RESOLUTION

INFORMATION SHEET / CIVIL DIVISION

Many cases can be resolved to the satisfaction of all parties without the necessity of traditional litigation, which can be expensive,

time consuming, and stressful. The Court finds that it is in the best interests of the parties that they participate in alternatives to

traditional litigation, including arbitration, mcdiation, neutral evaluation, special masters and referees, and settlement conferences.

Therefore, all matters shall be referred to an appropriate form of Alternative Dispute Resolution (ADR) before they are set for trial,

unless there is good cause to dispense with the ADR requirement.

What is ADR7

ADR is the general territ Iota wide variety of dispute resolution processes that are alternatives to litigation. Types of ADR

processes include mediation, arbitration, neutral evaluation, special masters and referees, and settlement conferences, among others

(urn is.

st ;17r

if

the

of choosing ADR instead of ihiganon?

ADR can have a number of advantages over litigation:

< ADR can save tune. A dispute can be resolved in a matter of months, or even weeks, while litigation can take years.

< ADR can tare money. Attorney's fees, court costs, and expen lees can be reduced or avoided altogether.

< AD It provides more participation. Parties have more opponunitics with ADR to express their interests and concerns, instead of

focusing exclusively on legal rights.

< A.Dft provides more control and flexibility. Parties can choose the ADR process that is most likel to bring a satisfactory

resolution to their dispute.

< ADR can reduce stress. ADR encourages cooperation and communication, while discouraging the adversarial attnospherc of

litigation. Surveys of parties who have participated in an ADR process have found much greater satisfaction than with parties who

have gone through

Whot arc (Inc main forms 0/ AD!? offered by the Court?

< Mediation is an infonnal, confidential, flexible and non . binding process m the mediator helps thc panics-to understand the

interests of everyone involved, and their practical and legal choices. The mediator helps the parties to communicate better,

explorc legal and practical settlement options, and reach an acceptable solution of the problern. The mediator does not

decide thc solution to the dispute; the parties do.

< Mediation may be appropriate when:

< The parties want a non-adversary procedure

< The parties have a continuing business or personal relationship

< Communication problems are interfering with a resolution

<.There is an emotional element involved

<The parties are interested in an injunction, consent decree, or other form of equitable relief

< Neutral evaluation, sometimes called "Early Neutral Evaluation" or "ENE", is an informal process in which the evaluator, an

experienced neutral lawyer, hears a compact presentation of both sides of the case, gives a non-binding assessment of the

strengths and weaknesses on each side, and predicts the likely outcome. The evaluator can help parties to identify issucs,

prepare stipulations, and draft discovery plans. The parties may use the neutral' s evaluation to discuss settlement.

Neutral evaluation may be appropriate when:

< The parties are far apart in their view of the law or value of the case

< The case involves a technical issue in which the evaluator has expertise

< Case planning assistance would be helpful and would save legal fees and costs

< The parties are interested in an injunction, consent decree, or other form of equitable relief

ALTERNATIVE DISPUTE RESOLUTION INFORMATION SHEET/ CIVIL DIVISION

CV•5003 REV 6/08

CM- 1

FOR COURT USE ONLY

ATTORKY 013_PABTy WTHOUT ATT_O_RNEY (Name, State Bar number, and address):

Heather E

E. Gibson, 240938

—

Kevin K. Panalii, 280630

20398 Blauer Drive

Saratoga, CA 95070

TELEPHONE NO.:

408.359.1035

FAX NO.:

-ENOORSED

•

FILED

408.359.1038

Al"TORNEY FOR (Name):

SUPERIOR COURT OF CALIFORNIA, COUN'TY OF

STREET ADDRESS:

2011 MAR 23 PM 5 : 06

191 N. First Street

MAILING ADDRESS:

CITY AND ZIP CODE:

BRANCH NAME:

Davidnupio..1i

4 .,:;:,:vorcoult

San Jose 95113

Down Town Superior

w

CASE NAME:

DeMaelk

Forest Surgical L.P. v. AETNA LIFE RsISURANCE COMPANY

CIVIL CASE COVER SHEET

Unlimited

i Limited

El (Amount

CASE NUMBER:

Complex Case DesIgnation

1 /

Joinder

Counter

JUDGE:

Filed with first appearance by defendant

demanded

demanded is

DEPT:

exceeds $25,000)

$25,000 or less)

(Cal. Rules of Court, rule 3.402)

Items 1-6 below must be completed (see instructions on page 2).

1. Check one box below for the case type that best describes this case:

(Amount

Auto Tort

= Auto (22)

= Uninsured motorist (46)

Other PI/PDNVD (Personal Injury/Property

Damage/Wrongful Death) Tort

Asbestos (04)

= Product liability (24)

Medical malpractice (45)

= Other PUPD/VVD (23)

Non-PI/PD/WD (Other) Tort

Business tort/unfair business practice (07)

Civil rights (08)

C=1 DefamatIon (13)

Fraud (16)

Intellectual property (19)

Professional negligence (25)

Other non-PUPDNVD tort (35)

Eruloyment

I WrongfuI termlnatIon (36)

1-1 Other ernployment (15)

El

El

El

El

El

El

El

.. ":1. ::,:titlIata

gy:

Contract

TA Breach of contract/warranty (06)

Rule 3.740 collections (09)

Other collections (09)

Insurance coverage (18)

Other contract (37)

Real Property

Eminent domain/Inverse

condemnation (14)

Wrongful eviction (33)

Other real property (26)

El

El

Unlawful DetaIner

= Commerclal (31)

= Residential (32)

= Drugs (38)

JudIcial RevIew

= Asset forfeiture (05)

onag

p w)ard (11)

re: a i br reiltiw

Pethtletiro:dici

Writ of mandate (02)

El o

El

2CV22 1

328

Provislonally Complex ClvIl LItIgatIon

(Cal. Rules of Court, rules 3.400-3.403)

El Antitrust/Trade regulation (03)

El Construction defect (10)

El Mass tort (40)

El Securities litigation (28)

El Environmentalifoxic tort (30)

Insurance coverage daims arising from the

El above

listed provisionally complex case

types (41)

Enforcement of Judgment

= Enforoement of judgment (20)

MIscellaneous ClvIl ComplaInt

= RICO (27)

= Other complaint (not specified above) (42)

MIscellaneous Civil PetitIon

Partnership and corporate govemance (21)

1-1 Other petitIon (not specitied above) (43)

El

complex under rule 3.400 of the California Rules of Court. If the case is complex, mark the

I-71 is not

2. This case I I is

factors requiring exceptional judicial management:

d. = Large number of witnesses

a = Large number of separately represented parties

Extensive

motion

practice

raising

difficult

or

novel

e. n Coordination with related actions pending in one or more courts

b I- 1

in other counties, states, or countries, or in a federal court

issues that will be time-consuming to resolve f = Substantial postjudgment judicial supervision

c. = Substantial amount of documentary evidence

3. Remedies sought (check all that apply): arn monetary b.= nonmonetary; dedaratory or injunctive relief C. = punitive

4. Number of causes of action (specify): 5

5. This case ri is F-ii is not a dass action suit

6. If there are any known related cases, file and serve a notice of related case. (You may use form CM-015 ),/

Date:

3/2//

4difer Cism

(TYPE OR PRINT NAME)

•

•

•

•

(SIGNATURE OF PARTY OR ATTORNEY FOR PARTY)

NOTICE

Plaintiff must file this cover sheet with the first paper filed in the action or proceeding (except small claims cases or cases filed

under the Probate Code, Family Code, or Welfare and Instituttons Code). (Cal. Rules of Court, rule 3.220.) Failure to file may result

in sanctions.

File this cover sheet in addition to any cover sheet required by local court rule.

lf this case is complex under rule 3.400 et seq. of the Califomia Rules of Court, you must serve a copy of this cover sheet on all

other parties to the action or proceeding.

Unless this is a collections case under rule 3.740 or a complex case, this cover sheet will be used for statistical purposes only.Psae 1 of 2

Forrn Adopted for Mandatory Use

Jucritial Cound of Caifornia

CM-010 (Rev. July 1. 2007)

CIVIL CASE COVER SHEET

Cel Rules of Court. rutes 2.30. 3.220. 3.400-3.403. 3.7442,

Csd. Standards of Judclet Actnarestration. std. 3.10

www.courenfo.ce.gov

INSTRUCTIONS ON HOW TO COMPLETE THE COVER SHEET CM-010

To Plaintiffs and Others Filing FIrst Papers. If you are filing a first paper (for example, a complaint) in a civil case, you must

complete and file, along with your first paper, the Civil Case Cover Sheet contained on page 1. This information will be used to compile

statistics about the types and numbers of cases filed. You must complete items 1 through 6 on the sheet. ln item 1, you must check

one box for the case type that best describes the case. If the case fits both a general and a more specific type of case listed in item 1,

check the more specific one. If the case has multiple causes of action, check the box that best indicates the primary cause of action.

To assist you in completing the sheet, examples of the cases that belong under each case type in item 1 are provided below. A cover

sheet must be filed only with your initial paper. Failure to file a cover sheet with the first paper filed in a civil case may subject a party,

its counsel, or both to sanctions under rules 2.30 and 3.220 of the California Rules of Court.

To Partles ln Rule 3.740 Collections Cases. A "collections case" under rule 3.740 is defined as an action for recovery of money

owed in a sum stated to be certain that is not more than $25,000, exclusive of interest and attorney's fees, arising from a transaction in

which property, services, or money was acquired on credit. A collections case does not include an action seeking the following: (1) tort

damages, (2) punitive damages, (3) recovery of real property, (4) recovery of personal property, or (5) a prejudgment writ of

attachment. The identification of a case as a rule 3.740 collections case on this form means that it will be exempt from the general

time-for-service requirements and case management rules, unless a defendant files a responsive pleading. A rule 3.740 collections

case will be subject to the requirements for service and obtaining a judgment in rule 3.740.

To Partles In Complex Cases. ln complex cases only, parties must also use the Civil Case Cover Sheet to designate whether the

case is complex. If a plaintiff believes the case is complex under rule 3.400 of the California Rules of Court, this must be indicated by

completing the appropriate boxes in items 1 and 2. If a plaintiff designates a case as complex, the cover sheet must be served with the

complaint on all parties to the action. A defendant may file and serve no later than the time of its first appearance a joinder in the

plaintiffs designation, a counter-designation that the case is not complex, or, if the plaintiff has made no designation, a designation that

the case is complex.

CASE TYPES AND EXAMPLES

ProvIsionally Complex CIvIl LItIgation (Cal.

Auto Tort

Contract

Auto (22)—Personal Injury/Property

Damage/Wrongful Death

Uninsured Motorist (46) (if the

case involves an uninsured

motorist claim subJect to

arbitration, check this item

instead of Auto)

Other PI/PONVD (Personal InIury/

Property DamageNVrongful Death)

Tort

Asbestos (04)

Asbestos Property Damage

Asbestos Personal Injury/

VVrongful Death

Product LIability (not asbestos or

toxic./environmental) (24)

Medical MalpractIce (45)

Medical MalpracticePhysicians & Surgeons

Other Professional Health Care

Malpractice

Other PUPDNVD (23)

Premlses Uability (e.g., slip

and fall)

Intentional Bodily Injury/PD/VVD

(e.g., assault, vandalism)

Intentional Inffiction of

Emotional Distress

Negligent Infliction of

Emotional Distress

Other PI/PDAND

Non-PUPDNVD (Other) Tort

Business Tort/Unfair Business

PractIce (07)

Civil Rights (e.g., discrimination,

false arrest) (not civil

harassment) (08)

Defamation (e.g., slander, libel)

(13)

Fraud (16)

Intellectual Property (19)

Professional Negligence (25)

Legat Malpradice

Other Professional MaIpractice

(not medical or legafi

Other Non-PI/PDNVD Tort (35)

Employment

VVrongful Termination (36)

Other Ernployment (15)

CM-010 (Rev. July 1, 2007)

Breach of ContractNVarranty (06)

Breach of Rental/Lease

Contract (not unlawful detainer

or wrongful eviction)

ContractNVarranty Breach—Seller

PlaIntiff (not fraud or negligence)

Negligent Breach of Contract/

Warranty

Other Breach of ContractNVarranty

CollectIons (e.g., money owed, open

book accounts) (09)

Collection Case—Seller Plaintlff

Other Promissory Note/Collections

Case

Insurance Coverage (not provisionally

complex) (18)

Auto Subrogation

Other Coverage

Other Contract (37)

Contractual Fraud

Other Contract Dispute

Real Property

Eminent DomaiNInverse

Condemnation (14)

VVrongful Eviction (33)

Other Real Property (e.g., quiet title) (26)

Writ of Possession of Real Property

Mortgage Foreclosure

Quiet Title

Other Real Property (not eminent

domain, landlord/tenant, or

foreclosure)

Unlawful Detalner

Commercial (31)

Residential (32)

Drugs (38) (if the case Involves Illegal

dregs, check this item; otherwise,

report as Commercial or Residential)

JudIcIal RevIew

Asset Forfeiture (05)

Petition Re: Arbitration Award (11)

1Nrit of Mandate (02)

VVrit—Administrative Mandamus

VVrit—Mandamus on Umited Court

Case Matter

Writ—Other Limited Court Case

Review

Offter Judicial Review (39)

Review of Health Officer Order

Notice of Appeal—Labor

Commissioner Appeals

CIVIL CASE COVER SHEET

Rules of Court Rules 3.400-3.403)

Antitrust/Trade Regulation (03)

Construction Defect (10)

Claims InvoIving Mass Tort (40)

Securities Litigation (28)

EnvIronmental/Tmdc Tort (30)

InsuranCe Coverage Claims

(arising from previsionally complex

case type listed above) (41)

Enforcement of Judgment

Enforcement ofJudgment (20)

Abstract ofJudgment (Out of

County)

Confession of Judgment (non-

domestic mlations)

Sister State Judgment

Administrative Agency Award

(not unpaid taxes)

PetitioNCertification of Entry of

Judgment on Unpald Taxes

Other Enforcement of Judgment

Case

miscellaneous Civil ComplaInt

RICO (27)

Other Complaint (not specified

above) (42)

Dedaratory Relief Only

Injunctive Relief Only (nonharassment)

Mechanics Uen

Other Commercial Complaint

Case (non-tort/non-complex)

Other Civil Complaint

(non-tort/non-complex)

Miseellaneous CIvit Petition

Partnership and Corporate

Govemance (21)

Other Petition (not specified

above) (43)

Civil Harassment

Workplace Violence

Elder/Dependent Adult

Abuse

Election Contest

Petition for Name Change

Petition for Relief From Late

Claim

Other Civil Petition

Page 2 ol2

EXHIBIT 32

EXHIBIT 33

EXHIBIT 34

EXHIBIT 35

EXHIBIT 36

EXHIBIT 37

EXHIBIT 38

EXHIBIT 39

EXHIBIT 40

EXHIBIT 41

EXHIBIT 42

EXHIBIT 43

EXHIBIT 44

Service of Process

Transmittal

TO:

Myrna Goodrich, U13N, Paralegal

Aetna,Inc.

980 Jolly Road

Blue Bell, PA 19422-1904

RE:

Process Served in California

FOR:

Aetna Life Insurance Company (Domestic State: CT)

05/17/2012

CT Log Number 520533014

ENCLOSED ARE COPIES OF LEGAL PROCESS RECEIVED BY THE STATUTORY AGENT OF THE ABOVE COMPANY AS FOLLOWS:

TITLE OF ACTION:

Knowles Surgery Center, LLC, Pltf. vs. Aetna Life Insurance Company, etc., et al.,

Dfts.

DOCUMENT(S) SERVED:

Summons, Complaint and Jury Demand, Exhibit(s), Notice(s), Instructions, Cover

Sheet, ADR Packet(s)

COURT/AGENCY:

Santa Clara County - Superior Court - San Jose, CA

Case # 112CV223326

NATURE OF ACTION:

Insurance Litigation - Policy benefits claimed for medical services rendered

ON WHOM PROCESS WAS SERVED:

C T Corporation System, Los Angeles, CA

DATE AND HOUR OF SERVICE:

By Process Server on 05/17/2012 at 15:46

JURISDICTION SERVED:

California

APPEARANCE OR ANSWER DUE:

Within 30 days after service - File written response // 9/4/12 at 1:30 p.m. - Case

Management Conference / / At least 15 days before the Case Management

Conference - File and serve a Case Management Statement

ATTORNEY(S) / SENDER(S):

Heather Gibson

Law Offices of Heather E. Gibson L.L.P.

20398 Blauer Drive

Saratoga, CA 95070

408-359-1035

ACTION ITEMS:

CT has retained the current log, Retain Date: 05/18/2012, Expected Purge Date:

05/23/2012

Image SOP

Email Notification, Desiree Beatt beattyd@aetna.com

Email Notification, Tracy Shorts s,^ortsT@aetna.com

CC Recipient(s)

Lisa Adinolfi, via Customer Pick-up

SIGNED:

PER:

ADDRESS:

C T Corporation System

Nancy Flores

818 West Seventh Street

Los Angeles, CA 90017

213-337-4615

TELEPHONE:

Page 1 of 1 / AT

Information displayed on this transmittal is for CT Corporation's

record keeping purposes only and is provided to the recipient for

quick reference. This information does not constitute a legal

opinion as to the nature of action, the amount of damages, the

answer date, or any information contained in the documents

themselves. Recipient is responsible for interpreting said

documents and for taking appropriate action. Signatures on

certified mail receipts confirm receipt of package only, not

contents.

SUM-100

SUMMONS

•

(CITACION JUDICIAL)

■FOR COPRT yfiE ONLY

(SOLO.PAR4 Ug(Ybt LA CORTE)

NOTICE TO DEFENDANT:

P

(AVISO AL DEMANDADO):

AETNA LIFE INSURANCE COMPANY, (A Foreign Corporation), and

DOES 1 through 25, inclusive

Ft 27 zipd

rzixIH

„

By:

YOU ARE BEING SUED BY PLAINTIFF:

Cut

DeiviGet

(LO ESTA DEMANDANDO EL DEMANDANTE):

KNOWLES SURGERY CENTER, LLC

NOTICEI You have been sued. The court may decide against you without your being heard unless you respond within 30 days. Read the information

below.

You have 30 CALENDAR DAYS after thls summons and legal papers are served on you to file a written response at this court and have a copy

served on the plaintiff. A letter or phone call will not protect you. Your written response must be in proper legal form if you want the court to hear your

case. There may be a court form that you can use for your response. You can find these court forms and more informafion at the Califomia Courts

Online Setf-Help Center (www.courtinfo.ca.goviselfhelp), your county law library, or the courthouse nearest you. If you cannot pay the filing fee, ask

the court clerk for a fee waiver form. If you do not file your response on time, you may lose the case by defautt, and your wages, money, and property

may be taken without further wamIng from the court.

There are other legal requirements. You may want to call an aftomey right away. If you do not know an attomey, you may waM to call an attorney

referral service. If you cannot afford an attomey, you may be elIgible for free legal services from a nonprofit legal services program. You can locate

these nonprofit groups at the Cafifomla Legal Services Web site (www.lawhelpcalifomia.org), the California Courts Online Self-Help Center

(www.courtinfo.ca.goviseffhelp), or by contacting your local court or county bar association. NOTE: The court has a statutory lien for waIved fees and

costs on any settlement or arbitration award of $10,000 or more in a civil case. The court's lien must be pald before the court will dismiss the case.

Lo han demandado. Si no responde dentro de 30 dles, Ia corte puede decIdir en su contra sin escuchar su versi6n. Lea informacido a .

continuaciOn.

Tiene 30 DIAS DE CALENDARIO despues de que le entreguen esta citacien y papeles legales para presentar una respuesta por escrito en esta •

corte y hacer que se entregue una copia al demandante. Una carta o una Ilamada telef6n1ca no lo protegen. Su respuesta por escrito tlene que estar

en formato legal correcto si desea que procesen su caso en la corte. Es posible que haya un formulado que usted pueda usar para su respuesta.

Puede encontrar estos formularios de Ia corte y mes informacI6n en el Centro de Ayuda de las Cortes de Califomia (www.sucorte.ca.gov ), en la

biblioteca de leyes de sutondado o en Ia coite que le quede m6s cerca. Si no puede pagar la cuota de presentaci6n, pida al secn3tario deJa corte

que le de un formulario de exenciOn de pago de cuotas. Sirto presenta su respuesta a tiempo, puede perder el caso por incumplimiento y la corte le

podre quitar su sueldo, dinero y bienes sin mes advertencia.

Hay otros requisitos legales. Es recomendable que Ilame a un abogado inmediatamente. S/no conoce a un abogado, puede Ilamar a un servicio de

remisiOn a abogados. Si no puede pagar a un abogado, es posible que cumpla con los requisitos para obtener servicios legales gratuitos de un

pregrama de servicios legales sIn fines de lucia. Puede encontrar estos grupos sin firres de lucro en el sitio web de Califomia Legal Services,

(www.lawhelpcalifomia.org), en el Centto de Ayuda de las Cortes de Califomia, (www.sucorte.ca.gov) o poniendose en contacto con Ia corte o el

colegio de abogados locales. AVISO: Por ley, la corte tiene derecho a reclamar las cuotas y los costos exentos por imponer un gravamen sobre

cualquier recuperaciOn de $10,000 6 m6s de valor recibfda mediante un acuerdo o una concesiOn de arbitrafe en un ciso de derecho civil. Tiene que

pagar el gravamen de Ia corte antes de que la corte pueda desechar el caso.

The name and address of the court is:

nombre y direcciOn de la corte es):

CASE NUMBER:

Memero del Ceso):

Alttlt%

Santa Clara County Superior

191 North First St., Saii)ose, CA 95113

The name, address, and telephone number of plaintiffs attorney, or plaintiff without an attomey, is:

(EI nombre, la direcciOn y el nOmero de telafono del abogado del demandante, o del demandante que no tiene abogado, es):

Heather Gibson, Law Offices of Heather E. Gibson, 20398 Blauer Dr., Saoja, CA; 408-359-1035

teeet.

DATE:

Clerk, by

DAiliDayAmAsida

(FectOR2 202 (Secreta

rio)

, Deputy

(Adjunto)

caidgypentiveOfFvT aetV

(For proof of service of this summons, use Proof of Service of Summons (form POS-010).)

(Para prueba de entrega de esta citatiOn use el formulario Proof of Service of Summons, (POS-010)).

NOTICE TO THE PERSON SERVED: You are served

[SEAL]

1. 1-1 as an individual defendant.

2. r--1 as the person sued under the fictitious name of (specify):

AcTiti4

3.

,,

,

on behalf of (specify): 1 646.(6 m

under

ogrUICE CDA1)64(

copowno Nt.)

CCP 416.10 (corporation)

CCP 416.20 (defunct corporation)

F-1 CCP 416.40 (association or partnership)

E

1i

1-1

CCP 416.60 (minor)

CCP 41.6.70 (conservatee)

CCP 416.90 (authorized person)

other (specify):

4. = by personal delivery on (date):

Pape 1 of 1

•Form Adopted for Mendetcry Use

Judlcial Coundl of Cafrtomla

SUM-10D [Rev. July 1, 2009]

SUMMONS

Code of CMI Procedure §§ 412.20, 485

wmv.courtinto.ca.gov

www.accesslaw.com

Heather E. Gibson (SBN 240938)

Law Oftices of Heather E. Gibson

20398 Blauer Drive

Saratoga, CA 95070

(408) 35971035

(408) 359-1102 (fax)

legal@basurgical.com

Attorneys for Plaintiff,

KNOWLES SURGERY CENTER, LLC

OR 27 irilz

,

E.

atWitAg

Jah.

444M

IN THE SUPERIOR COURT OF THE STATE OF CALIFORN1A

COUNTY OF SANTA CLARA

DOWNTOWN SUPERIOR COURT

LIMITED JURISDICTION-UNDER $10,000

KNOWLES SURGERY CENTER, LLC, ) Case No.

Plaintiff

v.

KNOWLES SURGERY CENTER, LLC.'

) COMPLAINT FOR DAMAGES AGAINS

) DEFENDANT AETNA LIFE INSURANC

) COMPANY

AETNA L1FE 1NSURANCE COMPANY

Foreign Corporation), and DOES 1 through )

)

25, inclusive,

Defendants

Al%"""6

1) Breach of Contract

2) California Business & Professions

Code § 17200 et seq.

3) Negligent Misrepresentation

4) Promissory Estoppel

5) Equitable Estoppel.

) DEMAND FOR JURY TR1AL

) DEMAND UNDER $10,000

PLAIN'FIFF'S COMPLAINT FOR DAMAGES

INTRODUCTION

2

3

1. This is an action for Breach of Contract, for violations of California Business and

4

Professions Code § 17200 et seq., for Negligent Misrepresentation, Promisso

5

Estoppel, and Equitable Estoppel against Defendant AETNA L1FE 1NSURANC

6

COMPANY. ("AETNA").

2 By the allegations set forth herein, Plaintiff KNOWLES SURGERY CENTER, Ile

7

("KNOWLES"), seeks damages for the difference between the amount that AETN

8

paid KNOWLES for surgical procedures performed, and the amount billed b

9

KNOWLES for those surgical procedures in addition to other damages, according t

10

proof at trial.

I1

2. Pursuant to AETNA'S agreement with KNOWLES, AETNA was required to pay 70°/

12

of the cost of approved surgica1 procedures for out-of-contract providers, such

13

KNOWLES.

14

3. Plaintiff KNOWLES is now pursuing payment on its own behalf only, for th

15

underpaid surgery by pursuing each Cause of Action against AETNA stated below.

16

4.

Defendant AETNA failed to make full payment to KNOWLES, and instead paid onl

17

$860.19 of the billed $12,500.00, or approximately 6% rather than the 70% promise

18

by AETNA.

19

5. Plaintiff KNOWLES is ignorant of the true names and capacities of defendants sue

20

herein as DOES 1-25, inclusive, and therefore sues defendants by such lictitious names.

21

Plaintiff KNOWLES will amend this complaint to allege their true names an

22

capacities when ascertained.

23

6. Plaintiff KNOWLES is informed and believes and thereon alleges that, at all time

24

herein mentioned, each of the defendants sued herein was the agent and employee o

25

each of the remaining defendants and was at all times acting within the purpose an

26

scope of such agency and employment.

27

///

28

PLAINTIFF'S COMPLAINT FOR DAMAGES

-2

KRISDICTION AND VENUE

7. This action arises under California law• and the amount in controversy is less tha

$10,000.00, and therefore venue in an limited jurisdiction is appropriate.

8. .lurisdiction is proper pursuant to Cal. Civ. Proc. Code §§ 410.10, 410.50 and 1060.

9. Venue is proper in this judicial district pursuant to Cal. Civ. Proc. Code § 395.

10. This case is not pre-empted by Federal ER1SA law, because Plaintiff has alleged direc

causes of action under California state law against its patient's insurer, AETNA, fo

breach of contract, negligent misrepresentation, promissory estoppel, breach of contrac

and equitable estoppel. Kurtz, Richard, Wilson & Co. Inc. v. Insurance Communicator

Marketing Corp. (1993) 12 Cal.App.4th 1249.)

THE PART1ES

11. Plaintiff, KNOWLES, is, and at all times herein mentioned was, a California Limited

Liability Corporation organized and existing under the laws of the State of California

with its principle place of business located at 555 Knowles Drive Suite 115, Los Gatos,

County of Santa Clara.

12. Plaintiff is informed and believes that Defendant AETNA both advertises for, and

conducts business on a continuous basis within the State of California, County of Santa

Clara.

13. The individual upon whom the surgery at issue was performed, identified by AETNA

Member ID W157266080 (in compliance with the Federal Health Insurance Portability

and Accountability Act (HIPAA)) resides within the County of Santa Clara in the State

of California.

14. The surgery upon which this lawsuit is predicated was performed at the KNOWLES

center located in Los Gatos , California, which is managed by the Bay Area Surgical

Management, LLC., located in Santa Clara County California.

///

PIAINl'IFF'S COMPLA 1NT FOR DAMAGES

-3

FACTUAL ALLEGATIONS

15. KNOWLES is an ambulatory surgery facility located in Los Gatos, California.

16. One of KNOWLES's patients, (identified by AETNA Member ID No. W157266080

and AETNA Claim ID: E334TXTSCOO in order to preserve the patient's privacy in

compliance with HIPPA laws) hereafter referred to as "PATIENT" was scheduled for

surgery on September 8, 2011 at KNOWLES. Dr. Norman J. Kahan was scheduled to

perform the surgery.

17. The surgery performed by Dr. Norman J. Kahan consisted of Right L5 &

SlTransforaminal Epidural Steroid Injection under Fluoroscopic Guidance,.

Epidurogram and use of Fluoroscopic Guidance, Conscious Sedation and Local

anesthetic for sedation by HIPPS and Current Procedural Terminology (CPT) Codes:

724.4, 64483,64484..

18. The PATIENT was insured by AETNA.

19. Prior to the PATIENT's scheduled surgery, on September 7 , 2011, Lisa a KNOWLES

employee verified with an employee of AETNA via phone that pre-authorization was

not necessary for the surgery the PATIENT was scheduled to undergo. AETNA

employee Doray M. and Lory S. provided a reference number of 1047897556 and

1047897556 for this surgery. The same AETNA employee then confirmed that the

PATIENT was covered under AETNA health insurance, and verified the terms of the

PAT1ENT's insurance coverage. In addition, KNOWLES contirmed that the PATIENT

was insured by AETNA online, in the provider self-service-eligibility and benefits

details portion of AETNA's web page. This online verification further verified that

AETNA would cover the PATIENT for at least 70% of the billed price of procedures

on the PATIENT by KNOWLES an out of network provider.

20. On September 8, 2011, Dr. Norman J. Kahan performed the PATIENT's surgery, as

scheduled, and exactly as described to the AETNA agent who stated that preauthorization was not necessary and provided reference numbers for the above-stated

planned procedures.

PLAINTIFFIS COMPLAINT FOR DAMAGES

-

4

21. Shortly following the PAT1ENT's surgery, KNOWLES billed AETNA for the

PATIENT's procedure, however, AETNA failed to tender the amount due.

22. Thereafter, KNOWLES contacted AETNA via written correspondende, sent on

December 22, 2011, informing AETNA of the underpaid claim, and requesting that the

claim be paid as promised.

23. Thereafter, KNOWLES contacted AETNA again via written correspondence, sent on 228-2012 informing AETNA of the underpaid claim, requesting that the claim be paid

according to the PATIENT's insurance benefits as promised, and informing it of

KNOWLES s intent to file suit in the event that no further payment was made within

fourteen (14) days of AETNA's receipt ofKNOWLES's correspondence.

24. To date, AE'TNA has refused to pay the contracted price for the PATIENT's surgical

procedures, therefore KNOWLES has brought this instant action to recover the amount

it is owed.

FIRST CAUSE OF ACTION

(Breach of Contract Against Defendant AETNA)

25. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

26. On information and belief, on or about August 27, 2007, the PATIENT and Defendant

AETNA, entered into a written contract whereby AETNA agreed to tender payment in

the amount of 70% of the billed price for qualified surgical procedures.

27. Because KNOWLES was an out-of-network provider at the time that the PATIENT's

surgery was performed, this agreement extended to those procedures performed at

KNOWLES.

28. Prior to performing surgery on PATIENT, KNOWLES contacted AETNA via phone in

order to verify that the scheduled surgical procedures would be considered "qualified"

and therefore covered by AE'TNA. AETNA verified the PATIENT vvas covered, and

that no pre-authorization was necessary for the scheduled procedures. Reference

numbers were provided: 1047897556 and 1047897556 for this surgery. Accordingly,

PLAINTIFF'S COMPLAINT FOR DAMAGES

-5

1

Plaintiff perfonned medically necessary surgery on the PATIENT, an individual

2

insured by AETNA.

3

29. Nevertheless, Defendant AETNA breached its contract as described in 20, 21, 22,

4

and 23 of the instant complaint by failing and refusing to perform in good faith its

5

promise to honor the contracted agreement and to tender 70% of the billed amount

6

which was it's obligation or $7,639.81 for services rendered.

7

30. As a result of the breach of Defendant AETNA, in the obligations pursuant to the

8

contract as described herein for the entire sum of $12,500.00 less the allowed amounts,

9

or $7,639.81 is now due, owing and unpaid; Plaintiff has made numerous demands

10

upon Defendant for payment, but no further payment has been made.

11

31. To date, Defendant AETNA has failed and refused, and continues to fail and refuse to

12

tender full payment pursuant to the terms of its contract as described herein for the

13

$12,500 billed for the procedures at issue by Plaintiff KNOWLES. Defendant has

14

therefore breached its contract with Plaintiff, who has been damaged thereby in the sum

15

of the difference between the amount allowed by AETNA, and the amount outstanding,

16

or $7,639.81 plus interest at the legal rate from and after the date due according to the

17

proof, plus additional damages including the costs of this lawsuit as stated below

18

according to proof.

19

20

SECOND CAUSE OF ACTION

•

(California Business & Professions Code 17200 eL seq. Against Defendant AETNA)

32. Plaintiff incorporates by reference each and every allegation in the preceding

21

paragraphs.

22

33. The Unfair Competition Act (UCA) California Business and Professions Code 17200 et

23

seq., prohibits any "unlawful, unfair or fraudulent business act or practices..."

24

34.1n the instant case, AETNA unlawfulljf refused to honor the terms of its contract

25

described herein in violation of section §235(2) of the Restatement Second of

26

Contracts, and thus, giving rise to FOREST's claim to damages pursuant to Califomia

27

Civil Code section §3300 et seq.

28

PLAINTIFF'S COMPLAINT FOlt DAMAGES

-6

1

35. Defendant AETNA, further illegally attempted to persuade Plaintiff into agreeing to

2

take less than the contracted arnount for services rendered, on numerous occasions, in a

3

bad faith attempt at settlement, in violation of California Insurance code § 790.03 and

4

also in contravention of California Business and Professions code §17200. et seq.

5

36. Defendant AETNA did nothing to correct the apparent illegalities in attempting to

6

persuade Plaintiff KNOWLES to settle for a lower amount than what it owed, and

7

instead, verified those illegalities by doing nothing in response to KNOWLES's

8

repeated requests for appropriate payment.

9

37. Further, there has been no response from DEFENDANT to Plaintiff's written demand

10

sent on February 28, 2012, and therefore, AETNA has further violated California Ins.

11

Code §790.03 by failing to respond within the applicable (30) day time period.

12

38. By engaging in unlawful conduct pursuant to California Civil Code §3300 that violates

13

the parameters set forth in the Restatement Second of Contracts §235(2), by making

14

misrepresentations with respect to authorization given for the PATIENT's surgical

15

procedures and the percentage of the authorized amount that would be paid, and for

16

violations of insurance code §790.03, AETNA is engaging in unlawful business

17

practices and is in violation of Business and Professions code §17200 et seq.

18

19

20

21

22

THIRD CAUSE OF ACT1ON FOR NEGLIGENT MISREPRESENTATION

(Against Defendant AETNA)

39. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

40. Defendant AETNA owed a duty to Plaintiff KNOWLES to give it accurate statements

of fact with respect to the pre-authorization of surgery scheduled to be performed on

23

24

25

the KNOWLES PATIENT insured by AETNA.

41. Defendant AETNA made a statement to KNOWLES through its agent, that " preauthorization was not necessary" for the surgery that the PATIENT was scheduled to

26

undergo on September 8, 2011, and thereafter provided reference numbers for the

27

28

same.

PLAINTIFF'S COMPLAINT FOlt DAMAGES

-7

42. The AETNA employee and agent who made this statement either knew, or should have

known, that making this statement to the KNOWLES employee who had called for preauthorization would cause that KNOWLES employee to rely on that statement and go

forward with the surgery with the understanding that AETNA had expressly authorized

it.

43. KNOWLES justifiably relied on AETNA's misrepresentations as set forth above, and

went forward with the procedure, reasonably expecting to be reimbursed at the very

least in the amount of 70% of the billed price of the surgery pursuant to the express

statements from AETNA, that out-of-network providers, such as KNOWLES would be

paid at least 70% of the billed amount.

44. In the event that the AETNA representative had told KNOWLES that it would not

authorize its insured's scheduled procedure for any reason, or refused to give preauthorization for any reason, then KNOWLES would not have gone forward with the

PAT1ENT's surgery as scheduled.

45. As a direct and proximate cause of the misrepresentation made to KNOWLES,

KNOWLES went forward with the PATIENT's surgery, and payment was not made at

the contracted for amount, and therefore KNOWLES suffered damages as a result of its

reliance upon AETNA's misleading and incorrect statements.

46. As a direct and proximate cause of KNOWLES's justifiable refiance upon AETNA's

misrepresentations, KNOWLES suffered loss according to proof at trial.

FOURTH CAUSE OF ACTION FOR PROMISSORY ESTOPPEL

(Against Defendant AETNA)

47. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

48. Defendant AETNA made a clear and definite promise to KNOWLES when

KNOWLES contacted AETNA, gave AETNA specific information regarding

procedures to be performed, prior to the PATIENT's surgery, and requested verification

that pre-authorization need not be given to KNOWLES. AETNA responded to

PLAINTIFF'S COMPLAINT FOR DAMAGES

-8

KNOWLES's request by expressly stating that " pre-authorization was not necessary"

for the procedure codes given and thereafter provided reference numbers as stated

herein. Therefore, KNOWLES, as an out-of-network provider would be paid for at

4

least 70% of the billed amount for the PATIENT's procedure. (Detailed in Exhibit A

5

attached hereto). Therefore, KNOWLES went forward with the PAT1ENT's scheduled

6

surgery in reliance on AETNA's statement.

7

49. AETNA made the above-mentioned promise that pre-authorization was not required

8

for the PATIENT's scheduled surgery with the expectation that KNOWLES would rely

9

on that promise, and would go forward with the PATIENT's surgery as scheduled.

10

50. It was foreseeable that KNOWLES would proceed with the PATIENT's surgery, as

11

scheduled, based on AETNA's assurance that " pre-authorization was not necessary"

12

and provided reference numbers prior to the time that the surgery was performed.

13

51. KNOWLES reasonably relied upon AETNA's promise that pre-authorization was not

14

required, and therefore went forward with the PATIENT's surgery as scheduled.

15

52. KNOWLES suffered a detriment of a definite and substantial nature as a result of its

16

reasonable reliance upon AETNA's above stated promise in that it was not reimbursed

17

at the contracted rate for the services rendered to the PATIENT, and in fact, was paid

18

less than 6% of the cost of the billed surgical procedures performed.

19

20

21

22

23

FIFTH CAUSE OF ACTION FOR EQUITABLE ESTOPPEL

(Against Defendant AETNA)

53. Plaintiff incorporates by reference each and every allegation in the preceding

paragraphs.

54. AETNA had been advised, prior to the date of the PATIENT's surgery, that

24

KNOWLES had scheduled surgery for that PATIENT, and had expressly explained to

25

AETNA what that surgery would consist of, therefore AETNA had been advised of all

26

relevant facts prior to the PATIENT's surgery.

27

55. AETNA was aware that, and intended for, KNOWLES to proceed with the PATIENT's

28

surgery, as scheduled, and AETNA's intentions were supported by its refusal to explain

PLAINTIFF'S COMPLA1NT FOR DAMAGES

-9

to KNOWLES that it would not cover any portion of the PATIENT's procedure at the

agreed upon contracted rate of 70')/0 or more of the billed procedure's price. As such,

AETNA's actions and omissions were reckless and malicious.

56. KNOWLES was ignorant of the true facts, specifically that AETNA had decided not to

cover the PATIENT's scheduled surgical procedure at the rate of 70% or more.

57. KNOWLES relied, to its detriment upon AETNA's statement that was given in moving

forward with the PATIENT's surgical procedure as scheduled, instead of cancelling it.

KNOWLES therefore lost a significant amount of money, in having to complete the

PATIENT's surgery, pay for all of the cost and labor associated with that surgery, and

then to be paid less than 6% of the billed price of that surgery. Consequently,

KNOWLES has changed its position for the worse in its good faith reliance upon

AETNA's negligent misrepresentations with respect to payment for the PATIENT's

procedures.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff prays for declaratory relief and judgment as follows:

1)

That defendant AETNA must pay to plaintiff the amount of $7,639.81.00

plus interest at the legal rate accruing from the date of breach;

2)

Pre-judgment and post-judgment interest as allowed by law;

3)

Costs According to proof; and

4)

Such other and further legal and equitable relief as the Court deems jus

and proper.

DEMAND FOR .IURY TRIAL

Plaintiff hereby demands a trial by jury.

LAW OFFICES OF HEATHER E. G1BSON

DATED: April 18, 2012

By:

HEATHER E. GIBSON

Attorney for Plaintiff Knowles Surgery Center, LLC

PLA I NTI FF'S COMPLA I NT FOR DA MAGES

- 10

EXHIBIT A

EXHIBIT A

Dec. 20. 201)

N 0.

8:00AM

KNOWLES SURGERY CENTER

Insurance Verification Forin

Patient Name:

Physician Name: Procedure/ CpT ents:

Employer Name: Employer Address: Workers Comp: Y N Date of Injury: Auth ft:

Adjnster's Name:

Work Phone: Claim #: Phone:

Phone0C4

Insurance Comp

Ciaims ddresS:

Plakei

City:

State: Ahreumr.

Subscriber (if diff rent from p . tien ): •

Relationship to Patient:

Subscriber DOB: Subscribers S.S gt;

ID #: cam

Patients D013:

Zip Code:

.s #: m.f l"

g:C 3

Group #: phone;

Insurance. Company Name: Claims Address: Zip Code: State: City: Subscriber (if different from patient): Relationship to Patient: Subscriber DOB: Patients S,S 41: Subscribers S.S#: Group ID#: Patients DOB: Date Called:

Contracted: Y

Called By;

. Effective Date:

In-Network:

Co-Pay: $

Verified With:_

(ifnot contracted obtain both In and Out Jetvvork)

Deductible: $

rnet: Deductible: $

Co-Ins:

.2 0

AMOUrrt

Out-of-Network:

Co - Pay:

11/ Ins C

BenefSt/ Coirerage Comments:

JN

otrr

tt.

vers

00P

gggi

2000

spmated Charges:

,•

,2C7)

f

pag

Per:

Auth #: Pre-Auth Required: Y

frQce5l ireJCP

Arnount met:

rterin

Daily Max:

DUE FRON PATIENT

DUE POR ANESI'HESIA

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address):

—

FOR COURT USE ONLY

Heatber E. Gibson (SBN 240938)

Law Offices of Heather E. Gibson

20398 Blauer Drive, Saratoga, CA 95070

TELEPHONE NO.:

ATTORNEY FOR (Name):

408-359-1035

FAX NO.:

ss.:a3)

-1

.

408-359-1102

Plaintiff Knowles Surgery Center, LLC

4PR. 27

SUPERIOR COURT OF CAUFORNIA, COUNTY OF Santa Clara

STREET ADORESS:

191 North First Street

nai2

MAILING ADDRESS:

San Jose, CA 95112

'

Su p erior

CASE NAME: Knowles Surgery Center, LLC v Aetna Life lns Co

CITY AND ZIP CODE:

BFtANCH NAME:

CIVIL CASE COVER SHEET

El Unlimited

rA

(Amount

demanded

exceeds $25,000)

Limited

(Amount

demanded is

$25,000 or less)

4

1? •

4(cA2

Vithiecit

CASE NUMBER:

Complex Case DesIgnation

Joinder

. Counter

Filed with first appearance by defendant

(Cal. Rules of Court, rule 3.402)

JUDGA

DEPT:

A at

Cl/ v 1

rl

'5 ' Z b

.

Items 1-6 below must be completed (see instructions on page 2).

1. Check one box below for the case type that

Auto Tort

= Auto (22)

Uninsured motortst (46)

Other PUPD/WD (Personal Injury/Property

Damage/Wrongful Death) Tort

Asbestos (04)

= Product liability (24)

Medical malpractIce (45)

Other PI/PDMD (23)

Non-PUPD/WD (Other) Tort

Business tort/unfair business practice (07)

= Civil rights (08)

Defamation (13)

Fraud (16)

Intellectual property (19)

= Professional negligence (25)

Other non-PUPD/WD tort (35)

Ene

l loyment

I

Wrongful termination (36)

Other employment (15)

El

El

El

El

El

LI

best describes thls case:

Contract

[71 Breach of contract/warranty (06)

= Rule 3.740 coltectIons (09)

= Other coIlections (09)

= Insurance coverage (18)

= Other contract (37)

Real Property

Eminent domain/Inverse

condemnation (14)

= Wrongfut eviction (33)

= Other real property (26)

Unlawful Detainer

Commerclal (31)

= Resldential (32)

= Drugs (38)

Judicial Review

Asset forfeiture (05)

Petitton re: arbitration award (11)

Writ of mandate (02)

LI

Provisionally Complex Civil LitlgatIon

(Cal. Rules of Court, rules 3.400-3.403)

=Antitrust/Trade regulation (03)

1-1 ConstructIon defect (10)

= Mass tort (40)

Securities litigation (28)

Environmental/ToxIc tort (30)

Insurance coverage claims arising from the

above listed prcivisionally complex case

types (41)

LI

LI

Enforcement ofJudgment

1-1 Enforcement of judgment (20)

MisceIlaneous Civil Complaint

RICO (27)

= Other complaint (not specified above) (42)

El

Miscellaneous Civil Petition

1-1 Partnership and corporate govemance (21)

Other pelition (not specified above) (43)

1-1 Other judicial review (39)

complex under rule 3.400 of the California Rules of Court. If the case is complex, mark the

2. This case I 1 is

LLI is not

factors requiring exceptional judicial management:

a. = Large number of separately represented parties d n Large number of witnesses

b. = Extensive motion practice raising difficult or novel e ElCoordination with related actions pending in one or more courts

in other counties, states, or countries, or in a federal court

issues that will be time-consuming to resolve f. El Substantial postjudgment judicial supervision

c El Substantial amount of documentary evidence 3. Remedies sought (check all that apply): a.M monetary b.= nonmonetary; declaratory or injunctive relief c. El punitive

4. Number of causes of action (specify):

5. This case = is

17:1 is not a class action suit.

6. lf there are any known related cases, file and serve a notice of related case. (You may use orm CM

Date: April 27, 202

Heather E. Gibson

(SI

(TYPE OR PRINT NAME)

RE OF PARTY OR ATTORNEY FOR PARTY)

NOTICE

• Plaintiff must file this cover sheet with the first paper filed in the action or proceeding (except small claims cases or cases filed

under the Probate Code, Family Code, or Welfare and Institutions Code). (Cal. Rules of Court, rule 3.220.) Failure to file may result

in sanctions.

• File this cover sheet in addition to any cover sheet required by local court rule.