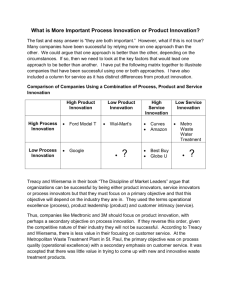

Build the management discipline to grow

advertisement

The Discipline to Grow April 2007 Michael Treacy Treacy & Company Inc. 781-400-5050 mtreacy@gen3.com Could my business grow steadily at double-digit rates? Most Most companies companies only only see see barriers barriers to to growth growth Market Market Opportunity Opportunity • The demand isn’t there Competitor Competitor Resistance Resistance • We’d start World War III Operational Operational Capacity Capacity • We couldn’t add that much capacity Financial Financial Capacity Capacity Management Management Capacity Capacity Copyright Treacy & Company, 2007 • We couldn’t afford the cash costs • I don’t have the management discipline to grow 2 But many firms are achieving even stronger growth Growth Growth Celebrities Celebrities Emerging Emerging Stars Stars Little Little Known Known Successes Successes • Wal*Mart (15.6%) • H&R Block (27.2%) • Mohawk (12.4%) • Harley Davidson (18.4%) • Lowes (21.2%) • Paychex (19.0%) • Starbucks (25.9%) • Medtronic (17.0%) • Oshkosh Truck (20.6%) • Southwest (11.3%) • Johnson Controls (13.9%) • Copyright Treacy & Company, 2007 3 Biomet (13.8%) What Does it Take to Grow at Double-Digit Rates? Key Question How It’s Answered Value Value Leadership Leadership • Why will customers do business with us? • Develop and deliver superior customer value Growth Growth Strategy Strategy • How and where are we going to achieve growth? • Build a growth portfolio of individual initiatives Growth Growth Discipline Discipline • How do we achieve steady growth results? • Develop a growth discipline in the management team Copyright Treacy & Company, 2007 4 Key Findings • Commit to superior customer value in everything you do Why Why should should customers customers do do business business with with you? you? Copyright Treacy & Company, 2007 5 Unmatched Customer Value Why Why should should customers customers do do business business with with you? you? Benefits Costs Products “What we sell” Price Uniquely Better Product Hassle-Free Results Expertise Service “How we do business” Copyright Treacy & Company, 2007 6 Value Leadership is built on Operating Model innovations Traditional PC Manufacturer Component Component Supplier Supplier Raw Material Assembly Finished Goods Distributor Distributor Dealer Dealer Dell Component Component Supplier Supplier Integrate Suppliers Copyright Treacy & Company, 2007 Assembly Assembly Build to Order Sell Direct Customer Intimacy – The architecture of customer value Why do you need us as a partner? How do we drive results for you? What are we competent at? Copyright Treacy & Company, 2007 Customer Business Problems “The Merrill Lynch point of view on these problems” “How Merrill Lynch drives results – what needs to get done” Enabling Programs (things that drive client performance) Service Engines (the things we’re good at doing) 8 “Why we’re qualified - our capabilities” Key Findings • Commit to superior customer value in everything you do • Focus on five, and only five, sources of revenue growth Copyright Treacy & Company, 2007 9 There are only five sources of revenue growth Base Base Retention Retention • To grow we first have to stop shrinking • Exploit the advantages of incumbency What Whatisisyour yourcustomer customerchurn churnrate? rate? What Whatare areyou youdoing doingabout aboutit? it? Copyright Treacy & Company, 2007 10 There are only five sources of revenue growth Base Base Retention Retention • To grow we first have to stop shrinking • Exploit the advantages of incumbency • The toughest way to grow – to win, someone else must lose • Use better value to take business directly from competitors Share Share Gain Gain How Howstrong strongisisyour yourvalue valueproposition? proposition? How Howeffective effectiveisisyour yourmarket marketcoverage? coverage? Copyright Treacy & Company, 2007 11 There are only five sources of revenue growth Base Base Retention Retention • To grow we first have to stop shrinking • Exploit the advantages of incumbency • The toughest way to grow – to win, someone else must lose • Use better value to take business directly from competitors Share Share Gain Gain Market Market Positioning Positioning • Half of success is showing up where growth is going to happen • Find the new growth segments before anyone else Which Whichmarket marketsegments segmentswill willgrow growmost moststrongly strongly over overthe thenext nextfive fiveyears? years? How Howcan canwe weget getpositioned positionedin inthose thosesegments? segments? Copyright Treacy & Company, 2007 12 There are only five sources of revenue growth Base Base Retention Retention • To grow we first have to stop shrinking • Exploit the advantages of incumbency • The toughest way to grow – to win, someone else must lose • Use better value to take business directly from competitors Share Share Gain Gain Market Market Positioning Positioning Adjacent Adjacent Markets Markets • Half of success is showing up where growth is going to happen • Find the new growth segments before anyone else • Attack neighboring markets • But, only when immediate and practical advantage is in hand In Inwhich whichmarkets marketsdo dowe wehave haveweak weakcompetition competition and andleveragable leveragableadvantage? advantage? Copyright Treacy & Company, 2007 13 There are only five sources of revenue growth Base Base Retention Retention Share Share Gain Gain Market Market Positioning Positioning Adjacent Adjacent Markets Markets New New Lines Lines of of Business Business Copyright Treacy & Company, 2007 • To grow we first have to stop shrinking • Exploit the advantages of incumbency • The toughest way to grow – to win, someone else must lose • Use better value to take business directly from competitors • Half of success is showing up where growth is going to happen • Find the new growth segments before anyone else • Attack neighboring markets • But, only when immediate and practical advantage is in hand • Acquire in unrelated markets • But, only when management has superior investment skill 14 Key Findings • Commit to superior customer value in everything you do • Focus on five, and only five, sources of revenue growth • Manage a portfolio of growth opportunities Copyright Treacy & Company, 2007 15 Copyright Treacy & Company, 2007 se gm m en en ts ta cq ui in si te tio rn ns al in no ad va ja ce tio tr n ns an ta sf cq or ui m si at tio io ns na li nn ne ov w at LO io B n ac qu is iti on s gr ow th on s cl ie nt s 3% ke ts eg to h nt ba se ac qu is iti itc cl ie Base Retention m ar sh ift in -li ne sw re ta in Percentage Revenue Growth How might your business grow 20% per year? One illustration Share Gain Market Position 20.0 16 Adjacent Markets 4% New Lines Of Business 0% 0% 3% 3% 5% 10.0 2% 0.0 0% Key Findings • Commit to superior customer value in everything you do • Focus on five, and only five, sources of revenue growth • Manage a portfolio of growth opportunities • Build the management discipline to grow Copyright Treacy & Company, 2007 17 People processes are key enablers of growth Culture Do we have our best talent in the roles where they will have the biggest impact? Deployment Do we have enough talent to “fund” our growth initiatives? Copyright Treacy & Company, 2007 Leadership Recruitment & Development 18 Do our shared attitudes and beliefs about risk taking and collaboration support our growth ambitions? Incentives Are our people focused on the right measures of performance that will drive growth? Build the management discipline to grow • Talent Management – Recruiting, development, deployment, and retention built for where we’re going, not where we’ve been • Innovation Management – Management that allows us to identify, create, test, refine, and deliver improvements in customer value quickly and effectively • Performance Management – Management control built on actionable revenue information and root cause analysis of performance shortfalls Copyright Treacy & Company, 2007 19 Better information is needed to manage growth Prior Period Revenue $7,689.0 Revenue Lost to Churn (9.0) -0.1% $7,680.0 99.9% Share Gain Revenue (0.1) 0.0% Market Positioning Revenue 9.7 0.1% Adjacent Market Revenue 7.5 0.1% New Line of Business Revenue 4.5 0.1% $8,721.0 13.4% Base Retention Revenue Current Period Revenue Copyright Treacy & Company, 2007 20 Everyone should use a Sources of Revenue Statement Prior Period Revenue $7,689.0 Revenue Lost to Churn (1,692.0) -22.0% Base Retention Revenue $5,997.0 78.0% Share Gain Revenue 1,647.0 21.4% Market Expansion Revenue 1,076.0 14.0% Adjacent Market Revenue 0.0 0.0% New Line of Business Revenue 0.0 0.0% $8,721.0 113.4% Current Period Revenue Copyright Treacy & Company, 2007 21 Conclusions • Growth opportunities abound • The challenge of growth isn’t in the marketplace – it’s in the management team • Growth demands a management discipline - just like cost control • Engage the whole management team in the challenge of growth • Certain principles underlie all forms of growth: – Your choice of markets shapes your fate. – New revenue only comes from customers – The best management team beats the best strategy every time Copyright Treacy & Company, 2007 22 The Discipline to Grow April 2007 Michael Treacy Treacy & Company Inc. 781-400-5050 mtreacy@gen3.com