Some Observations on the Convergence Experience of Turkey

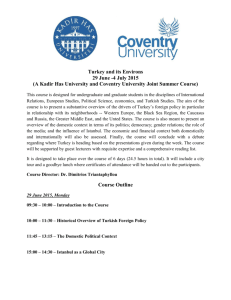

advertisement