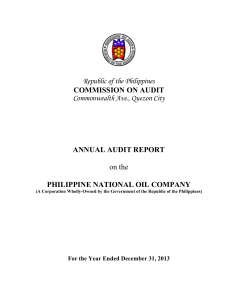

2011 - Philippine National Oil Company

advertisement