A Concise Guide to the Employees' Compensation Ordinance

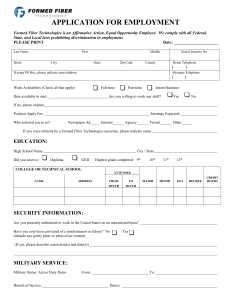

advertisement