Bank and Cash Financial Procedures

advertisement

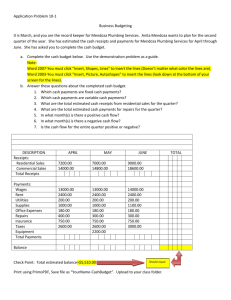

CREST Bank and Cash Financial Procedures Contents 1.1 Introduction ………………………………………………………………………….. 2 1.2 Opening/Closing of College Bank Accounts ……………………………………. 2 1.3 Bank Accounts in Operation ……………………………………………………… 2 1.4 Maximising Return on Surplus Funds …………………………………………… 2 1.5 Treasury Management …………………………………………………………….. 2 1.6 Cash Flow Forecast ……………………………………………………………….. 2 1.7 Internet Banking ……………………………………………………………………. 2 1.8 Departments Routinely Receiving Payments …………………………………… 3 1.9 Other Departments – Non Routine Receipts …………………………………… 3 1.10 Unanticipated Receipts with Other Departments ………………………………. 3 1.11 Receipts …………………………………………………………………………….. 4 1.12 Storage of Cash and Transfer of Lodgements to the Bank …………………… 6 1.13 Lodgements and Lodgement Reconciliations …………………………………... 7 1.14 Security of Cash in Transit and Financial Stationery …………………………... 8 1.15 Cheque/BACS Payment Requests Signing …………………………………….. 8 1.16 Disbursement of Cheques ………………………………………………………… 9 1.17 Direct Debit Receipts and Payments ……………………………………………. 9 1.18 Bank Reconciliations ………………………………………………………………. 9 Appendix A – List of Authorised Cheque Signatories Bank and Cash Financial Procedures – April 2012 1 1.1 Introduction The Finance Department has overall responsibility for the management and security of cash within the College. 1.2 Opening/Closing of College Bank Accounts No department or student organisation within the College may open a bank account in the College name or any other name for College business. Prior written authorisation to open any new College bank accounts must be obtained from the Principal. The Principal must also give written permission to close a College bank account. 1.3 Bank Accounts in Operation A list of all College Bank Accounts is held by the Head of Finance. 1.4 Maximising Return on Surplus Funds The College has a policy of maximising the return on any cash not being used for operations. The current account for the College currently has an automatic sweep facility with any funds greater than £30k being moved to an interest bearing call account on a daily basis. In addition, the College makes use of a deposit account that earns interest. 1.5 Treasury Management Please refer to the College Treasury Management policy. 1.6 Cash Flow Forecast A cash flow forecast is prepared to effectively manage cash balances. The forecast is built around the basic aspects of cash management, as follows: Operations; Cash Flow; and Financial Condition. The cash flow forecast is prepared on an annual basis and is broken down by month. Performance against forecast is monitored on a monthly basis by the Head of Finance who investigates and documents variances between actual and forecast balances. 1.7 Internet Banking The College currently has an online banking facility which permits the review of bank statements and transactions. Payments of some minor routine transactions that are required to be made on a faster basis than can be achieved by BACS or by cheque are made via internet banking e.g. payment of monthly childcare vouchers. Occasional other urgent payments are made in this way. Any such payments are approved in advance in accordance with the routine approval processes in place for payments made by any other means. Access to the facility is password secured and restricted to the Head of Finance (who is also the Administrator), the Assistant Accountant and to the Administrative Officer Finance – Cash Management. Permissions available to each person are dependent upon their respective roles and determined by the Administrator. Bank and Cash Financial Procedures – April 2012 2 1.8 Departments Routinely Receiving Payments 1.8.1 Finance Department Ideally all payments received from staff, students and visitors/customers - both in person or via the post - should be received by the Finance Department so that: - a receipt can be issued to the person paying, the payment can be locked away securely in accordance with the Colleges insurance cash handling obligations and safe cash holding limits – see section 1.11, checks can be made to ensure that all income due is received, staff are protected from the possibility of cash and cheques going missing and against allegations that payment has been misappropriated. The Halls Office is also authorised to receive certain payments connected with Residence and Catering related activity – see section 1.11. 1.8.2 Other Departments – Routine Receipts Certain other departments outside Finance routinely receive funds. These Departments are - Library - Learning Resources (previously LSS) and - Hospitality Services including Halls Office, Refectory and Betty’s Coffee Shop. Each of these departments has its own detailed individually documented cash handling procedures in place. To ensure that best practice in the safe handling of receipts is observed, any proposed changes to existing systems or requirement for a new system in these Departments must be agreed with the Head of Finance prior to being implemented. Other departments who may need to routinely request payments from students and other customers, e.g. Academic Registry for student application processing and Lifelong Learning must discuss the arrangements with the Finance Office in advance to avoid the receipt of payments directly within their department either in person or via the post. 1.9 Other Departments – Non-Routine Receipts Departments setting up new non-routine arrangements that involve the receipt of payments e.g. student contributions to courses costs and field trips should not issue any payment instructions to participants without first discussing the arrangements with the Finance Office. Lists of students who are to make payment for e.g. resources or courses can be provided to the Finance Office in advance and the student instructed to make payment in the Finance Office. In addition, courses offered to students can be advertised generally to students and the students book their place by making payment at the Finance Office. The Finance Office will liaise with the relevant department/co-ordinator as appropriate regarding uptake of places and outstanding contributions. 1.10 Unanticipated Receipts within Other Departments On the rare occasions when a department unexpectedly receives payment by cash or cheques from any source, these funds must be forwarded as soon as practicable after Bank and Cash Financial Procedures – April 2012 3 receipt but no later than one week after receipt, to the Finance Department for receipting, storage and lodgement. 1.11 Receipts 1.11.1 Finance and Halls Office Kalamazoo Receipts Finance and Halls Office (excluding Chatz (Refectory) and Betty’s Coffee Shop) receive payments from customers in person, by post and over the telephone. Payment may be received by cash, cheque and debit/credit card. Halls and Finance Office use Kalamazoo type pre-numbered duplicate cash receipt books to record all non-cash register receipts for the College. Both these departments must immediately record payments received and issue receipts to the customer when possible. Kalamazoo receipts for payments made by debit/credit card should be issued only after the transaction has been successfully completed. If it is not possible to issue a receipt, e.g. no contact details have been supplied by the customer, the receipt must be retained, ideally with any supporting paperwork if this has been received. If no supporting paperwork is received, a full written explanation of what the payment relates to should be attached to the receipt and this should be filed with all other receipt paperwork. No deletions or corrections should be made to any receipts. In the event of a receipt being incorrectly completed, it should be marked “void” and all parts should be retained in the receipt book with an explanation regarding why the receipt was spoiled. Customers wishing to make payment by cash in person to other departments e.g. Lifelong Learning must be brought to the Finance Office so that the payments may be receipted, recorded and safely stored awaiting lodgement. Finance Office receipts can be issued by any member of the finance team. normally in place to ensure that there is appropriate segregation of duties. A rota is Halls Office receipts are normally issued by either of the two staff who work on the counter at Halls Office. Halls Office make up their own lodgements, normally twice per week, and provide Finance with a copy of their Kalamazoo receipt book on a weekly basis. Halls Office lodgements are then traced to the College bank accounts and each transaction is recorded on the accounting system by the Administrative Officer Finance – Cash Management. Please refer to section 1.14 for guidance on the safe transit of cash to the bank. The Payroll Officer is responsible for managing receipts forwarded to Finance for lodging by Library and Learning Resources. The Administrative Officer Finance – Cash Management issues kalamazoo receipts for all payments made by customers/funders directly into the College bank account. Stocks of unused Kalamazoo receipts are securely stored by the Finance Department. 1.11.2 Other Departments Issuing Receipts The only other departments authorised to receive payments in person, by cash or cheque are the Library, Learning Resources, Chatz and Betty’s Coffee Shop who each issue cash register receipts for purchases which are made in person by the customer. Chatz will introduce the ability to pay by debit/credit card in due course. Bank and Cash Financial Procedures – April 2012 4 No other department is authorised to receive money, either temporarily or permanently, within the College unless written permission has been received from the Head of Finance who will ensure that suitable controls have been put in place. 1.11.3 Management of Receipts 1.11.3.1 Library & Learning Resources Receipts The Library and Learning Resources Departments make lodgements of their takings, normally on a weekly basis, via the Finance Department. These departments must each provide Finance with: - a summary schedule setting out the amount received according to the cash register reports since the last lodgement was made compared with the cash takings for the period, - the related cash register receipts, - the cash for lodgement. These are forwarded to the Payroll Officer who will immediately check the cash amount received and the cash register reports. When all is in order, a Kalamazoo receipt will be issued to the relevant department and a separate bank lodgement will be prepared by the Payroll Officer for lodgement at the next available date for Finance Office lodgements. 1.11.3.2 Chatz and Betty’s Coffee Shop Receipts Chatz and Bettys’ lodgements are made by the Halls Office and thus the checking routines undertaken in Finance are different to those for the Library and Learning Resources. Cash register till receipts and summaries are forwarded by Halls Office to Finance where checking is carried out and the lodgement is traced to the bank statement. 1.11.4 Payments received by Post Other departments within the College have an important role in generating income for the College e.g. Lifelong Learning. However, in order to safeguard staff responsible for handling incoming post and college resources, customers must be discouraged from making payments by cash through the post. Special arrangements are in place for the recording of payments received by post which apply to the opening of post received at Halls Office and Main Reception only. Post must be opened in the presence of two people immediately upon receipt and payments received recorded in a post received log book. Both persons must initial and date the log book immediately after the post is opened to evidence their involvement in the process. The payments received are then immediately receipted (Halls Office for post received there and in Finance for post received at Main Reception) and the supporting letter/remittance advice, the receipt and the log book are then reviewed and the log book initialled by an independent person within Finance or Halls Office to validate that all monies received by post have been receipted and checked. Departments who may from time to time request payments from customers/students must clearly identify the recipient of related correspondence within the College in all their promotional materials and instructions to potential customers to ensure that the department’s Bank and Cash Financial Procedures – April 2012 5 post will be opened by Main Reception. This is required only in order to avoid the inadvertent handling of payments received within their department. 1.12 Storage of Cash and Transfer of Lodgements to the Bank The following limits for the storage of cash in College safes are currently in operation: Location Safe Type Safe Limit Finance Stratford Stronghold £3,000 Finance Chubb £2,000 Learning Resources Stafford £2,000 Halls Stafford £2,000 Halls Stafford £2,000 Halls Chubb £2,000 The limit for cash stored outside business hours and not held in a safe is £350. Cash received awaiting lodgement may need to be stored in more than one safe to comply with the above safe cash holding limits. A lodgement must be made up prior to the cash holding limit being exceeded and stored securely in the departmental safe(s) until it can be safely lodged. These limits do not apply to cheque payments. The College’s insurance policy provides for the following thresholds relating to the transit of cash both on campus and en route to the bank: Amount of Cash in Lodgement(s) No of Able Bodied Persons Present Up to £2,499 One able bodied person £2,500 - £4,999 Two able bodied persons £5,000 – £7,499 Three able bodied persons £7,500 - £10,000 Four able bodied persons Over £10,000 Professional Security Company In addition: - the College is not insured for cash in transit in excess of £5,000, cash up to a maximum of £5,000 can be held outside a safe at any time during the working day. The Finance Office and Halls Office alone have responsibility for arranging their own lodgements. Both departments must ensure that the safe cash holding limits are not exceeded. If the limits are exceeded due to the unanticipated receipt of a large amount of cash, immediate action is required to store the funds securely in separate safes until an emergency bank lodgement can be arranged. Bank and Cash Financial Procedures – April 2012 6 1.13 Lodgements and Lodgement Reconciliations 1.13.1 Funds Transfered from Library and Learning Resources to Finance for Lodgement All cash receipts and supporting documentation should be forwarded to the Payroll Officer on an agreed day each week to facilitate lodgement. After checking and receipting, the Payroll Officer will then arrange for the lodgement of all funds received since the last lodgement was made. Lodgements take place at various times on a weekly basis or more often as required depending on the scale of cash receipts held in order to comply with safe cash holding limits. 1.13.2 Halls Office Lodgements Twice weekly, or more often as required depending on the scale of receipts held in order to comply with safe cash holding limits, Halls Office will arrange the lodgement of funds received directly to the College bank account. Please refer to section 1.14 for guidance on the safe transit of cash to the bank. The Halls Secretary will provide a copy of the Halls cash book to the Administrative Officer Finance – Cash Management together with all the supporting documentation on a regular basis – ideally this should be done on a weekly basis. This provides details of all money being received each day and a total of all money lodged to the bank. The lodgements from the Halls cash book are then traced to the College bank statements by the Administrative Officer Finance – Cash Management who enters the details of these transactions onto the Colleges computerised accounting system (Integra). The checking undertaken will include verifying the completeness of the receipt sequences, checking the coding and invoice allocation information provided and ensuring that all monies recorded as received have been lodged. 1.13.3 Lodgement Reconciliatons Halls and Finance Offices On a daily basis a written Daily Count reconciliation is undertaken of all receipts recorded for the day against funds received. This is normally undertaken by the Payroll Officer in Finance and Halls Office Secretary in Halls Office. This Daily Count reconciliation is independently reviewed by someone else within the relevant department. When lodgements are being prepared for transfer to the bank, a lodgement summary of all the kalamazoo receipt numbers covered by the period that the lodgement relates to is prepared by the Payroll Officer re the Finance lodgement and the Halls Secretary re the Halls lodgements. The lodgement summary is then independently checked and countersigned prior to the lodgement being made ensuring that all funds are being lodged, that there are no unexplained gaps in the receipt number sequence and there are no gaps between the first receipt number in the current lodgement against the last receipt number on the previous lodgement. A hard copy of the lodgement summaries for Finance and Halls are kept on file by the Administrative Officer Finance – Cash Management. The Head of Finance must be made immediately aware of any significant differences found in all reconciliation checks including those for Library and Learning Resources and an investigation will be required. Bank and Cash Financial Procedures – April 2012 7 1.14 Security of Cash in Transit and Financial Stationery No cash can be transferred via internal or external mail. All cash deposits, apart from those lodged directly to the bank on behalf of Halls Office, should be hand delivered to the Finance Office, either by an individual designated by the Head of Department or by the Security Supervisor. Halls Office lodgements are normally made by the Security Supervisor. As Halls Office lodgements may be included along with all other College lodgements which are managed by the Finance Department, Finance will be responsible for ensuring that, where any combination of lodgements has cash in excess of £2,499, the correct number of additional persons will be available to transfer the lodgements to the bank. The numbers of persons required to accompany cash is in accordance with the table at 1.12 above. All monies received should be stored in a locked safe ensuring that the safe cash holding limits imposed by the insurers are observed. 1.14.1 Storage of Financial Stationery It is important that financial stationery is securely stored to guard against misuse. Accordingly the following procedures should be followed: 1.14.2 Kalamazoo Receipts, Cheque Books and Lodgement Books All current Kalmazoo receipts, cheque books and lodgement books, including the current batch of computerised cheques must be stored in the safe in the Head of Finance’s Office. Cheque stubs of used cheque and lodgement books and unused Kalamazoo receipts, cheque and lodgement books including supplies of computerised cheques should be locked securely away in designated cabinets in the Finance Office. Only authorised Finance Office staff should remove the cheque and lodgement books, and should replace them in the safe immediately after use. Any concerns over the security of any financial stationery should be brought to the attention of the Head of Finance. 1.14.3 College Credit Card The College credit card must be kept in the safe in the Head of Finance’s Office. Approval for use must be sought from the Head of Finance before removal from the safe. The College credit card will only be used in exceptional circumstances. Complete and fully authorised procurement paperwork is required before any payment by the College credit card can be made. 1.15 Cheque/BACS Payment Requests Signing All cheques/BACS Payment Requests produced for payment must be signed by any two of the authorised signatories to the College bank accounts (Appendix A). Cheques/BACS Payment Requests should be signed only after each signatory has reviewed the appropriate supporting documentation such as invoices, travel claims etc. Bank and Cash Financial Procedures – April 2012 8 Each piece of supporting documentation should be initialled and dated by each person signing the associated cheque/BACS Payment Request. 1.16 Disbursement of Cheques Ideally cheques/BACS Payment Requests should be signed within the Finance Department so that any queries can be promptly resolved. However it may be necessary in exceptional circumstances for cheques/BACS Payment Requests be signed outside the department. Once the relevant second signatory has signed the cheque/BACS Payment Request, it should be returned in person to the Finance Department. The Purchasing Officer within the Finance Department then sends the cheque to the relevant supplier. For BACS payments an e-mail will be sent to the payee’s nominated e-mail address. 1.17 Direct Debit Receipts and Payments To reduce administration and promote secure transfer of funds from customers, the College seeks to increase the number of customers who make payment directly into the College bank account. The College does, however, seek to keep to a minimum the number of payments that are taken directly from the College bank account by suppliers by Direct Debit. Advance permission of the Head of Finance with the countersignature of another cheque signatory will be required before any new direct debit payment arrangement can be made. Records of all direct debit payments arrangements/agreements will be maintained by the Administrative Officer Finance – Cash Management. 1.18 Bank Reconciliations 1.18.1 Preparing Bank Reconciliations Bank reconciliations will be prepared on a monthly basis for all bank accounts apart from those relating to the Support Funds which are reconciled on a quarterly basis. Reconciliations must be prepared by the Assistant Accountant in line with the Finance Department period-end close down timetable. Any unusual reconciling items will be investigated during the process and in rare cases when adjustments are required, these must be approved by the Head of Finance. Each quarter the Head of Finance will be consulted about the course of action to be taken in relation to all cheques that are more than 6 months old and not yet presented to a bank. The Assistant Accountant will evidence the preparation of the reconciliations by way of dated signature. 1.18.2 Review of Bank Reconciliations The bank reconciliations should be reviewed by the Head of Finance on a timely basis after their preparation. This review should be evidenced by way of dated signature. Dr Anne Heaslett Principal Bank and Cash Financial Procedures – April 2012 20 April 2102 Date Review Date: April 2014 For distribution to: All Staff 9 Appendix A – List of Authorised Cheque Signatories Dr Anne Heaslett Principal Dr Clifford Boyd Vice Principal Ms Audrey Curry Assistant Vice Principal Ms Ursula Doherty Head of Human Resources Mrs Christine Nesbitt Head of Hospitality Services Ms Jo O’Boyle Head of Finance Mr John Chapman Head of Estates