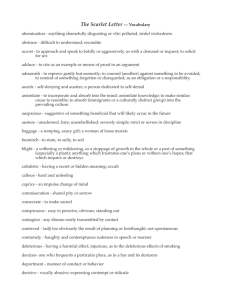

drafting, appearances and pleadings

advertisement