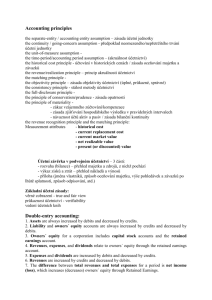

The Accounting Cycle

advertisement