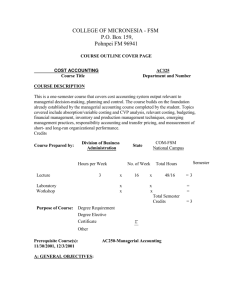

OAF 221 MANAGEMENT AND COST ACCOUNTING

advertisement

THE OPEN UNIVERSITY OF TANZANIA FACULTY OF BUSINESS MANAGEMENT DEPARTMENT OF ACCOUNTING AND FINANCE OAF 221: MANAGEMENT AND COST ACCOUNTING MODULE AIMS • • • To enable students to have a thorough understanding of cost concepts, cost accumulation Techniques and the different uses of the costing information for decision making. To prepare students to examine and demonstrate, the role of management accounting in provision and interpretation of information required by managers for decision making, planning and control To provide students with an exposure of the interrelationships between cost accounting, management accounting and financial accounting MODULE CONTENT Lecture 1: Introduction to Cost Accounting: Objectives: At the end of this lecture you will be able to Explain :- Cost terms, cost Concepts and purposes of costs (i) (ii) Describe the relationship among cost accounting, management accounting and financial accounting Explain the nature of cost accounting and management accounting (iii) (iv) Explain the role of Cost Accounting in business decisions Content • Cost terms, cost concepts, cost purposes • Cost accounting, management accounting and financial accounting Relationships • The nature of cost accounting and management accounting • The role of cost accounting in business decisions Lecture 2: Classification of costs Objectives: At the end of this lecture you will be able to (i) Classify costs (ii) Explain situations where cost is an asset or expense (iii) Describe cost estimation methods 1 Content: • • • Classification of costs Cost as an asset or expense Cost estimation methods Lecture 3: Costing for the Elements of Costs and flow of cost through accounts Objectives: At the end of this lecture you will be able to (i) Explain costing for the elements of costs (ii) Describe the flow of costs through accounts (iii) Prepare the schedule of cost of goods manufactured Content • Costing for the elements of costs • Flow of costs through Accounts • Schedule of cost of goods manufactured Lecture 4: Costing for production Overheads. Objectives At the end of this lecture you will be able to (i) Describe the process of costing for overheads and their problems (ii) Apportion and allocate overheads (iii) Treat under and over recovery of overheads Content • Costing for overheads and their problems • Apportionment and Allocation of overheads • Treatment of Under and over recovery of overheads Lecture 5: Cost accumulation: Job order/Batch costing Objectives At the end of this lecture you will be able to (i) Describe features of Job/Batch costing (ii) Explain accounting methods used to collect and report costs. (iii) Demonstrate ability to accumulate costs by using Job-order cost accounting Content • • Features of Job/Batch costing system Accounting methods used to collect and report costs 2 • Job-order cost accounting, treatments and reporting Lecture 6: Cost accumulation: Contract costing Objectives At the end of this lecture you will be able to (i) Describe features of contract costing (ii) Explain accounting methods used to collect and report costs. (iii) Demonstrate ability to accumulate costs by using contract cost accounting Content • • • Features of Contract costing system Accounting methods used to collect and report costs Contract cost accounting, treatments and reporting Lecture 7: Process costing Objectives At the end of this lecture you will be able to (i) Explain the features of process costing (ii) Explain accounting methods used to collect and report costs (iii) Describe transfers in Process Costing (iv) Describe the flow of costs in a process costing system (v) Explain the concepts of Opening and closing Work in process (vi) Explain special features of equivalent units of production (vii) Explain treatments of material losses in manufacturing industries Describe valuation of stock using Weighted Average and FIFO Methods (viii) accounting methods used to collect and report costs Content • • • • • • • • Features of process costing Accounting methods used to collect and report costs Transfers in Process Costing The flow of costs in a process costing system Opening and closing Work in process Equivalent units of production Material losses in manufacturing industries Stock Valuation methods 3 Lecture 8: Costing for joint products and By-products Objectives At the end of this lecture you will be able to (i) Describe joint products and By-products and their differences (ii) Explain Methods of joint product and By-Product costing (iii) Explain Joint costs, split off point, and subsequent costs treatments (iv) Demonstrate ability of apportioning joint costs (v) Explain problems of dealing with joint products in service organization Content • • • • • Joint products and By-products Methods of By-Product costing Joint costs, split off point, and subsequent costs treatments Methods of apportioning joint costs Problems of dealing with joint products in service organization Lecture 9: Income effects of alternative Inventory Valuation Methods Objectives At the end of this lecture you will be able to (i) Classify variable costs and fixed costs for income reporting purposes (ii) Draft variable costing and absorption costing income statements. (iii) Reconcile incomes reported under variable and absorption costing Content • • • Classification of variable costs and fixed costs for income reporting Variable costing and absorption costing income statements Reconciliation of incomes reported under variable and absorption costing Lecture 10: Cost Volume Profit Relations Objectives At the end of this lecture you will be able to. (i) Describe cost volume profit (C-V-P) analysis (ii) State the uses, assumptions and limitation of cost volume profit analysis. (iii) Describe and apply the methods of computing break-even point (iv) Demonstrate the concept of:- Margin of safety, traditional break even chart, Contribution break even chart, Profit charts and Multi product profit charts (v) Differentiate between the accountant's and economist's break-even charts. (vi) Explain the concepts of Uncertainty and Sensitivity analysis 4 (vii) Identify and explain cost and revenue drivers Content • Cost Volume Profit (C-V-P) analysis • Uses, assumptions and limitation of cost volume profit analysis. • Methods of computing break-even point • Margin of safety, traditional break even chart, Contribution break even chart, Profit volume charts and Multi product profit volume charts • Differences between the accountant's and economist's break-even charts. • Uncertainty and Sensitivity analysis • Cost and revenue drivers Lecture 11: Budgeting Objectives At the end of this lecture you will be able to (i) Explain the objectives, advantages, and challenges of Budgeting (ii) Describe stages in the planning process (iii) Describe the budgeting process (iv) Identify and demonstrate types of Budgets (v) Explain the concept of:- Planning programming and Budgeting System (PPBS), Uncertainty in Budgeting, Budget Committee, Budgeting Factor, Budgeting Manual (vi) Explain Problems in Budgeting. Content • • • • • • Objectives, advantages, and challenges of Budgeting Stages in the planning process Budgeting Process Types of Budgets Planning programming and Budgeting System (PPBS), Uncertainty in Budgeting, Budget Committee, Budgeting Factor, Budgeting Manual Problems in Budgeting. Lecture 12: Budgetary Control including behavioral issues Objectives At the end of this lecture you should be able to (i) (ii) (iii) (iv) (v) (vi) Explain the concept of responsibility Accounting Identify and Explain types of Responsibility Centers Explain the concept of Controllability Explain the problem of Dual Responsibility Explain the concept of Feed Forward and Feedback reports Consider non-Monetary Factors in budgeting process 5 (vii) Explain Control of different types of Costs (viii) Explain the concept of Participation in the Budgetary Process (ix) Explain the conflicting roles of budget (x) Explain Communication Aspects of Budgeting (xi) Explain Motivational Aspects of Budgeting (xii) Explain dysfunctional Aspects of Budget Systems Content • • • • • • • • • • • • Responsibility Accounting Types of Responsibility Centers The concept of Controllability Problem of Dual Responsibility The concept of Feed Forward and Feedback reports Consideration of non-Monetary Factors in budgeting process Controlling of different types of Costs Participation in the Budgetary Process Conflicting roles of budget Communication Aspects of Budgeting Motivational Aspects of Budgeting Dysfunctional Aspects of Budget Systems Lecture 13: Standard Costing and Variance Analysis Objectives At the end of this lecture you will be able to (i) Define standards (ii) Explain the nature and Objectives of Standards (iii) Differentiate between:- a budgetary System and a Standard Cost system, flexible Budget and standard costing (iv) Identify and explain types of standards (v) Explain uses of standards (vi) Describe the setting of Standards (vii) Explain Importance of behavioral aspects of standard costing (viii) Describe the principle of variance analysis (ix) Describe the relationships of variances (x) Identify, explain and compute various types of variances (xi) Identify and explain the difficulties in interpreting variances (xii) Reconcile budgeted profit and actual results. (xiii) Make decisions of whether to investigate or not to investigate variances. (xiv) Explain advantages and disadvantages of standard costing Content • The concepts of standards 6 • • • • • • • • • • • • • Nature and Objectives of Standards Differences between :-budgetary System and a Standard Cost system, flexible Budget and standard costing Types of standards Uses of standards Setting of Standards Behavioral aspects of standard costing The principle of variance analysis Relationships of variances Types of variances Difficulties in interpreting variances Reconciliation between budgeted profit and actual results. Decisions of whether to investigate or not to investigate variances. Advantages and disadvantages of standard costing Lecture 14: Advanced Variances Objectives At the end of this lecture you will be able to (i) Explain and compute mix and yield variances (ii) Explain and compute the sales margin variances Content • Mix and yield Variances • Sales margin variances Lecture 15: Measuring Costs and Benefits for D-Making Objectives At the end of this lecture you will be able to (i) (ii) (iii) (iv) Identify and provide the meaning of relevant and irrelevant cost Explain the benefits of relevant costs in decision making Identify quantitative and qualitative factors in decision making Make short term decision using relevant costs Content • • • • Relevant and irrelevant cost Benefits of relevant costs in decision making Quantitative and qualitative factors in decision making Relevant costs and short term decisions - make or buy a component 7 - sell or process further Acceptance/rejections of special Order Temporary shut down Equipment replacement Lecture 16: Pricing Decisions Objectives At the end of this lecture you will be able to (i) Explain Pricing Objectives (ii) Identify pricing policies (iii) Explain factors influencing pricing decisions (iv) Identify and explain pricing strategies and methods (v) Identify and use relevant costs for pricing decisions Content • Pricing Objectives • Pricing policies • Major factors influencing pricing decisions • Pricing Strategies and methods • Relevant costs for pricing decisions Lecture 17: Decision Making under Uncertainty Objectives At the end of this lecture you will be able to (i) Describe a decision making model (ii) Identify risk and uncertainty in decision making (iii) Demonstrate the application of probability distribution in decision making under uncertainty (iv) Use decision trees as a model in decision making (v) Use cost information for pricing under conditions of uncertainty (vi) Make decisions for buying perfect and imperfect information (vii) Apply max min, maxi max and regret criteria Content • Decision making model • Risk and uncertainty in decision making • Application of probability distribution in decision making under uncertainty • Decision trees as a model in decision making • Cost information for pricing under conditions of uncertainty • Decision for buying perfect and imperfect information • Max min, maxi max and regret criteria. 8 Lecture 18: Divisional performance Measures Objectives At the end of this lecture you will be able to (i) Explain the importance of performance appraisal and its necessity in professionalized concerns (ii) Describe the benefits and problems of decentralization (iii) Identify and describe cost centers, profit centers and investment centers (iv) Explain and calculate various types of profitability measures used for performance appraisal (v) Explain the advantages and disadvantages of the various methods of performance measurement. Content • The importance of performance appraisal • Benefits and problems of decentralization • Cost centers, profit centers and investment centers • Profitability measures used for performance appraisal • Advantages and disadvantages of the various methods of performance measurement. Lecture 19: Transfer pricing Objectives At the end of this lecture you will be able to (i) Provide the meaning and objectives of transfer pricing (ii) Describe the theoretical economic background to transfer pricing (iii) Explain the importance of transfer pricing (iv) To establish the optimal transfer pricing using various transfer pricing strategies Content • Meaning and objectives of transfer pricing • The theoretical economic background to transfer pricing • Importance of transfer pricing • Optimal transfer pricing Lecture 20: Applications of Qualitative methods to management accounting Objectives (i) (ii) (iii) (iv) At the end of this lecture you will be able to Describe and apply correlation and regression analysis to management accounting Describe and apply quantitative models for planning and control of stocks Describe and apply linear programming to management accounting 9 Content Correlation and regression analysis Quantitative models for planning and control of stocks Linear programming Comments: To master this Module, you are expected to have working knowledge of arithmetic and algebra. In addition you are required to practice reading and computing on a daily basis You are expected to have computational devices such as calculators and text books. Assessment You will be assessed through a compulsory student progressive portfolio (ungraded), timed test (30%) and final examination (70%). Pass mark shall be 40%. Other Requirements Library visits, group discussions, use of other sources of information/materials including eresources, and lectures where possible. Recommended readings: Anthony, B. & Deaden (1995) Management control systems, tests and cases.. New York: Richard Irwin Drury, C. (2004) Management and Cost Accounting. 6th Edition. London: BookPower Hongreen, C. & Ittner, G. Poster (2009). Cost Accounting: A Managerial Emphasis, Horngreen, C. T., Bhimani, A., Foster, G. M. & Strikant, M. D (2005) Management and cost accounting. 2nd Edition. Europe: Prentice Hall Lucey, T. (2003) Management accounting. 5th Edition. London: Book Power Prentice Hall. New York Ray Proctor, Management Accounting for Business Decisions: Financial Times /Prentice Hall Web resources: http://www.tutor2u.net http://www.accaglobal.co.uk 10