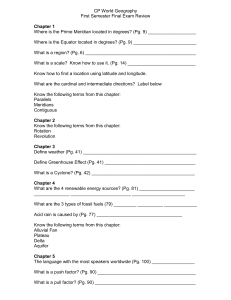

Mohd Alias Ibrahim v RHB Bank Bhd & Anor [2011] 4

advertisement

![Mohd Alias Ibrahim v RHB Bank Bhd & Anor [2011] 4](http://s3.studylib.net/store/data/008820779_1-79b068bfc07d4f8e95f19c455e1c0101-768x994.png)