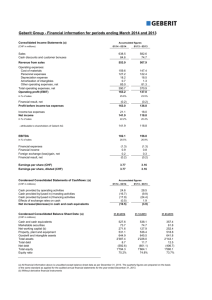

Annual report 2013

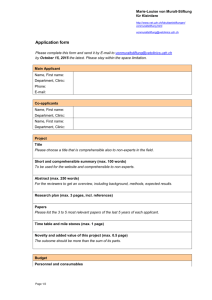

advertisement