Rhode Island Forms of Organization

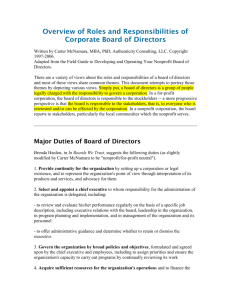

advertisement