Briefing Paper on Identity Theft and Related Topics for Volunteer

advertisement

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 1

This paper compiles and summarizes information from various resources and is intended

to help you quickly gain basic knowledge needed to make presentations to students. I have

attached copies of some of the resources I have used and included a bibliography. The articles

attached may be copywritten and are not to be publicly circulated or reproduced without the

permission of the copyright holders, except as may be stated in them.

This paper is for your use only. It is not to be made publicly available without my

permission. I does not create any attorney client relationship. The sources for this briefing paper

are either cited herein or are listed in the bibliography.

This paper covers the subject in a great deal more detail than may be prudent in dealing

with students at this level. Nevertheless, you may find yourself being asked questions on the

subject and I would hope this briefing paper would assist you in answering those questions.

In footnotes or text, I will refer to various sources in the bibliography by shorthand

identification. Please refer to the bibliography for that purpose. Much of this paper is drawn from

a recent article I have posted for the benefit of clients, and is therefore in the first person.

!

What is Identity Theft and how widespread is it?

According to Consumer Reports, citing a recent survey by the Center for Social and Legal

Research, seven million persons were victims of identity theft in 2002. “Stop thieves from

stealing you”, Consumer Reports, October 2003. The personal and financial cost is large, and

growing. It amounts to millions of dollars in lost money and time with the average victim losing

$800 and spending two years clearing his or her name and credit record. “Stop thieves from

stealing you”, Consumer Reports, October 2003. Id. Many times, the victims do not learn of the

crime for a year or more. Id.

Identity theft occurs when someone fraudulently uses your name, identifying data and credit to

borrow money, buy merchandise or services in your name. If the perpetrator has obtained a new

credit card or otherwise borrowed money in your name, odds are you won’t learn about it until he

or she has run up a large balance, because the criminal will have made sure that the statements go

to another address than yours.

The key to this crime is your personal private information, especially your Social Security

number, birthdate, existing credit card or bank account information, driver’s license numbers,

mother’s maiden name, to cite the most common examples. See FTC Website on Identity Theft,

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 2

www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm.

Sometimes, this information comes from the identity thief stealing it from financial institutions,

merchants, credit bureaus, or government. Just as often it comes because you, the victim, are

careless or duped by elaborate schemes into letting your information go. Through a scheme

called “phishing”, you receive a very official looking email warning you that your bank or other

account has been compromised, or needs to be verified. You are asked to click on a link,

supposedly to go to the supposed sender, to reply. In fact, that link does something quite

different, and may result in you unknowingly downloading a malicious computer program (called

a Trojan Horse) that tracks and sends out a record of what you are typing (called “keyboard

logging”) or finds and sends out confidential information off your computer, without your

knowledge. See Privacy Rights Clearinghouse website, http://www.privacyrights.org/index.htm

!

What indicators are there that one is a victim of identity theft?

Usually, the first indication is suspicious activity in a bank account or credit card

account. Sometimes the first hint is when a collector tracks you down. Because the perpetrators

want you to remain ignorant of what they are doing, they will often use a false address so that

you do not receive notice.

Under the New Jersey Identity Theft Protection Act, discussed below, businesses and

agencies need to promptly report thefts of personal information. This prompt reporting will help

provide you an early alert to possible trouble. This change is a major improvement.

What should students do to minimize the threats?

The following information is compiled from a variety of sources, cited herein or in the

bibliography. Some of the ideas are my own.

!

Don’t let others have or use your accounts. I and others have often seen clients whose

problems stemmed from letting a boyfriend etc. have a PIN number, use a credit card or

bank account. In one instance I know about, the husband was intercepting the mail, and

opening credit card accounts in the wife’s name without her knowledge. Another

common scenario is co-signing a car loan or mortgage.

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 3

!

Maintain physical security of your important information.

This seems obvious, but you should safeguard your driver’s license and other government

ID at all times. Lock desks, cabinets, and safes containing such information in your office and

home. Memorize your Social Security number and do not carry your Social Security number with

you in your wallet, or keep a copy of it in your wallet or purse.

!

Don’t give away information.

Never disclose your Social Security number, account number or credit card PIN numbers, birth

date, driver’s license number or mother’s maiden name unless you initiated the transaction. On

paper documents, don’t include such data unless required to do so on an official application for

employment, financing, or insurance. (Ask employers, schools, and financial institutions to offer

alternatives.).

No legitimate bank or lender will ever ask for such information over the phone, or via email.

IF YOU DIDN’T MAKE THE CALL OR ONLINE PURCHASE, OR ISSUE THE EMAIL,

DON’T GIVE OUT THE INFORMATION.

!

Protect information on your computer, and safeguard yourself when online.

Author’s Note: You will be talking to kids who have a surprising level of computer

literacy. This information is helpful for you to have knowledge of what you are talking

about, but unless, like me, you are an “amateur computer geek”, stay away from any

technical details you do not know about. Just provide the basic warnings and confess

your ignorance where appropriate. This segment is compiled from personal experience

and knowledge, as well as recommendations on the cited locations.

!

See the FTC web site, http://onguardonline.gov. This very valuable site contains tips on

ways to safeguard yourself when you are online. OnguardOnline is a partnership between

the FTC, other federal agencies, and the technology industry. The site offers advice on

identity theft, phishing, spyware, spam, online shopping, and other pertinent computer

topics.

!

Install firewalls, internet privacy and virus-detection software on your home computers

to discourage hackers from “tapping into” your computer via the Internet. Shutting off

computers when not in use is also helpful (although hackers in Eastern Europe or Russia

can be expected to work around the clock). Hackers use computer programs to “probe”

large numbers of internet addresses looking for “doors that are unlocked”. A firewall is

nothing more than a “lock”. It encourages the hacker to leave you alone.

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

"

Page 4

More information than you need to know: Firewalls come in two types:

software and hardware. The hardware firewall can be as simple and inexpensive

as a “cable router” which is hooked up between your cable modem and your

computer. Through “network address translation”, (the technical details of which I

am ignorant), the cable router becomes the “computer” that a hacker sees when

she probes your site, but from your side, you are able transparently to access the

Internet. These routers typically have an “administrative password” that allows

you to control how the router works. You always want to change this password

from the default (usually “0000") to something else which is hard to crack. (See

“Use Good Passwords” below). To remember the password on the few occasions

you need it, you can write the password on a label on the bottom of the router

!

If you use a wireless network at home, make sure it is secure and shut it off when not in

use. Be especially careful when using wireless connections in public places or public

computers. Avoid using either for financial transactions, and if you do, be sure to log off

when done.

!

Deal only with reputable Web sites. Check privacy and security policies of Web sites

before making purchases, trading stocks, or banking online. A professional-looking Web

site is no guarantee of security. Don’t respond to unsolicited e-mail requests for personal

information. (See phishing, below)

!

Use good passwords. Password-protect your bank and brokerage accounts. Create

passwords at least eight characters long that use combinations of letters, punctuation and

numbers.

"

Hints: To make them hard to crack but easy to remember, develop an acronym

from a phrase you will remember, substituting 1 for “a”, 2 for “to”, 4 for “for”etc.

(eg. “to make them hard to crack!” becomes “2mth2c!”). Or intentionally misspell

words, use capital and lower case letters in unusual ways.

"

How to remember all those passwords. This is the usual reason why people use

few passwords or bad ones. Quick access to passwords near the computer is what

is needed. One solution is to keep a binder nearby with alphabetic dividers (with

a separate sheet for each website etc, kept in alphabetic order. The tradeoff in

security is obvious, but since it is not yet technically possible to “hack into” the

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 5

binder from your computer, the real problem is unauthorized people getting hold

of the binder and the records in it. This is less of a concern if the binder is made to

look innocuous, (ie “hidden in plain sight”). Another way is to create a passwordprotected file containing a listing of all passwords and a HIGHLY secure

password. The file should be given an innocuous-sounding name (Again, hidden

in plain sight: don’t label it “passwords”!) A third alternative is to use one of the

software firewall or “Internet Privacy” packages, that maintain for you a secure

location for all passwords.

!

Watch out for “phishing” and spyware. These are ways in which malicious programs

get installed on your computer which then operate as conduits, feeding information about

you back out over the Internet.

"

“Phishing” is done by very official-looking emails that either direct you to a

bogus site where you volunteer your password or other private information in the

mistaken belief you are providing it to your bank or other business you deal with.

Attached are copies of two recent emails I received. The one from Wells Fargo

(note the misspelling “Forgo”) is obvious. The Ebay one (I did have an ebay

account at one time) is less so. The point is that, although the text of the “link”

looks right, where you go or what happens when you click the link has nothing to

do with the label that you see. Sometimes the link takes you to a site which, upon

connection, downloads a program on your computer which then steals your data

or does something else equally undesireable.

Author note: This is very important for kids to know. Not being as jaded

and suspicious as we adults, they can easily be taken in by this type of

scam. This is also something that “hits them where they live”.

"

“Spyware” are little programs that get installed when you go to a website, and

make use of the fact that websites are supposed to communicate with and

download information on your computer (eg “cookies” which are the reason that

when you go back, the site “remembers” you). Mostly, these programs send out

“anonymous” information about your consumer preferences, based on where

users at your computer go on the internet. They also can bog down the computer.

However, they can include “keyloggers” which capture the keystrokes at your

computer including passwords and private information, then send these out

without your knowledge.

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 6

Author note: I didn’t really think this happened. However, I set up my

software firewall to warn me whenever certain key information such as

specified account numbers and Social Security numbers was leaving my

computer. I was surprised when, twice, such warnings popped up at

times I was not sending that information out...

!

Report any suspicious activity right away. Always look at your bank statements or

credit card statements right away, and always question anything that does not look right.

Keep your charge receipts until the credit card bill comes in. That way, if the charge is

more than what you authorized, you can prove it.

"

Personal note. In one recent instance, a client of mine reported her car was

broken into, but her wallet, with all the cash still in it, was left on the ground

outside. Since nothing was stolen, she did not report the incident. However, the

thieves has copied down her credit card numbers and other important information.

Soon afterwards, they began a spending spree and she spent months trying to

straighten things out.

!

Shred or destroy all unused credit cards, all credit card offers or “convenience

checks”, and anything else with confidential information on it. A “pre-approved”

credit card application form with your name on it could be just the ticket for a thief to

steal your identity. Likewise, your credit card company may send you “balance transfer”

or “cash advance” checks attached to your statement. Always shred these. The best choice

is a “crosscut” shredder. For large volumes of paper, you should check your yellow pages

for a commercial company. In some areas, local governments sponsor annual “free

shredder” days as a public service. Before throwing out files containing Social Security

numbers, account numbers, and birth dates, shred them with a cross-cut shredder. Destroy

CDs or floppy disks containing sensitive data by shredding, cutting, or breaking them.

Use hard-drive shredding software or remove and destroy your hard drive before

discarding a computer. Just deleting files isn’t enough.

!

Watch your credit. Order copies of credit report every year from each of the three major

credit reporting agencies. Under FACTA, you are entitled to a free credit report once a

year. See PRC FACTA Article

!

Guard mail. Information can be stolen from your mail. Consider using a locked mailbox

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 7

or slot, a postal mailbox, or mailing directly at the post office. Consider paying bills

online as a way to avoid using the mail at all.

!

Guard your cards. Try not to let waiters, sales clerks, or gas-station attendants disappear

from view with your credit or debit card, to avoid “skimming.” Crooks can use a

handheld card reader to copy the information from your card’s magnetic strip.

!

Beware strange ATMs. Avoid using private or strange-looking automated teller

machines, because they may be rigged to skim data off your card’s magnetic strip. Six- or

seven-character PINs (personal identification numbers) are harder to crack than shorter

ones, but you may not be able to use them at machines abroad. See above about good

passwords.

!

Watch out for “shoulder surfers” when using pay phones or public Internet access; use

your free hand to shield the keypad. Don’t use cordless phones to conduct sensitive

financial or medical business, because eavesdroppers on other phones and those using

eavesdropping equipment may be able to overhear your conversations.

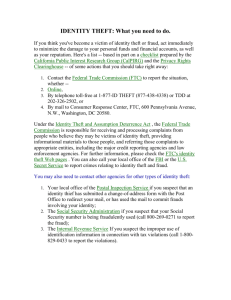

What steps should be taken if one is a victim of identity theft?

See “Take Charge:Fighting Back against Identity Theft”, FTC Website,

www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm and the New Jersey Identity Theft webpage,

www.state.nj.us/identitytheft. Copy of the “Fighting Back” article is attached. Below is a brief

summary but the “Fighting Back” article is hard to beat.

!

!

!

!

!

Immediately file a police report. See New Jersey Identity Theft Protection Act, discussed

below, and get a copy..

Immediately contact all your credit card companies, banks etc. and order an “initial fraud

alert” good for 90 days.

Request a “security freeze” on your credit report. See discussion below of New Jersey

Identity Theft Protection Act.

If your driver’s license was stolen or the number obtained illegally, report this to the state

motor vehicle agency in question.

For bank or credit accounts, ask for new PIN numbers, and replacement accounts with

new numbers.

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 8

!

If you do any of this by phone, take careful note of the date, time and person you spoke

to. Ask for an incident number and ask for an address, fax number and email address

where you can confirm your report. Then confirm each report.

!

Be sure to put everything in writing and keep careful records of all letters or emails and

any other dealings you have, especially those where the bank or lender agrees to credit

your account. Set up a filing system.

What Rights or Protections do consumers have?

!

Limitation of Liability Provisions under the federal Electronic Funds Transfer Act.

Most students are going to have ATM cards, if not credit cards. They need to know about

the importance of promptly reporting theft or loss of these items. The Electronic Funds

Transfer Act, 15 U.S.C 1693 et seq. and regulations under it provide important

protections where unauthorized use of a MAC card or other form of electronic transfer

(an “unauthorized electronic funds transfer”) takes place. (See footnote 3 for definition of

this term)1

a.

The student’s maximum loss is $50 or the amount or value obtained before the

bank gets notice of the unauthorized use, or of circumstances leading to a

reasonable belief the use was unauthorized.. 11 U.S.C. 1693g. except that

b.

If the student does not report loss or theft of a card within 2 business days after

learning about it, the exposure goes up to $500.00. Id..2

c.

And, if the student does not report an unauthorized transfer within 60 days after

the bank sends the statement on which the transfer appears, the liability is

unlimited. Id.

1

Separate rules apply to billing disputes for credit cards and some credit card companies

afford complete protection against loss or theft.

2

In extenuating circumstances such as extended travel or hospitalization, the 2 day

deadline can be increased to a “reasonable time under the circumstances.

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

d.

2.

Page 9

If the student lets somone else use the card etc or her PIN number, she’s out of

luck. 3

Additional Rights under the New Jersey Identity Theft Protection Act, N.J.S.A.

56:11-44 et seq.

On January 1, 2006, the New Jersey Identity Theft Protection Act, [“ITPA”] goes into

effect. It contains several important provisions:

1.

Security Freezes. All consumer credit reporting agencies “CRA’s” must place a

“security freeze” on the consumer report of the consumer, upon written request, within

five business days. N.J.S.A. 56:11-46(b), and send the consumer written confirmation of

this within five business days after placing the freeze. Id. At the same time, the CRA

must gie the consumer a PIN or password to use in obtaining authorization for the release

of credit information. Id.

"Security freeze" means a notice placed in a consumer's consumer report, at the request of

the consumer and subject to certain exceptions, that prohibits the consumer reporting

agency from releasing the report or any information from it without the express

authorization of the consumer, but does not prevent a consumer reporting agency from

advising a third party that a security freeze is in effect with respect to the consumer

report. N.J.S.A. 56:11-30.

Once this happens, and until the consumer releases the freeze, the consumer has control

3

The term "unauthorized electronic fund transfer" means an electronic fund transfer from

a consumer's account initiated by a person other than the consumer without actual authority to

initiate such transfer and from which the consumer receives no benefit, but the term does not

include any electronic fund transfer (A) initiated by a person other than the consumer who was

furnished with the card, code, or other means of access to such consumer's account by such

consumer, unless the consumer has notified the financial institution involved that transfers by

such other person are no longer authorized, (B) initiated with fraudulent intent by the consumer

or any person acting in concert with the consumer, or (C) which constitutes an error committed

by a financial institution” 15 U.S.C.A. § 1693a(11)

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 10

of his/her credit report. Release of information can only be made by certified or overnight

mail or secure email, and by providing the PIN or password, and other information

“generally deemed sufficient to identify a person”. N.J.S.A. 56:11-46(d). These requests

must be acted on by the CRA within three business days. N.J.S.A. 56:11-46(e)

While the freeze is in place, the CRA may not chiange the consumer’s name, date of

birth, Social Security number or address on the credit report without sending written

confirmation to the consumer within 30 days. N.J.S.A. 56:11-47.

Wilful violations of these provisions expose the CRA to actual damages of $100-$1000

and punitive damages plus counsel fees and costs. N.J.S.A. 56:11-38 and 56:11-50.

Negligent violations expose the violator to actual damages, counsel fees and costs. Id.

This is in addition to remedies available under previous enactments for obtaining a

consumer report under false pretenses or knowingly without a permissible purpose.4

2.

Police must take police reports of identity theft. Local law enforcement agencies must

take any complaint of identity theft and provide the complainant a copy of the complaint,

even though “jurisdiction may lie elsewhere for investigation and prosecution of” the

crime. N.J.S.A. 2C:21-17.6(a). This is intended to prevent these agencies from refusing to

take such complaints as “a civil matter”.

3.

Prompt disclosure to consumers of any breach of security involving personal

information. Under N.J.S.A. 56:8-161 to 166, “Any business that conducts business in

New Jersey, or any public entity that compiles or maintains computerized records that

include personal information, shall disclose any breach of security of those computerized

records following discovery or notification of the breach to any customer who is a

resident of New Jersey whose personal information was, or is reasonably believed to have

been, accessed by an unauthorized person.” N.J.S.A. 56:8-163(a). This must be done “in

the most expedient time possible and without unreasonable delay” subject to certain

limitations. Id. A report must be made to law enforcement authorities before the report to

consumers. N.J.S.A. 56:8-163(b). Protected personal information includes “an

4

Under N.J.S.A. 56:11-38., any natural person who obtains a consumer report under false

pretenses or knowingly without a permissible purposes may be held liable for actual damages or

$1000, whichever is greater, plus punitive damages and counsel fees and costs.

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 11

individual's first name or first initial and last name linked with any one or more of the

following data elements: (1) Social Security number; (2) driver's license number or State

identification card number; or (3) account number or credit or debit card number, in

combination with any required security code, access code, or password that would permit

access to an individual's financial account.” N.J.S.A. 56:8-161.

4.

All records of personal information must be destroyed when no longer in use. N.J.S.A.

56:8-162.

5.

Prohibited posting or display of Social Security numbers. Under N.J.S.A. 56:8-164,

no person, business or public agency may do any of the following, except as required by

other State or federal law:

(1) Publicly post or display... any four or more consecutive numbers taken from an

individual's Social Security number;

(2) Print an individual's Social Security number on any materials that are mailed

to the individual, unless State or federal law requires the Social Security number

to be on the document to be mailed;

(3) Print an individual's Social Security number on any card required for the

individual to access products or services provided by the entity;

(4) Intentionally communicate or otherwise make available to the general public

an individual's Social Security number;

(5) Require an individual to transmit his Social Security number over the Internet,

unless the connection is secure or the Social Security number is encrypted; or

(6) Require an individual to use his Social Security number to access an Internet

web site, unless a password or unique personal identification number or other

authentication device is also required to access the Internet web site.

6.

Consumer Fraud Remedies. Violations of the provisions concerning reporting security

breaches, non-disclosure of Social Security numbers, and requirements to destroy records

containing personal information are treated as violations of the Consumer Fraud Act,

which Act provides for treble damages and counsel fees. N.J.S.A. 56:8-166.

Briefing Paper on Identity Theft and Related Topics

for Volunteer Presenters of the

New Jersey Bankruptcy Law Foundation & HESAA

Joint Financial Literacy Project

By: Steven R. Neuner Esq.

Dated: December 19, 2005

Page 12

BIBLIOGRAPHY and SOURCES

“CU” and “ConsumerReports”-Consumer Union of U.S. Inc. See the August 2005 issue of

Consumer Reports for articles on Credit Scores. These resources are available for subscribers to

ConsumerReports.org their online resource. I have consulted the following articles:

November 2004: “Guarding your credit record”

October 2003: “Stop thieves from stealing you”

“FICO”- Fair Isaac Corporation. Website, www.myfico.com. Site contains lots of information

and financial calculators which demonstrate the costs of bad credit.

“FACTA”- The Fair and Accurate Credit Transaction Act of 2003, Pub. L 108-159, which added

new sections to the federal Fair Credit Reporting Act, 15 U.S.C. 1681 et seq. I relied on the

excellent article, attached hereto, from PRC entitled “FACTA, The Fair and Accurate Credit

Transactions Act: Consumers Win Some, Lose Some”

“Privacy Rights Clearinghouse” or “PRC” - a non-profit organization based in San Diego

California. Website: www.privacyrights.org

“PRC FACTA Article”–“Privacy Rights Clearninghouse, “FACTA, The Fair and Accurate

Credit Transactions Act: Consumers Win Some, Lose Some”, 2005, available online at

www.privacyrights.org/fs/fs6a-facta.htm

“FTC Take Charge”–“Take Charge: Fighting Back Against Identity Theft”

www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm

Attachment A: Sample “phishing” emails

Page 1 of 1

Dear Wells Forgo customer,

We recently reviewed your account, and suspect that your wellsfargo account account may have

been accessed by an unauthorized third party. Protecting the security of your account and of the

wellsfargo network is our primary concern. Therefore, as a preventative measure, we have

temporarily limited access to sensitive account features.

To restore your account access , please take the following steps to ensure that your account has

not been compromised:

1. Login to your wellsfargo account. In case you are not enrolled yet for Internet Banking, you will

have to use your Social Security Number as both your Personal ID and Password and fill in the

required information, including your name and account number.

2. Review your recent account history for any unauthorized withdrawals or deposits, and check your

account profile to make sure no changes have been made. If any unauthorized activity has taken

place on your account, report to wells fargo immediately.

To get started, please click the link below:

http://online.wellsfargo.com/signon

We apologize for any inconvenience this may cause, and appreciate your assistance in helping us

maintain the integrity of the entire Wells Fargo system. Thank your for your prompt attention to this

matter.

Sincerely,

Wells Fargo Team.

Please do not reply to this email. Mails sent to this address cannot be answered. For assistance, log

in to your wellsfargo account and choose the "Help" link in the header of any page.

Start your day with Yahoo! - make it your home page

about:blank

11/16/2005

PayPal

Page 1 of 1

PayPal Security Measures!

We are contacting you to remind you that: on 3 December 2005 our Account Review Team identified some

unusual activity in your account, one or more attempts to log in to your PayPal account from a foreign IP

address.

IP Address

Time

Country

80.53.1.130

December 2, 2005 15:05:08

PDT

Poland

80.53.255.174

December 2, 2005 15:07:58

PDT

Poland

141.85.99.169

December 3, 2005 15:13:09

PDT

Romania

141.85.99.169

December 3, 2005 21:28:08

PDT

Romania

195.61.146.130

December 3, 2005 21:33:43

PDT

Romania

In accordance with PayPal's User Agreement and to ensure that your account has not been compromised, access to your

account was limited. Your account access will remain limited until this issue has been resolved. To secure your account

and quickly restore full access, we may require some additional information from you.

To securely confirm your PayPal information please go directly to https://www.paypal.com/ log

in to your PayPal account and perform the steps necessary to restore your account access as

soon as possible or click bellow:

To continue your verification procedure click here

Thank you for using PayPal!

The PayPal Team

Please do not reply to this e-mail. Mail sent to this address cannot be answered. For assistance, log in to your

PayPal account and choose the "Help" link in the footer of any page.

To receive email notifications in plain text instead of HTML, update your preferences here.

about:blank

12/5/2005

Attachment B:

“Stop-Think-Click, Seven Practices for Safer Computing”

OnGuardOnline.gov

STOP • THINK • CLICK

Seven Practices for Safer Computing

Access to information and entertainment, credit and financial services, products from every corner

of the world — even to your work — is greater than earlier generations could ever have imagined.

Thanks to the Internet, you can order books, clothes, or appliances online; reserve a hotel room

across the ocean; download music and games; check your bank balance 24 hours a day; or access

your workplace from thousands of miles away.

The flip-side, however, is that the Internet — and the anonymity it affords — also can give online

scammers, hackers, and identity thieves access to your computer, personal information, finances,

and more.

But with awareness as your safety net, you can minimize the chance of an Internet mishap. Being

on guard online helps you protect your information, your computer, even yourself. To be safer and

more secure online, adopt these seven practices.

1. Protect your personal information. It’s valuable.

Why? To an identity thief, your personal information can provide instant access to your financial

accounts, your credit record, and other assets.

If you think no one would be interested in your personal information, think again. The reality is

that anyone can be a victim of identity theft. In fact, according to a Federal Trade Commission

survey, there are almost 10 million victims every year. It’s often difficult to know how thieves

obtained their victims’ personal information, and while it definitely can happen offline, some

cases start when online data is stolen. Visit www.consumer.gov/idtheft to learn what to do if your

identity is stolen.

Unfortunately, when it comes to crimes like identity theft, you can’t entirely control whether you

will become a victim. But following these tips can help minimize your risk while you’re online:

• If you’re asked for your personal information — your name, email or home address,

phone number, account numbers, or Social Security number — find out how it’s going

to be used and how it will be protected before you share it. If you have children, teach

them to not give out your last name, your home address, or your phone number on the

Internet.

• If you get an email or pop-up message asking for personal information, don’t reply or

click on the link in the message. The safest course of action is not to respond to requests

for your personal or financial information. If you believe there may be a need for such

information by a company with whom you have an account or placed an order, contact

that company directly in a way you know to be genuine. In any case, don’t send your

personal information via email because email is not a secure transmission method.

OnGuardOnline.gov

STOP • THINK • CLICK

• If you are shopping online, don’t provide your personal or financial information through

a company’s website until have checked for indicators that the site is secure, like a lock

icon on the browser’s status bar or a website URL that begins “https:” (the “s” stands for

“secure”). Unfortunately, no indicator is foolproof; some scammers have forged security

icons.

• Read website privacy policies. They should explain what personal information the

website collects, how the information is used, and whether it is provided to third

parties. The privacy policy also should tell you whether you have the right to see what

information the website has about you and what security measures the company takes to

protect your information. If you don’t see a privacy policy — or if you can’t understand

it — consider doing business elsewhere.

2. Know who you’re dealing with.

And know what you’re getting into. There are dishonest people in the bricks and mortar world

and on the Internet. But online, you can’t judge an operator’s trustworthiness with a gut-affirming

look in the eye. It’s remarkably simple for online scammers to impersonate a legitimate business,

so you need to know whom you’re dealing with. If you’re shopping online, check out the seller

before you buy. A legitimate business or individual seller should give you a physical address and a

working telephone number at which they can be contacted in case you have problems.

Phishing: Bait or Prey?

“We suspect an unauthorized transaction on your account. To ensure that your

account is not compromised, please click the link below and confirm your identity.”

“Phishers” send spam or pop-up messages claiming to be from a business or organization that you

might deal with — for example, an Internet service provider (ISP), bank, online payment service,

or even a government agency. The message usually says that you need to “update” or “validate”

your account information. It might threaten some dire consequence if you don’t respond. The

message directs you to a website that looks just like a legitimate organization’s, but isn’t. The

purpose of the bogus site? To trick you into divulging your personal information so the operators

can steal your identity and run up bills or commit crimes in your name. Don’t take the bait:

never reply to or click on links in email or pop-ups that ask for personal information. Legitimate

companies don’t ask for this information via email. If you are directed to a website to update

your information, verify that the site is legitimate by calling the company directly, using contact

information from your account statements. Or open a new browser window and type the URL

into the address field, watching that the actual URL of the site you visit doesn’t change and is still

the one you intended to visit. Forward spam that is phishing for information to spam@uce.gov and

to the company, bank, or organization impersonated in the phishing email. Most organizations

have information on their websites about where to report problems.

OnGuardOnline.gov

STOP • THINK • CLICK

Free Software and File-Sharing: Worth the hidden costs?

Every day, millions of computer users share files online. File-sharing can give people

access to a wealth of information, including music, games, and software. How does

it work? You download special software that connects your computer to an informal

network of other computers running the same software. Millions of users could be

connected to each other through this software at one time. Often the software is free and easily

accessible.

But file-sharing can have a number of risks. If you don’t check the proper settings, you could allow

access not just to the files you intend to share, but also to other information on your hard drive,

like your tax returns, email messages, medical records, photos, or other personal documents. In

addition, you may unwittingly download pornography labeled as something else. Or you may

download material that is protected by the copyright laws, which would mean you could be

breaking the law.

If you decide to use file-sharing software, set it up very carefully. Take the time to read the End

User Licensing Agreement to be sure you understand and are willing to tolerate the side effects of

any free downloads.

Spyware

Many free downloads — whether from peers or businesses — come with potentially

undesirable side effects. Spyware is software installed without your knowledge or

consent that adversely affects your ability to use your computer, sometimes by

monitoring or controlling how you use it. To avoid spyware, resist the urge to install any software

unless you know exactly what it is. Your anti-virus software may include anti-spyware capability

that you can activate, but if it doesn’t, you can install separate anti-spyware software, and then use

it regularly to scan for and delete any spyware programs that may sneak onto your computer.

Email attachments and links: Legitimate or virus-laden?

Most viruses sent over email or Instant Messenger won’t damage your computer without your

participation. For example, you would have to open an email or attachment that includes a virus

or follow a link to a site that is programmed to infect your computer. So hackers often lie to get

you to open the email attachment or click on a link. Some virus-laden emails appear to come

from a friend or colleague; some have an appealing file name, like “Fwd: FUNNY” or “Per your

request!”; others promise to clean a virus off your computer if you open it or follow the link.

Don’t open an email or attachment — even if it appears to be from a friend or coworker — unless

you are expecting it or know what it contains. You can help others trust your attachments by

including a text message explaining what you’re attaching.

OnGuardOnline.gov

STOP • THINK • CLICK

3. Use anti-virus software and a firewall, and update both regularly.

Dealing with anti-virus and firewall protection may sound about as exciting as flossing your teeth,

but it’s just as important as a preventive measure. Having intense dental treatment is never fun;

neither is dealing with the effects of a preventable computer virus.

Anti-virus Software

Anti-virus software protects your computer from viruses that can destroy your data, slow your

computer’s performance, cause a crash, or even allow spammers to send email through your

account. It works by scanning your computer and your incoming email for viruses, and then

deleting them.

To be effective, your anti-virus software should update routinely with antidotes to the latest

“bugs” circulating through the Internet. Most commercial anti-virus software includes a feature to

download updates automatically when you are on the Internet.

WHAT TO LOOK FOR AND WHERE TO GET IT

You can download anti-virus software from the websites of software companies or buy

it in retail stores. Look for anti-virus software that:

• Recognizes current viruses, as well as older ones.

• Effectively reverses the damage.

• Updates automatically.

Firewalls

Don’t be put off by the word “firewall.” It’s not necessary to fully understand how it works; it’s

enough to know what it does and why you need it. Firewalls help keep hackers from using your

computer to send out your personal information without your permission. While anti-virus

software scans incoming email and files, a firewall is like a guard, watching for outside attempts to

access your system and blocking communications to and from sources you don’t permit.

Some operating systems and hardware devices come with a built-in firewall that may be shipped

in the “off ” mode. Make sure you turn it on. For your firewall to be effective, it needs to be set up

properly and updated regularly. Check your online “Help” feature for specific instructions.

If your operating system doesn’t include a firewall, get a separate software firewall that runs in

the background while you work, or install a hardware firewall — an external device that includes

firewall software. Several free firewall software programs are available on the Internet.

OnGuardOnline.gov

STOP • THINK • CLICK

ZOMBIE DRONES

Some spammers search the Internet for unprotected computers they can control and

use anonymously to send unwanted spam emails. If you don’t have up-to-date anti-virus

protection and a firewall, spammers may try to install software that lets them route email

through your computer, often to thousands of recipients, so that it appears to have come from

your account. If this happens, you may receive an overwhelming number of complaints from

recipients, and your email account could be shut down by your Internet Service Provider (ISP).

4. Be sure to set up your operating system and Web browser software properly, and update

them regularly.

Hackers also take advantage of Web browsers (like Internet Explorer or Netscape) and operating

system software (like Windows or Linux) that are unsecured. Lessen your risk by changing the

settings in your browser or operating system and increasing your online security. Check the

“Tools” or “Options” menus for built-in security features. If you need help understanding your

choices, use your “Help” function.

Your operating system also may offer free software “patches” that close holes in the system that

hackers could exploit. In fact, some common operating systems can be set to automatically

retrieve and install patches for you. If your system does not do this, bookmark the website for your

system’s manufacturer so you can regularly visit and update your system with defenses against

the latest attacks. Updating can be as simple as one click. Your email software may help you avoid

viruses by giving you the ability to filter certain types of spam. It’s up to you to activate the filter.

If you’re not using your computer for an extended period, turn it off or unplug it from the phone

or cable line. When it’s off, the computer doesn’t send or receive information from the Internet

and isn’t vulnerable to hackers.

5. Protect your passwords.

Keep your passwords in a secure place, and out of plain view. Don’t share your passwords on the

Internet, over email, or on the phone. Your Internet Service Provider (ISP) should never ask for

your password.

In addition, hackers may try to figure out your passwords to gain access to your computer. You can

make it tougher for them by:

• Using passwords that have at least eight characters and include numbers or symbols.

OnGuardOnline.gov

STOP • THINK • CLICK

• Avoiding common words: some hackers use programs that can try every word in the

dictionary.

• Not using your personal information, your login name, or adjacent keys on the

keyboard as passwords.

• Changing your passwords regularly (at a minimum, every 90 days).

• Not using the same password for each online account you access.

One way to create a strong password is to think of a memorable phrase and use the first letter

of each word as your password, converting some letters into numbers that resemble letters. For

example, “How much wood could a woodchuck chuck” would become HmWc@wcC.

6. Back up important files.

If you follow these tips, you’re more likely to be more secure online, free of interference from

hackers, viruses, and spammers. But no system is completely secure. If you have important files

stored on your computer, copy them onto a removable disc, and store them in a safe place.

7. Learn who to contact if something goes wrong online

Hacking or Computer Virus

If your computer gets hacked or infected by a virus:

• Immediately unplug the phone or cable line from your machine. Then scan your

entire computer with fully updated anti-virus software, and update your firewall.

• Take steps to minimize the chances of another incident.

• Alert the appropriate authorities by contacting:

º your ISP and the hacker’s ISP (if you can tell what it is). You can usually find

an ISP’s email address on its website. Include information on the incident from

your firewall’s log file. By alerting the ISP to the problem on its system, you can

help it prevent similar problems in the future.

º the FBI at www.ifccfbi.gov. To fight computer criminals, they need to hear

from you.

OnGuardOnline.gov

STOP • THINK • CLICK

Internet fraud

If a scammer takes advantage of you through an Internet auction, when you’re shopping online, or

in any other way, report it to the Federal Trade Commission, at ftc.gov. The FTC enters Internet,

identity theft, and other fraud-related complaints into Consumer Sentinel, a secure, online

database available to hundreds of civil and criminal law enforcement agencies in the U.S. and

abroad.

Deceptive Spam

If you get deceptive spam, including email phishing for your information, forward it to

spam@uce.gov. Be sure to include the full header of the email, including all routing information.

You also may report phishing email to reportphishing@antiphishing.org. The Anti-Phishing

Working Group, a consortium of ISPs, security vendors, financial institutions and law

enforcement agencies, uses these reports to fight phishing.

Divulged Personal Information

If you believe you have mistakenly given your personal information to a fraudster, file a complaint

at ftc.gov, and then visit the Federal Trade Commission’s Identity Theft website at

www.consumer.gov/idtheft to learn how to minimize your risk of damage from a potential theft of

your identity.

PARENTS

Parental controls are provided by most ISPs, or are sold as separate software. Remember that

no software can substitute for parental supervision. Talk to your kids about safe computing

practices, as well as the things they’re seeing and doing online.

OnGuardOnline.gov provides practical tips from the federal government and

the technology industry to help you be on guard against Internet fraud, secure your

computer, and protect your personal information.

September 2005

OnGuardOnline.gov

Take Charge: Fighting Back Against Identity Theft

Page 1 of 18

GO

Search:

HOME | CONSUMERS | BUSINESSES | NEWSROOM | FORMAL | ANTITRUST | CONGRESSIONAL | ECONOMIC | LEGAL

Privacy Policy | About FTC | Commissioners | File a Complaint | HSR | FOIA | IG Office | En Español

Facts for Consumers

PDF Version

Take Charge: Fighting Back Against Identity Theft

(formerly: "ID Theft: When Bad Things Happen to Your Good Name")

To Print: Use File/Page Setup

in your browser to set page

margins to zero or your printer's

minimum margin settings.

TABLE OF CONTENTS

INTRODUCTION

STAYING ALERT

HOW IDENTITY THEFT OCCURS

z

z

If Your Personal Information Has Been Lost or Stolen

IDENTITY THEFT VICTIMS: IMMEDIATE STEPS

MINIMIZING RECURRENCES

z

z

z

z

z

z

z

z

z

Placing Fraud Alerts on Your Credit Report

Closing Accounts

Filing a Police Report

Filing a Complaint with the Federal Trade Commission

The Identity Theft Report

Tips For Organizing Your Case

Chart Your Course of Action

z

z

z

z

z

z

z

z

z

z

z

z

z

z

z

z

z

z

z

z

Bank Accounts and Fraudulent Withdrawals

Bankruptcy Fraud

Correcting Fraudulent Information in Credit Reports

Credit Cards

Criminal Violations

Debt Collectors

Driver's License

Investment Fraud

Mail Theft

Passport Fraud

Phone Fraud

Social Security Number Misuse

Student Loans

Tax Fraud

What To Do Today

Maintaining Vigilance

A Special Word About Social Security Numbers

The Doors and Windows are Locked, But...

APPENDIX

z

RESOLVING SPECIFIC PROBLEMS

Getting Your Credit Report

z

z

It's the Law

Federal

State

Instructions for Completing the ID Theft Affidavit

The ID Theft Affidavit

Annual Credit Report Request Form

The FTC's Privacy Policy

INTRODUCTION

In the course of a busy day, you may write a check at the grocery store, charge tickets to a ball game, rent a car, mail your tax

returns, change service providers for your cell phone, or apply for a credit card. Chances are you don't give these everyday

transactions a second thought. But an identity thief does.

http://www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm

12/19/2005

Take Charge: Fighting Back Against Identity Theft

Page 2 of 18

Identity theft is a serious crime. People whose identities have been stolen can spend months or years and thousands of dollars

cleaning up the mess the thieves have made of a good name and credit record. In the meantime, victims of identity theft may lose

job opportunities, be refused loans for education, housing, or cars, and even get arrested for crimes they didn't commit.

Humiliation, anger, and frustration are among the feelings victims experience as they navigate the process of rescuing their

identity.

Working with other government agencies and organizations, the Federal Trade Commission (FTC) has produced this booklet to

help you remedy the effects of an identity theft. It describes what steps to take, your legal rights, how to handle specific problems

you may encounter on the way to clearing your name, and what to watch for in the future.

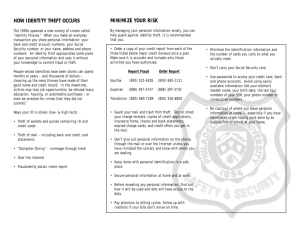

HOW IDENTITY THEFT OCCURS

I first was notified that someone had used my Social Security number for their taxes in February 2004. I also found

out that this person opened a checking account, cable and utility accounts, and a cell phone account in my name.

I'm still trying to clear up everything and just received my income tax refund after waiting four to five months. Trying

to work and get all this cleared up is very stressful.

From a consumer's complaint to the FTC, July 9, 2004

Despite your best efforts to manage the flow of your personal information or to keep it to yourself, skilled identity thieves may use

a variety of methods to gain access to your data.

How identity thieves get your personal information:

z

z

z

z

z

z

z

z

z

They get information from businesses or other institutions by:

{ stealing records or information while they're on the job

{ bribing an employee who has access to these records

{ hacking these records

{ conning information out of employees

They may steal your mail, including bank and credit card statements, credit card offers, new checks, and tax information.

They may rummage through your trash, the trash of businesses, or public trash dumps in a practice known as "dumpster

diving."

They may get your credit reports by abusing their employer's authorized access to them, or by posing as a landlord, employer,

or someone else who may have a legal right to access your report.

They may steal your credit or debit card numbers by capturing the information in a data storage device in a practice known as

"skimming." They may swipe your card for an actual purchase, or attach the device to an ATM machine where you may enter

or swipe your card.

They may steal your wallet or purse.

They may complete a "change of address form" to divert your mail to another location.

They may steal personal information they find in your home.

They may steal personal information from you through email or phone by posing as legitimate companies and claiming that you

have a problem with your account. This practice is known as "phishing" online, or pretexting by phone.

How identity thieves use your personal information:

z

z

z

z

z

z

z

z

z

z

They may call your credit card issuer to change the billing address on your credit card account. The imposter then runs up

charges on your account. Because your bills are being sent to a different address, it may be some time before you realize

there's a problem.

They may open new credit card accounts in your name. When they use the credit cards and don't pay the bills, the delinquent

accounts are reported on your credit report.

They may establish phone or wireless service in your name.

They may open a bank account in your name and write bad checks on that account.

They may counterfeit checks or credit or debit cards, or authorize electronic transfers in your name, and drain your bank

account.

They may file for bankruptcy under your name to avoid paying debts they've incurred under your name, or to avoid eviction.

They may buy a car by taking out an auto loan in your name.

They may get identification such as a driver's license issued with their picture, in your name.

They may get a job or file fraudulent tax returns in your name.

They may give your name to the police during an arrest. If they don't show up for their court date, a warrant for arrest is issued

in your name.

http://www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm

12/19/2005

Take Charge: Fighting Back Against Identity Theft

Page 3 of 18

If Your Personal Information Has Been Lost or Stolen

If you've lost personal information or identification, or if it has been stolen from you, taking certain steps quickly can minimize the

potential for identity theft.

Financial accounts: Close accounts, like credit cards and bank accounts, immediately. When you open new accounts, place

passwords on them. Avoid using your mother's maiden name, your birth date, the last four digits of your Social Security number

(SSN) or your phone number, or a series of consecutive numbers.

Social Security number: Call the toll-free fraud number of any of the three nationwide consumer reporting companies and place an

initial fraud alert on your credit reports. An alert can help stop someone from opening new credit accounts in your name. See

consumer reporting company contact information. For more information about fraud alerts, see the Fraud Alerts box.

Driver's license/other government-issued identification: Contact the agency that issued the license or other identification

document. Follow its procedures to cancel the document and to get a replacement. Ask the agency to flag your file so that no one

else can get a license or any other identification document from them in your name.

Once you've taken these precautions, watch for signs that your information is being misused. See STAYING ALERT.

If your information has been misused, file a report about the theft with the police, and file a complaint with the Federal Trade

Commission, as well. If another crime was committed for example, if your purse or wallet was stolen or your house or car was

broken into report it to the police immediately.

IDENTITY THEFT VICTIMS: IMMEDIATE STEPS

If you are a victim of identity theft, take the following four steps as soon as possible, and keep a record with the details of your

conversations and copies of all correspondence.

1. Place a fraud alert on your credit reports, and review your credit reports.

Fraud alerts can help prevent an identity thief from opening any more accounts in your name. Contact the toll-free fraud number

of any of the three consumer reporting companies below to place a fraud alert on your credit report. You only need to contact one

of the three companies to place an alert. The company you call is required to contact the other two, which will place an alert on

their versions of your report, too.

Equifax: 1-800-525-6285; www.equifax.com; P.O. Box 740241, Atlanta, GA 30374- 0241

Experian: 1-888-EXPERIAN (397-3742); www.experian.com; P.O. Box 9532, Allen, TX 75013

TransUnion: 1-800-680-7289; www.transunion.com; Fraud Victim Assistance Division, P.O. Box 6790, Fullerton, CA 92834-6790

Once you place the fraud alert in your file, you're entitled to order free copies of your credit reports, and, if you ask, only the last

four digits of your SSN will appear on your credit reports.Once you get your credit reports, review them carefully. Look for inquiries

from companies you haven't contacted, accounts you didn't open, and debts on your accounts that you can't explain. Check that

information, like your SSN, address(es), name or initials, and employers are correct. If you find fraudulent or inaccurate

information, get it removed. See Correcting Credit Reports to learn how. Continue to check your credit reports periodically,

especially for the first year after you discover the identity theft, to make sure no new fraudulent activity has occurred.

Fraud Alerts

There are two types of fraud alerts: an initial alert, and an extended alert.

z

z

An initial alert stays on your credit report for at least 90 days. You may ask that an initial fraud alert be

placed on your credit report if you suspect you have been, or are about to be, a victim of identity theft. An

initial alert is appropriate if your wallet has been stolen or if you've been taken in by a "phishing" scam.

When you place an initial fraud alert on your credit report, you're entitled to one free credit report from each

of the three nationwide consumer reporting companies.

An extended alert stays on your credit report for seven years. You can have an extended alert placed

on your credit report if you've been a victim of identity theft and you provide the consumer reporting

company with an "identity theft report." When you place an extended alert on your credit report, you're

entitled to two free credit reports within twelve months from each of the three nationwide consumer reporting

http://www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm

12/19/2005

Take Charge: Fighting Back Against Identity Theft

Page 4 of 18

companies. In addition, the consumer reporting companies will remove your name from marketing lists for

pre-screened credit offers for five years unless you ask them to put your name back on the list before then.

To place either of these alerts on your credit report, or to have them removed, you will be required to provide

appropriate proof of your identity: that may include your SSN, name, address and other personal information

requested by the consumer reporting company.

When a business sees the alert on your credit report, they must verify your identity before issuing you credit. As

part of this verification process, the business may try to contact you directly. This may cause some delays if

you're trying to obtain credit. To compensate for possible delays, you may wish to include a cell phone number,

where you can be reached easily, in your alert. Remember to keep all contact information in your alert current.

2. Close the accounts that you know, or believe, have been tampered with or opened fraudulently.

Call and speak with someone in the security or fraud department of each company. Follow up in writing, and include copies (NOT

originals) of supporting documents. It's important to notify credit card companies and banks in writing. Send your letters by

certified mail, return receipt requested, so you can document what the company received and when. Keep a file of your

correspondence and enclosures.

When you open new accounts, use new Personal Identification Numbers (PINs) and passwords. Avoid using easily available

information like your mother's maiden name, your birth date, the last four digits of your SSN or your phone number, or a series of

consecutive numbers.

If the identity thief has made charges or debits on your accounts, or on fraudulently opened accounts, ask the company for the

forms to dispute those transactions:

z

z

For charges and debits on existing accounts, ask the representative to send you the company's fraud dispute forms. If the

company doesn't have special forms, use the sample letter to dispute the fraudulent charges or debits. In either case, write to

the company at the address given for "billing inquiries," NOT the address for sending your payments.

For new unauthorized accounts, ask if the company accepts the ID Theft Affidavit. If not, ask the representative to send you

the company's fraud dispute forms. If the company already has reported these accounts or debts on your credit report, dispute

this fraudulent information. See Correcting Credit Reports to learn how.

Once you have resolved your identity theft dispute with the company, ask for a letter stating that the company has closed the

disputed accounts and has discharged the fraudulent debts. This letter is your best proof if errors relating to this account reappear

on your credit report or you are contacted again about the fraudulent debt.

Proving You're a Victim

Applications or other transaction records related to the theft of your identity may help you prove that you are a

victim. For example, you may be able to show that the signature on an application is not yours. These

documents also may contain information about the identity thief that is valuable to law enforcement. By law,

companies must give you a copy of the application or other business transaction records relating to your identity

theft if you submit your request in writing. Be sure to ask the company representative where you should mail

your request. Companies must provide these records at no charge to you within 30 days of receipt of your

request and your supporting documents. You also may give permission to any law enforcement agency to get

these records, or ask in your written request that a copy of these records be sent to a particular law

enforcement officer.

The company can ask you for:

z

z

proof of your identity. This may be a photocopy of a government-issued ID card, the same type of

information the identity thief used to open or access the account, or the type of information the company

usually requests from applicants or customers, and

a police report and a completed affidavit, which may be the Identity Theft Affidavit or the company's own

affidavit.

3. File a report with your local police or the police in the community where the identity theft took place.

http://www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm

12/19/2005

Take Charge: Fighting Back Against Identity Theft

Page 5 of 18

Then, get a copy of the police report or at the very least, the number of the report. It can help you deal with creditors who need

proof of the crime. If the police are reluctant to take your report, ask to file a "Miscellaneous Incidents" report, or try another

jurisdiction, like your state police. You also can check with your state Attorney General's office to find out if state law requires the

police to take reports for identity theft. Check the Blue Pages of your telephone directory for the phone number or check

www.naag.org for a list of state Attorneys General.

4. File a complaint with the Federal Trade Commission.

By sharing your identity theft complaint with the FTC, you will provide important information that can help law enforcement officials

across the nation track down identity thieves and stop them. The FTC can refer victims' complaints to other government agencies

and companies for further action, as well as investigate companies for violations of laws the agency enforces.

You can file a complaint online at www.consumer.gov/idtheft. If you don't have Internet access, call the FTC's Identity Theft

Hotline, toll-free: 1-877-IDTHEFT (438-4338); TTY: 1-866-653- 4261; or write: Identity Theft Clearinghouse, Federal Trade

Commission, 600 Pennsylvania Avenue, NW, Washington, DC 20580.

Be sure to call the Hotline to update your complaint if you have any additional information or problems.

The Identity Theft Report

An identity theft report may have two parts:

Part One is a copy of a report filed with a local, state, or federal law enforcement agency, like your local police department, your

State Attorney General, the FBI, the U.S. Secret Service, the FTC, and the U.S. Postal Inspection Service. There is no federal law

requiring a federal agency to take a report about identity theft; however, some state laws require local police departments to take

reports. When you file a report, provide as much information as you can about the crime, including anything you know about the

dates of the identity theft, the fraudulent accounts opened and the alleged identity thief.

Note: Knowingly submitting false information could subject you to criminal prosecution for perjury.

Part Two of an identity theft report depends on the policies of the consumer reporting company and the information provider (the

business that sent the information to the consumer reporting company). That is, they may ask you to provide information or

documentation in addition to that included in the law enforcement report which is reasonably intended to verify your identity theft.

They must make their request within 15 days of receiving your law enforcement report, or, if you already obtained an extended

fraud alert on your credit report, the date you submit your request to the credit reporting company for information blocking. The

consumer reporting company and information provider then have 15 more days to work with you to make sure your identity theft

report contains everything they need. They are entitled to take five days to review any information you give them. For example, if

you give them information 11 days after they request it, they do not have to make a final decision until 16 days after they asked

you for that information. If you give them any information after the 15-day deadline, they can reject your identity theft report as

incomplete; you will have to resubmit your identity theft report with the correct information.

You may find that most federal and state agencies, and some local police departments, offer only "automated" reports a report

that does not require a face-to-face meeting with a law enforcement officer. Automated reports may be submitted online, or by

telephone or mail. If you have a choice, do not use an automated report. The reason? It's more difficult for the consumer reporting

company or information provider to verify the information. Unless you are asking a consumer reporting company to place an

extended fraud alert on your credit report, you probably will have to provide additional information or documentation when you use

an automated report.

Tips For Organizing Your Case

Accurate and complete records will help you to resolve your identity theft case more quickly.

z

z

z

z

z

Have a plan when you contact a company. Don't assume that the person you talk to will give you all the

information or help you need. Prepare a list of questions to ask the representative, as well as information

about your identity theft. Don't end the call until you're sure you understand everything you've been told. If

you need more help, ask to speak to a supervisor.

Write down the name of everyone you talk to, what he or she tells you, and the date the conversation

occurred. Use Chart Your Course of Action to help you.

Follow up in writing with all contacts you've made on the phone or in person. Use certified mail, return

receipt requested, so you can document what the company or organization received and when.

Keep copies of all correspondence or forms you send.

Keep the originals of supporting documents, like police reports and letters to and from creditors; send copies

http://www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm

12/19/2005

Take Charge: Fighting Back Against Identity Theft

z

z

Page 6 of 18

only.

Set up a filing system for easy access to your paperwork.

Keep old files even if you believe your case is closed. Once resolved, most cases stay resolved, but

problems can crop up.

Chart Your Course of Action [PDF version of form]

Use this form to record the steps you've taken to report the fraudulent use of your identity. Keep this list in a safe place for

reference.

Nationwide Consumer Reporting Companies - Report Fraud

Consumer

Reporting

Company

Equifax

Experian

TransUnion

Phone Number

Date

Contacted

Contact

Person

Comments

Contact

Person

Comments

1-800-525-6285

1-888-EXPERIAN

(397-3742)

1-800-680-7289

Banks, Credit Card Issuers and Other Creditors

(Contact each creditor promptly to protect your legal rights.)

Creditor

Address and

Phone Number

Date

Contacted

Law Enforcement Authorities - Report Identity Theft

Agency/Department

Phone

Number

Date

Contacted

Contact

Person

http://www.ftc.gov/bcp/conline/pubs/credit/idtheft.htm

Report

Number

Comments

12/19/2005

Take Charge: Fighting Back Against Identity Theft

Page 7 of 18

RESOLVING SPECIFIC PROBLEMS

I received a copy of my credit report and saw about a half a dozen items that I didn't know anything about. It's

affected my credit rating so badly that I couldn't get a student loan. I didn't realize there was a problem until my

student loan application was denied.

From a consumer's complaint to the FTC, May 25, 2004

While dealing with problems resulting from identity theft can be time-consuming and frustrating, most victims can resolve their

cases by being assertive, organized, and knowledgeable about their legal rights. Some laws require you to notify companies

within specific time periods. Don't delay in contacting any companies to deal with these problems, and ask for supervisors if you

need more help than you're getting.

Bank Accounts and Fraudulent Withdrawals

Different laws determine your legal remedies based on the type of bank fraud you have suffered. For example, state laws protect

you against fraud committed by a thief using paper documents, like stolen or counterfeit checks. But if the thief used an electronic

fund transfer, federal law applies. Many transactions may seem to be processed electronically but are still considered "paper"

transactions. If you're not sure what type of transaction the thief used to commit the fraud, ask the financial institution that

processed the transaction.

Fraudulent Electronic Withdrawals

The Electronic Fund Transfer Act provides consumer protections for transactions involving an ATM or debit card, or another

electronic way to debit or credit an account. It also limits your liability for unauthorized electronic fund transfers.

You have 60 days from the date your bank account statement is sent to you to report in writing any money withdrawn from your

account without your permission. This includes instances when your ATM or debit card is "skimmed" that is, when a thief captures

your account number and PIN without your card having been lost or stolen.

If your ATM or debit card is lost or stolen, report it immediately because the amount you can be held responsible for depends on

how quickly you report the loss.

z

z

z

If you report the loss or theft within two business days of discovery, your losses are limited to $50.