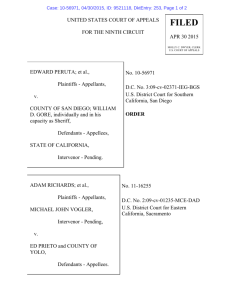

Plaintiffs' Response to Motion to Dismiss - EU Claims

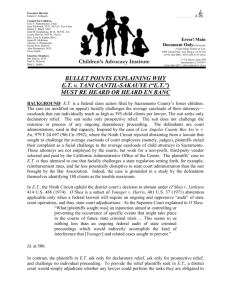

advertisement