C.A.S.H. Resource Manual

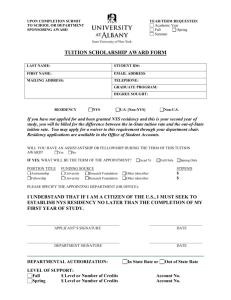

advertisement