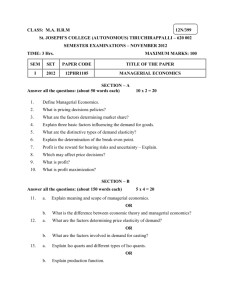

Managerial and Customer Costs of Price Adjustment: Direct

advertisement