Corporate Expense Reimbursement Policy

advertisement

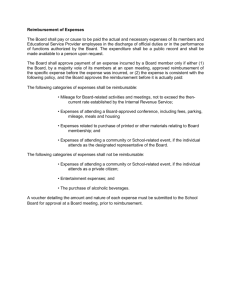

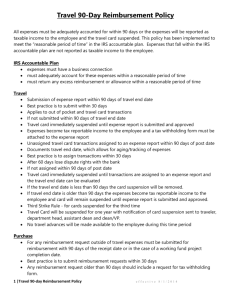

Policy or Procedure: Policy Page 1 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 Corporate Expense Reimbursement Policy Dated: December 30, 2007 Revision: 2.91 Policy or Procedure: Policy Page 2 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 1.0 PURPOSE The purpose of this policy is to establish reimbursement guidelines for employees, consultants and contractors incurring business travel and entertainment expenses and other business related expenses on behalf of the company. 2.0 BACKGROUND In order to meet business objectives, Verisign employees, consultants and contractors will need to travel, entertain, and/or incur expenses on behalf of the company. The company agrees to reimburse them for costs incurred while engaged on such activities. The main objectives of this policy are: • • • Ensure employees, consultants and contractors have a clear and consistent understanding of the processes and requirements established for reimbursement of travel, entertainment and other business related expenses. Provide business travelers with an acceptable level of services and comfort within reasonable cost. Ensure that all authorized expenditures meet and comply with all requirements for the most favorable tax and expense treatments for VeriSign. 3.0 SCOPE This policy applies to all GLOBAL expense reimbursements. This policy is to be used in conjunction with the Global Travel Policy located at the following website: https://intranet.verisign.com/Intranet/Travel/TravelPolicy/000212 4.0 RESPONSIBILITY The Chief Financial Officer is responsible for the creation, establishment, maintenance, revision and publication of this Policy. All Managers, Directors, Vice Presidents and GLT members (Global Leadership Team) are accountable for ensuring compliance with this policy when approving business travel and expenses. All employees are responsible for reading, understanding and complying with this policy and their applicable Country Addenda. Accounts Payable may audit expense reports for compliance to company policies. Non compliant transactions are subject to short pay, additional review, and may require additional management approval. VeriSign retains the right to modify, alter and delete this policy and its appendices in its sole discretion. VeriSign shall communicate any changes to VeriSign employees as appropriate. GLT members may impose stricter guidelines than in this policy to their functional groups. Consequence Violation of this Policy or its appendices may result in loss of travel privileges, disciplinary action, up to and including termination of employment and/or non-reimbursement of expenses, to the extent permitted by law. Activities which are fraudulent, or not in compliance with VeriSign policies are subject to individual liability and Policy or Procedure: Policy Page 3 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 local and civil laws. Consequences apply to direct offenders as well as those who collude or through negligence fail to detect information they knew or should have known. 5.0 POLICY All Expense reimbursements require that Original Receipts are attached for expenditures of $50.00 USD (excludes Gifts in Kind which require receipts) or greater unless local country statutes requires receipt submission for “all” expenses incurred regardless of the amount. Tear tabs should not be submitted as receipts. In the US, employees must scan legible receipts into iExpense using the bar code cover sheet from Oracle after the receipt is entered in iExpense. Original Receipts should be maintained by the employee for one calendar year after submission. Where iExpense is not used, receipts must be taped to an 8.5”x11” piece of paper (US employees) or A4 size (non-US employees), in chronological order. Expense Reimbursement Reports need to be submitted within 30 days of completion of any business reimbursable activity. Expense reimbursement claims should always contain a description outlining purpose of trip or purpose of the expense incurred. Expense Reimbursement Reports older than 180 days of completion of any business reimbursable activity requires functional group GLT approval. Expense reports must be submitted in local currency. For international travel, the exchange rate should be clearly stated either on the receipt or in the iExpense exchange rate field. The OANDA Web site, www.oanda.com, can be used to find the appropriate exchange rate. Receipts should be annotated with the equivalent. Reimbursable business expenses should be paid for using the VeriSign Corporate Travel Card, whenever and wherever possible. Note that contractors are not eligible to receive VeriSign Employee Corporate Cards. Contractors should obtain written approval from VeriSign for all expenses billable to VeriSign and should invoice VeriSign for reimbursement of all billable expenses. Invoices for billable expenses should be accompanied by documentation substantiating the expense. Expense Reimbursement claims should NOT be used for the acquisition of capital equipment. Purchases of goods and services over $2,500 should generally be placed on a Purchase Order. Expense reimbursement claims should NOT be used to procure expenses for events or one time large purchases that should be procured through a Purchase Order process where applicable. Please refer to the Signature Authorization Policy located at the following website: https://intranet.verisign.com/Intranet/PurchasingFinance/Payment/PaymenttoSuppliers/001255 GLT members have the discretion to allow expenses under special circumstances that are not specified within the policy or that are not in line with the policy with respect to their personal expenses; however such exceptions shall require an additional third party approval by either the CFO or CEO. The matrix below outlines the key components of the Expense Reimbursement Policy. Reimbursable Expenses and Guidelines: Nature of Expense Air Travel Description Tickets and change fees Policy Guidance Reimbursable only when purchased via Designated Travel Agency or corporate online travel tool. Changed tickets require proof of change and receipt. Policy or Procedure: Policy Page 4 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 Airline Lounge Airline lounge access for one airline only Car Rental Follow car rental guidelines per travel policy. Hotel and Lodging Follow room class and spending guideline per travel policy. Hotel Cancellations Fees Non-Hotel Lodging Per Diem Personal Meals Business Meals and Customer Entertainment Reservations are expected to be cancelled by employee through their travel representative Lodging with family and/or friends For inCode Consulting employees only Follow daily spending guidelines per travel and entertainment policy Taken with clients, prospects or business associates Employees MUST have functional VP approval in writing included with receipt and should travel at MINIMUM 6 trips per calendar year. Employees MUST submit car rental agreement/receipt and/or credit card record of charge (ROC). For international employees, for Value Added Tax (VAT) purposes, employees need to ensure that the VeriSign company name and address and supplier’s VAT number is listed on the receipts / invoices. Employees MUST submit itemized hotel folio in order to receive reimbursement. Hotel Folio must have $0 balance due as proof of payment. For international employees, Invoice folio should be addressed to VeriSign. (or specific corporate structure, i.e. Ltd. GmbH, etc) and should also include employee name and hotel VAT number. Reimbursable- employees should cancel reservations through travel representative Reimbursable, only for a ‘gift in kind’ (i.e. present, meal, no cash gifts allowed) with prior management approval and itemized receipt and all receipts for the gift in kind must be provided regardless of the amount. The allowance limit is $50 for each night lodging with relatives or friends up to a total of $600 per year per individual friend or relative and may include weekend nights to take advantage of lower airfares or it is not practical for the employee to return home. Only allowed for consulting Employees Reimbursable (See Table in Travel Policy ) Reimbursable for reasonable and actual costs. The following information is required for reimbursement: a. Names of individuals present b. Name and location where meal took place. c. Exact amount and date of expense. d. Specific business topic discussed Policy or Procedure: Policy Page 5 of 13 Telecommunication Expenses (such as cellular, PDA, high speed internet services) Monthly combined expenses incurred in conjunction with business usage for high speed internet only Business Mileage Per mile cost incurred when traveling for business only if no car allowance or company car Gratuities Reimbursable for reasonable costs, in general should not exceed 20% Tolls & Parking Laundry/Dry Cleaning #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 Allowed for trips in excess of 3 days excluding personal meals. e. Highest-level employee present should pay the bill and submit the expense f. Itemized receipt should be included (tear-off tabs are not generally acceptable). • High speed internet services are Reimbursable. • Cell phone and PDA are not reimbursable as VeriSign has corporate programs for these. Mileage for business trips will be reimbursed per local statutory requirements (Please refer to matrix in Appendix section by region or country). Employees who work at a VeriSign Office for 5 hours on a non work day may expense mileage. Reimbursable Reimbursable Reimbursable Excess Baggage Reimbursable as a result of job requirement (mktg. materials, etc.) Spousal/Companion Travel Expenses are reimbursable if incurred as part of a company sponsored event which specifically includes spouse/ partner. Note that there may be income tax implications to the reimbursed employee for spousal travel. License fees, passport, visa fees and professional association memberships Reimbursable if related to job function Customer Gifts for non government officials Gifts up to $100 not to exceed $600 per year are allowable. Gifts over $100 require approval of SVP of Sales. Gift cards are not allowable. Note: IRS considers gift cards taxable and gifts over $600 per year as taxable. Non reimbursable via iExpense. Should be processed via the Purchase Order Process Policy or Procedure: Policy Page 6 of 13 Customer Gifts for Government Officials Employee Gifts/flowers Revision: Final 2.9 All Customer Gifts for Government officials require approval from SVP of Legal. If approved, such gifts should not exceed the guidelines of other Customer Gifts. Up to $100 for special occasions or illness as approved by manager. Gift Cards are not allowable. Employee recognition is intended to be managed via the Thrive program. Note: Employee gifts over the limit may be taxable income to the employee. Department Recognition/Thank you Lunches Corporate Travel Card Awards Program Non reimbursable via iExpense. Should be processed via the Purchase Order Process. Non reimbursable. Should be processed via PCard. Reimbursable To be eligible for reimbursement, employee should travel a minimum of 6 trips in the annual period and have VP approval submitted with the expense reimbursement request Reimbursable Foreign Exchange Charges on Corporate card and ATMs for international transactions while on approved international travel IT Equipment and accessories #.# Corporate Expense Reimbursement Policy Small peripherals for travelers only Small peripherals (such as laptop batteries or internet cables) may be reimbursed for travelers only, for emergency purchases. Other IT equipment requests should be requested via GSD Non-Reimbursable Expenses and Guidelines: Nature of Expense Airline Tickets Description Tickets booked outside designated agency or websites other than booking tool unless country is not supported by Agency. Policy Guidance Not reimbursable. Policy or Procedure: Policy Page 7 of 13 Airline Upgrades; Hotel Membership Personal Air Travel Personal Meals Vehicle code violations, citations and fines Personal Car Housing and rental allowances Cellular Phones, and cell phone bills Revision: Final 2.9 Upgrade coupons; status and hotel memberships If incurred in conjunction with business Flat amounts for daily meals (per diem) While conducting business travel, whether on personal, company or rented vehicle Personal car insurance or other personal car expenses. Costs of housing when sponsored by VeriSign Employees should use Corporate program which is centrally billed Capital Equipment Contractor/Consultant Expenses Travel and other allowable expenses IT Equipment and accessories Includes all computer equipment and accessories under the capitalization threshold amount Charitable Contributions Donations made on behalf of VeriSign must be approved in advance by CFO Sponsorships Employee Recognition Personal #.# Corporate Expense Reimbursement Policy Babysitting/Pet Sitting Service, Barber/Hairstylist, Not reimbursable. Incremental costs associated with personal air travel are not reimbursable Not reimbursable when flat amounts are reported every day for each meal without receipts except for inCode consulting employees Not reimbursable Not reimbursable. Not reimbursable through Expense Reimbursement process. Should be managed via HR for relocations or inpat/expat stays or via Purchase order for all other requests. Corporate Housing requests require CFO approval. Not reimbursable Not reimbursable. Should be managed via Purchase order Not reimbursable. Contractor/Consultants should be managed via Purchase Order or Contingent workforce online systems, as applicable. Generally, not reimbursable through Expense Reimbursement process and should be requested through the Corporate IT/ Engineering support IT departments. Small peripherals (such as laptop batteries or internet cables) may be reimbursed for travelers only, for emergency purchases. Not reimbursable. All Charitable contributions, regardless of value require CFO approval and should be processed via Purchase Order under the category CRP.CHARTY.FEES . . Not reimbursable. All Sponsorships, regardless of value, should be processed via Oracle Purchase Order and require CFO approval. Not Reimbursable. Should be managed via corporate Thrive Program Not reimbursable. Policy or Procedure: Policy Page 8 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 Clothing, Personal Items and services purchased while traveling are not reimbursable (i.e. toiletries, clothing, cosmetics, shoe shine, etc.); manicure/pedicure; massages; spa treatments Other NonReimbursable Expenses considered of a personal nature as follows: 1. In-flight headsets 2. Airline and trip insurance. 3. Use of personal frequent flyer miles to pay for business travel 4. Shopping club memberships 5. High value personal items lost or stolen. 6. Post travel laundry and cleaning services. 7. Late payment fees and interest on credit cards, 8. Lost luggage by airline (should be claimed through airline). 9. In Room Alcohol, & movies Not reimbursable 6.0 Corporate Travel Card This section details general and global policies on use of the Employee Corporate Travel Card, cash advance policy and expense reimbursement guidelines and is applicable in those countries in which a Corporate Travel Card solution is available. A. Use of Corporate Travel Card The Corporate Travel Card is intended to be used for reimbursable expenses. Personal or non-reimbursable expenses should not be paid via the corporate card. In the event that non-reimbursable charges are made on the card, it is the responsibility of the employee to pay for those expenses. Policy or Procedure: Policy Page 9 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 B. Reconciliation of Corporate Travel Card Account Employee Corporate Travel Card accounts must be kept current at all times. Expense reports must be submitted on a timely basis (within 30 days of date of expense) and balanced to your monthly statement to prevent the account from aging past its due date. Any charge amount in dispute should not be expensed. These charges should only be expensed once the dispute has been resolved and indicates the disputed amount is valid and will not be credited by the vendor. Please call the 800# on the back of your card to set up a dispute. VeriSign reserves the right to notify managers of any overdue balances related to VeriSign business travel expenses. Terminated Employee with an Outstanding Balance: If there is an outstanding balance on a terminated employee’s Corporate Travel Card account reconciliation must be completed to determine what the balance consists of. If it is business charges an expense voucher must be created to clear the outstanding balance. Personal balances on an employee’s account are the responsibility of the employee. Personal balances not reimbursed by the employee may be subject to delinquency fees and could result in their account being reported to a credit bureau. C. Delinquency Charges Accounts past due will incur delinquency charges for which employees are personally responsible. If accounts become excessively overdue charging privileges are suspended and eventually cancelled. Delinquency charges must be paid by the employee. If an extreme circumstance exists, a delinquency fee may be charged to the cost center, if a written letter of explanation and approval accompanies the expense voucher from the cost center vice president. Any delinquency charge over $250.00 must have approval of employee’s vice president or above. Corporate Travel Card accounts must be reconciled by employees monthly to prevent account delinquencies. Account balances outstanding for 60 days will be charged a delinquency fee. Charging privileges will be suspended for those account balances outstanding for 75 days. Accounts aged to 90 days will be charged a $25.00 suspension fee in addition to all applicable delinquency fees. Employees are personally responsible to pay the 90 Day Suspense fee. Accounts aged to 120 days will automatically be cancelled. At 180 days, the delinquency will be reported to a credit bureau and can appear on the employee's personal credit report. Delinquency charges must be paid by the employee since they are responsible for reconciling their accounts on a timely basis. If an extreme circumstance exists, a delinquency fee may be charged to the cost center, if a written letter of explanation and approval accompanies the expense voucher from the cost center VP or above. Any delinquency charge over $250.00 must have approval of the unit SVP/GLT or above. Delinquency charges should be expensed on a separate voucher to prevent a delay in payment of normal T&E expenses. D. Cash Advances Cash advances are generally not allowed and require GLT approval on an exception basis. All cash advances require receipts to match the amount of the advance. Employees should use the Employee Corporate Travel Card, whenever possible, to pay for expenses incurred on a business trip; however minimal cash advance to cover incidental expenses may be taken and charged to the Corporate Travel Card. APPENDIX: Mileage Reimbursement by country: Country/Region Reimbursement amount Policy or Procedure: Policy Page 10 of 13 United States Austria Denmark Germany Israel Italy Spain Sweden Switzerland UK Australia China India Korea Singapore Taiwan Latin America 0.505 USD per mile 0.4625 USD per km 0.7395 USD per km 0.7621 per km 0.6685 per km 0.7657 Per km 0.5954 Per km 1.70 SEK, Own car 0.90 SEK, Company car until 10.000 km/year 0.70 CHF /km more than 10.000km/year 0.60 CHF/km Reimbursable amount for noncompany car drivers without car allowance: car allowance First 10,000 miles 40p Over 10,000 miles 25p (All reimbursable amounts are per mile) AUD 0.535/km Petrol Receipt- business activity only INR 8/km Petrol Receipt SGD 0.50/km Petrol Receipt Guidelines under development #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 Policy or Procedure: Policy Page 11 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 ADDENDUM: CONSULTING EMPLOYEES Per Diem for Project Related Employee Transactions Daily or Monthly allowances (Per Diems) are available to employees that travel overnight outside of their normal base of operation (home office or office location) to cover expenses for subsistence and incidentals. The type of Per Diem available to the employee depends upon the project and situation. The employee will be told explicitly by their supervisor or project manager whether daily or monthly Per Diem applies. In all cases, the rate for the Per Diem is established according to the local laws and regulations of the employing company. For example, the daily Per Diem amount for US based employees that are traveling domestically is based upon the IRS Daily Per Diem amount under the High-Low Substantiation Method and is dependent upon geography. International Per Diem rates for US employees were established according to U.S. State Department guidelines. Revised US Daily Per Diem and Mileage Rates (Effective January 1, 2008) Daily Per Diem Rates for 2008 Total High Expense US Cities: Low Expense US Cities: Breakfast Lunch Dinner $58/day (US Dollars) $ 9.00 $ 15.00 $ 34.00 $45/day (US Dollars) $ 7.00 $ 12.00 $ 26.00 Cities Qualifying for High Per Diem of $58/day (US) Effective Date of $58 Rate State Key City County/Location ARIZONA CALIFORNIA Phoenix/Scottsdale Napa Maricopa Napa 1/1 - 3/31 San Diego San Diego All Year San Francisco San Francisco All Year Santa Monica Santa Monica City Limits All Year Aspen Pitkin 12/1-3/31 Telluride San Miguel 10/1-4/30 Vail Eagle DISTRICT OF COLUMBIA Washington DC/MD/VA Includes the cities of Alexandria, Fairfax, and Falls Church, and the counties of Arlington, Fairfax, and Loudoun in Virginia as well as the counties of Montgomery and Prince George's in Maryland 12/1-3/31 All Year FLORIDA Key West Monroe All Year Miami Miami-Dade 1/1-4/30 Naples Collier 2/1-3/31 Palm Beach Boca Raton, Delray Beach 2/1-3/31 ILLINOIS Chicago Cook/Lake 10/1-6/30; 9/1-9/30 LOUISIANA New Orleans/St. Bernard Orleans/St. Bernard/ Plaquemine/Jefferson MASSACHUSETTS Boston Suffolk All Year Cambridge Middlesex (except Lowell) All Year COLORADO All Year 10/1-10/31 Policy or Procedure: Policy Page 12 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 Martha's Vineyard Dukes 7/1-8/31 Nantucket Nantucket 6/1-8/31 Baltimore Baltimore All Year Ocean City Worcester All Year Floral Park/Garden City Nassau All Year Glen Cove/Great Neck Nassau All Year Roslyn Nassau All Year Manhattan/Staten Island Brooklyn/Queens/Bronx 71/-8/31 Riverhead/Ronkonkoma Suffolk All Year Melville/Smithtown Huntington Station Suffolk All Year Suffolk All Year Amagansett/East Hampton Suffolk All Year Montauk/Southhampton Suffolk All Year Islandia/Commack/Medford Suffolk All Year Stony Brook/Hauppauge Suffolk All Year Centereach Suffolk All Year Tarrytown/White Plains Westchester All Year New Rochelle/Yonkers Westchester All Year PENNSYLVANIA Philadelphia Philadelphia All Year RHODE ISLAND Jamestown/Middletown Newport All Year Newport Newport 10/1-10/31 and 5/1-9/30 UTAH Park City Summit 12/1-3/31 VIRGINIA Cities of Alexandria, Fairfax, and Falls Church, and the counties of Arlington, Fairfax, and Loudoun WASHINGTON Seattle MARYLAND NEW YORK All Year King All Year Policy or Procedure: Policy Page 13 of 13 #.# Corporate Expense Reimbursement Policy Revision: Final 2.9 The Chart below should be used as guideline to daily meal spending guidelines (amount per day/not per meal.)Generally, employees should allocate 20% for breakfast, 30% for lunch, and 50% for dinner of the daily spending guideline. AVERAGE DAILY MEAL SPENDING GUIDELINES UP TO US$ 50 UP TO US$ 75 Bangladesh Nigeria Pakistan Argentina Brazil Canada Central America Chile Caribbean India Sri Lanka Venezuela Jordan Malaysia Philippines South Africa United States New Zealand Boston Chicago Miami Phoenix Australia Czech Republic Denmark Egypt Greece Hungary Iceland Iceland Indonesia Mexico Nepal Oman Poland Portugal Thailand Turkey Uruguay Viet Nam UP TO US$ 100 Honolulu Los Angeles New York San Francisco San Juan Austria Bahrain Belgium Finland France Germany Ireland Israel Italy Kazakhstan Korea Kuwait Lebanon Luxembourg Mali Morocco Netherlands Norway Peoples Republic of China Qatar Russia Saudi Arabia Senegal Singapore Spain Sweden Taiwan Tunisia United Arab Emirates United Kingdom UP TO US$ 125 Barcelona Birmingham Frankfurt Hong Kong London* Madrid Mexico City Milan Monaco Moscow Oslo Paris Rome Seoul St. Petersburg Japan Switzerland