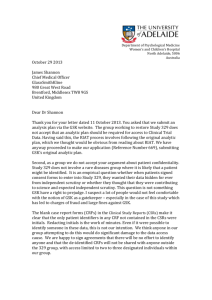

3.1.3 Biovail Corporation et al. IN THE MATTER OF THE

advertisement