ACCELERATED PROGRAM QUALIFYING COURSES APPLICATION

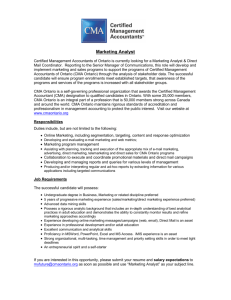

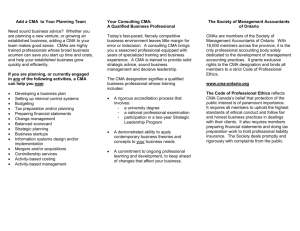

advertisement

Certified Management Accountants of Ontario REFERENCE NO. 25 York Street, Suite 1100, Toronto, Ontario M5J 2V5 ACCELERATED PROGRAM QUALIFYING COURSES APPLICATION PLEASE PRINT GIVEN NAME SURNAME TITLE: MR. MRS. MISS MS. DR. PROF. MIDDLE NAME DELIVERY ADDRESS: MAIL: COURSE MATERIAL: RESIDENCE BUSINESS RESIDENCE BUSINESS (PREFERABLE) BUSINESS ADDRESS: POSITION TITLE ________________________________________________________________________________________________________ BUSINESS TEL. (________)_____________________________ COMPANY NAME ______________________________________________________________________________________________________ EXT. __________________________________________________ ADDRESS_______________________________________________________________________________________________________________ HOME TEL. (________) ________________________________ PROVINCE __________________ POSTAL CODE _____________________________ FAX (________) _________________________________________ E-MAIL ADDRESS: ___________________________________________________________________________________________________ BIRTHDATE ___________________________________________ CITY_______________________________________ May be provided to a third party for shipping confirmation purposes. RESIDENCE ADDRESS: SEX: ADDRESS _________________________________________________________________ CITY_______________________________________ BUZZER CODE _____________________________ MALE FEMALE DESIGNATIONS _______________________________________ PROVINCE __________________ POSTAL CODE _____________________________ WHICH ONE OF THE FOLLOWING MOST INFLUENCED YOUR DECISION TO SEEK INFORMATION REGARDING THE CMA PROGRAM? CHECK (✓) ONLY ONE EMPLOYER, AGENCY COLLEAGUE, FRIEND CMA MEMBER UNIVERSITY PROFESSOR UNIVERSITY CAREER OFFICE CAREER FAIR/CONFERENCE ALUMNI MAILING ADVERTISEMENT WEB SITE OTHER: SPECIFY CMA PRESENTATION: AT SECONDARY SCHOOL AT UNIVERSITY POST-UNIVERSITY _______________________________________ WHO INFLUENCED YOUR DECISION TO ENTER THE CMA PROGRAM? CHECK (✓) ALL THAT APPLY EMPLOYER, AGENCY COLLEAGUE, FRIEND CMA MEMBER FAMILY MEMBER UNIVERSITY PROFESSOR UNIVERSITY CAREER OFFICE CMA STAFF OTHER: SPECIFY _____________________________ BUSINESS PROFILE CODES: PLEASE SEE OVER FOR THE APPROPRIATE CODES POSITION TYPE: ____________________________________ EMPLOYMENT SECTOR: ___________________________________ COMPANY SIZE: ____________________________________ EDUCATIONAL BACKGROUND: UNIVERSITY____________________________________________________ DEGREE & SPECIALIZATION ____________________________________________ GRAD DATE _______________________ UNIVERSITY____________________________________________________ DEGREE & SPECIALIZATION ____________________________________________ GRAD DATE _______________________ PLEASE SELECT FROM THE FOLLOWING SEVEN COURSES FOR THIS APPLICATION: CHECK (✓) OR INTRODUCTORY MANAGEMENT ACCOUNTING 2012-13 FEE REMITTANCE $490.00 + $63.70 (HST) = $553.70 _______________________ INTRODUCTORY FINANCIAL ACCOUNTING STATISTICS $490.00 + $63.70 (HST) = $553.70 _______________________ CANADIAN BUSINESS LAW $490.00 + $63.70 (HST) = $553.70 _______________________ ECONOMICS (Micro and Macro) $490.00 + $63.70 (HST) = $553.70 _______________________ MICRO ECONOMICS $383.71 + $49.88 (HST) = $433.59 _______________________ MACRO ECONOMICS $383.71 + $49.88 (HST) = $433.59 _______________________ $64.00 + $8.32 (HST) = $72.32 _______________________ REGISTRATION FEE(1) Please note that students must have successfully completed an Introductory Financial Accounting TOTAL REMITTANCE $_______________________ course with 60% at the undergraduate level or graduate level in order to register for CMA Ontario’s No refunds will be granted once the application has been processed Introductory Management Accounting course. There is no prerequisite for the Introductory Financial Full payment must be submitted with the form. Accounting course. Students will not be permitted to register in both the Introductory Management HST Registration No. 12396 9610 RT0001 Accounting and Introductory Financial Accounting courses concurrently. Registration fees in the amount of $72.32 are due each year by July 1st. If you are not yet a member or have not paid your 2012-2013 registration fees (due as of July 1st, 2012), please pay them as part of this application. Please be advised that your application will not be processed if you have any outstanding fees on your account. 1) Non-refundable registration fee for year ending June 30, 2013 (includes HST). Please refer to the Pre-Professional Candidate Handbook prior to enrolment for detailed information on CMA Ontario’s policies regarding eligibility, refund, cancellation and course procedures. Method of payment (check one only) : Card Number: Cheque Visa MasterCard ____ ____ ____ ____ /____ ____ ____ ____ /____ ____ ____ ____ /____ ____ ____ ____ Expiry Date: ____ ____ /____ ____ M M Y Remittance $ ___________________ Y Cardholder’s Name: __________________________________________________________ Cardholder’s Signature: ____________________________________________________________________________ If paying by cheque, please mail the cheque, payable to CMAO, and this form to the address above. If paying by credit card, you may submit this form by fax to 416-977-2128, email (as a scanned pdf) to info@cma-ontario.org or by mail to the address above. Please also note that all applicants must be able to demonstrate proficiency in one of Canada’s official languages. I agree to abide by CMA Ontario’s regulations and the Professional Misconduct and Code of Professional Ethics regulation. I understand that, in the collection, storage, use and disclosure of personal information, CMA Ontario abides by the Personal Information Protection and Electronic Documents Act and Section 61 of the Certified Management Accountants Act, 2010. SIGNATURE ___________________________________________________________________________ DATE ___________________________________________________________ Reference No. Certified Management Accountants of Ontario Declaration with Respect to Character Have you ever been convicted or found guilty of a criminal or other statutory offence for which you have not received a pardon? 1 Has a civil judgment involving fraud or theft ever been rendered against you? YES NO YES NO YES Have you ever been expelled or removed from any educational institution? NO Have you ever been sanctioned or penalized by any court, tribunal, licensing or regulatory body? YES NO Have you ever been refused admission to or been expelled from a licensing or professional organization? With the past six (6) years, have you been the subject of an Insolvency Event as defined in the Bankruptcy and Insolvency Regulation of CMA Ontario? YES NO YES NO For any questions above answered yes, please attach an explanation and/or supporting documentation to this application at the time of submission. I declare that the above information and any explanation or documentation provided in relation to this declaration is true and complete. This statement is made in full recognition of my responsibilities under the Certified Management Accountants Code of Professional Ethics. Dated in the City of Applicant: Full Legal Name in the Province of Ontario, this day of , 20 . Applicant: Signature If you have previously received a decision of the Registrar or the Review Committee of CMA Ontario in relation to the matter disclosed above, please attach a copy to this declaration. 1 Do not include parking infractions or offences under the Highway Traffic Act CMA Canada BUSINESS PROFILE CODES Please INSERT the appropriate codes on your Membership and Enrolment Application. Position Type Employment Sector (cont’d) Employment Sector (cont’d) 101 102 103 104 110 111 112 115 116 120 121 122 150 151 152 153 154 155 156 160 161 162 170 180 181 182 190 191 192 193 EDUCATION PUBLIC ADMINISTRATION 30.05 30.10 30.15 30.20 30.25 30.30 30.35 60.05 60.10 60.15 60.20 60.25 60.30 195 199 Junior Analyst Intermediate Analyst Senior Analyst Financial Analyst Junior Accountant Intermediate Accountant Senior Accountant Supervisor Manager Chief Accountant Assistant Controller Controller Treasurer Director Corporate Secretary General Manager Vice President President Chief Financial Officer Partner Principal Sole Proprietor Academic Internal Auditor Government Auditor External Auditor Systems Analyst Executive (Non Accounting) Supervisor (Non Accounting) Analyst/Internal Consultant (Non Accounting) Consultant Other Employment Sector AGRICULTURE, FORESTRY & FISHERIES 10.05 10.10 10.15 10.20 10.25 10.30 Agricultural Services Farm Management Services Fisheries Forestry Products & Services Landscape & Horticulture Other COMMUNICATIONS 15.05 15.10 15.15 15.20 15.25 15.30 Cable Radio Communications Services Telephone TV Broadcasting Other CONSTRUCTION 20.05 20.10 20.15 20.20 General Building Contractors Heavy Construction Contractors Trade Contractors Other CONSULTING SERVICES 25.05 25.10 25.15 25.20 25.25 25.30 25.35 25.40 25.45 25.45 Public Accounting Controllership Financial Planning Forensic Accounting Human Resources Information Technology Management Accounting Management Consulting Taxation Other College Libraries Ministry of Education School & Education Services Secondary Schools University Other ENGINEERING & RESEARCH DEVELOPMENT 35.05 35.10 35.15 35.20 35.25 35.30 35.35 Aviation Building Materials Computer Software Construction Energy Industry Environmental Other ENTERTAINMENT 40.05 40.10 40.15 40.20 40.25 Amusement & Recreation Casino Motion Pictures Sports Other FINANCE, INSURANCE & REAL ESTATE 45.05 45.10 45.15 45.20 45.25 45.30 45.50 45.55 45.70 45.40 Banking Credit Agencies, Except Banks Holding Companies, Re-Investment Investment Counselling/ Management Security & Commodity Services Trust Companies Insurance Agents Insurance Carriers Real Estate Other MANUFACTURING 50.05 50.08 50.10 50.15 50.18 50.20 50.25 50.28 50.30 50.35 50.38 50.40 50.45 50.48 50.50 50.55 50.58 50.60 50.65 50.68 50.70 50.75 Apparel & Related Products Chemicals & Allied Products Computer & Electronic Products Drugs Electrical Equipment Fabricated Metal Products Food & Kindred Products Furniture & Fixtures Leather & Leather Products Lumber & Wood Products Machinery, Except Electrical Measuring, Analyzing & Controlling Instruments Paper & Allied Products Petroleum & Coal Products Primary Metal Industries Printing & Publishing Rubber & Plastics Stone, Clay & Glass Products Textile Mill Products Tobacco Manufacturers Transportation Equipment Other MINING 55.05 55.10 55.15 55.20 55.25 Coal & Lignite Mining Metal Mining Minerals Oil & Gas Extraction Other Crown Corporations Federal Government Municipal Government Provincial Government Regional Government Other RETAIL TRADE 65.05 65.10 65.15 65.20 65.25 65.30 65.35 65.40 Apparel & Accessory Stores Auto Dealers, Auto Parts & Accessories Building Materials, Hardware, Garden Supply Eating & Drinking Places Food Stores Furniture & Home Furnishings General Merchandise Other SERVICES 70.05 70.10 70.15 70.20 70.25 70.30 70.35 70.40 70.45 70.50 70.55 Advertising/Public Relations Auto Repair, Leasing & Rental Services Business Services Environmental Services Health Care Services Legal Services Lodging Places, Restaurants, Convention Facilities Non-Profit Membership Organizations Personal Services Social Services Other TRANSPORTATION 75.05 75.10 75.15 75.20 75.25 75.30 75.35 Air Transportation Local Transportation Pipe Line Transportation Railroad Transportation Trucking & Warehousing Water Transportation Other UTILITIES & ENERGY 80.05 80.10 80.15 80.20 80.25 Electric Power Natural Gas Petroleum Water Other WHOLESALE TRADE 85.05 85.10 85.15 Wholesale Durables Wholesale Non-Durables Other Company Size 001 002 006 011 051 101 201 501 over 1,000 No. of Employees 1 2–5 6 – 10 11 – 50 51 – 100 101 – 200 201 – 500 501 – 1,000 over 1,000 Certified Management Accountants of Ontario August 20, 2011 Professional Misconduct and Code of Professional Ethics Regulation 1. Preamble 1.1 Capitalized terms used in this Regulation (and not otherwise defined herein) shall have the meanings ascribed to such terms in the Bylaws of Certified Management Accountants of Ontario (CMA Ontario). 1.2 The Interpretation provisions of the Bylaws (namely, Section 2) form part of this Regulation and are incorporated herein by reference. 2. Professional Misconduct 2.1 In this section, “negligence” means an act or an omission, either alone or cumulatively, in the carrying out of the work by a Member, Student, Firm, Public Accounting Firm or Professional Corporation that constitutes a failure to maintain the standards that a reasonable and prudent Member, Student, Firm, Public Accounting Firm or Professional Corporation of equivalent designation in CMA Ontario would maintain in the circumstances. 2.2 For the purposes of the Bylaws, the following actions constitute “professional misconduct”: (a) negligence; (b) a breach by a Member, Student, Firm, Public Accounting Firm or Professional Corporation of the Act, or the Bylaws or the Regulations; (c) undertaking work the Member, Student, Firm, Public Accounting Firm or Professional Corporation is not competent to perform by virtue of his, her or its training and experience; (d) fraud, theft, forgery, tax evasion, violation of securities laws, or unlawful conduct in the Member’s, Student’s, Firm’s, Public Accounting Firm’s or Professional Corporation’s professional capacity, including any criminal conviction of the above; Professional Misconduct and Code of Professional Ethics Regulation p. 1 of 5 Certified Management Accountants of Ontario 3. August 20, 2011 (e) pleading guilty to or being found guilty of a criminal offence but being discharged absolutely or upon conditions prescribed in a probation order; (f) the failure of a Member, Student, Firm, Public Accounting Firm or Professional Corporation to respond promptly and cooperate fully with respect to requests for information and other communications from CMA Ontario. Code of Professional Ethics All Members, Students, Firms, Public Accounting Firms and Professional Corporations will adhere to the following Code of Professional Ethics of CMA Ontario: 3.1 3.2 A Member, Student, Firm, Public Accounting Firm or Professional Corporation will act at all times with: (a) responsibility for and fidelity to public needs; (b) fairness and loyalty to such Member's, Student’s, Firm’s, Public Accounting Firm’s or Professional Corporation’s associates, clients and employers; and (c) competence through devotion to high ideals of personal honour and professional integrity. A Member, Student, Firm, Public Accounting Firm or Professional Corporation will: (a) maintain at all times independence of thought and action; (b) not express an opinion on financial reports or statements without first assessing her, his or its relationship with her, his or its client to determine whether such Member, Student, Firm, Public Accounting Firm or Professional Corporation might expect her, his or its opinion to be considered independent, objective and unbiased by one who has knowledge of all the facts; (c) when preparing financial reports or statements or expressing an opinion on financial reports or statements, disclose all material facts known to such Member, Student, Firm, Public Accounting Firm or Professional Corporation in order not to make such financial reports or statements Professional Misconduct and Code of Professional Ethics Regulation p. 2 of 5 Certified Management Accountants of Ontario August 20, 2011 misleading, acquire sufficient information to warrant an expression of opinion and report all material misstatements or departures from generally accepted accounting principles; and (d) 3.3 comply with the requirements of the CMA Ontario Independence Regulation for Assurance, Audit and Review Engagements. A Member, Student, Firm, Public Accounting Firm or Professional Corporation will: (a) not disclose or use any confidential information concerning the affairs of such Member's, Student’s, Firm’s, Public Accounting Firm’s or Professional Corporation’s employer or client unless authorized to do so or except when such information is required to be disclosed in the course of any defence of himself, herself or itself or any associate or employee in any lawsuit or other legal proceeding or against alleged professional misconduct by order of lawful authority of the Board or any Committee of CMA Ontario in the proper exercise of their duties but only to the extent necessary for such purpose and only as permitted by law; (b) obtain, at the outset of an engagement, written agreement from any party or parties to whom work is contracted not to disclose or use any confidential information concerning the affairs of such Member’s, Student’s, Firm’s, Public Accounting Firm’s or Professional Corporation’s employer or client unless authorized to do so or except when such information is required to be disclosed in the course of any defence of himself, herself or itself or any associate or employee in any lawsuit or other legal proceeding but only to the extent necessary for such purpose and only as permitted by law; (c) inform his, her or its employer or client of any business connections or interests of which such Member's, Student’s Firm’s, Public Accounting Firm’s or Professional Corporation’s employer or client would reasonably expect to be informed; (d) not, in the course of exercising his, her or its duties on behalf of such Member's, Student’s, Firm’s, Public Accounting Firm’s or Professional Corporation’s employer or client, hold, receive, bargain for or acquire any fee, remuneration or benefit without such employer's or client's knowledge and consent; and (e) take all reasonable steps, in arranging any engagement as a consultant, to establish a clear understanding of the scope and objectives of the work before it is commenced and will furnish the client with an estimate of cost, Professional Misconduct and Code of Professional Ethics Regulation p. 3 of 5 Certified Management Accountants of Ontario August 20, 2011 preferably before the engagement is commenced, but in any event as soon as possible thereafter. 3.4 3.5 A Member, Student, Firm, Public Accounting Firm or Professional Corporation will: (a) conduct himself, herself or itself toward Members, Students, Firms, Public Accounting Firms and Professional Corporations with courtesy and good faith; (b) not commit an act discreditable to the profession; (c) not engage in or counsel any business or occupation which, in the opinion of CMA Ontario, is incompatible with the professional ethics of a management accountant or public accountant; (d) not accept any engagement to review the work of a Member, Student, Firm, Public Accounting Firm or Professional Corporation for the same employer except with the knowledge of that Member, Student, Firm, Public Accounting Firm or Professional Corporation, or except where the connection of that Member, Student, Firm, Public Accounting Firm or Professional Corporation with the work has been terminated, unless the Member, Student, Firm, Public Accounting Firm or Professional Corporation reviews the work of others as a normal part of his, her or its responsibilities; (e) not attempt to gain an advantage over Members, Students, Firms, Public Accounting Firms and Professional Corporations by paying or accepting a commission in securing management accounting or public accounting work; (f) uphold the principle of adequate compensation for management accounting and public accounting work; and (g) not act maliciously or in any other way which may adversely reflect on the public or professional reputation or business of a Member, Student, Firm, Public Accounting Firm or Professional Corporation. A Member, Student, Firm, Public Accounting Firm or Professional Corporation will: (a) at all times maintain the standards of competence expressed by the Board from time to time; Professional Misconduct and Code of Professional Ethics Regulation p. 4 of 5 Certified Management Accountants of Ontario August 20, 2011 (b) disseminate the knowledge upon which the profession of management accounting is based to others within the profession and generally promote the advancement of the profession; (c) undertake only such work as he, she or it is competent to perform by virtue of his, her or its training and experience and will, where it would be in the best interests of an employer or client, engage, or advise the employer or client to engage, other specialists; (d) expose before the proper tribunals of CMA Ontario any incompetent, unethical, illegal or unfair conduct or practice of a Member, Student, Firm, Public Accounting Firm or Professional Corporation which involves the reputation, dignity or honour of CMA Ontario; and (e) endeavour to ensure that a professional partnership, company or individual, with which such Member, Student, Firm, Public Accounting Firm or Professional Corporation is associated as a partner, principal, director, officer, associate or employee, abides by the Code of Professional Ethics and the Rules of Professional Conduct established by CMA Ontario. Professional Misconduct and Code of Professional Ethics Regulation p. 5 of 5