best laid plans.qxp - University of Glasgow

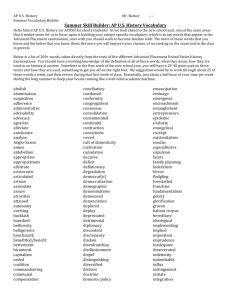

advertisement