grey area of ethics: the significance of levinas' perspective on

advertisement

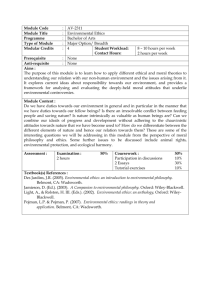

GREY AREA OF ETHICS: THE SIGNIFICANCE OF LEVINAS’ PERSPECTIVE ON ACCOUNTING STUDENTS’ DELIBERATIVE MORAL REASONING Kias Ayu Damara Supriyadi ( Universitas Gadjah Mada ) ABSTRACT:This study aims to analyze the significance of Levinas‟ perspective on the deliberative moral reasoning of accounting students when facing a grey area of ethics in a corporate accounting context. In a between-subjects experimental design, 36 undergraduate accounting students at Faculty of Economics and Business, UniversitasGadjahMada, were randomly assigned into two groups, which are treatment group and control group. The first group received a treatment of Levinas‟ perspective, while the second received no treatment at all. However, both responded to the same four ethical dilemmas faced by corporate accountants designed to measure their deliberative moral reasoning. As expected, students in the treatment group exhibited significantly higher deliberative moral reasoning than those in the control group. This result thus suggests that Levinas‟ perspective has significance on accounting students‟ deliberative moral reasoning when facing a grey area of ethics in a corporate accounting scheme. Keywords: Levinas‟ perspective, deliberative moral reasoning, accounting students, grey area of ethics. INTRODUCTION Nowadays, there has been a widespread belief that the world is facing the era of moral freedom, when people are more inclined to create their own morality (Wolfe, as cited in Bruhn, 2009).Corporate accountants, as we fully aware, are likely to face the grey area of ethics. It is possibly due to their position, as explained by Gowthorpe and Amat (2005) that preparers of financial statements are in a position to manipulate the economic reality view provided by those statements to interested parties. As such, accountants now, as a group, are regarded to have lower levels of moral reasoning than other professional groups (Eynon et al., as cited in McPhail& Walters, 2009). 1 Apart from an individual‟s ethical ideology and moral philosophy, some blamed the negative effect business and accounting education have on ethical development of students (McCabe and colleagues, 1991, and Gray and colleagues, 1994, as cited inMcPhail& Walters, 2009). More specifically, some researchers pointed out that ethics education students received during college are seen to contribute to poor ethical choices (Jennings, 2004; Fleming et al., 2009). Vis-à-vis to that argument, Roberts also noted that ethics in business can only be perceived as a strategy of being seen to be ethical, which is the obverse of being responsible (as cited in Aasland, 2004). The above issue is important since ethics education which does not depart from the „real ethics‟ may not result in ethical behavior of students expected to be corporate accountants in the future. This study thus examines how to enhance the deliberative moral reasoning of accounting students, which involves the formulation of an intention to act on a particular ethical dilemma (Thorne, 2000) with Levinas‟ perspective which is argued to be related to what „real ethics‟ is. The focus on the deliberative moral reasoning is chosen because according to Fleming et al. (2009), understanding students‟ ability to execute professional judgment is crucial to assessing the outcome of accounting education. Moran (in McPhail& Walters, 2009) explained that, for Levinas, the phenomenology of ethics is associated with „the effort to constrain one‟s freedom and spontaneity in order to be open to the other person, or more precisely to allow oneself to be constrained by the other.‟ In other words, there is a tendency to do otherwise than privileging oneself over the others (Aasland, 2004). Such a motive is what Aasland called ethics. This study then hypothesizes that there is a significant difference in the deliberative moral reasoning between students with Levinas‟ perspective and those without it. 2 The hypothesis is tested by employing a 1 x 2 between subject experimental design. Thirty six undergraduate accounting students who participated in this study were randomly assigned into two groups, of which treatment group got Levinas‟ treatment,while control group did not get it, yet, both groups responded to the same measurement of deliberative moral reasoning in corporate accounting context, which is Fleming et al.‟s adaptation of Accounting Ethical Dilemma Instrument (AEDI) developed by Thorne. As expected before, there is a significant difference between deliberative moral reasoning in both groups. Moreover, this research found that accounting students in the treatment group exhibited a higher level of deliberative moral reasoning than those in the control group. The results of this study enrich the studies of behavioral accounting and encourage further research aimed to enhance the deliberative moral reasoning of accounting students who later might become corporate accountants.As for accounting students, this research provides a new approach which may help those who consider to becorporate accountants to exercise a better professional judgment under a grey area of ethics. The remaining of this paper is organized as follows. In the next section, background in regards to ethics education is discussed and hypothesis of this research is developed. The following section addresses research method for this study and presents the results. At last, this paper concludes the research, outlines the limitations, as well as proposes some suggestions for future research. LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT Ethical Ideologies: Idealism vs. Relativism 3 Smith and Quelch (as cited in Lu & Lu, 2010) emphasized that the sources of ethical disparities among individuals are idealism and relativism. Moral relativism alleges that all moral standards are concerned with the culture in which they happened (Schlenker& Forsyth, as cited in Lu & Lu, 2010). Forsyth stated that highly relativistic individuals are more likely to believe that morals action depend on the encompassing circumstances and individuals involved than believing simply in absolute moral truths (as cited in Marques & Pereira, 2009). Based on moral relativism, moral rules cannot be derived from universal moral principles, but abide as a function of time, place, as well culture. Thus, there is no set of rules that can be formulated to determine what is right and what is wrong for all individuals (Swaidan,Vitell, &Rawwas, 2003). Meanwhile, idealism describes the extent to which an individual focuses on the inherent rightness or wrongness of an action, despite the consequences of that action (Swaidan et al., 2003). Forsyth (as cited in Lu & Lu, 2010) explained that idealistic individuals comply with moral absolutes when making moral judgments. Meanwhile, less idealistic people think that harm is sometimes needed to produce well. They prefer to have a utilitarian perspective suggesting that an action is right if it produces the greatest good for the greatest number of people affected by the action, although it may harm a certain group of people (Forsyth, as cited in Swaidan et al., 2003). Cognitive-Development Theory In general, people with cognitive developmental perspective have concentrated on the study of the development of cognitive reasoning structures which trigger an ethical decision choice (Thorne, 2000). Referring to Kohlberg‟s model of Cognitive Moral Development (CMD), there are three levels of moral development, which are pre-conventional, conventional, 4 and post-conventional (McPhail& Walters, 2009). For those with pre-conventional moral development, the moral acceptability of alternative actions is defined by the rewards and punishments. For people with conventional moral development, the moral acceptability confirms to group norms. As for the last, moral development considers universal moral principles regardless of the impacts on oneself (Thorne, 2000). Based on this perspective, Rest‟s Model of Ethical Action has been widely used to define the ethical decision process of accountants (Thorne 1998; Thorne 2000; Jones et al. 2003, as cited in Fleming et al, 2009). The model has four components including: (1) identification of an ethical dilemma, (2) ethical judgment, (3) intention to act ethically, and (4) ethical behavior (Rest, as cited in Fleming et al, 2009). The focus of this study is on investigating the ethical judgment by examining the development and level of corporate accountants‟ moral reasoning, especially the deliberative moral reasoning. As Thorne (2000) stated that deliberative reasoning is similar to an accountant‟s intention to execute professional judgment to resolve an ethical dilemma. Ethics for Business vs. Ethics in Business Business ethics is recently being a very prominent business topic. Moreover, the dilemmas and debates addressing business ethics have drawn a number of attention from various parties (Crane &Matten, 2007). Aasland (2009) stated that there is still an unanswered question left from both American and European literature: Is „business ethics‟ a knowledge of „ethics for business‟ or is it a knowledge of „ethics in business? Aasland (2009) stated that ethics for business describes – and prescribes – how companies respond to ethical challenges in society, and thereby constitutes an important part of the knowledge called business management. There are several reasons why Aasland regarded 5 ethics for business as instrumental knowledge and not „real ethics‟: 1. The main interest of business leaders is to find tools that can work instead of looking for the truth about humans as well as their perspectives on right and wrong; 2. Economic and business management knowledge is equipped with a logical structure, sometimes called „boomerang effect‟. It means that it will always pay to behave morally, because if one does not, it will hit back at oneself and one‟s company as decreased trust or a negative reputation; 3. In the end, pursuing the interest of a company and more than that of others is self-centered perspective. In contrast, what Aasland (2009) called ethics in business is the occurrence of the idea that it is possible to put the other before myself, also within and between business organizations. Thus, the difference between both terms is that, while ethics for business is knowledge that business develops and applies for itself, ethics in business is ethics which can only be applied and developed for the sake ofthe other. Levinas’ Perspective Campbell et al. (2009) argued that within a different stream of accounting ethics literature there is a small but growing discussion about the ethics of Emmanuel Levinas (Shearer, 2002; MacIntosh, 2004; Roberts, 2003; McKernan and KosmalaMacLullich, 2004) as well as a sociological translation of Levinas‟ work provided by Zygmunt Bauman (McPhail, 2001; Funnell, 1998; Junge, 2001, Tester, 2002). Levinas perceived ethics by employing a very different perspective from traditional moral philosophy. He brought a phenomenological view to the study of ethics (McPhail& Walters, 2009). He commented: The absolute nakedness of a face, the absolute defenceless face, without covering, clothing or mask, is what opposes my power over it, my violence and opposes it in an absolute way, with an opposition which is opposition itself (cited in Bauman, 1993, p. 73). 6 Levinas questioned, „how does the experience of ethics present itself to us; what is the given-ness of ethics?‟ He realized that it presents itself through the Other, through the encounter with the face; through the face to face (McPhail&Walters, 2009). To better understand Levinas‟ perspective, there is Bauman‟s thought about Levinas‟ work within a modern social context. It will be only later, when I acknowledge the presence of the face as my responsibility, that both I and the neighbor acquire meanings: I am I who is responsible, he is he to whom I assign the right to make me responsible. It is this creation of meaning of the Other, and thus also of myself, that my freedom, my ethical freedom, comes to be. (As cited in Bauman, 1993: 86) Bauman‟s explanation above makes Levinas‟ perspective more applicable to the sociological perspective. It is the fundamental of sympathy and core responsibility for others implied from Levinas‟ work. In order to bring Levinas‟ work into the economy, this research suggests to once again refer to Aasland‟s book. Aasland (2004) opened up the issue by explaining what Spinoza called conatus essendi is. It is a will to preserve oneself, that applies to all unliving, as well as all living. However, humans do not always follow their conatus. This kind of ethics differs with other ethical ideologies which stated that ethics is developed from a reason, or even consequences one may have on oneself as well as the others. Nonetheless, why it emerges is caused by the faculty to be conscious and to reflect about himself or herself that each human has. The capacity to question the conatus and set the other before oneself is, by Levinas, suggested to happen from the encounter with the Other. Yet, he also acknowledges that I not only meet with the Other, but also the third, the fourth, etc., as the Others. By then, I am forced to always do evaluation, comparison, and searching for what is just, because the called forth mercy for each unique Other drives me to always strive for more justice. 7 Levinas‟ grounding of ethics begins with „the way the face of the Other makes a claim on me to restrain myself‟ (McPhail& Walters, 2009). Moran (as cited in McPhail& Walters, 2009) explained that for Levinas, the phenomenology of ethics involves „the effort to constrain one‟s freedom and spontaneity in order to be open to the other person, or more precisely to allow oneself to be constrained by the other.‟ This idea of good to be able to put the Other before the I is what Aasland (2009) argued as the „real ethics‟. This research brings this perspective to be applied in accounting context, particularly in the grey area of ethics faced by corporate accountants. Accordingly, the following alternative hypothesis tests the applicability of such perspective in corporate accounting context.: Ha: There is a significant difference in the deliberative moral reasoning between accounting students, treated as corporate accountants, who get Levinas‟ treatment and those who do not. RESEARCH METHOD Participants There were 48 undergraduate accounting students from Faculty of Economics and Business, UniversitasGadjahMada, who participated in this study. Of the 48 participants, eight failed the internal validity check. Furthermore, two failed in completing the assignments, and the other two participants were omitted because they did not complete the assignments as directed, thus, resulting in a final sample of 36. Based on demographic data, sixty-four percent of the students were female, seventy-eight percent of the students were in their fourth year of study at FEB UGM, and all of the participants had completed a business ethics course as well as a cost accounting course. Research Design, Variables, and Measurement 8 This study analyzes the significance of Levinas‟ perspective on the deliberative moral reasoning of accounting students in a corporate accounting context by employing a 1x2 between subject experimental design. The independent variable in this research is Levinas‟ perspective which is embedded in the treatment scenario, whereas the dependent variable being studied is the deliberative moral reasoning of accounting students treated as corporate accountants. Moreover, there is a control group who did not get any treatment. As of the deliberative moral reasoning of accounting students treated as corporate accountants, it is measured by Fleming et al.‟s adaptation of Accounting Ethical Dilemma Instrument (AEDI) developed by Thorne. This instrument consists of four different cases which capture elements of the standards of ethical practice-competence, confidentiality, integrity, and credibility-set forth in the IMA Statement of Ethical Professional Practice (Institute of Management Accountants [IMA], as cited in Fleming et al., 2009). Furthermore, each of them shows the ethical dilemma faced by a corporate accountant and has questions related to how they believe “the accountant described in the case would realistically respond, taking into consideration the pressures and tradeoffs that influence accountants‟ behaviors on the job” (Thorne, as cited in Fleming et al., 2009). After reading the cases, participants in both groups rated the importance of predetermined 12 items for consideration on five-point scales (SangatPenting, Penting, CukupPenting, AgakPenting, danTidakPenting). In each case‟s items for considerations, there are three items representing principled moral development. Afterwards, the participants ranked in order of decreasing importance the four most important considerations to a realistic response to the ethical dilemma (Fleming et al., 2009). Each participant‟s DP-SCORE was then calculated by adding the points assigned to the principled items for consideration based on the rankings for 9 each case (4 points for first rank, 3 points for second rank, 2 points for third rank, and 1 point for fourth rank) and converting the participant‟s total points to a percentage of total possible points (Thorne, as cited in Fleming et al., 2009). The total scores provided an insight the extent to which each participant‟s deliberative moral reasoning affects his/her real action when facing a grey area of ethics. Further analysis examines the significance of Levinas‟ work on the deliberative moral reasoning of accounting students. RESULTS Descriptive Statistics Descriptive statistics summarizes the mean, standard deviation, minimum, and maximum of the samples being studied. Table 1 Descriptive Statistics N Minimum Maximum Mean Std. Deviation DPScore1 18 12.50 40.00 25.5556 7.55157 DPScore2 18 2.50 37.50 16.1111 8.36758 Valid N (listwise) 18 The results of the descriptive statistics presented in the Table 4.1.1 describe that there are 36 samples in this research, divided equally to a treatment group (denoted as Group 1) and to a control group (denoted as Group 2). The deliberative moral reasoning (denoted as DPScore) of Group 1 has a minimum of 12.50 and a maximum of 40.00, with a mean of 25.5556. On the other hand, the DPScore of Group 2 shows a minimum of 2.50, a maximum of 37.50, and a mean of 16.1111. From the results above, it can be noted that the deliberative moral reasoning of the treatment group is, on average, higher than that of the control group. 10 Normality Test Since the data used in this research are ratio data, then a normality test on the data should be carried out to meet another parametric assumption. Thus, the Kolmogorov-Smirnov test is conducted. If the value of K-S significance is greater than the significance level (α) of 0.05, thus, data are normally distributed. The results of this test are as follows. Table 2 Test Statisticsa DPScore Most Extreme Absolute .556 Differences Positive .000 Negative -.556 Kolmogorov-Smirnov Z 1.667 Asymp. Sig. (2-tailed) a. .008 Grouping Variable: Group The test statistic table indicates that the probability of the Kolmogorov-Smirnov Z statistic falls below the significance level of 0.05, that is, 0.008. It means that the distributions of the two groups are significantly different from each other, thus, the null hypothesis stated that data are normally distributed is rejected. The Mann-Whitney Test As data are not normally distributed, then a nonparametric test of two independentsamples, which is Mann-Whitney test, is used. Table 3 Ranks Group DPScore 1 N Mean Rank 18 24.31 Sum of Ranks 437.50 11 2 18 Total 36 12.69 228.50 Table 4 Test Statisticsb DPScore Mann-Whitney U 57.500 Wilcoxon W 228.500 Z -3.320 Asymp. Sig. (2-tailed) .001 Exact Sig. [2*(1-tailed Sig.)] .001a a. b. Not corrected for ties Grouping Variable: Group The Mann-Whitney test results as shown in Table 4.4 indicate that there is a significance difference between both groups. That is, the treatment group exhibited a significantly higher deliberative moral reasoning than the control group. It is explained by the fact that the test shows a significance value of 0.001, which is less than the significance level of 0.05. Therefore, the hypothesis of this study is accepted. The Independent-Samples T Test Nevertheless, even though the normality test failed to prove that the data used in this study are normally distributed, but by referring to the Central Limit Theorem, the data of more than 30 can be regarded as normally distributed data. Hence, this research performs a parametric test to draw a conclusion about whether or not the hypothesis is accepted. Analytical technique used for this study is the independent- samples t-test by utilizing SPSS 15.0. The independent-samples t-test is conducted to see if there are any significant differences in the means for two groups in the variable of interest (Sekaran&Bougie, 2010). In this research, the 12 means of deliberative moral reasoning from a treatment group and a control group were tested to see whether there is a significant mean difference between them. Table 5 Group Statistics Group DPScore N Mean Std. Deviation Std. Error Mean 1 18 25.5556 7.55157 1.77992 2 18 16.1111 8.36758 1.97226 Table 6 Independent Samples TestLevene’s Test for Equality of Variances F DPScore Equal variances assumed Sig. .003 .955 Equal variances not assumed Table 7 Independent-Samples TestT Test for Equality of Means 95% Confidence Interval of the T Df Sig. Mean Std. Error (2-tailed) Difference Difference Difference Lower Upper 3.555 34 .001 9.44444 2.65667 4.04543 14.84346 3.555 33.648 .001 9.44444 2.65667 4.04335 14.84554 Since the significance value of Levene‟s test is 0.955 (p > 0.05), therefore, it can be assumed that the variances are approximately equal. Furthermore, the t-test results in t value of 3.555 on sig (α) 5% with 34 degrees of freedom. The significance of 0.001, which is less than 13 0.05, implies that there is a significant difference between both groups. People in the treatment group had significantly higher deliberative moral reasoning than those in the control group. Thus, the hypothesis stated previously that there is a significant difference on the deliberative moral reasoning between accounting students who get Levinas‟ treatment and those who do not is accepted. DISCUSSION The results of parametric test and nonparametric test above stated that there is a significant difference between accounting students in the treatment group and those in the control group. It is indicated by the Mann-Whitney‟s significance value of 0.001. In addition to that, the same significance value of 0.001 is also provided by the independent-samples t-test. Both of them are less than the significance level of 0.05, therefore, it can be implied that there is a significant difference between deliberative moral reasoning in both groups. Moreover, the results suggest that accounting students in the treatment group exhibited a higher level of deliberative moral reasoning than those in the control group did. Although as far as researcher aware that there is not any research trying to analyze the significance of Levinas‟ perspective on the deliberative moral reasoning of accounting students in corporate accounting scheme before, but there are some logical reasons why Levinas‟ work may have a significant effect on their moral reasoning. In regards to what Aasland (2009) said, the reason why it may happen is because there is a tendency that people in general resist the temptation to always maximize gains for themselves, an idea which dominates the economy world. There is something humanity which triggers the actions of being ethical and responsible for the sake of the others, that needs no reason. Due to the faculty to be conscious about themselves and reflect upon themselves that 14 each human has, people may do otherwise than pursue their self-interests. Henceforth, by realizing that they encounter with the Other, and also the third, the fourth, etc., they will strive for more justice in their actions. In addition, by valuing that each individual is unique, they become more objective. That, along with the ability to place the Other before the self, is somehow in line with post-conventional moral stage in the Kohlberg‟s model used in this study. That is why Levinas‟ perspective is able to be applied in business and enhance the deliberative moral reasoning of accounting students who might become corporate accountants in the near future. CONCLUSIONS, LIMITATIONS, AND SUGGESTIONS The objectives of this research were to analyze empirically (1) the ethical decision process of accounting students treated as corporate accountants by measuring the deliberative moral reasoning they apply to the resolution of a grey area of ethics and; (2) the significance of Levinas‟ perspective on the deliberative moral reasoning of accounting students in corporate accounting scheme. Treating undergraduate accounting students enrolled in FEB UGM as corporate accountants facing ethical dilemmas, the results of this study show statistically that there is a significance difference in the deliberative moral reasoning exhibited by accounting students assigned in the treatment group and those in the control group. More specifically, the treatment group who receiving Levinas‟ treatment, showed significantly higher DP-Score (deliberative moral reasoning score) when facing ethical dilemmas than those in the control group and received no treatment at all.After reviewing the statistical facts, the researcher may conclude that Levinas‟ perspective of putting the Other before the self as well as core responsibility for others was proven to be able to enhance their deliberative moral reasoning. 15 The implications of this study are limited by research design in general. More specifically, it is in regards to the scope and number of samples which were limited to only 36 accounting students in their third year and fourth year enrolled in FEB UGM Yogyakarta. Therefore, the result of this study could not be generalized into all situations. Secondly, the experiments were carried out in the end of classes, by asking permission from the lecturers. So that, extraneous variables from either internal of the subjects being studied or the environment might influence the outcome of the experiments. Future studies might include more samples of accounting students from several universities so as to get broader scope. In addition, future research are also suggested to carry out a class which is really designed for experiment purpose in order to minimize or even eliminate the chance of extraneous variables to be able to effect the outcome of the experiment. REFERENCES Aasland, D. G. (2004).On the Ethics behind "Business Ethics".Journal of Business Ethics, 53 (1/2), 3-8. Aasland, D. G. (2009).Ethics and economy: After Levinas. London: MayFlyBooks. Bauman, Z. (1993). Postmodern ethics. Available from http://www.amazon.com/PostmodernEthics-Zygmunt-Bauman/dp/063118693X. Black, D. E., &Christensen, T. E. (2009). US Managers‟ Use of „Pro Forma‟ Adjustments to Meet Strategic Earnings Targets. Journal of Business Finance & Accounting, 36 (3/4), 297-326. doi:10.1111/j.1468-5957.2009.02128.x. Boynton, W. C., & Johnson, R. N. (2006).Modern auditing: Assurance services and the integrity of financial reporting. New Jersey, NJ: John Wiley & Sons, Inc. Bruhn, J. G. (2009). The Functionality of Gray Area Ethics in Organizations.Journal of Business Ethics, 89, 205-214. doi:10.1007/s10551-008-9994-7. Campbell, D., McPhail, K., & Slack, R. (2009). Face Work in Annual Reports: A Study of the Management of Encounter through Annual Reports, Informed by Levinas and Bauman. Accounting, Auditing & Accountability Journal, 22 (6), 907932.doi:10.1108/09513570910980463. 16 Cooper, D.R., & Schindler, P. S. (2011).Business research methods. Boston: McGraw Hill. Crane, A., &Matten, D. (2007). Business ethics, a European perspective: Managing corporate citizenship and sustainability in the age of globalization. Retrieved from http://books.google.com/books?id=hLLMwe_TM9cC&q=prominent+business+topic#v=s nippet&q=prominent%20business%20topic&f=false. Editor.(2003). United States District Court for the Southern District of California.Retrieved from http://www.sec.gov/litigation/complaints/comp18205.htm. Fleming, D. M., Romanus, R. N., &Lightner, S. M. (2009). The Effect of Professional Context on Accounting Students‟ Moral Reasoning.Issues in Accounting Education, 24 (1), 13-30. Gowthorpe, C., &Amat, O. (2005). Creative Accounting: Some Ethical Issues of Macro- and Micro-Manipulation. Journal of Business Ethics, 57 (1), 55-64. Hogan, C. E., Rezaee, Z., Riley, R. A. Jr., &Velury, U. K. (2008). Financial Statement Fraud: Insights from the Academic Literature. Auditing: A Journal of Practice & Theory, 27 (2), 231–252. doi: 10.2308/aud.2008.27.2.231. Jennings, M. M. (2004). Incorporating Ethics and Professionalism into Accounting Education and Research: A Discussion of the Voids and Advocacy for Training in Seminal Works in Business Ethics. Issues in Accounting Education, 19 (1), 7-26. Jogiyanto, HM. (2007). Metodepenelitianbisnis: pengalaman.Yogyakarta: BPFE. Salah kaprahdanpengalaman- Lu, L.-C., & Lu, C.-J. (2010). Moral Philosophy, Materialism, and Consumer Ethics: An Exploratory Study in Indonesia. Journal of Business Ethics, 94, 193–210. doi:10.1007/s10551-009-0256-0. Marques, P. A., & Pereira, J. A. (2009).Ethical Ideology and Ethical Judgments in the Portuguese Accounting Profession.Journal of Business Ethics, 86, 227– 242.doi:10.1007/s10551-008-9845-6. McPhail, K., & Walters, D. (2009).Accounting and business ethics. New York, NY: Routledge. Megan, O., Haţegan, C., Caciuc, L., Cotleţ, B. (2009). The Cash-Flow Statement – Between True and Manipulation.Annals of the University of Petroşani, Economics, 9 (2), 127-136. Prasetya, D. (2011, September 4). ProdukSingapuradanJepangGempur Indonesia.KOMPAS.Retrieved from http://bisniskeuangan.kompas.com/read/2011/09/04/1945029/Produk.Singapura.dan.Jepa ng.Gempur.Indonesia. Sekaran, U., &Bougie, R. (2010).Research methods for business: a skill-building approach. New Jersey, NJ: John Wiley & Sons, Inc. 17 Swaidan, Z., Vitell, S. J., &Rawwas, M. Y. A. (2003). Consumer Ethics: Determinants of EthicalBeliefs of African Americans. Journal of Business Ethics 46, 175-186. Thorne, L. (2000). The Development of Two Measures to Assess Accountants‟ Prescriptive and Deliberative Moral Reasoning. Behavioral Research in Accounting, 12, 139-169. Turner, J. L., Mock, T. J., & Srivastava, R. P. (2003). An Analysis of the Fraud Triangle. Retrieved from http://aaahq.org/audit/midyear/03midyear/papers/Research%20Roundtable%203-TurnerMock-Srivastava.pdf. APPENDIX APPENDIX A I. Descriptive Statistics N Table 1 Descriptive Statistics Minimum Maximum Mean Std. Deviation DPScore1 18 12.50 40.00 25.5556 7.55157 DPScore2 18 2.50 37.50 16.1111 8.36758 Valid N (listwise) 18 II. Normality Test Table 2 Test Statisticsa DPScore Most Extreme Absolute .556 18 Differences Positive .000 Negative -.556 Kolmogorov-Smirnov Z 1.667 Asymp. Sig. (2-tailed) a. .008 Grouping Variable: Group III. The Mann-Whitney Test Table 3 Ranks N Mean Rank Group Sum of Ranks DPScore 1 18 24.31 437.50 2 18 12.69 228.50 Total 36 Table 4 Test Statisticsb DPScore Mann-Whitney U Wilcoxon W 228.500 Z a. b. IV. 57.500 -3.320 Asymp. Sig. (2-tailed) .001 Exact Sig. [2*(1-tailed Sig.)] .001a Not corrected for ties Grouping Variable: Group The Independent-Samples T Test Table 5 Group Statistics 19 Group DPScore N Mean Std. Std. Error Deviation Mean 1 18 25.5556 7.55157 1.77992 2 18 16.1111 8.36758 1.97226 Table 6 Independent Samples TestLevene’s Test for Equality of Variances F DPScore Equal variances Sig. .003 .955 assumed Equal variances not assumed Table 7 Independent-Samples TestT Test for Equality of Means 95% Confidence Interval of the Sig. Mean Std. Error (2-tailed) Difference Difference 34 .001 9.44444 3.555 33.648 .001 9.44444 t 3.555 Df Difference Lower Upper 2.65667 4.04543 14.84346 2.65667 4.04335 14.84554 APPENDIX B RESEARCH INTRUMENT*partial 20 TREATMENT GROUP BAGIAN I Kasus Financial Fraud PT XYZ* PT XYZ adalah sebuah perusahaan publik yang menjual perangkat lunak dan berbasis di Jakarta. Pada tahun 200X, publik digemparkan oleh adanya sebuah kasus financial fraud yang membawa nama perusahaan tersebut. Menurut keterangan resmi yang dirilis oleh media, tujuan dari fraud tersebut adalah untuk meningkatkan pendapatan dan harga saham perusahaan. Untuk mencapai tujuan ini, PT XYZ sengaja menyusun laporan keuangan yang secara material tidak wajar selama 11 kuartal secara berturut-turut, antara bulan April 199X hingga Desember 200X. Aksi kecurangan tersebut dilakukan oleh beberapa karyawan dan manajemen tingkat atas dengan melaporkan pendapatan senilai ratusan juta terkait dengan kontrak tidak mengikat (non-binding arrangement) dengan pelanggan, yang tidak sesuai dengan PABU. PT XYZ kemudian berusaha menutupi kecurangan tersebut dengan melakukan berbagai aksi lain seperti membukukan kontrak tersebut. Seperti yang sudah dapat diprediksi, para pelanggan tidak membayar, sehingga rekening piutang di neraca menggelembung. Untuk membuat piutang seakan tertagih dengan cepat, manajer senior di PT XYZ melakukan transaksi dengan sebuah bank untuk dapat menukarkan piutang dengan kas. PT XYZ mencatat transaksi ini sebagai penjualan piutang dan menghilangkannya dari neraca perusahaan. Ada tiga masalah dalam kontrak ini. Pertama, PT XYZ sudah memberikan bank tersebut recourse (jaminan bahwa apabila timbul default dalam pembayaran piutang, maka bank dapat menagih pembayarannya kepada PT XYZ) dan membayar atau membeli kembali piutang yang tidak terbayarkan tersebut. PT XYZ seharusnya mencatat kontrak tersebut sebagai pinjaman dan tetap meninggalkan piutang di neraca. Kedua, beberapa piutang yang “dijual” tersebut tidak valid karena para pelanggan tidak diwajibkan untuk membayar. Ketiga, beberapa nota yang “dijual” tersebut palsu. Karyawan senior berusaha menyembunyikan kecurangan tersebut dengan cara writing-off rekening piutang. Kasus financial statement fraud ini menyebabkan harga saham PT XYZ anjlok hingga akhirnya PT XYZ bangkrut dan para stakeholders dirugikan. 21 Kasus financial fraud PT XYZ atau bahkan kasus-kasus serupa yang terjadi di perusahaan lain tentunya tidak akan terjadi apabila pihak manajemen maupun karyawan tidak menghalalkan segala cara agar harga saham dan pendapatan meningkat, atau agar kinerjanya terlihat baik. Walaupun pada akhirnya mereka akan dihadapkan pada beberapa pilihan dalam proses pengambilan keputusan, namun seharusnya mereka tidak mengambil keputusan yang hanya menguntungkan diri mereka sendiri maupun perusahaan, ataupun hanya melihat konsekuensi dari keputusan mereka terhadap perusahaan saja. Mereka seharusnya sadar bahwa keputusan yang akan diambilnya adalah respons terhadap tanggung jawab mereka terhadap banyak pihak (stakeholders/pemangku kepentingan secara luas), bukan hanya terhadap para pemegang saham saja. Hal tersebut akan menyebabkan mereka mampu menempatkan kepentingan orang lain di atas kepentingan sendiri. Selain itu, mereka akan mempertimbangkan adanya keberadaan pihak-pihak lain yang berkepentingan guna mencari lebih banyak keadilan (justice) bagi semua pihak. *kasus diadaptasi dari kasus Peregrine System, Inc. Sumber: Editor.(2003). United States District Court for the Southern District of California.Retrieved from http://www.sec.gov/litigation/complaints/comp18205.htm. Pernyataan 1. Manipulasi terhadap laporan keuangan fair untuk dilakukan demi kepentingan para pemegang saham (shareholders). STS TS N S SS 2. Apabila Anda bertindak sebagai pihak manajemen, maka dalam suatu proses pengambilan keputusan, Anda akan menempatkan kepentingan para pemangku kepentingan (creditor, customer, masyarakat, pemerintah, dan lain-lain) di atas kepentingan Anda dan perusahaan. STS TS N S SS 3. Kebebasan Anda dalam mengambil suatu keputusan bisnis dibatasi oleh adanya pertimbangan atas keberadaan pihak-pihak lain yang berkepentingan (investor, creditor, 22 customer, masyarakat, pemerintah, dan stakeholder lainnya) dan akan terkena dampak dari keputusan yang akan Anda ambil. STS TS N S SS BAGIAN II Kasus Perusahaan Alice dan Perusahaan ABC Alice adalah seorang staf akuntan dan CMA (Certified Management Accountant) di Perusahaan ABC.Perusahaan tersebut mengembangkan sistem akuntansinya sendiri dengan bantuan konsultan. Sistem yang diberi namaACME Accounting System tersebut mulai dioperasikan tahun ini, sesaat sebelum perusahaan mempekerjakan Alice. Sebagai bagian dari tugas Alice, Alice diminta oleh bosnya untuk mengevaluasi quality control sistem akuntansi itu sebagai persiapan untuk audit tahunan perusahaan. Alice menemukan beberapa kelemahan pengendalian yang parah di dalam sistem ACME. Sebelum memberikan laporan ke pihak manajemen ABC, Alice diberitahu oleh bosnya untuk memodifikasi komentar negatif terkait dengan sistem akuntansi ACME dan untuk menunggu dan melihat saja jika auditor menemukan suatu masalah. Secara realistis, apakah Alice seharusnya mengubah laporannya? (Berilah tanda √ pada satu pilihan yang tersedia di bawah) ____ Sebaiknya mengubah laporannya ____ Tidak dapat memutuskan ____ Tidak mengubah laporannya Di dalam proses memberikan nasihat untuk Alice, apakah sebaiknya dia mengubah laporannya atau tidak, ada banyak hal yang harus dipertimbangkan. Di bawah ini adalah daftar beberapa hal yang dapat menjadi pertimbangan. Berikanlah suatu penilaian akan pentingnya masing-masing pertimbangan di bawah ini: 23 Skala Kepentingan SP P CP AP TP 1. Apakah kelemahan pada sistem ACME dapat diperbaiki dengan mudah, yakni dengan mengimbangi pengendalian yang lain. 2. Apakah pegawai yang baik itu adalah pegawai yang tunduk pada keputusan atasannya. 3. Apakah pekerjaan Alice dapat terancam jika dia menolak merevisi laporannya. 4. Apakah pertimbangan yang wajar mengenai posisi keuangan perusahaan dapat digunakan untuk memprediksi reputasi professional. 5. Apa yang terbaik untuk perusahaan Alice. 6. Apakah Alice memiliki tugas untuk memastikan bahwa laporan itu akurat. 7. Apa nilai potensial dari suatu audit independen sebagai pengganti penilaian terbaru masyarakat mengenai nilai perusahaan. 8. Bagaimana masyarakat seharusnya dilayani. 9. Apakah perusahaan benar-benar peduli dengan pengendalian internal atau apakah yang mereka benar-benar inginkan hanya opini audit yang bersih. 10. Akankah dengan mengubah laporan konsisten dengan apa yang Alice pikir benar. 11. Tindakan Alice apa yang akan diharapkan rekanrekan kerja Alice di perusahaan. 12. Apakah faktor-faktor yang relevan dalam menentukan tanggung jawab professional Alice. 24 Taman KT I/466●Yogyakarta, Indonesia55133●081215701870 ●kiasayudamara@gmail.com KIAS AYUDAMARA Personal Information Date of Birth Place of Birth Marital Status Nationality : : : : May 9th, 1989 Yogyakarta, Indonesia Single Indonesian Education Degrees November 2011 — June 2012 Uppsala University, Sweden Lotus Erasmus Mundus Exchange Program September 2009 — February 2010 Hiroshima University of Economics, Japan Short Term Exchange Program July 2007— November 2011 UniversitasGadjahMada, Indonesia Bachelor Degree in Accounting with Cumulative GPA of 3.74 out of 4.00 Scale June 2004— July 2007 SMA N 1 Yogyakarta High School Diploma Professional Experience February 2011— July 2011 Faculty of Economics and Business, UniversitasGadjahMada Yogyakarta, Indonesia Lecture‟s Assistant for Accounting Principles I and Business Ethics Courses Responsible for grading and August 2010— January 2011 Faculty of Economics and Business, UniversitasGadjahMada tutoring. Yogyakarta, Indonesia Lecture‟s Assistant for Advanced Financial Accounting I and Advanced Accounting II Courses Responsible for grading and tutoring. 25 Other Experiences January 2011— February 2011 ACICIS Buddy Program Yogyakarta, Indonesia Assisting the incoming international students finding their housings and introducing local culture and environment to them. July 2010— August 2010 UGM Community Service Magelang, Indonesia The program was conducted in order to help the local people in TersanGede Village, Magelang, improve their ways of making use of coconut products mainly by giving them some kind of workshops of how to make by-products of coconuts. I was acting a treasurer for various subunit activities and as a coordinator for social events held during the meantime. March 2010— April 2010 Voluntary Work Yogyakarta, Indonesia Giving English lesson for orphans at one of orphanages in Yogyakarta. September 2009— February 2010 Community Service Yogyakarta, Indonesia Responsible for teaching English at local elementary school and organizing social activities with Gion Community Center, Hiroshima. Awards Lotus Erasmus Mundus Scholarship, November 2011-May 2012 PPA (Academic Achievement Improvement) Scholarship, January 2010-Desember 2011 JASSO (Japan Student Services Organization) Scholarship, September 2009-February 2010 Skills Computer Skills: Microsoft Office (Word, Excel, Power Point), Photoscape Language Skills: Indonesian (native speaker), English (fluent-received from either formal or non-formal education), Japanese (basic) Personal Interests Travelling Reading and writing Photography 26 SUPRIYADI Associate Professor E-mail: pri@mmugm.ac.id 1) 1988 Undergraduate Degree in Accounting (Drs.), Faculty of Economics, Universitas Gadjah Mada EDUCATION 2) 1993 Master of Science in Accounting at the University of California, Fresno, USA 3) 1998 Doctoral Degree in Accounting at the University of Kentucky, USA 1. Financial Accounting 2. Behavioral Accounting 3. Business and Professional Ethics RESEARCH INTERESTS COURSE TAUGHT PROFESSIONAL Introductory Accounting I (Undergraduate Program) Intermediate Accounting I (Undergraduate Program) Behavioral Accounting (Master of Science Program) Business and Professional Ethics (Master of Applied Program) Behavioral Research in Accounting (Doctorate Program) The Indonesian Institute of Accountant ORGANIZATION MEMBERSHIP A Member of Appealing Committee (2006-2011) The Head of Yogyakarta Branch (2011-2016) Peer Reviewed Journal 1. 2011 Exploring the Model of Internet Use: Indonesian Contect. INTELLECTUAL Co-Author, Published in UTCC- International Journal of Business and Economics CONTRIBUTION1 (Thailand), Vol. 3, No. 1 2. 2010 The Moderating Effect of Procedural Justice on the Effectiveness of the Balanced Scorecard 1 For each of the intellectual contributions, please categorize whether the intellectual contribution is Learning and Pedagogical Research (contribution influence the teaching-learning activities of the school), or Contributions for Practice (influence professional practice in the faculty member’s field), or Discipline-based Research (contributions add to the theory or knowledge base of the faculty member’s field). 27 Performance Measures in Improving Managerial Performance through Organizational Commitment. Gadjah Mada International Journal of Business, Vol. 12.No. 3 3. 2005 Analisis Moderasi Set Kesempatan Investasi Terhadap Hubungan Antara Kebijakan Deviden dan Aliran Kas Bebas dengan Tingkat Leverage Perusahaan (Moderation Analysis on Investment Opportunity toward The Relationship Between Dividend Policy and Free Cash Flow with Company‟s Leverage Level). Co-Author, Published in Jurnal Ekonomi dan Bisnis, Vol. X1 No. 2 4. 2005 The Influence of Contingency Factor as Moderating Variable to the Relation between Users‟ Participation and the Success of Information System in PTP Nusantara – XIV (Persero). Co-author. Published in Jurnal Sosiosains Vol. 18, No. 1 5. 2005 Pengaruh Krisis Moneter terhadap Nilai Tambah Informasi Arus Kas (The Influence of Monetary Crisis on the Value Added of Cash Flow Information). Co-author. Published in Jurnal Akuntansi & Investasi, Vol. 6, No. 1 6. 2003 Executive Involvement and Participation in the Management of Information System. Co-author. In: Jurnal Sosiohumanika, Vol. 16A, No. 3 Research Monograph 1. 2011 Examining Order Effect and Response Mode on Investment Judgment. Co-Author. Presented in the peer-reviewed international conference in 28 Amsterdam, The Netherland 2012. 2. 2011 The Effectiveness of Flexible Working Arrangement and Stress Management Training in Mitigating Auditors‟ Burnout: An Experimental Study. Co-Author. Presented in the peer-reviewed international conference in Melbourne, Australia 2012. 3. 2010 Culture and Effectiveness of Good Corporate Governance Implementation: Indonesian Case Study. Research Project sponsored by POSCO South Korea (Peer-reviewed Research Competition). Co-Author. Professional Experience2 1. 2008 – present Director of Master of Science and Doctorate Programs, FEB, Universitas Gadjah Mada 2. 2011 – present Head of the Indonesian Accounting Association – Yogyakarta Branch 3. 2007 – 2011 A Member of the Appealing Committee of PROFESSIONAL QUALIFICATION the Indonesian Accounting Association 4. 2007 – 2008 Associate Dean for Academic Affairs, FEB, Universitas Gadjah Mada 5. 2004 – 2007 Director of Master of Management Program, Universitas Gadjah Mada 6. 2003 – present Editorial Manajemen Board Member, Akuntansi dan Jurnal Sistem Informasi MAKSI, Master of Science in Accounting Program, Diponegoro 2 Position hold in a company or organization as BoD, Commissioner, etc. OR Position hold in profession organization 29 University, Semarang 7. 2003 – present Editorial Board Member, Jurnal Telaah dan Riset Akuntansi, Syiah Kuala University, Banda Aceh 8. 2000 – present Managing Director, Gadjah Mada International Journal of Business, Master Management Program, of Universitas Gadjah Mada 9. 2000 – present Editorial Board Member, Jurnal Bisnis dan Akuntansi, STIE Trisakti, Jakarta 10. 2000 – present Editorial Board Member, The Journal of Accounting, Economics Management, Research, Faculty and of Economics UTY, Yogyakarta 11. 2000 – present Editorial Board Member, Media Riset Akuntansi, Auditing, dan Informasi, Trisakti University, Jakarta 12. 2000 – present Editorial Board Member, Indonesian Management and Accounting Research, Trisakti University, Jakarta Yogyakarta, June 26, 2012 Supriyadi 30 STATEMENT I confirm that this article has not been previously published elsewhere, nor is it under consideration by any other publisher. Yogyakarta, 30 June 2012 First Author KiasAyuDamara 31