Michigan Gas Tax Revenue - Cass County Road Commission

advertisement

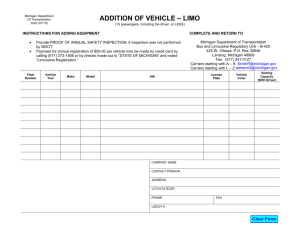

Michigan Gas Tax Revenue 950 This brochure has been prepared to explain how these funds are secured and how they are used. Concerns or Questions If you have concerns or questions about the road commission and its functions, or would like to learn more about funding, please contact us at Cass County Road Commission Cass County Road Commission 900 850 Cass County Road Commission Hours: Winter: 7:00 a.m. to 3:30 p.m. Monday through Friday Summer: (April—September) 6:00 a.m. to 4:00 p.m. Monday through Thursday Millions 800 750 700 650 600 550 Cass County Road Commission 500 2001 2011 Michigan’s gas tax revenue declined over $100 million from 2001 to 2011. 340 N. O’Keefe Street P.O. Box 68 Cassopolis, MI 49031 Phone: 269-445-8611 Fax: 269-445-2376 Website: www.casscoroad.com Michigan Gas Tax Revenue FAQ’s “I just bought a more fuelefficient vehicle. How much do I pay in Michigan fuel taxes?” How much do I contribute towards Michigan state fuel taxes with the vehicle I drive? It doesn’t matter if you pay $1 or $5 a gallon for fuel—the tax per gallon stay the same. Michigan gas tax is 18.7¢ per gallon and .15¢ for diesel fuel. As gas prices go up the gas tax stays the same. Michigan’s state gas tax is one of the lowest in the Great Lakes region. How does Michigan’s gas tax rate compare? How much do I contribute to the funding of Michigan roads? HOW MUCH DO I CONTRIBUTE TO THE FUNDING OF MICHIGAN ROADS? (For an individual vehicle) Annual Driven Miles= miles Vehicle’s Fuel Economy= Vehicle Registration Fee= “I have a Dodge Durango. How much do I pay in Michigan state fuel taxes?” A Dodge Durango with a combined fuel efficiency of 14 miles per gallon generates $16.70 per month in state fuel taxes. miles/gal $ Annual Miles Driven + Fuel Economy= per/year Gal/year (A) MICHIGAN Michigan Gas Tax ($0.19/gal) * (A)= C o m p a r is o n o f G a s T a x e s (use $0.15/gal for Diesel vehicle) $ per/year $ per/year (C) $ per mile $ per/year (D) $ per mile 0.35 Annual Michigan road taxes & fees= (B) + vehicle reg. fees= 0. 3 0.25 “I drive a 2012 Ford Focus. What do I pay in Michigan state fuel taxes?” 0. 2 0.15 0. 1 0.05 0 0. 31 0. 29 0. 28 0. 19 0. 18 0. 19 A Ford Focus with a combined fuel efficiency of 31 miles per gallon generates $7.54 per month in Michigan state fuel taxes. Michigan Gas Tax & fees per mile=(C) + Annual Miles Driven= FEDERAL Fed Gas Tax ($0.184/gal) * (A)= (use $0.244/gal for diesel vehicles) Fed Road taxes per mile= (D) + Annual miles driven=