Independent Assurance Practitioner's Report

advertisement

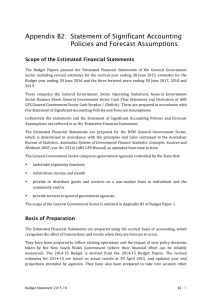

The Treasury Statement in relation to the Estimated Financial Statements for the 2015-16 Budget Scope The 2015-16 Budget presents financial statements for the general government sector. These include: General Government Sector Operating Statement General Government Sector Balance Sheet General Government Sector Cash Flow Statement and Derivation of ABS GFS General Government Sector Cash Surplus/(Deficit) The statements have been prepared in accordance with the Statement of Significant Accounting Policies and Forecast Assumptions. Collectively the Statements and Statement of Significant Accounting Policies and Forecast Assumptions are termed the ‘Estimated Financial Statements’. The Estimated Financial Statements cover the revised estimates for the current year ending 30 June 2015, and estimates for the Budget year ending 30 June 2016 and the three forward years ending 30 June 2017, 2018 and 2019. Best available information The practicalities associated with preparing Budget papers make it is necessary to rule off at a point in time so that all information is internally consistent. The Estimated Financial Statements have been prepared to reflect existing operations, the impact of new Government policy decisions and year-end projections provided by agencies based on end-April data. They have also been prepared to take into account other economic and financial data available to Treasury up to 18 June 2015, including Commonwealth Government funding decisions announced in the 2015-16 Commonwealth Budget. Any estimates or assumptions made in measuring revenues, expenses, other economic flows, assets or liabilities are based on the latest information available at the time. Assumptions are detailed under the headings Material Economic and Other Assumptions and Summary of Other Key Assumptions. Estimated Financial Statements and Auditor-General’s Report Page 1 Professional judgement The prospective nature of the Estimated Financial Statements means it is necessary to apply professional judgement in their preparation. That judgement includes an informed assessment of the most likely economic and financial outcomes including spending and revenue profiles. Differences between underlying assumptions and eventual outcomes can reflect the reality of an uncertain operating environment and the impact of many variables over which the Government has little or no control. In my opinion, the Estimated Financial Statements have been properly prepared in accordance with the Statement of Significant Accounting Policies and Forecast Assumptions and the methodologies used to determine those assumptions are reasonable. Philip Gaetjens Secretary The Treasury 19 June 2015 Page 2 Estimated Financial Statements and Auditor-General’s Report 2015-16 Budget Estimated Financial Statements The following pages form part of the estimated financial statements subject to assurance review. General Government Sector Operating Statement 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 Actual Revised Forward Estimates Budget $m $m $m $m $m $m Revenue from Transactions Taxation 24,295 26,046 27,855 28,678 30,085 31,343 Grants and Subsidies - Commonwealth General Purpose 15,894 17,065 17,346 17,864 18,214 18,828 - Commonwealth Specific Purpose Payments 7,449 8,073 8,619 9,262 9,681 9,997 - Commonwealth National Partnership Payments 3,963 2,829 2,712 3,794 2,587 1,622 - Other Grants and Subsidies 1,026 1,045 1,098 1,062 783 887 5,677 6,352 8,212 8,856 8,496 8,256 609 651 508 482 481 479 2,260 2,410 1,468 1,081 946 831 700 779 424 452 472 505 4,133 3,892 3,901 4,132 4,411 4,566 66,005 69,143 72,143 75,663 76,157 77,315 27,056 28,287 28,936 30,452 31,715 33,288 - Superannuation Interest Cost 1,762 1,698 1,476 1,478 1,499 1,447 - Other Superannuation Sale of Goods and Services Interest Dividend and Income Tax Equivalents from Other Sectors Other Dividends and Distributions Fines, Regulatory Fees and Other Total Revenues from Transactions Expenses from Transactions Employee Superannuation 2,694 2,839 2,926 3,066 3,024 3,050 Depreciation and Amortisation 3,954 4,165 4,440 4,645 4,880 5,009 Interest 2,249 ... 2,268 ... 2,244 ... 2,242 ... 2,253 ... 2,259 ... 14,345 14,680 17,567 18,118 17,742 17,821 - Current Grants and Subsidies 9,644 10,179 11,092 11,570 11,605 11,388 - Capital Grants 3,052 2,969 941 898 849 796 64,757 67,085 69,624 72,469 73,567 75,058 ... ... ... ... ... ... 1,247 2,058 2,520 3,194 2,590 2,257 Other Property Other Operating Grants and Subsidies Total Expenses from Transactions Transactions from Discontinuing Operations BUDGET RESULT - SURPLUS/(DEFICIT) [Net Operating Balance] Estimated Financial Statements and Auditor-General’s Report Page 3 General Government Sector Operating Statement (cont) 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 Actual $m Other Economic Flows - Included in the Operating Result Gain/(Loss) from Superannuation ... Gain/(Loss) from Other Liabilities (689) Other Net Gains/(Losses) 285 Share of Earnings from Associates (excluding Dividends) 118 Dividends from Asset Sale Proceeds ... Deferred Income Tax from Other Sectors (458) Other (42) Discontinuing Operations - Other Economic Flows ... Other Economic Flows - included in Operating Result (785) Revised $m Budget $m Forward Estimates $m $m $m ... (684) 581 (16) 118 ... (27) ... 137 155 (15) 100 ... 105 ... 392 95 (11) ... ... 125 ... 244 100 (17) ... ... 67 ... 118 171 (8) ... ... 24 ... (28) ... 483 ... 602 ... 394 ... 305 462 2,030 3,002 3,796 2,984 2,562 (83) ... 3,790 (401) (4,757) ... 6,049 ... 5,024 ... 3,364 ... 9,819 (0) 3,397 ... 6,106 ... 3,379 ... 3,498 ... 3,392 ... Net Gain/(Loss) on Equity Investments in Other Sectors 3,978 4,562 7,033 9,034 5,756 5,159 Net Gain/(Loss) on Equity Investments in Other Sectors Discontinued Net Gain/(Loss) on Financial Instruments at Fair Value Other Other Economic Flows - Other Comprehensive Income 148 (3) (21) 7,408 ... ... (1,248) 4,605 ... ... (2,831) 12,590 ... ... (3,466) 18,784 ... ... (1,963) 13,278 ... ... (1,463) 10,587 7,870 6,635 15,592 22,580 16,262 13,149 Operating Result Other Economic Flows - Other Comprehensive Income Items that will not be Reclassified to Operating Result Superannuation Actuarial Gains/(Loss) Deferred Tax Direct to Equity Revaluations Share of Earnings from Associates from Revaluations Items that may be Reclassified Subsequently to Operating Result Comprehensive Result - Total Change in Net Worth (a) Key Fiscal Aggregates Comprehensive Result - Total Change in Net Worth Less: Net Other Economic Flows Equals: Budget Result - Net Operating Balance Net Acquisition of Non-Financial Assets Purchases of Non-Financial Assets Sales of Non-Financial Assets Less: Depreciation Plus : Change in Inventories Plus : Other Movements in Non-Financial Assets - Assets Acquired Using Finance Leases - Other Equals: Total Net Acquisition of Non-Financial Assets 7,870 (6,623) 1,247 6,635 15,592 22,580 16,262 13,149 (4,578) (13,073) (19,386) (13,672) (10,892) 2,058 2,520 3,194 2,590 2,257 8,432 (517) (3,954) (25) 9,479 (469) (4,165) (4) 9,186 (687) (4,440) 1 8,216 (400) (4,645) (2) 7,705 (474) (4,880) 8 7,018 (535) (5,009) (1) 114 (1,567) 2,484 131 (1,719) 3,254 183 60 4,302 109 69 3,347 125 107 2,591 3,420 110 5,003 (1,236) (1,196) (1,783) (153) (1) (2,747) 8,546 9,610 9,369 8,325 7,830 10,438 Less: Equals: Net Lending/(Borrowing) [Fiscal Balance] OTHER FISCAL AGGREGATES (b) Capital Expenditure (a) Total change in net worth’ is before transactions with owners as owners, and before revisions to equity from changes to accounting policies. Therefore it may not equal the movement in balance sheet net worth. (b) Capital expenditure comprises purchases of non-financial assets plus assets acquired using finance leases. Page 4 Estimated Financial Statements and Auditor-General’s Report General Government Sector Balance Sheet June 2014 June 2015 June 2016 June 2017 June 2018 June 2019 Forward Estimates Actual Revised Budget $m $m $m $m $m $m 10,881 7,470 102 5,723 6,699 21 5,059 6,277 19 5,441 6,098 40 5,090 5,773 76 10,865 3,232 1,033 4,650 11,369 4,885 1,175 4,786 11,671 2,919 1,301 4,939 12,219 1,037 1,378 5,042 12,869 1,115 1,354 5,101 88,943 3,897 10 131,082 95,976 3,882 10 134,525 105,007 3,870 10 141,072 110,761 3,854 10 145,879 115,918 3,846 10 151,153 Assets Financial Assets Cash and Cash Equivalent Assets 9,966 Receivables 6,833 Tax Equivalents Receivable 206 Investments, Loans and Placements Financial Assets at Fair Value 9,562 Other Financial Assets 4,607 Advances Paid 944 Deferred Tax Equivalents Assets 4,695 Equity Investments in Other Public Sector Entities 84,695 Investments in Associates 4,039 Other Equity Investments 10 Total Financial Assets 125,557 Non-Financial Assets Inventories Forestry Stock and Other Biological Assets Assets Classified as Held for Sale Investment Properties Property, Plant and Equipment Land and Buildings Plant and Equipment Infrastructure Systems Intangibles Other Non-Financial Assets Total Non-Financial Assets 248 7 106 137 244 7 300 142 245 7 42 142 243 7 103 142 251 7 68 142 250 7 47 142 64,100 9,533 74,239 2,356 2,061 152,790 67,334 10,373 78,970 2,661 2,392 162,423 69,672 10,407 83,686 2,984 2,817 170,003 70,064 10,451 89,337 2,940 3,456 176,742 70,619 10,388 94,446 2,691 3,960 182,572 70,911 10,255 102,471 2,370 4,269 190,721 Total Assets 278,346 293,505 304,528 317,814 328,451 341,874 117 5,553 40 122 5,748 48 113 4,976 81 100 4,746 49 86 4,755 18 73 4,856 27 ... 13 31,028 791 14,435 ... 11 31,632 901 15,179 ... 9 32,019 885 15,222 ... 7 32,220 893 15,184 ... 6 32,233 861 15,211 ... 4 35,417 734 15,464 48,262 488 7,934 1,918 54,053 532 8,365 2,512 49,735 537 8,565 2,390 40,379 528 8,788 2,345 34,519 522 9,103 2,298 31,084 523 9,441 2,265 Total Liabilities 110,578 119,102 114,533 105,239 99,614 99,889 NET ASSETS 167,768 174,403 189,995 212,575 228,837 241,985 Liabilities Deposits Held Payables Tax Equivalent Payables Liabilities Directly Associated with Assets Held for Sale Borrowings and Derivatives at Fair Value Borrowings at Amortised Cost Advances Received Employee Provisions (a) Superannuation Provisions Deferred Tax Equivalent Provisions Other Provisions Other Liabilities ... NET WORTH Accumulated Funds Reserves 20,085 147,683 16,733 157,669 22,047 167,948 32,316 180,258 39,564 189,273 44,283 197,703 TOTAL NET WORTH 167,768 174,403 189,995 212,575 228,837 241,985 14,979 11,979 19,992 35,833 46,265 51,264 6,869 69,716 6,655 76,964 9,875 75,984 12,270 69,175 13,112 64,496 15,799 64,653 OTHER FISCAL AGGREGATES Net Financial Worth (b) Net Debt (c) Net Financial Liabilities (a) Superannuation liabilities are reported net of prepaid superannuation contribution assets. (b) Net debt comprises the sum of deposits held, advances received and borrowing, minus the sum of cash deposits, advances paid, and financial assets at fair value. (c) Net financial liabilities equals total liabilities less financial assets excluding equity investments in other public sector entities. Estimated Financial Statements and Auditor-General’s Report Page 5 General Government Sector Cash Flow Statement 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 Actual Revised Budget Forward Estimates $m $m $m $m $m $m Cash Receipts from Operating Activities Taxes Received Receipts from Sales of Goods and Services Grants and Subsidies Received Interest Receipts Dividends and Income Tax Equivalents Other Receipts Total Cash Receipts from Operating Activities 24,081 6,316 28,272 550 2,806 7,441 26,247 6,275 28,898 631 2,306 7,684 27,909 8,522 29,866 467 2,128 6,486 28,708 9,281 31,981 442 1,435 6,692 30,107 8,921 31,264 435 1,032 6,941 31,379 8,823 31,316 435 916 7,273 69,467 72,041 75,378 78,539 78,700 80,142 Cash Payments from Operating Activities Payments for Employees Payments for Superannuation Payments for Goods and Services Grants and Subsidies Paid (26,297) (27,897) (29,232) (30,309) (31,488) (32,991) (3,392) (3,438) (3,698) (4,081) (4,277) (4,435) (15,750) (16,590) (19,927) (20,327) (19,824) (19,830) (8,556) (9,151) (9,597) (9,913) (9,805) (9,439) Interest Paid Other Payments Total Cash Payments from Operating Activities Net Cash Flows from Operating Activities (1,614) (1,733) (1,684) (1,682) (1,651) (1,639) (4,482) (3,850) (3,440) (3,527) (3,557) (3,647) (60,090) (62,660) (67,578) (69,840) (70,601) (71,981) 9,376 9,381 7,800 8,699 8,099 8,162 605 450 697 400 474 535 (8,325) (9,332) (9,184) (8,313) (7,737) (6,986) (7,720) (8,881) (8,487) (7,913) (7,263) (6,451) Net Cash Flows from Investments in Non-Financial Assets Sales of Non-Financial Assets Purchases of Non-Financial Assets Net Cash Flows from Investments in Non-Financial Assets Cash Flows from Investments from Financial Assets for Policy Purposes Receipts 2,875 965 222 203 212 267 Payments (305) (1,398) (3,071) (3,694) (2,268) (1,725) 2,570 (433) (2,849) (3,491) (2,056) (1,458) Net Cash Flows from Investments in Financial Assets for Policy Purposes Net Cash Flows from Investments in Financial Assets for Liquidity Purposes Receipts from Sale/Maturity of Investments Payments for Purchases of Investments Net Cash Flows from Investments in Financial Assets for Liquidity Purposes Net Cash Flows from Investing Activities 724 9,095 495 2,721 2,515 460 (4,984) (8,202) (2,181) (636) (658) (682) (4,260) 893 (1,686) 2,085 1,857 (223) (8,422) (13,023) (9,319) (7,463) (8,132) (9,410) Cash Flows from Financing Activities Advances Received Advances Repaid 98 154 23 38 39 29 (54) (61) (53) (53) (53) (94) Proceeds from Borrowings 2,204 1,281 640 480 430 513 Repayments of Borrowings (444) (1,215) (533) (543) (726) (879) Deposits Received (net) (956) 4 (9) (14) (14) (14) 15 (8) (0) (2) ... ... Other Financing (net) Net Cash Flows from Financing Activities 863 155 69 (92) (323) (445) Net Increase/(Decrease) in Cash Held 829 1,114 (5,154) (712) 313 (415) 9,376 9,381 7,800 8,699 8,099 8,162 (7,720) (8,881) (8,487) (7,913) (7,263) (6,451) 1,656 500 (687) 786 836 1,711 Derivation of Cash Result Net Cash Flows from Operating Activities Net Cash Flows from Investments in Non-Financial Assets Cash Surplus/(Deficit) Page 6 Estimated Financial Statements and Auditor-General’s Report Derivation of ABS GFS General Government Sector Cash Surplus/(Deficit) 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 Actual $m Revised $m Budget $m Forward Estimates $m $m $m Cash Surplus/(Deficit) 1,656 500 (687) 786 836 1,711 Assets Acquired under Finance Leases (114) (131) (183) (109) (125) (3,420) (195) (129) (12) 97 32 (32) 1,347 240 (882) 773 743 (1,741) Other Financing Arrangements ABS GFS Surplus/(Deficit) (a) (a) Comprises movements in payables and receivables of a capital nature Estimated Financial Statements and Auditor-General’s Report Page 7 Statement of Significant Accounting Policies and Forecast Assumptions Scope of the Estimated Financial Statements The Budget Papers present the Estimated Financial Statements of the General Government Sector including revised estimates for the current year ending 30 June 2015, estimates for the Budget year ending 30 June 2016 and the three forward years ending 30 June 2017, 2018 and 2019. These comprise the General Government Sector Operating Statement, General Government Sector Balance Sheet, General Government Sector Cash Flow Statement and Derivation of ABS GFS General Government Sector Cash Surplus / (Deficit). These are prepared in accordance with this Statement of Significant Accounting Policies and Forecast Assumptions. Collectively the statements and the Statement of Significant Accounting Policies and Forecast Assumptions are referred to as the ‘Estimated Financial Statements’. The Estimated Financial Statements are prepared for the NSW General Government Sector, which is determined in accordance with the principles and rules contained in the Australian Bureau of Statistics, Australian System of Government Finance Statistics: Concepts, Sources and Methods 2005 (cat. No. 5514) (ABS GFS Manual) as amended from time to time. The General Government Sector comprises government agencies controlled by the State that: undertake regulatory functions redistribute income and wealth provide or distribute goods and services on a non-market basis to individuals and the community and/or provide services to general government agencies. The scope of the General Government Sector is outlined in Appendix B3 of Budget Paper 1. Basis of Preparation The Estimated Financial Statements are prepared using the accrual basis of accounting, which recognises the effect of transactions and events when they are forecast to occur. They have been prepared to reflect existing operations and the impact of new policy decisions taken by the New South Wales Government (where their financial effect can be reliably measured). The 2014-15 Budget is derived from the 2014-15 Budget Papers. The revised estimates for 2014-15 are based on actual results at 30 April 2015, and updated year end projections provided by agencies. They have also been prepared to take into account other economic and financial data available to Treasury up to 18 June 2015, including Commonwealth Government funding decisions announced in the 2015-16 Commonwealth Budget. Page 8 Estimated Financial Statements and Auditor-General’s Report In keeping with these principles, where the impact of a policy decision or planned event cannot be reliably estimated, the impact is not reflected within the Estimated Financial Statements (e.g. due to uncertainties regarding the timing and amount of future cash flows). Any estimates or assumptions made in measuring revenues, expenses, other economic flows, assets or liabilities are based on the latest information available at the time, professional judgments derived from experience and other factors considered to be reasonable under the circumstances. Actual results may differ from such estimates. Assumptions are detailed below, under the headings Material economic and other assumptions and Summary of other key assumptions. Accounting Policies Australian Accounting Standards do not include requirements or provide guidance on the preparation or presentation of prospective financial statements. However, recognition and measurement principles within Australian Accounting Standards have been applied in the presentation of the Estimated Financial Statements to the maximum extent possible. The Estimated Financial Statements do not include the impact of business asset transactions until they are finalised. The financial impact of future planned discontinuing operations or restructures are not recognised due to the commercial-in-confidence nature of the transactions. The Estimated Financial Statements adopt the accounting policies expected to be used in preparing general purpose financial statements for 2014-15. With the exception of those matters below, the policies are not materially different from those applied in the Total State Sector Accounts 2013-14. Note 1 of the Total State Sector Accounts 2013-14 sets out the significant accounting policies, including the principles of consolidation and the recognition and measurement policies for revenues, expenses, other economic flows, assets and liabilities. Change in Accounting Policies The following Australian Accounting Standards have been adopted in 2014-15, impacting on the State’s financial estimates as follows. Revisions to Standards relating to Consolidations, Joint Arrangements and Associates The State has adopted the following new and revised standards relating to consolidations, joint arrangements and associates on 1 July 2014: AASB 10 Consolidated Financial Statements; AASB 11 Joint Arrangements; AASB 12 Disclosure of Interests in Other Entities; AASB 127 Separate Financial Statements; and AASB 128 Investments in Associates and Joint Ventures. AASB 10 introduced a revised definition of control and provided several new principles in assessing whether control exists. AASB 11 requires joint arrangements to be accounted for based on their contractual arrangements, and distinguishes between joint operations and joint ventures. AASB 12 contains the disclosure requirements associated with ‘other entities’ (i.e. subsidiaries, associates and joint ventures) that were previously located in AASB 127, 128 and 131 and Interpretations 112 and 113. Estimated Financial Statements and Auditor-General’s Report Page 9 The impact of any changes to control relationships on the Estimated Financial Statements, arising from these new and revised standards, is not expected to be significant. The General Government Sector does not consolidate Public Non-Financial Corporations and Public Financial Corporations that it controls on a line by line basis; and instead, recognises an equity investment in those entities and a gain or loss for changes in the carrying amount of the investment. Presentation of the Estimated Financial Statements The Estimated Financial Statements follow the presentation requirements for General Government Sector reporting contained in AASB 1049 Whole of Government and General Government Sector Financial Reporting. AASB 1049 harmonises generally accepted accounting principles (GAAP, i.e. Australian accounting standards) with Government Finance Statistics (GFS) principles in accordance with the GFS framework adopted by the Australian Bureau of Statistics. This occurs by requiring that: the statement of comprehensive income (referred to as the operating statement) classifies income and expenses as either transactions or other economic flows to be consistent with GFS principles, applied from a GAAP perspective The net operating balance (i.e. Budget result) is the net result of harmonised GFS-GAAP transactions for the general government sector. In the operating statement: the net operating balance (i.e. the Budget result) is the net result of income and expense transactions. It excludes other economic flows, which represent changes in the volume or value of assets or liabilities that do not arise from transactions with other entities and which are often outside the control of government. the operating result is the same under both the harmonised GFS-GAAP and pure GAAP presentations. Further, AASB 1049 requires: the financial statements adopt the recognition, measurement and disclosure requirements of GAAP where options exist in GAAP, the financial statements adopt the option that is aligned with GFS, to minimise differences between GAAP and GFS where options do not exist in GAAP and there is conflict between GAAP and GFS, GAAP prevails. Due to the prospective nature of the statements, detailed notes to the financial statements, including disclosure of contingent assets and liabilities, are not required to be presented within the meaning of Australian Accounting Standards as outlined in Section 27A (5) of the Public Finance and Audit Act 1983. Page 10 Estimated Financial Statements and Auditor-General’s Report Each year ends on 30 June. All monetary amounts are presented in Australian dollars and rounded to the nearest million dollars ($m). Use of a zero (“0”) represents amounts rounded to zero. Use of three dots (“…”) represents nil amounts. Tables may not add in all instances due to rounding to the nearest million dollars. Presentation Changes There has been a minor presentation change within the Balance Sheet since the release of the 2014-15 Budget Papers to separately disclose ‘Financial Assets at Fair Value’ and ‘Other Financial Assets’ that are not recorded at fair value under the heading ‘Investments, Loans and Placements’. This presentation remains consistent with GAAP and GFS presentation requirements. Definitions Key technical terms, including fiscal aggregates, are defined in the Glossary to Budget Paper No 1. Material Economic and Other Assumptions The Estimated Financial Statements have been prepared using the material economic and other assumptions as set out in Table B2.1. Key economic performance assumptions (a) 2013-14 2014-15 Outcomes Forecasts 2015-16 Forecasts 2016-17 2017-18 and 2018-19 (b) Forecasts Projections New South Wales Real state final demand 2.7 3¼ 3½ 3½ Real gross state product 2.1 2½ 3 3 2¾ Employment 0.6 1¼ 1¾ 1¾ 1¼ 5.7 6 5¾ 5¾ 2.5 1¾ 2½ 2¾ 2.8 1¾ 2½ 2¾ 2.5 2¼ 2½ 2¾ 3.1 4 4 4¾ Unemployment rate (c) (d) Sydney CPI - through the year to June quarter (d) Wage price index (e) Nominal Gross State Product (a) Per cent change, year average, unless otherwise indicated. (b) Average across 2017-18 and 2018-19. 2½ 3½ (c) Year average, per cent. (d) 2014-15 includes a ¾ of a percentage point detraction from the abolition of the carbon tax. 2014-15 to 2016-17 include a ¼ of a percentage point contribution from tobacco excise increases. (e) Nominal GSP measures the value of production whereas real GSP measures the volume of production. The difference is a measure of the average change in prices for goods and services produced. Source: ABS 5206.0, 5220.0, 6202.0, 6401.0, 6345.0 and Treasury Estimated Financial Statements and Auditor-General’s Report Page 11 Summary of Other Key Assumptions The following section outlines the other key assumptions used in the preparation of the Estimated Financial Statements. The summary takes into account materiality in relation to the General Government Sector’s overall financial position and sensitivity to changes in key economic assumptions. Notwithstanding these key assumptions, agency finance officers apply appropriate professional judgement in determining estimated financial information. Revenues from Transactions Taxation Taxation revenue is forecast by assessing economic and other factors that influence the various taxation bases. For example for payroll tax, this involves an assessment of the outlook for employment and wages. Forecasts of government guarantee fees take into account an assessment of the level of debt of public non-financial corporations and their credit rating differential compared with the State as a whole. The forecasts of taxation revenue also involve the analysis of historical information and relationships (using econometric and other statistical methods) and consultation with relevant government agencies. Grants revenue Forecast grants from the Australian Government are based on the latest available information from the Australian Government and projections of timing of payments at the time of preparation of the Budget. This takes into account the conditions, payment timetable and escalation factors relevant to each type of grant. The Goods and Services Tax (GST) grants are forecast based on estimates of the national GST pool by the Australian Government. For 2015-16, the GST forecast is based on the assessed relativity for New South Wales in 2015-16 and the Australian Government’s population projections. The assessed relativity is the average of the past three years annual per capita relativities (2011-12, 2012-13 and 2013-14) as published by the Commonwealth Grants Commission. After 2015-16, the State’s share of GST is based on assessed relativities in a particular year and the Australian Government’s population and GST pool projections. The forecast per capita annual relativities are based on the projected relative fiscal capacity of New South Wales compared to other States and Territories. Sales of goods and services Revenue from the sale of goods and services is forecast taking into account factors including estimates of changes in demand for services provided or expected unit price variations based on proposed fee increases imposed by general government agencies and/or indexation. Page 12 Estimated Financial Statements and Auditor-General’s Report Dividend and income tax equivalents from other sectors Dividend and income tax equivalent revenues are estimated by public financial and non-financial corporations based on expected profitability and the agreed dividend policy at the time of the Budget. Fines, regulatory fees and other revenues Fines, regulatory fees and other revenues include estimates of fines issues by the Courts, estimated traffic infringement fines, estimated revenue from enforcement orders, regulatory fees, contributions and royalty revenue for which estimates are based on assessments of coal volumes and prices and the Australian dollar exchange rate. Other revenue forecasts are adjusted for indexation where appropriate. Expenses from Transactions Employee expenses Employee expenses are forecast based on expected staffing profiles, current salaries, conditions and on-costs. Employee expenses are adjusted over the forecast period for approved wage agreements. Beyond the period of the agreements, allowance is made for further adjustments consistent with the Government’s wages policy at a net cost of 2.5 per cent per annum inclusive of scheduled increases in the superannuation guarantee levy. The forecasts for employee expenses also reflect the impact of new approved initiatives and required efficiency savings. Superannuation expense (and liabilities) Superannuation expenses comprise: for the defined contribution plan, the forecast accrued contribution for the period, and for defined benefit plans, the forecast service cost and the net interest expense. This excludes the re-measurements, (i.e. actuarial gains and losses and return on plan assets excluding the gross interest income) which are classified as ‘other economic flows – other comprehensive income’. Superannuation expenses for defined contribution plans are based on assumptions regarding future salaries and contribution rates. Superannuation expenses for defined benefit plans are estimated based on actuarial advice applying the long-term Government Bond yield as at 30 June in the prior year to the opening value of net liabilities (gross superannuation liabilities less assets), less benefit payments at the mid-point of the contribution year, plus any accruing liability for the year. Forecasts of defined benefit superannuation liabilities are based on actuarial estimates of cash flows for the various defined benefit superannuation schemes discounted using a nominal long-term Commonwealth Government bond yield as at 30 June. Gross liability estimates are based on a number of demographic and financial assumptions. The major financial assumptions used for the budget and forward estimates period are outlined in the table below. Estimated Financial Statements and Auditor-General’s Report Page 13 The table below sets out the major financial assumptions used to estimate the superannuation expense and liability in respect of defined benefit superannuation for the budget and forward estimates period. Superannuation Assumptions – Pooled Fund / State Super Schemes 2014-15 % 2015-16 % 2016-17 % 2017-18 % 2018-19 % Liability discount rate 2.77 3.02 3.79 4.33 4.55 Expected return on investments 15.3 8.60 8.60 8.60 8.60 2.25 2.50 2.50 2.50 2.50 2.25 2.50 2.50 2.50 2.50 1.50 2.50 2.75 2.75 2.50 Expected salary increases(a) - SSS and SASS Members - PSS Members (b) Expected rate of CPI (b) (a) Taking the increased Superannuation Guarantee Contribution into account, total remuneration will increase by 2.5 per cent. (b) SSS – State Superannuation Scheme, SASS – State Authorities Superannuation Scheme, PSS – Police Superannuation Scheme Depreciation and amortisation Property, plant and equipment is depreciated (net of its residual value) over its useful life. Depreciation is generally allocated on a straight-line basis. Depreciation is forecast on the basis of known asset carrying valuations, the expected economic life of assets, assumed new asset investment and asset sales programs. The expense is based on the assumption that there will be no change in depreciation rates over the forecast period, but includes the estimated impact of the current and future revaluation of assets over the forecast period. The depreciation expense may also be impacted by future changes in useful lives, carrying value, residual value or valuation methodology. Certain heritage assets, including original artworks and collections and heritage buildings, may not have a limited useful life because appropriate custodial and preservation policies are adopted. Such assets are not subject to depreciation. Land is not a depreciable asset. Intangible assets with finite lives are amortised under the straight line method. Intangible assets with an indefinite life are not amortised, but tested for impairment annually. Interest expense The forecasts for the interest expenses are based on: payments required on the current general government sector debt, expected payments on any new borrowings (including any refinancing of existing borrowings) required to finance general government activities based on forward contracts for NSW Treasury Corporation bonds, and the unwinding of discounts on non-employee provisions. Page 14 Estimated Financial Statements and Auditor-General’s Report Other operating expenses Other operating expenses mainly represent the day-to-day running costs incurred in the normal operations of agencies and include the cost of supplies and services. They are forecast by applying appropriate economic parameters and known activity changes, including planned changes in the method of service delivery and the application of government policy. Other operating expenses also reflect the impact of government efficiency strategies, such as efficiency dividends. Grants and subsidies expense Grant and subsidy expenses generally comprise cash contributions to local government authorities and non-government organisations. For the general government sector they include grants and subsidies paid to the Public Non-Financial Corporation and Public Financial Corporations sectors. The forecast grant payments are determined taking into account current and past policy decisions, the forecast payment schedules and escalation factors relevant to each type of grant. Other Economic Flows Revaluations The estimates are based on an examination and extrapolation of historical trends in the valuation of non-financial physical assets. The forward estimates include the estimated impact of revaluations of non-financial physical assets. Superannuation actuarial gains / losses The forecast gain or loss on defined benefit superannuation is based on the revised estimates of the margin of forecast fund earnings in excess of the expected discount rate. Net gain on equity investments in other sector entities The gain or loss on equity investments in other sector entities is based on estimates of the public financial corporation and public non-financial corporation sectors’ forward comprehensive results adjusted for transactions with owners. The underlying management estimates of future comprehensive results are based on current Statements of Corporate Intent. Future distributions to owners are based on the Treasury Commercial Policy Framework. Estimated Financial Statements and Auditor-General’s Report Page 15 Assets Land and buildings, plant and equipment, and infrastructure The estimates of non-financial physical assets over the forecast period are at fair value and take into account planned acquisitions, disposals, and the impact of depreciation and revaluations. New investments in assets are valued at the forecast purchase price and, where appropriate, recognised progressively over the estimated construction period. The forward estimates include the estimated impact of revaluations of non-financial physical assets. These estimates are based on an examination of expected cost trends. The Estimated Financial Statements also include provisions for future capital expenditure. These include agency estimates of approved projects and future new works held within agencies, as well as a central estimate for future new works still to be approved at the agency level. The central estimate for future new works is based upon historical trends. Liabilities Borrowings Estimates for borrowings are based on current debt levels, amortisation of any premiums or discounts and the cash flows expected to be required to fund future government activities. Employee provisions Employee provisions are forecast based on expected staffing profiles and current salaries, conditions and on-costs. For the forecast period, employee benefits are adjusted for approved wage agreements. Beyond the period of the agreements, allowance is made for further adjustments consistent with the Government’s wages policy at a net cost of 2.5 per cent per annum inclusive of scheduled increases in the superannuation guarantee levy. The forecasts for employee expenses also reflect the impact of new initiatives and required efficiency savings. Superannuation provisions Refer to superannuation expense (above) for information on assumptions that also impact the measurement of the superannuation provisions. Other provisions Other provisions include the State’s obligations for several insurance schemes. To estimate future claim liabilities, actuarial assumptions have been applied for future claims to be incurred, claim payments, inflation and liability discount rates. Actual liabilities may differ from estimates. Page 16 Estimated Financial Statements and Auditor-General’s Report