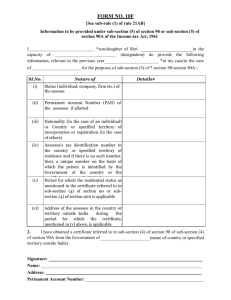

Small Industries Development Bank of India Act, 1989

advertisement