Enterprise Architecture Management British Petroleum Case Study

advertisement

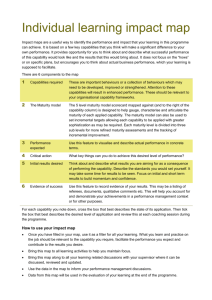

Managing the IT Capability Enterprise Architecture Management British Petroleum Case Study Company Profile – British Petroleum British Petroleum (BP) is a global oil and gas company with operations in 100 countries and exploration and production in 29 countries. BP is globally ranked number 3 in Oil and Gas and employs 97,600 people in more than 100 offices worldwide. The company recorded sales in 2007 of $284.3 billion with a net income of $17.8 billion and has over 1.2 million shareholders. IT plays a critical role in BP’s operations with 2,500 full time staff (4,000 including contractors and outsourcing providers). Enterprise Architecture is an essential part of IT governance and there are 15 group Enterprise Architecture (EA) staff with 175 Solution Architects deployed across the IT function. The overall IT budget for BP is approximately $2.5 billion. Why is Enterprise Architecture Management (EAM) critical for BP? The business need for Architecture Management As with many IT organisations, BP IT is asked by business to consistently provide the right capabilities, at the right time and at the right cost. There are a number of challenges to realising value from enterprise architecture frameworks including: ///Traditionally, emphasis often tends to be on defining processes and artefacts for an ‘end state’ technical design when in reality business is ever changing ///EA is often seen as a ‘program’ with enterprise wide implementation of best practices and control, which can often be perceived as constraining and/or controlling speed of innovation BP’s need for Architecture Management BP operates within a federated structure of Architecture with a consolidated Group EA function responsible for setting group-level technical standards and co-ordinating architecture activities across all the business facing IT teams. Each major business unit has an embedded IT function (Integrated Supply & Trading, Exploration and Production and Refining and Marketing) with a Chief Architect who is responsible for embedding local Architecture Management practices. In order to realise economies of scale across BP, this organisational model requires: ///Standardized frameworks, governance, processes and extended use of shared services ///An integrated target architecture and increased EA input to IT. BP joined IVI and participated in pilot studies of the new Enterprise Architecture Framework. The EAM maturity level (Figure 1) is measured against eight key capability building blocks grouped by three category areas (Figure 2). ///Metrics and value indicators are can often be absent from discussions. Enterprise Architecture Management is sometimes perceived as a governance program or control, thus diminishing the potential business value of the effort. Figure 1 Maturity curve for Enterprise Architecture Management Source: Innovation Value Institute However there was significant variation across business units including: BP Assessment Assessment results indicate a maturity level of 2 – Basic (Figure 2). However the average maturity levels mask variation between EA teams. As the pilot was carried out from an individual point of view it enabled teams to focus on capabilities within their individual organisations and scope of responsibility. For almost all capabilities, one or more teams self-assessed at maturity level ‘3’. 1 Initial Figure 2 Average Capability Maturity for 6 Teams Source: Innovation Value Institute ///Architecture activities take place at localised levels ///Value informally understood but with a limited number of metrics captured ///Architecture roles and responsibilities defined but vary considerably across teams The group EA function has the potential to deliver greater business value with the key areas of improvement, namely – Architecture Planning, Governance/Processes, Framework, Value measurement. 2 Basic 3 Intermediate 4 Advanced Planning Architecture 2.6 Planning 5 Optimising Average 2.6 Strategic Planning 2.7 Practices Architecture 2.1 Framework 2.3 Architecture Processes 2.0 Architecture Governence 2.4 Architecture Value 1.9 Org Structure & Skills 2.7 People 2.6 Communications & Stakeholder Mgmt IT&S Functions IT&S Enterprise Architecture E&P Tech. & Services R&M Global Infrastructure IT&S, IST Potential areas of best practice 2.4 Creating a Roadmap to increase EAM maturity The assessment provides a useful roadmap with key targets to address within the next 24 months by focussing on the highest priority areas and leveraging existing best practices. Current State 12 month target 2–3 year target Maturity level 2–3 3 4 Characteristics Target architecture and roadmaps defined for most segments / functions except for E&P and Group level Consistent, business driven target architecture & roadmaps (for some business and all technical domains) in place Consistent, business driven target architecture & roadmaps (for all business and all technical domains) in place Figure 3 Detailed View of Architecture Planning capability Source: Innovation Value Institute Some business buy-in for Functions, IST, R&M Standard formats not always used across domains even within the same segment or function For all embedded teams, all domains -D efinitions defined and agreed -O wners agreed -A s-is and target architectures documented - Implementation roadmap agreed and fed into planning process Summary Participation in the IT-CMF pilot test has delivered significant benefits to BP. One of the key findings for the company was the identification of varying maturity levels amongst different divisions within the company. Efficient yearly thorough refresh process Technology more proactive in bringing opportunities to the business Large proportion of the roadmap delivered by leveraging existing assets This is encouraging for all teams as it confirms that higher maturity is achievable and not just aspirational. At the same time, it also provides a company specific model of ‘centres of excellence’ for different capabilities For more information visit www.ivi.ie Copyright © 2010 Innovation Value Institute