Projects - National University of Singapore

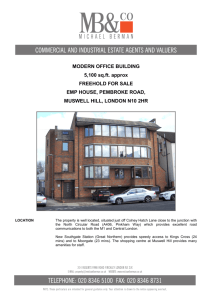

advertisement