2013 Annual Report

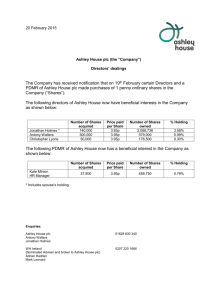

advertisement