CONSOLIDATED FINANCIAL HIGHLIGHTS

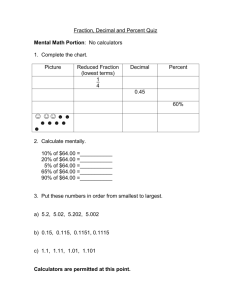

advertisement

Nintendo Co., Ltd. CONSOLIDATED FINANCIAL HIGHLIGHTS January 30, 2013 Nintendo Co., Ltd. 11-1 Kamitoba hokotate-cho, Minami-ku, Kyoto 601-8501 Japan Consolidated Results for the Nine Months Ended December 2011 and 2012 (1) Consolidated operating results (Amounts below one million yen are rounded down) Net sales Operating income million yen % 543,033 (2.4) 556,166 (31.2) Nine months ended December 31, 2012 Nine months ended December 31, 2011 million yen (5,857) (16,408) Ordinary income million yen 22,756 (66,027) % - Net income million yen 14,545 (48,351) % - % - [Note] Percentages for net sales, operating income etc. show increase (decrease) from the same period of the previous fiscal year. Net income per share yen 113.75 (378.10) Nine months ended December 31, 2012 Nine months ended December 31, 2011 (2) Consolidated financial positions As of December 31, 2012 As of March 31, 2012 Total assets Net assets million yen 1,588,585 1,368,401 million yen 1,209,280 1,191,025 Capital adequacy ratio % 76.1 87.0 Dividends Year ended March 31, 2012 Year ending March 31, 2013 End of 1st quarter yen - End of 2nd quarter yen 0.00 0.00 Dividend per share End of 3rd quarter yen - Annual Year-end yen yen 100.00 100.00 100.00 100.00 Net income Net income per share Year ending March 31, 2013 (forecast) Consolidated Financial Forecast for the Fiscal Year Ending March 31, 2013 Net sales Year ending March 31, 2013 million yen % 670,000 3.5 Operating income million yen (20,000) % - Ordinary income million yen 20,000 % - million yen 14,000 [Notes] This forecast is changed from the forecast in the report of "Consolidated Financial Highlights" released on Oct. 24, 2012. Percentages for net sales, operating income etc. show increase (decrease) from the last fiscal year. - 1- % - yen 109.48 Nintendo Co., Ltd. Others (1) Changes for important subsidiaries during the nine-month period ended December 31, 2012 : Not applicable (2) Application of peculiar methods for accounting procedures : Applicable [Notes] Please refer to "3. Other Information: Application of peculiar methods for accounting procedures" at page 3 for details. (3) Changes in accounting procedures: 1) Related to accounting standard revisions etc. 2) Other changes 3) Changes in accounting estimates 4) Modified restatements : Applicable : Not applicable : Applicable : Not applicable [Notes] Please refer to "3. Other Information: Changes in accounting procedures" at page 3 for details. (4) Outstanding shares (common shares) ① Number of shares outstanding (including treasury stock) As of Dec. 31, 2012 : 141,669,000 shares ② Number of treasury stock As of Dec. 31, 2012 : 13,792,161 shares ③ Average number of shares Nine months ended 127,877,370 shares Dec. 31, 2012 : As of March 31, 2012 : 141,669,000 shares As of March 31, 2012 : 13,791,286 shares Nine months ended Dec. 31, 2011 : 127,878,563 shares [Notes] 1. This earnings release report is not subject to audit procedures based on the Financial Instruments and Exchange Act. At the time of disclosure of this report, the audit procedures for the financial statements are in progress. 2. Forecasts announced by the Company (Nintendo Co., Ltd.) referred to above were prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast, and other forecasts). As for the information related to the forecasts, please refer to "Notice of Full-Year Financial Forecast Modifications" released today, on January 30, 2013. - 2- Nintendo Co., Ltd. 1. Consolidated Operating Results Nintendo continues to pursue its basic strategy of “Gaming Population Expansion” by offering compelling products that anyone can enjoy, regardless of age, gender or gaming experience. During the nine months ended December 31, 2012, for the “Nintendo 3DS” hardware (3DS and 3DS XL), “Nintendo 3DS XL,” with screens approximately 1.9 times larger than those of “Nintendo 3DS,” was launched as a new size variation of “Nintendo 3DS” in Japan and Europe in July, and in the U.S. in August. As regards the “Nintendo 3DS” software, “New Super Mario Bros. 2,” released in Japan in July, and in the U.S. and Europe in August, marked a total of 5.96 million units in worldwide sales. In addition, “Animal Crossing: New Leaf,” a game in which the player character becomes the mayor of a village and can enjoy customizing the village and communicating with other player characters, sold well in both packaged and downloadable formats. This title was released in Japan in November and became a hit title with 2.73 million units sold in total. Furthermore, Nintendo’s evergreen titles, such as “SUPER MARIO 3D LAND” and “Mario Kart 7,” released last fiscal year, kept selling steadily. With significant contributions from these titles, the “Nintendo 3DS” hardware and software reached worldwide sales of 12.71 and 39.56 million units respectively. Regarding the “Nintendo DS” (DS, DS Lite, DSi and DSi XL), the latest titles from the Pokémon series, “Pokémon Black Version 2/ Pokémon White Version 2,” released in Japan in June, and in the U.S. and Europe in October, reached a total of 7.63 million units in sales. However, the worldwide sales of the “Nintendo DS” hardware and software were only 2.15 million units and 30.24 million units respectively due to an accelerated generational change to “Nintendo 3DS” in the handheld device segment. A new home console “Wii U,” with which people can enjoy two-screen gameplay by utilizing a TV and the Wii U controller, “Wii U GamePad,” was launched as the successor of “Wii,” in the U.S. and Europe in November, and in Japan in December. As for the “Wii U” software, “New Super Mario Bros. U” and “Nintendo Land,” both of which were released simultaneously with the “Wii U” hardware, sold 2.01 and 2.33 million units respectively. The worldwide sales of the “Wii U” hardware were 3.06 million units and those of the “Wii U” software were 11.69 million units. With respect to the “Wii” system, although “Mario Party 9,” the latest title in the Mario Party series, sold over one million units, the sales of the “Wii” hardware and software were 3.53 and 45.08 million units worldwide respectively, mainly due to few new title releases. Affected by the yen appreciation against the Euro during this nine-month period and the above results, among other factors, net sales were 543 billion yen (of which overseas sales were 360.7 billion yen or 66.4% of the total sales). Owing to the fact that the “Wii U” hardware sales have a negative impact on Nintendo’s profits, the operating loss was 5.8 billion yen. As a result of exchange gains totaling 22.2 billion yen due to the depreciation of the yen at the end of calendar year 2012, however, ordinary income was 22.7 billion yen and net income was 14.5 billion yen. 2. Consolidated Financial Forecast The financial forecast announced on October 24, 2012 has been revised. Please refer to "Notice of Full-Year Financial Forecast Modifications" released today, on January 30, 2013, for details. 3. Other Information Application of peculiar methods for accounting procedures With respect to certain consolidated subsidiaries, corporate income tax amount is calculated by taking the amount of income before income taxes through the nine-month period ended December 31, 2012 multiplied by reasonably estimated annual effective tax rate with the effects of deferred taxes reflected. Changes in accounting procedures Following the revision of the Corporation Tax Act, Nintendo and its domestic consolidated subsidiaries have computed depreciation by the method on the basis of the revised Corporation Tax Act over property, plant and equipment acquired on or after April 1, 2012 since the three-month period ended June 30, 2012. Its impact is immaterial on operating loss, ordinary income and income before income taxes and minority interests. - 3- Nintendo Co., Ltd. 4. Consolidated Balance Sheets million yen Description As of Mar. 31, 2012 As of Dec. 31, 2012 (Assets) Current assets Cash and deposits Notes and accounts receivable-trade 462,021 508,745 43,378 171,159 496,301 438,331 Inventories 78,446 126,853 Other 62,788 84,079 Allowance for doubtful accounts (2,149) (1,209) Short-term investment securities Total current assets 1,140,786 1,327,960 87,856 86,588 Noncurrent assets Property, plant and equipment Intangible assets Investments and other assets 7,706 9,391 132,052 164,646 227,615 260,625 1,368,401 1,588,585 86,700 271,343 Income taxes payable 1,008 3,263 Provision 2,565 716 65,164 80,541 155,438 355,865 14,444 14,965 Total noncurrent assets Total assets (Liabilities) Current liabilities Notes and accounts payable-trade Other Total current liabilities Noncurrent liabilities Provision Other Total noncurrent liabilities Total liabilities 7,493 8,474 21,937 23,440 177,376 379,305 10,065 10,065 (Net assets) Shareholders' equity Capital stock Capital surplus Retained earnings 11,734 11,734 1,419,784 1,421,541 (156,682) Treasury stock 1,284,901 Total shareholders' equity (156,690) 1,286,651 Accumulated other comprehensive income Valuation difference on available-for-sale securities Foreign currency translation adjustment Total accumulated other comprehensive income 1,570 3,728 (95,528) (81,226) (93,957) (77,497) 81 126 Total net assets 1,191,025 1,209,280 Total liabilities and net assets 1,368,401 1,588,585 Minority interests - 4- Nintendo Co., Ltd. 5. Consolidated Statements of Income million yen Description Nine months ended Dec. 31, 2011 Nine months ended Dec. 31, 2012 Net sales 556,166 543,033 Cost of sales 425,064 415,781 Gross profit 131,101 127,251 Selling, general and administrative expenses 147,509 133,108 Operating income (loss) (16,408) (5,857) Interest income Foreign exchange gains Other 5,975 1,393 4,222 22,225 3,154 Total non-operating income 7,369 29,602 340 469 2,440 447 Non-operating income Non-operating expenses Sales discounts Loss on redemption of securities 53,725 Foreign exchange losses 482 Other 56,988 Total non-operating expenses Ordinary income (loss) (66,027) 71 989 22,756 Extraordinary income Gain on sales of noncurrent assets 49 - Total extraordinary income 49 - 72 22 Extraordinary loss Loss on disposal of noncurrent assets Soil removal expenses - 380 Total extraordinary loss 72 402 (66,051) 22,354 Income (loss) before income taxes and minority interests Total income taxes (17,674) 7,743 Income (loss) before minority interests (48,376) 14,610 Minority interests in income (loss) Net income (loss) (25) 64 (48,351) 14,545 6. Consolidated Statements of Comprehensive Income million yen Description Nine months ended Dec. 31, 2011 Income (loss) before minority interests Nine months ended Dec. 31, 2012 (48,376) 14,610 (926) 2,160 (29,599) 14,297 Other comprehensive income Valuation difference on available-for-sale securities Foreign currency translation adjustment Share of other comprehensive income of associates accounted for using equity method (0) (1) Total other comprehensive income (30,525) 16,456 Comprehensive income (78,902) 31,066 (78,876) 31,005 (25) 60 (Comprehensive income attributable to) Comprehensive income attributable to owners of the parent Comprehensive income attributable to minority interests - 5- Nintendo Co., Ltd. 7. Others (1) Consolidated sales information million yen Category Electronic entertainment products Other Nine months ended Dec. 31, 2011 Hardware Software Total electronic entertainment products Playing cards, Karuta, etc. Total Nine months ended Dec. 31, 2012 339,469 215,466 554,935 1,230 344,748 197,101 541,849 1,183 556,166 543,033 million yen (2) Geographical sales breakdown Nine months ended December 31, 2012 Nine months ended December 31, 2011 Japan The Americas Europe Other Total Net sales 182,320 201,075 142,968 16,668 543,033 Component ratio 33.6% 37.0% 26.3% 3.1% 100.0% Net sales 120,927 214,684 194,328 26,226 556,166 Component ratio 21.7% 38.6% 34.9% 4.8% 100.0% million yen (3) Other consolidated information Nine months ended December 31, 2011 Year ending March 31, 2013 (Forecast) 1 USD = 6,962 38,892 62,866 79.01 yen 8,068 39,127 49,070 80.00 yen 12,000 55,000 70,000 82.50 yen 1 Euro = 110.64 yen 102.17 yen 106.63 yen 2.5 billion 1.7 billion 2.4 billion 2.3 billion 1.4 billion 3.2 billion - Depreciation of property, plant and equipment Research and development expenses Advertising expenses Average exchange rates Nine months ended December 31, 2012 Consolidated net sales in U.S. dollars Consolidated net sales in Euros Non-consolidated purchases in U.S. dollars (4) Balance of major assets and liabilities in foreign currencies influenced by exchange rate fluctuations (non-consolidated) million U.S. dollars/euros USD Euro Cash and deposits Accounts receivable-trade Accounts payable-trade Cash and deposits Accounts receivable-trade As of Mar. 31, 2012 Balance Exchange rate 1,226 1 USD = 295 82.19 yen 312 1,576 1 Euro = 109.80 yen 262 - 6- As of Dec. 31, 2012 Balance Exchange rate 2,635 1 USD = 1,472 86.58 yen 1,529 313 1 Euro = 802 114.71 yen As of Mar. 31, 2013 Estimated exchange rate 1 USD = 90.00 yen 1 Euro = 120.00 yen Nintendo Co., Ltd. (5) Consolidated sales units, number of new titles, and sales units forecast Nintendo DS Hardware Software New titles Nintendo 3DS of which Nintendo 3DS XL Hardware Hardware Software New titles Hardware Wii Software New titles Wii U Hardware Software New titles Japan The Americas Other Total Japan The Americas Other Total Japan The Americas Other Japan The Americas Other Total Japan The Americas Other Total Japan The Americas Other Total Japan The Americas Other Japan The Americas Other Total Japan The Americas Other Total Japan The Americas Other Japan The Americas Other Total Japan The Americas Other Total Japan The Americas Other Actual Apr. - Dec. '11 21 235 208 464 605 2,780 1,735 5,120 54 107 113 360 415 368 1,143 810 997 997 2,804 67 74 68 84 408 404 896 840 4,649 3,418 8,906 31 123 116 - Actual Apr. - Dec. '12 1 192 22 215 447 1,622 955 3,024 11 44 65 504 398 369 1,271 281 197 227 705 1,608 1,348 1,001 3,956 84 65 67 24 185 145 353 396 2,425 1,687 4,508 10 46 56 83 132 90 306 148 640 382 1,169 15 37 29 Sales Units in Ten Thousands Number of New Titles Released Forecast Life-to-date Apr. '12-Mar. '13 Dec. '12 3,299 5,968 6,100 15,367 230 21,138 38,998 32,919 93,055 3,300 1,839 1,715 2,081 1,088 997 899 2,984 1,500 281 197 227 705 2,938 3,006 2,554 8,499 5,000 197 171 176 1,269 4,755 3,914 9,938 400 7,347 47,444 31,562 86,353 5,000 457 1,221 1,213 83 132 90 306 400 148 640 382 1,169 1,600 15 37 29 [Notes] 1 2 3 4 5 6 7 Nintendo DS means Nintendo DS, Nintendo DS Lite, Nintendo DSi and Nintendo DSi XL. Software sales units and the number of new titles for Nintendo DS do not include those of Nintendo DSiWare. Software sales units and the number of new titles for Nintendo 3DS are those of Nintendo 3DS card software (packaged and downloadable versions). Software sales units and the number of new titles for Wii do not include those of Virtual Console and WiiWare. Software sales units and the number of new titles for Wii U are those of Wii U disc software (packaged and downloadable versions). Actual software sales units of each platform include the quantity bundled with hardware. While forecasted software sales units include the quantity bundled with hardware for nine months ended December 31, 2012, they do not include the quantity to be bundled with hardware on and after January 1, 2013. 8 "New titles - Other" sections count the number of new titles released only in Europe on and after April 1, 2012. - 7-