Lecture 8

advertisement

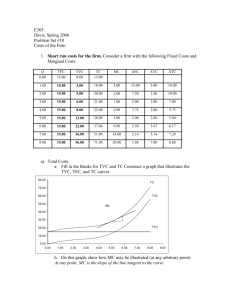

Review of Producer Choice 1. Production function - Types of production functions - Marginal productivity - Return to Scale 2. The cost minimization problem - Solution: MPL(K,L)/w = MPK(K,L)/r - What happens when price of an input changes? 3. Deriving the cost function - Types of costs (Fixed and Variable) - Short-run costs and long-run costs - Properties of the cost function (marginal and average costs) Economies Of Scale Definitions We say that a cost function exhibits economies of scale, if the average cost decreases as output rises, all else equal. We say that a cost function exhibits diseconomies of scale, if the average cost increases as output rises, all else equal. The smallest quantity at which the long run average cost curve attains its minimum point is called the minimum efficient scale. Economies Of Scale Economies of scale, diseconomies of scale, minimum efficient scale. AC ($/yr) AC(Q) Q (units/yr) 0 Q* = MES Economies Of Scale Why are there economies of Scale? 1. Increase returns to scale- Fixed costs - Larger scale of production permits more specialized inputs. 2. Decreasing return to scale- Organizational structure and managerial costs - Adding software engineers increases communication costs: If there are n engineers, there are ½n*(n – 1) pairs, so that communication costs rise at the square of the project size - “The Peter Principle”: Workers move up until they become incompetent - System slack: it is easier to hide inefficiencies in a large organization than in a small one Economies Of Scale Economies of Scale and Returns to scale - When the production function exhibits decreasing returns to scale, the long run average cost function exhibits diseconomies of scale - When the production function exhibits increasing returns to scale, the long run average cost function exhibits economies of scale - When the production function exhibits constant returns to scale, the long run average cost function is flat: it neither increases nor decreases with output. Economies Of Scope External economy of scale, or an industry economy of scale: Industry demand can effect the price of inputs A firm has Economies of Scope if production of various related goods, decreases the average costs Example: Boeing produces both commercial and military jets. Even though production is separate, there are various externalities that may reduce costs When there are Economies of Scope producing other goods decreases average costs When there are Economies of scale producing more decreases the average costs Economic Costs Definition: the Economic Profit is the between total revenue and the economic costs Difference between economic profit and accounting profit: The economic profit includes the opportunity costs Example: Suppose you start a business: - the expected revenue is $50,000 per year. - the total costs of supplies and labor are $35,000. - Instead of opening the business you can also work in the bank and earn $25,000 per year. - The opportunity costs are 35,000+20,000=55,0000 - The economic profit is -$5,000 - The accounting profit is $15,000 Main Goal: Derive the Firm’s Supply Definition: the Economic Profit is the different between total revenue and the economic costs A firm takes the price as given and chooses Q to maximize profit. When the firm sells Q units, it’s profit is given by pQ TC (Q) or TR (Q) TC (Q) The Firm’s Problem: Profit Maximization The single firm’s problem: max (Q) TR (Q) TC (Q) Q - The Marginal Revenue is the rate which Total Revenue changes with output. TR(Q) MR(Q) Q “When the firm increases output by an additional “small” unit, the marginal revenue is the additional revenue generated” - The Marginal Cost is the rate which Total Cost change with output. TC (Q) MC (Q) Q “When the firm increases output by an additional “small” unit, the marginal cost is the additional cost incurred generated” Profit Maximization The single firm’s problem: max (Q) TR (Q) TC (Q) Q Optimality condition: If MR> MC then profit rises if output is increased If MR < MC then profit falls if output is increased. Therefore, the profit maximization condition for a price-taking firm is MR = MC What is the marginal revenue? the price as given, therefore marginal revenue is just TR the price MR p Q Optimality condition: And the firm chooses quantity such that: P = MC(Q) Profit Maximization Optimality condition: 1. P = MC(Q) 2. MC(Q) increases Short Run Supply In the Short Run there are some fixed inputs: 1.There are fixed costs 2.Total Costs of producing Q units: Total variable costs + total fixed costs What are the firm’s Costs when producing 0? Fixed costs consist of 1. Sunk costs are unavoidable- for example patent licensing cost 2. Non-Sunk Costs can be avoided- for example if the firm can rent out some of the capital. The key difference is Sunk costs are incurred when the firm produces nothing, and non-sunk costs can be avoided Short Run Supply Example: Off-shore drilling Independent contractors are hired by a petroleum company to drill wells in the sea , using oil rigs: Short Run Supply Example: Off-shore drilling What are the costs of a contractor who runs an off-shore oil rig? - Personnel: Crew managers, engineers, marine personnel, drilling workers…. - Drilling supplies such as drills and fuel - Maintenance costs, food, medical care - Insurance Key point: personnel costs are fixed because the contractor commits to hiring the workers, before she knows whether there are wells to drill - Drilling supplies and fuel are variable costs Short Run Supply Example: Off-shore drilling When there are no wells to drill, the output is zero. What are the costs to the contractor in this case? There are several options: 1. A “Hot Stacked” rig is taken out of service but remains fully stacked with workers and ready to operate- in this case all fixed costs are sunk, but variable costs are avoided. 2. A “Cold Stacked” rig is taken out of service for a long period of time, the crew is laid off and the doors are welded shut. In this case the only sunk cost is the insurance, while the other fixed costs are non-sunk Short Run Supply Question: When does the firm choose to produce, and when does the firm prefer to shut down? Assume all fixed costs are sunk: P*Q – TVC(Q) – TFC > -TFC P*Q – TVC(Q) > 0 P > AVC(Q) Key definition: If the price drops below the shut down price the firm prefers to produces nothing than any positive amount. Note: A firm may choose to operate in the short run even if economic profit is negative. Important to remember: if the firm produces output Q and sells it for a price p then; 1. When p>ATC(Q) the firm makes a profit. When p<ATC(Q) the firm loses money 2. When p>AVC(Q) the firm produces Q>0, when p<AVC(Q) the firm shuts down 3. When AVC(Q)<p<ATC(Q) the firm operates at a loss Short Run Supply Key Definition: A single firm’s Short run supply curve specifies the profit maximizing output for each market price. The firm’s short run supply curve is give by: 1. When P < Ps the firm chooses to produce nothing, Q=0 2. When P > Ps the firm chooses to produce Q>0 such that MC(Q)=p $ SMC ATC AVC Ps Quantity In this case all fixed costs are sunk: At prices below ATC but above AVC, Even though profits are negative , the firm is better off producing than shutting down because of sunk costs. Short Run Supply when all fixed costs are sunk What if some fixed costs are not sunk? When does the firm choose to produce, and when does the firm prefer to shut down? Now, TFC = SC + NSC, and when the firm produces it incurs the NSC and the variable costs P*Q – TVC(Q) – NSC-SC > -SC P*Q – TVC(Q) -NS> 0 P > AVC(Q)+NS/Q ANSC = AVC + NSFC/Q Now, the shut down price, Ps is the minimum of the ANSC curve. . Short Run Supply when some fixed costs are not sunk The firm’s short run supply curve is give by: 1. When P < Ps = the firm chooses to produce nothing, Q=0 2. When P > Ps the firm chooses to produce Q>0 such that MC(Q)=p Short Run Supply Example: all fixed costs are sunk Suppose a firm has the following cost function TC(Q) = 100 + 30Q -10 Q2 + Q3 What is the supply curve? Solution in two steps: i. Figure out the shutdown price ii. Figure out how much the firm produces TFC = 100 (sunk) ATC(Q)=100/Q+30-10Q+ Q2 TVC(q) = 30Q -10 Q2 + Q3 AVC(q) = 30-10Q+ Q2 MC(q) = 30 -20Q+3 Q2 Shutdown price: p=MC(Q)>AVC(Q) - When q=5: mc(q)=AVC(q), shutdown price p=mc(5)=5 The firm’s short run supply curve is: - If the price is P < 5: then the firm produces nothing Q = 0 - If price is P > 5: then P = MC(Q) P = 30 -20Q+3 Q2 Short Run Supply Example: all fixed costs are not sunk Suppose a firm has the following cost function if Q>0 TC(Q) = 100 + 20Q + Q2 and if Q=0 TC(Q)=0. What is the supply curve? Solution in two steps: i. Figure out the shutdown price ii. Figure out how much the firm produces TFC = 100 (non- sunk) TVC(Q) = 20Q + Q2 ATC(Q) = 100/Q+20 + Q MC(Q) = 20 + 2Q When all fixed costs are non sunk the firm produces only if P>ATC, Why? Shutdown when p=MC(q)=ATC(Q) or when q=10. Therefore the shutdown price is p=40. The Firm’s demand is: - If the price is P < 40: then Q = 0 - If price is P > 40: then P = MC(Q) P = 20+2q Q = 10 + ½P Short Run Market Supply Curve Definition: The short run market supply is the sum of the quantities each firm supplies at that price. Example: suppose 3 types of firms with different marginal costs and different shut down prices. Each firm has a different