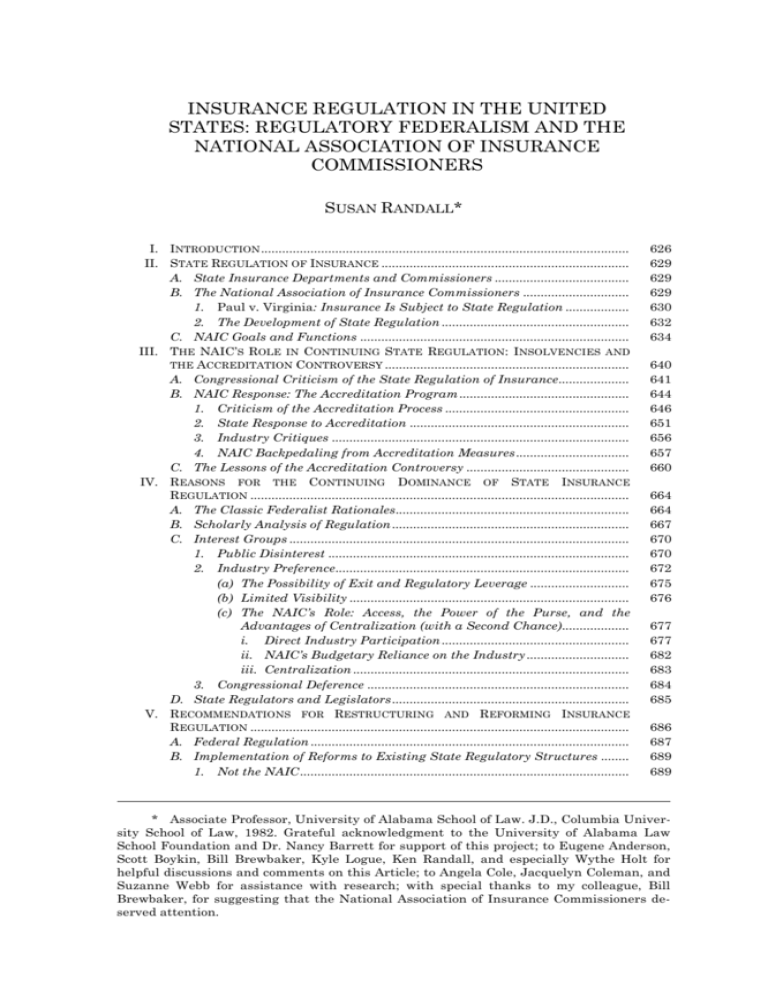

insurance regulation in the united states

advertisement