Your Insurance Policy - Campbell & Haliburton Insurance

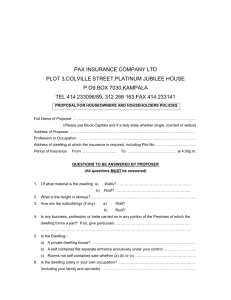

advertisement