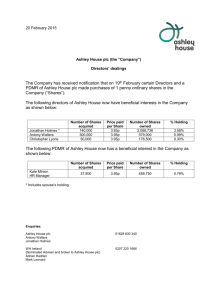

Woolworths Group plc

advertisement